If you've ever scrolled through a crypto forum, joined a Telegram group, or followed traders on X, chances are you've come across the term HODL. It looks like a typo of "hold," right? Well, that's how it started. But over time, it has evolved into a crypto philosophy embraced by millions of traders and investors worldwide.

As of September 2025, with Bitcoin valued between US$115,000 and $117,500 and Ethereum approximately between US$4,400 and $4,600, "HODL" has become much more than just internet slang. For beginners, understanding HODL isn't just about knowing the meme; it's about learning how long-term conviction in crypto has shaped wealth-building strategies and why many traders believe it's the path to financial freedom.

This article will break down what HODL means, its origins, its significance, its success stories, potential risks to consider, and whether it remains an effective approach in the current cryptocurrency landscape.

HODL Meaning in Crypto Explained

HODL is a slang term in the crypto community that means holding onto your cryptocurrency investments instead of selling them during market dips. It's essentially a brief way of saying "avoid panic selling," which means enduring fluctuations for future profits.

While the word came from a drunken forum post in 2013, it has since become an acronym for "Hold On for Dear Life."

So when you hear someone say "Just HODL your Bitcoin," they're encouraging you to stay invested, ignore short-term noise, and believe in the long-term potential of crypto.

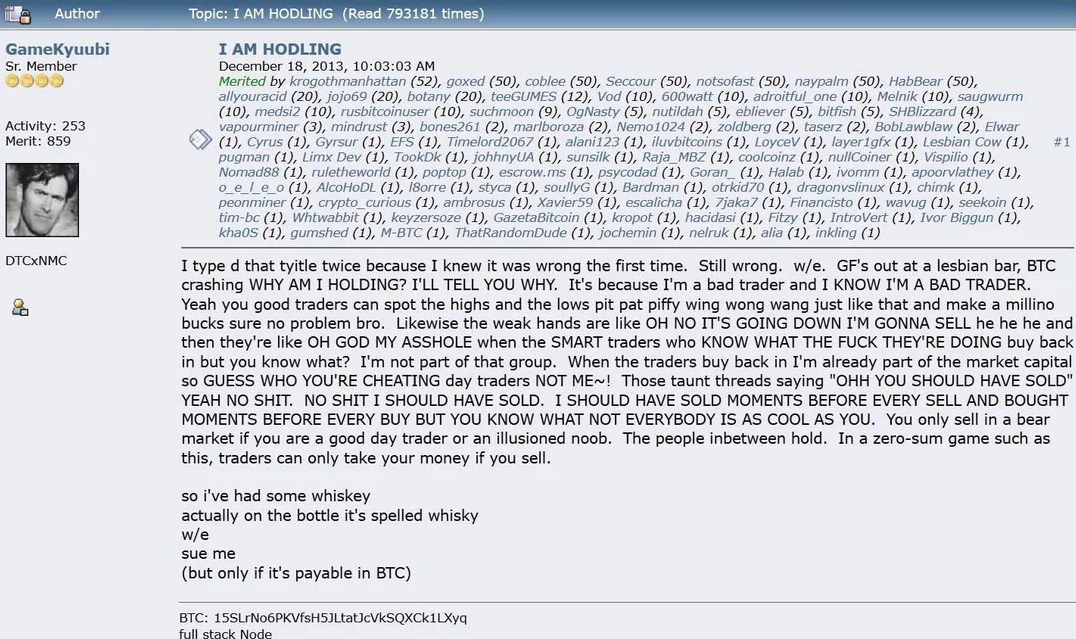

What Is the Origin of HODL?

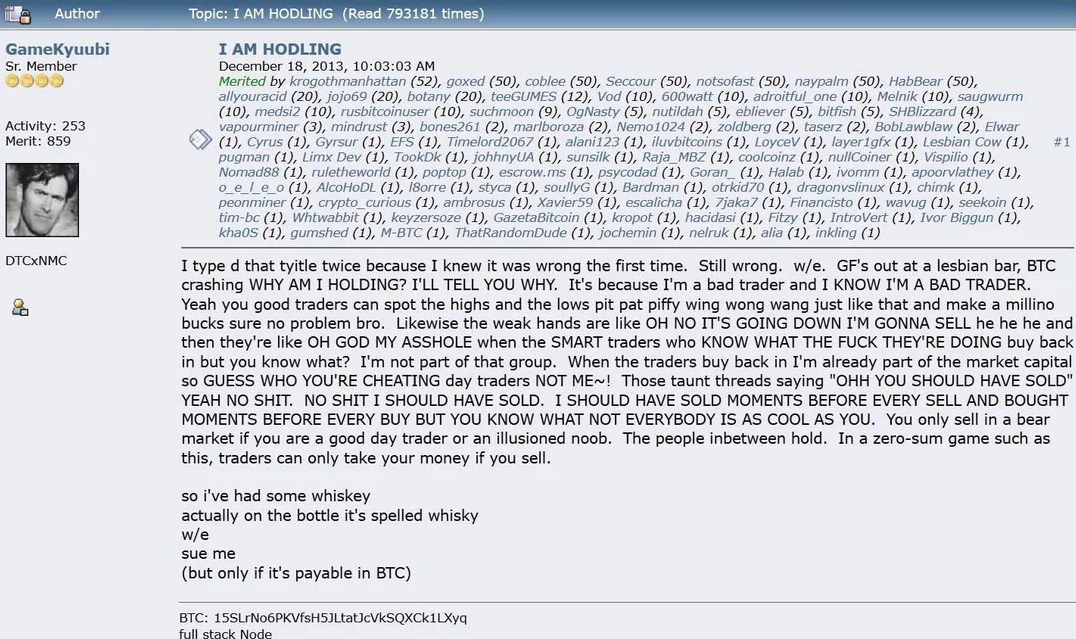

As mentioned above, the story of HODL goes back to December 18, 2013, when a Bitcoin forum user named GameKyuubi wrote a post titled "I AM HODLING." At the time, Bitcoin had crashed from around $1,100 to below $500 in just a few weeks.

In frustration (and after a few whiskeys), he admitted he wasn't a good trader and decided to hold his coins instead of panic-selling. His typo: "HODL" instead of "HOLD", went viral.

That one post expressed a sentiment felt by many crypto enthusiasts: liquidating assets during a downturn typically results in realised losses, while holding on may lead to future gains. From there, HODL became part of crypto culture, a rallying cry during every downturn.

Why HODL Became a Crypto Investment Philosophy?

At its core, HODL is more than just holding coins; it's about believing in the long-term value of blockchain technology and digital assets.

Here's why it caught on:

Extreme volatility: Bitcoin and altcoins can fluctuate by 20–50% within a few days. HODLing prevents errors fueled by fear.

Long-term growth: Despite multiple crashes, Bitcoin went from $0.003 in 2010 to over $115,000 in 2025. Long-term holders were rewarded.

Scepticism from outsiders: Early adopters embraced HODL as a symbol of pride against those labelling Bitcoin a bubble.

Emotional control: HODLing helps traders resist fear (FUD) and greed (FOMO).

In short, HODLing became a survival strategy, and for many, a path to wealth.

Why HODL Has Become More Relevant in 2025?

Here's what makes HODL especially meaningful now:

1) Record Volatility but Strong Upside

Bitcoin has surged past US$115,000, and ETH is in the US$4,000+ range. These moves encourage long-term holders.

2) Institutional Involvement

ETFs and macroeconomic expectations (rate cuts and inflation adjustments) have made crypto less niche and more mainstream.

3) Regulatory Developments

Stablecoin legislation, increased staking rewards for ETH, and wider adoption of blockchain infrastructure. These push the narrative beyond speculative investing toward more utility.

Real-World HODL Examples & Success Stories

To help bring this to life, here are some examples of people or groups who applied HODL well in recent years:

1) Early BTC Buyers (2010-2012):

Those who bought BTC when it was under US$10 and held on have seen life-changing returns. For example, an early adoption of even a few BTC would be worth millions now, given the current price.

2) Long-Term ETH Investors:

Investors who purchased ETH before its significant upgrades or before staking utility gained prominence (when ETH was under $1,000) and held onto their assets during downturns around the $1,500–2,000 range. They've benefited as ETH is now trading in the US$4,400–4,600 range.

3) Institutions & Corporate Holdings:

Michael Saylor's company, MicroStrategy, started buying Bitcoin in 2020. As of 2025, they hold ~581,000 BTC, worth over $63 billion.

HODL vs Active Trading: What Fits You Better Today?

If you're reading this, you might be wondering: should you HODL, trade actively, or mix both? Here are comparisons with updated data:

HODL generally means fewer trades, less stress about short-term price swings, and lower transaction fees. With Bitcoin near US$115,000 and Ethereum in the US$4,400 range, those HODLing from past cycles have earned significant profits.

Active Trading can generate massive returns but typically involves more time, emotional control, higher fees, and greater risk.

Numerous traders adopt hybrid strategies by holding core crypto assets (BTC and ETH) while actively trading smaller-cap or altcoins, or allocating a portion of their portfolio for short-term investments.

What Are the Risks & Caveats of HODLing?

Even though HODL has many advantages, it's not without potential pitfalls. New traders should understand:

1) Asset Selection Matters

Not all cryptocurrencies are equal. Some tokens/projects may fail or become irrelevant. HODLing a low-quality or unproven project can result in large losses.

2) Opportunity Cost

By holding everything long term, you might miss chances to cash in (take profits) when assets are temporarily overheated.

3) Psychological Stress

Experiencing significant price decreases of 30%, 50%, or even higher can induce panic if you aren't mentally ready or lack confidence.

4) Regulatory & Macro Risks

Changes in regulations, tax legislation, or general economic policies (such as interest rates and inflation) can significantly affect outcomes.

How to HODL the Right Way? Practical Strategies

If you want to apply HODL in your portfolio now, here are the recommended steps and tips:

1. Choose Strong, Proven Assets

Currently, many view Bitcoin and ETH as some of the most dependable core investments due to network effects, liquidity, utility, staking (for ETH), and institutional interest.

2. Set Your Time Horizon

Determine if you are holding for 1 year, 3 years, 5 years, or until you achieve a financial objective. That helps you stay calm in downturns.

3. Use Secure Storage

Hardware wallets, cold storage, or secure custodial services matter, especially for large holdings.

4. Rebalance Occasionally

Even long-term holders may take profits at certain thresholds (say when something has run up strongly) and "rebalance" to maintain a risk profile they're comfortable with.

5. Stay Informed

Rules, large-scale occurrences, interest rate choices, and crypto-supportive technological advancements (such as enhancements, staking, and scalability) all affect worth.

6. Don't Fall for Hype Alone

The cryptocurrency sector is rife with excitement. Hence, exercise caution with "moonshot" initiatives lacking essential support.

Frequently Asked Questions

1. What Does HODL Mean in Crypto Trading?

HODL is a slang term in the crypto community that means holding onto your cryptocurrency long-term rather than selling during volatility.

2. How Much Would I Have if I HODLed Bitcoin Since 2015?

If you bought 1 BTC in 2015 at around US$250 and held it until September 2025, it would now be worth over US$115,000, a return of more than 45,000% in 10 years.

3. Should Beginners Use the HODL Strategy?

Yes, but cautiously. HODL is excellent for newcomers who lack the time for daily trading.

4. How Does HODLing Compare to Traditional Investing?

HODLing crypto can deliver far higher returns than stocks or gold, but comes with more volatility. For instance, gold rose about 30% over the last five years, while Bitcoin rose more than 280% since 2020 despite several crashes.

5. Can I HODL Altcoins, or Is It Only for Bitcoin?

You can HODL altcoins like Ethereum, Solana, or BNB, but risk levels are higher. For example, Ethereum, priced around US$3,600 in September 2025, has grown from under US$100 in 2017.

Conclusion

In conclusion, HODL started as a joke, yet it has evolved into a validated long-term investment approach that has generated numerous crypto millionaires today.

For beginners, HODLing can be a smart entry point into crypto, provided you choose quality assets, secure your holdings and stay patient through volatility. However, remember: HODL isn't about blind faith, it's about long-term conviction with informed decisions.

So, whether you're buying your first Bitcoin or adding more ETH to your portfolio, ask yourself: Are you ready to HODL through the ups and downs for the bigger picture? Because in crypto, history has shown that sometimes the best move isn't to trade, but simply to HODL.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.