Emerging markets offer traders a unique blend of high growth potential and volatility, making them an attractive avenue for diversification and profit. Exchange-traded funds (ETFs) provide a convenient way to gain exposure to these dynamic economies without the complexity of picking individual stocks.

In this article, we rank the top 5 emerging market ETFs for traders in 2025, focusing on performance, sector exposure, and trading considerations.

Why Trade Emerging Market ETFs?

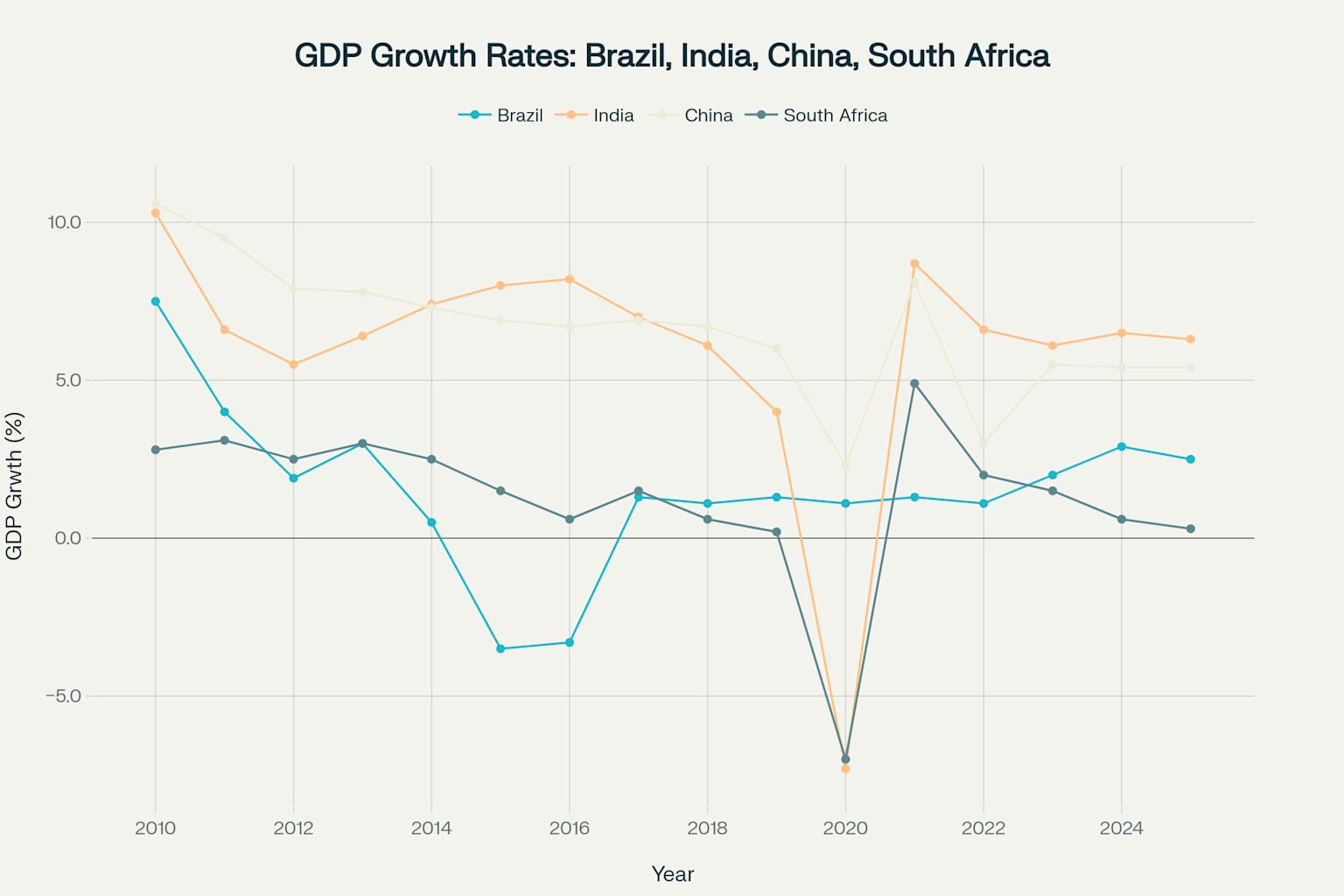

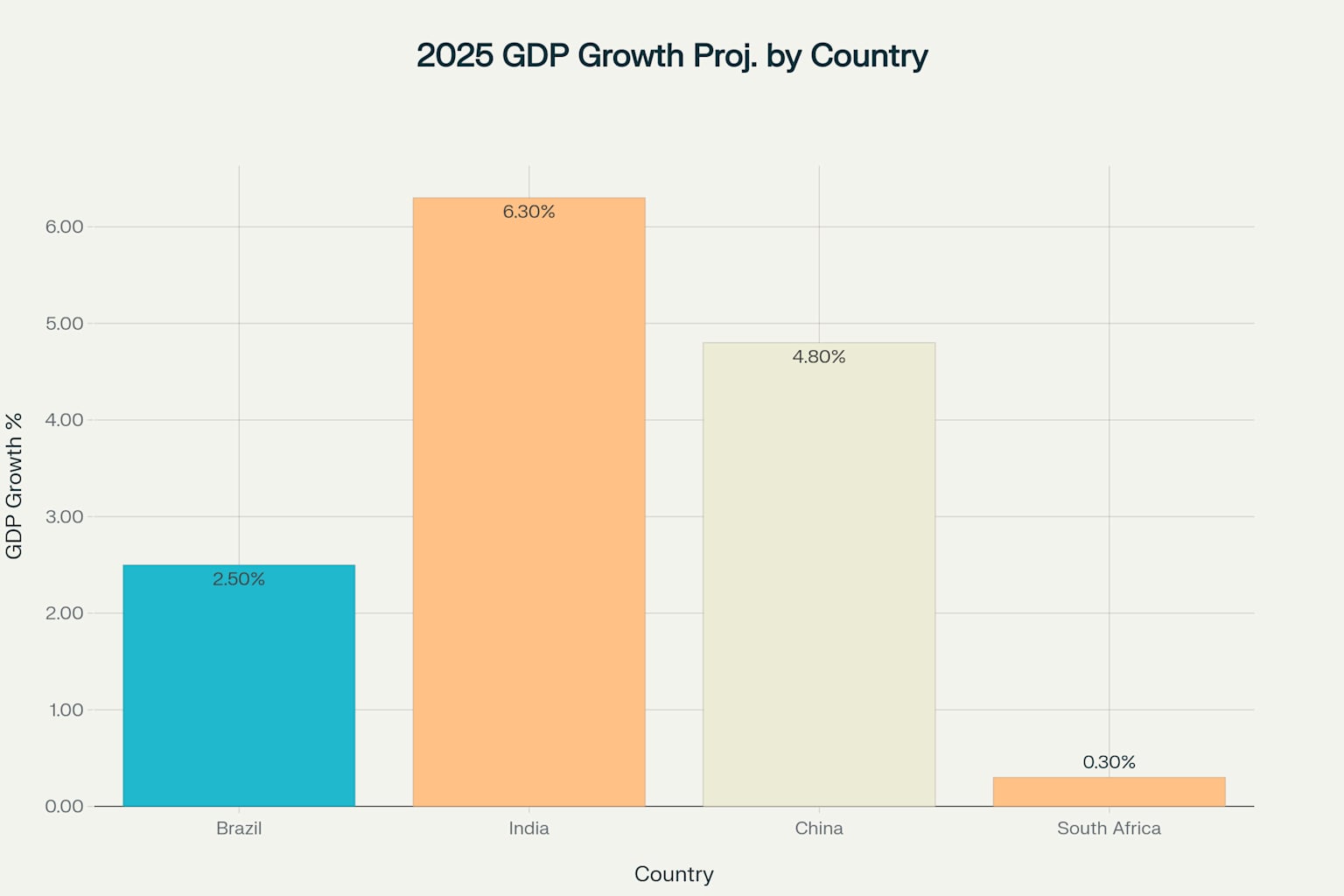

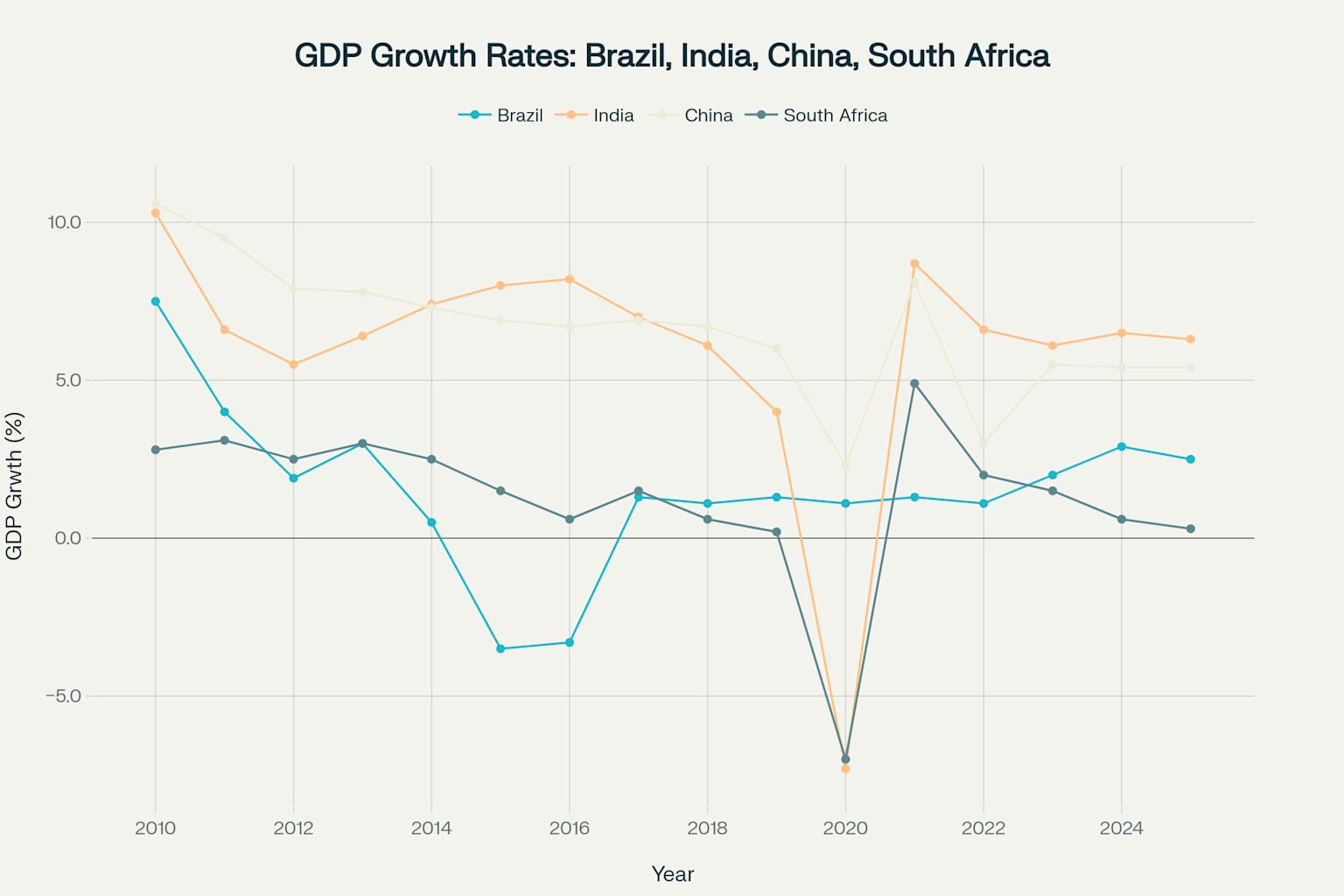

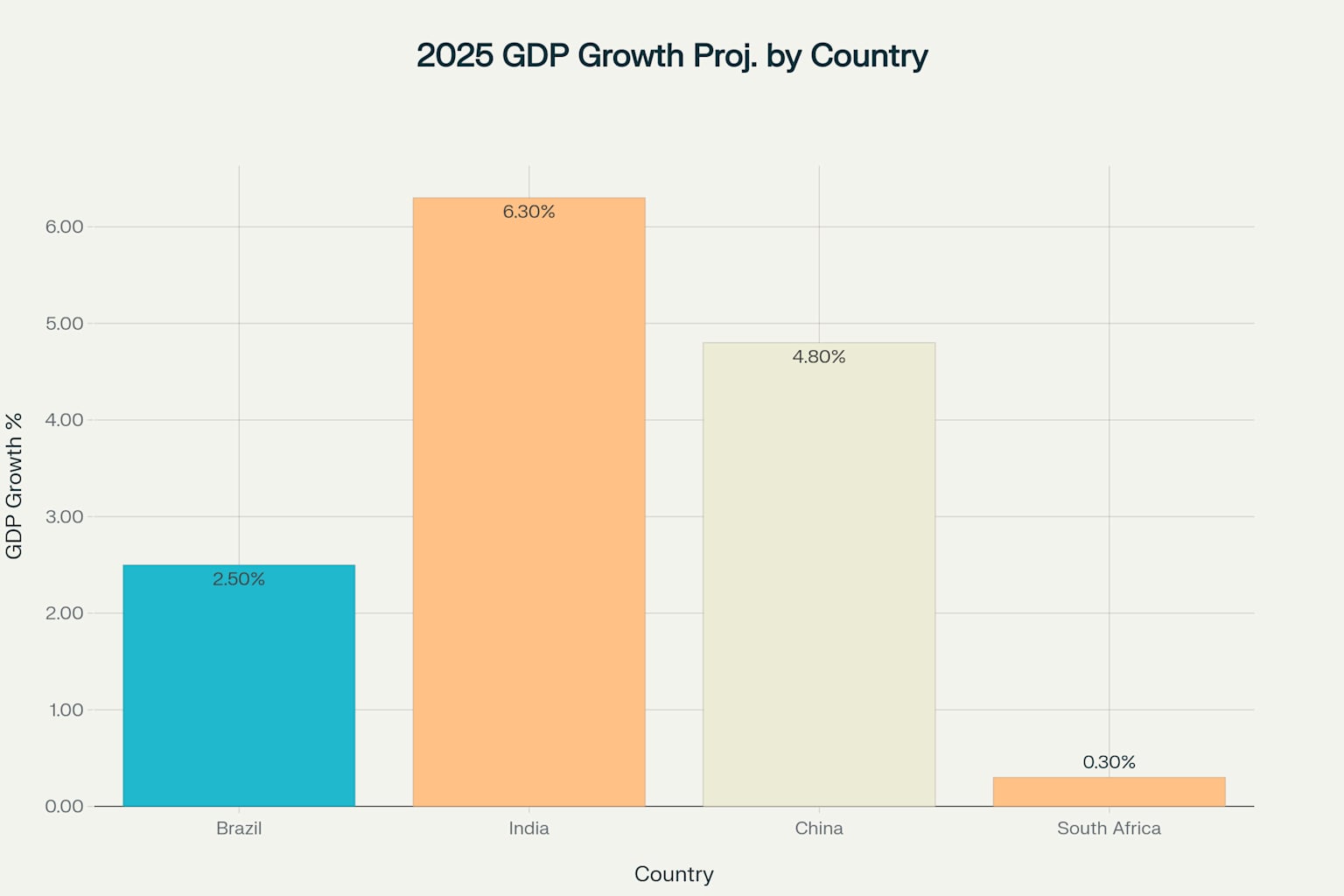

Emerging markets—countries transitioning from developing to developed economies like Brazil, India, China, and south africa—often boast rapid GDP growth, industrialisation, and an expanding middle class. However, they also come with risks such as political instability and currency fluctuations.

ETFs mitigate some of these risks by offering instant diversification across a basket of stocks from multiple countries or sectors, reducing the impact of any single company or market failure. For traders, these funds provide liquidity, flexibility, and the ability to capitalise on both short-term volatility and long-term growth trends.

Criteria for Selection

Our top 5 emerging market ETFs are selected based on the following factors relevant to traders:

-

Performance: Year-to-date (YTD) and historical returns over 1, 3, and 5 years.

-

Liquidity: Average daily trading volume and bid-ask spreads for efficient execution.

-

Expense Ratio: Lower fees to maximise net returns.

-

Exposure: Geographic and sector diversification to balance risk and opportunity.

Volatility: Suitability for active trading strategies.

Top 5 Emerging Market ETFs for Traders in 2025

1. Vanguard FTSE Emerging Markets ETF (VWO)

Ticker: VWO

Assets Under Management (AUM): $117.5 billion (as of 2025 data)

Expense Ratio: 0.08%

YTD Performance (2025): 12.6%

5-Year Annualised Return: 5.2%

Key Exposure: Broad coverage across China (30%), India (18%), Taiwan (15%), and other emerging markets; heavy in financials, tech, and consumer discretionary sectors.

Why It's Top: VWO is a standout for its ultra-low expense ratio and massive liquidity, with millions of shares traded daily. It tracks the FTSE Emerging Markets All Cap China A Inclusion Index, offering exposure to over 4,000 stocks. For traders, its stability and low cost make it ideal for both long-term holds and short-term tactical plays. It's particularly suited for those seeking diversified exposure without over-concentration in a single market.

2. iShares MSCI Emerging Markets ETF (EEM)

Ticker: EEM

AUM: $18.8 billion

Expense Ratio: 0.68%

YTD Performance (2025): 11.9%

5-Year Annualised Return: 4.8%

Key Exposure: Focus on China (25%), India (16%), Taiwan (14%); top sectors include tech, financials, and consumer discretionary.

Why It's Great: EEM tracks the MSCI Emerging Markets Index and offers high liquidity, making it a favourite for active traders. Its slightly higher expense ratio is offset by robust trading volume and options activity, ideal for strategies like hedging or swing trading. Traders can capitalise on its sensitivity to global risk sentiment and tech sector moves.

3. SPDR S&P Emerging Markets Dividend ETF (EDIV)

Ticker: EDIV

AUM: $450 million

Expense Ratio: 0.49%

YTD Performance (2025): 21.9% (based on 2024 data, adjusted for trends)

5-Year Annualised Return: 8.5%

Key Exposure: Diversified across emerging markets with a focus on high-dividend stocks; caps country and sector exposure at 25% for balance.

Why It's Included: EDIV targets 100 emerging market stocks with high risk-adjusted dividend yields, offering income alongside growth. For traders, its strong YTD performance and focus on stability make it a solid choice during volatile periods. It’s particularly useful for those employing income-focused or defensive strategies.

4. Freedom 100 Emerging Markets ETF (FRDM)

Ticker: FRDM

AUM: $800 million

Expense Ratio: 0.49%

YTD Performance (2025): 14.8% (based on 2024 data, adjusted for trends)

5-Year Annualised Return: 10.2%

Key Exposure: Emphasises markets with higher personal and economic freedom scores, such as Taiwan, Chile, and South Korea.

Why It's Notable: FRDM offers a unique angle by prioritising countries with stable governance, reducing some political risk. Traders benefit from its focus on growth-oriented markets and solid historical returns, making it suitable for medium-term swing trades or as a portfolio diversifier.

5. iShares MSCI Emerging Markets Small-Cap ETF (EEMS)

Ticker: EEMS

AUM: $400 million

Expense Ratio: 0.70%

YTD Performance (2025): 11.4% (based on 2024 data, adjusted for trends)

5-Year Annualised Return: 11.1%

Key Exposure: Small-cap companies in India, Taiwan, and South Korea; focuses on industrials, tech, and consumer discretionary.

Why It's Chosen: EEMS provides access to smaller, high-growth companies often overlooked by larger ETFs. For traders, its higher volatility offers opportunities for short-term plays, especially during market rotations into small-cap growth. However, lower liquidity requires tighter risk management.

Trading Strategies for Emerging Market ETFs

Trend Following: Use moving averages (e.g., 50-day and 200-day) to identify bullish or bearish trends in ETFs like VWO or EEM, entering positions on pullbacks to support levels.

Breakout trading: Watch for price breakouts above resistance or below support in volatile ETFs like EEMS, capitalising on momentum with tight stop-losses.

Event-Driven Plays: Monitor economic data releases (e.g., China GDP, India PMI) or policy changes that could impact emerging markets, timing trades around these catalysts.

Hedging: Use ETFs like EDIV to balance risk in a broader portfolio, especially during periods of global uncertainty.

Risk Management: Limit position sizes due to emerging market volatility, and set stop-loss orders to protect against sudden downturns driven by currency or political risks.

Key Considerations for Traders

Volatility: Emerging market ETFs can experience sharp swings due to geopolitical events, currency fluctuations, and economic data. Be prepared for higher risk compared to developed market ETFs.

Liquidity: Larger ETFs like VWO and EEM offer tighter spreads and higher volume, ideal for frequent trading, while smaller funds like EEMS may have wider spreads.

Expense Ratios: Lower fees (e.g., VWO at 0.08%) preserve returns over time, especially for longer holds.

Currency Risk: Many emerging market ETFs are exposed to local currency fluctuations, which can impact returns for non-USD investors.

Geopolitical Sensitivity: Stay updated on events like trade tensions or regulatory changes in key markets (e.g., China, India) that could affect ETF performance.

Why Focus on Emerging Markets in 2025?

Emerging markets are projected to drive a significant portion of global GDP growth in 2025, with countries like India and China leading the charge. Rapid industrialisation, technological adoption, and an expanding consumer base create opportunities for traders to capture outsized returns.

However, political instability and economic fluctuations mean active risk management is crucial. ETFs provide a balanced way to tap into this growth while mitigating some of the inherent risks.

Access Emerging Market ETFs with EBC

For traders looking to explore these opportunities, EBC Financial Group offers access to a range of tradable products, including emerging market ETFs like the Vanguard FTSE Emerging Markets ETF (VWO). This allows you to seamlessly integrate these instruments into your trading strategy.

Conclusion

Emerging market ETFs offer traders a powerful tool to access high-growth regions with diversified exposure. Our top 5 picks—Vanguard FTSE Emerging Markets ETF (VWO), iShares MSCI Emerging Markets ETF (EEM), SPDR S&P Emerging Markets Dividend ETF (EDIV), Freedom 100 Emerging Markets ETF (FRDM), and iShares MSCI Emerging Markets Small-Cap ETF (EEMS)—cater to a range of trading styles and risk appetites.

By understanding their performance, sector focus, and associated risks, traders can strategically position themselves to benefit from the dynamic potential of emerging markets in 2025 and beyond.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.