The VB ETF provides diversified access to U.S. small‑capitalisation stocks at ultra‑low cost, making it a compelling building‑block for long‑term growth‑oriented portfolios.

Below, this article summarises the VB ETF's key facts, structure, performance, strengths, weaknesses, portfolio use, and recent developments.

What the VB ETF Really Is

The VB ETF, formally the Vanguard Small‑Cap ETF (ticker VB), is an exchange‑traded fund issued by The Vanguard Group. It seeks to track the performance of the CRSP US Small Cap Index, an unmanaged benchmark representing the U.S. small‑capitalisation segment.

Key facts:

Inception date: 26 January 2004.

Expense ratio: 0.05 % (as of the latest prospectus).

Total net assets: roughly US$68.26 billion for the ETF share class (as at 30 Sept 2025).

Number of holdings: ~1.332 small‑cap stocks.

The fund is passively managed using full replication of the index, meaning it holds the constituent stocks of the CRSP index rather than a sample or synthetic strategy.

VB ETF Key Metrics Breakdown

| Metric |

Value |

| Number of stocks |

1,332 |

| Median market‑cap |

US$9.4 billion |

| Price/Earnings (P/E) ratio |

21.6x |

| Price/Book (P/B) ratio |

2.4x |

| Return on Equity (ROE) |

10.2 % |

| Foreign holdings |

0.4 % |

In short, VB ETF is a broad‑based U.S. small‑cap equity fund offering a low‑cost, diversified vehicle into that asset class.

Why the VB ETF Might Matter to You

There are several reasons why VB ETF is worthy of consideration:

1. Small‑cap premium:

Historically, smaller companies have offered higher growth potential than large‑cap peers, albeit with greater risk and volatility. By gaining exposure to the small‑cap segment via VB, an investor can tilt their portfolio toward growth opportunities.

2. Diversification benefit:

If an investor already holds large and mid‑cap exposures, adding a broad small‑cap fund helps diversify across market‑cap spectrum and may help capture idiosyncratic small‑company returns.

3. Cost‑efficiency:

With an expense ratio of 0.05 %, VB is very competitively priced in its category. Lower fees mean more of the fund's returns are passed to the investor.

4. Portfolio role clarity:

For a long‑term investor (for example, someone aged 27 with a multi‑decade horizon), VB can serve as the "growth lane" segment of the portfolio, with awareness of its higher risk profile.

Thus, for an investor seeking long‑term growth, willing to accept volatility, and craving cost‑efficient access to U.S. small‑cap stocks, VB ETF may occupy a valuable niche.

VB ETF Sector Exposure & Metrics Breakdown

1. Holdings and sector breakdown

VB ETF Sector Weightings

| Sector |

Approximate weight |

| Industrials |

22.3 % |

| Consumer Discretionary |

14.5 % |

| Financials |

14.2 % |

| Technology |

13.6 % |

| Health Care |

11.3 % |

| Real Estate |

7.1 % |

| Energy |

4.1 % |

| Utilities |

3.9 % |

| Basic Materials |

3.8 % |

| Consumer Staples |

3.3 % |

| Telecommunications |

1.8 % |

Top 10 Holdings of VB ETF

| Ticker |

Company |

Approx. Weight* |

| NRG |

NRG Energy Inc |

~0.45% |

| INSM |

INSM (Insmed Inc) |

~0.44% |

| SOFI |

SOFI Technologies Inc |

~0.43% |

| EME |

EME (EMCOR Group Inc) |

~0.41% |

| FIX |

FIX (Comfort Systems USA) |

~0.42% |

| ATO |

ATO (Atmos Energy Corp) |

~0.39% |

| ALAB |

ALAB (Astera Labs Inc) |

~0.37% |

| PSTG |

PSTG (Pure Storage Inc) |

~0.37% |

| PTC |

PTC Inc |

~0.35% |

| WSM |

WSM (Williams‑Sonoma Inc) |

~0.35% |

These show that industrials and consumer discretionary dominate the fund, with technology and financials also meaningful. It remains broadly diversified across sectors, though admittedly skewed towards the "growth" sectors.

2. Additional metrics & risk indicators

Turnover rate: ~12.9 % (relatively low for small‑cap funds).

Standard deviation (3‑yr) ~19.18 % — reflective of the higher volatility inherent in the small‑cap space.

Expense ratio vs category: At 0.05 % the fund is much lower than the average small‑cap core fund (~0.35 %).

Taken together, the anatomy of VB ETF reveals a broad small‑cap portfolio, modest valuations, reasonable diversification, strong cost control, and risk metrics consistent with small‑cap equity exposure.

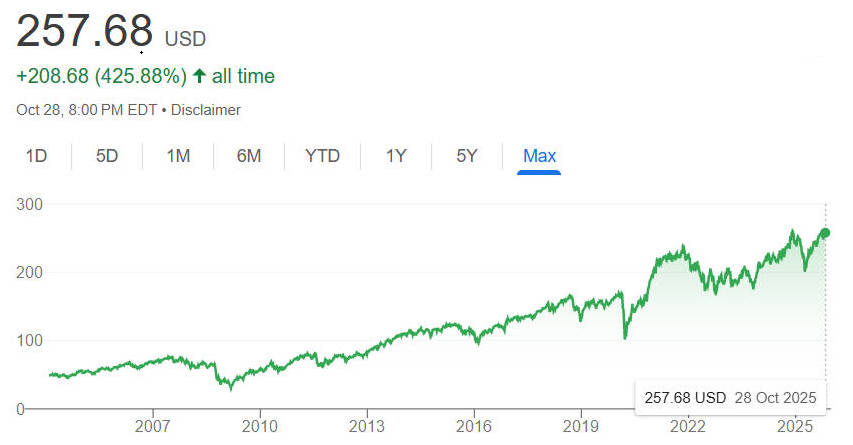

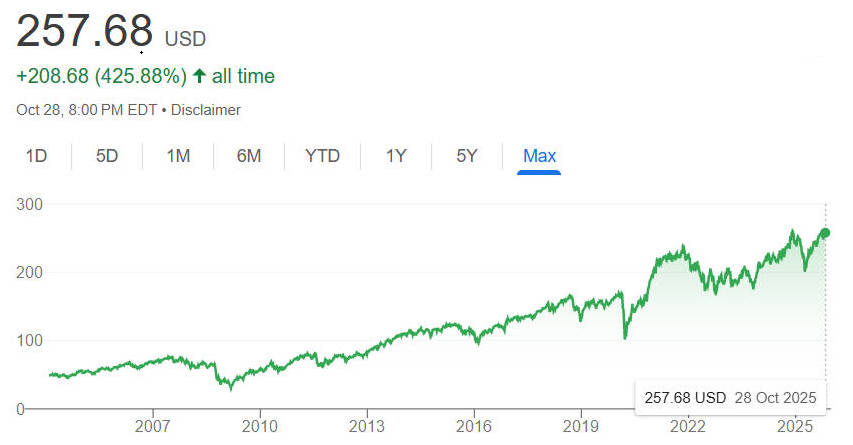

Performance & Behavioural Patterns of the VB ETF

Historical returns of VB ETF Vs. Benchmarks

| Period |

VB (%) |

Category (%) |

| YTD |

6.89 |

6.31 |

| 1-Month |

0.96 |

0.72 |

| 3-Month |

7.56 |

8.28 |

| 1-Year |

8.67 |

6.31 |

| 3-Year |

15.94 |

14.50 |

| 5-Year |

12.22 |

12.68 |

| 10-Year |

10.57 |

9.56 |

Behavioural patterns

Because small‑cap stocks tend to be more sensitive to economic growth, liquidity and risk sentiment, VB's returns may rise significantly during favourable growth regimes, but may lag or decline in slower growth/flight‑to‑safety periods.

Benchmarks and comparison

The fund's benchmark (CRSP US Small Cap Index) and similar indices (e.g., Russell 2000) provide context: small‑cap indices often outperform large‑cap indices over long horizons but with meaningful periods of underperformance or drawdowns. Investors must keep the time‑horizon in mind when investing in VB.

Strengths and Weaknesses: A Balanced View of the VB ETF

1. Strengths

Broad diversification within small‑cap segment:

With over 1.300 holdings, VB reduces single‑stock risk compared to concentrated small‑cap funds.

Low cost:

At 0.05 %, the expense ratio is among the lowest available for U.S. small‑cap index ETFs, meaning less drag on returns.

Transparency and simplicity:

The fund uses full replication, tracks a well‑known index, and is issued by a trusted provider (Vanguard).

Growth potential:

Small‑cap companies often present higher growth trajectories, which can benefit long‑term investors.

2. Weaknesses

Higher volatility and risk:

As noted, standard deviation ~19 % implies wider swings in value, which may be uncomfortable for risk‑averse investors.

Small‑cap underperformance risk:

In periods of slower economic growth, rising interest rates or defensive market sentiment, small‑caps may lag large‑caps.

U.S. only exposure:

VB provides U.S. small‑cap exposure only; investors seeking global small‑cap diversification will need to combine with other funds.

Market‑cap drift:

Though labelled "small‑cap," companies may grow and exit the small‑cap range over time, or the index's definition may shift; this may lead to differing exposures than some investors expect.

For an investor based in Taiwan or elsewhere outside the U.S., additional considerations include currency risk, foreign withholding tax on dividends, and the brokerage or access cost for U.S.‑listed ETFs.

How to Use the VB ETF in Your Portfolio

1. Allocation considerations

For a long‑term investor (for example at age 27) seeking both stability and growth, VB can serve as the growth‑oriented small‑cap component. A suggested allocation might be 5–15 % of the overall portfolio, depending on one's risk appetite and time horizon.

2. Complementary exposures

VB should not stand alone. Consider pairing it with:

A large‑cap U.S. index fund (for core exposure)

A mid‑cap fund (to cover the mid‑size company range)

An international equity fund (for geographic diversification)

Bond or fixed‑income exposure (for risk mitigation)

3. Rebalancing and monitoring

Rebalance periodically (e.g., annually) to target allocations, as small‑cap segments can drift.

Monitor sector/capitalisation drift: ensure VB is still fulfilling the small‑cap exposure you intended.

Ensure you are comfortable with the volatility and have the requisite time horizon (ideally 10 + years) to allow small‑cap exposure to play out.

4. Specific notes for non‑U.S. investors

Be aware of currency risk: U.S. dollar fluctuations will impact returns for a Taiwanese (NTD) investor.

Check tax implications: U.S. dividends may be subject to withholding; local tax treaties may apply.

Ensure brokerage access to U.S.‑listed ETFs or consider locally listed equivalents (though cost and liquidity may differ).

Recent Developments & What to Watch for Ahead

1. Macro and market‑environment factors

Small‑cap performance is sensitive to economic growth, interest‑rate changes and risk appetite.

If growth accelerates, VB could benefit; if the environment turns defensive, it may underperform.

Valuation matters:

At a P/E ratio of ~21.6x for VB, the valuation is not cheap; investors should be mindful of entry timing.

Fee environment:

While VB already is very low cost, the broader ETF industry continues to push fees lower, so tracking costs and competition remains relevant.

Index methodology:

The CRSP US Small Cap Index's construction and inclusion criteria should be monitored, as small‑cap definitions evolve.

2. What to watch

Relative performance versus large‑cap or mid‑cap indices

Portfolio drift: whether VB's exposure remains firmly in "small‑cap" territory

Sector shifts: as certain sectors surge (e.g., technology), how VB's weighting adjusts

Economic cycle: small caps tend to lead early in expansions but may suffer in downturns

Key Take‑aways

VB ETF is a low‑cost, broadly diversified U.S. small‑cap equity fund.

It provides growth potential and a diversification complement to large‑cap holdings, but comes with higher risk and volatility.

For long‑term investors willing to accept the ups and downs, VB can be a meaningful building‑block in a growth‑oriented portfolio.

However, it must be used with an awareness of its risk profile, and within a broader diversified framework (including large‑cap, international and perhaps fixed‑income).

Non‑U.S. investors should pay attention to currency, tax and access issues.

Ultimately, if you have a long horizon, sufficient risk tolerance and want to tilt toward growth in the small‑cap space, VB ETF is a compelling option—but it is not a free lunch, and timing, allocation and discipline matter.

In summary, VB ETF offers a balanced gateway to U.S. small‑cap growth, provided you approach it as one component of a well‑designed portfolio rather than a stand‑alone "silver bullet".

Frequently Asked Questions

Q1. What does the VB ETF invest in?

The VB ETF tracks the CRSP US Small Cap Index, comprising U.S. small‑capitalisation stocks across growth and value styles.

Q2. What are the main risks associated with VB ETF?

Key risks include higher volatility than large‑cap funds, potential underperformance in defensive or slow‑growth periods and exposure to U.S.‑small‑company risk.

Q3. At what time horizon does the VB ETF make sense?

Given its small‑cap nature and higher volatility, the VB ETF is more suited to investors with a longer horizon (e.g., 10 + years) and willingness to accept ups and downs.

Q4. How should I allocate VB ETF within a diversified portfolio?

For growth‑oriented portfolios, a typical allocation might range between 5‑15% of equity holdings, depending on risk tolerance and other exposures.

Q5. Can I rely solely on VB ETF for all my equity exposure?

No. While VB offers broad small‑cap exposure, it should complement large‑cap, mid‑cap, international and fixed‑income holdings rather than serve as the sole equity allocation.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.