Vanguard index funds have long been a cornerstone for investors seeking low-cost, diversified, and reliable growth over the long term. With a reputation for simplicity and robust performance, Vanguard's suite of index mutual funds and ETFs offers something for every investor—whether you're just starting out or fine-tuning a mature portfolio.

Here's a guide to the best Vanguard index funds for long-term investors and what makes them stand out in 2025.

Why Choose Vanguard Index Funds?

Vanguard is renowned for its commitment to low fees, transparency, and investor-first philosophy. Index funds, by their nature, track a specific market benchmark—such as the S&P 500 or a total bond market index—rather than relying on active management. This approach reduces costs and aims to match, rather than beat, the market's performance.

Key benefits of Vanguard index funds:

Low expense ratios: Vanguard consistently offers some of the lowest fees in the industry, allowing more of your returns to compound over time.

Diversification: Many Vanguard funds provide broad exposure to hundreds or even thousands of securities, spreading risk across sectors and geographies.

Simplicity: Index funds are easy to understand and manage, making them ideal for buy-and-hold investors.

Strong track records: Vanguard's flagship funds have delivered solid long-term returns, earning top ratings from analysts.

Best Vanguard Index Funds for Stocks

1. Vanguard 500 Index Fund (VFIAX/VOO)

What it tracks: S&P 500, representing 500 of the largest US companies.

Why it's a top pick: Offers instant diversification across leading US firms and has a very low expense ratio (0.04% for Admiral Shares, 0.03% for the ETF).

Who it's for: Investors seeking core US large-cap exposure.

2. Vanguard Total stock market Index Fund (VTSAX/VTI)

What it tracks: The entire US stock market, including large-, mid-, and small-cap companies.

Why it's a top pick: Provides comprehensive exposure to the US equity market with just one fund; low fees and strong long-term growth.

Who it's for: Those wanting to capture the full breadth of US stocks.

3. Vanguard Growth Index Fund (VIGAX/VUG)

What it tracks: US large-cap growth stocks, focusing on sectors like technology and consumer services.

Why it's a top pick: Ideal for investors seeking higher growth potential, albeit with more volatility.

Who it's for: Long-term investors comfortable with market swings.

4. Vanguard FTSE All-World ex-US Index Fund (VFWAX/VEU)

What it tracks: International stocks from developed and emerging markets, excluding the US.

Why it's a top pick: Diversifies your portfolio beyond domestic equities, capturing global growth opportunities.

Who it's for: Investors seeking international exposure.

Best Vanguard Index Funds for Bonds

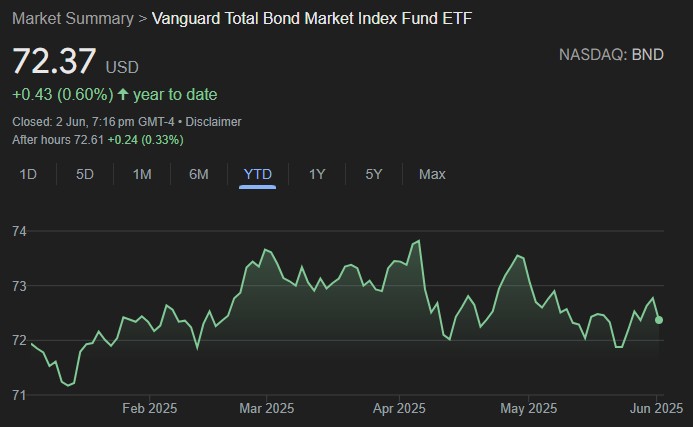

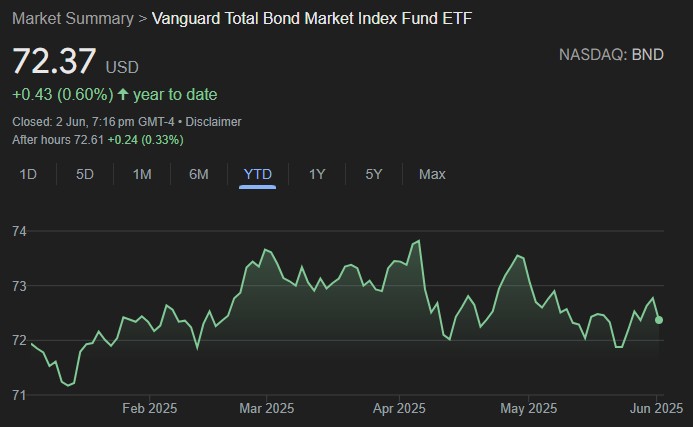

5. Vanguard Total Bond Market Index Fund (VBTLX/BND)

What it tracks: US investment-grade bonds, including government and corporate bonds.

Why it's a top pick: Offers broad fixed-income exposure, helping to balance equity risk and provide income.

Who it's for: Anyone seeking stability and diversification in their portfolio.

6. Vanguard Short-Term Inflation-Protected Securities Index Fund (VTAPX/VTIP)

What it tracks: Short-term US Treasury Inflation-Protected Securities (TIPS).

Why it's a top pick: Helps protect against inflation while limiting interest rate risk.

Who it's for: Investors worried about rising prices and seeking a defensive bond allocation.

How to Build a Diversified Long-Term Portfolio

A well-diversified portfolio often includes a mix of US stocks, international stocks, and bonds. Vanguard's index funds make it easy to achieve this with just a few funds. For example:

Core US equity: VFIAX/VOO or VTSAX/VTI

International equity: VFWAX/VEU

Fixed income: VBTLX/BND and/or VTAPX/VTIP

Adjust your allocations based on your risk tolerance, investment horizon, and financial goals. Younger investors may favour more equities for growth, while those nearing retirement might increase their bond holdings for stability.

Tips for Long-Term Success

Stay the course: Avoid the temptation to time the market. Regular investing and holding through market cycles historically delivers strong results.

Reinvest dividends: Take advantage of compounding by reinvesting income distributions.

Review periodically: Rebalance your portfolio as needed to maintain your desired risk profile.

Conclusion

Vanguard's index funds remain among the best choices for long-term investors in 2025, offering low costs, diversification, and a proven track record. By selecting a mix of stock and bond funds tailored to your goals, you can build a resilient portfolio designed to grow with you over the years.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.