EMB ETF provides diversified exposure to US dollar denominated emerging market sovereign and quasi-sovereign bonds while offering materially higher income than many developed market bond alternatives, balanced against credit, liquidity and geopolitical risk. This short answer summarises the fund proposition.

The paragraphs that follow will explain the ETF structure and benchmark, quantify current yields and costs, explore the principal drivers and risks, show how investors commonly use EMB ETF in portfolios, present practical implementation notes and metrics in tabular form, and finish with frequently asked questions.

EMB ETF: Fund Profile, Benchmark And Core Mechanics

The iShares J.P. Morgan USD Emerging Markets Bond ETF, widely known by its ticker EMB, was launched in December 2007 to track the J.P. Morgan EMBI Global Core Index. The fund aims to replicate the performance of US dollar denominated sovereign and quasi-sovereign debt issued by emerging market countries, subject to index rules and tracking error.

The ETF structure means investors gain market exposure through a tradeable exchange listed vehicle rather than by buying individual bonds.

Key structural points are straightforward:

EMB holds a broad set of bonds that meet the index liquidity and maturity rules.

The index is designed to represent US dollar external debt from emerging markets and to limit concentration by capping exposure to single issues, which helps achieve diversification within the fund.

The ETF distributes income to holders and reflects market price and NAV daily.

Key Facts And Latest Statistics of EMB ETF

Below are the most important up-to-date figures that investors typically check first: expense ratio, assets under management, yield measures, effective duration and number of holdings.

| Key Fact |

Figure |

| Issuer |

iShares by BlackRock |

| Benchmark |

J.P. Morgan EMBI Global Core Index |

| Fund Launch Date |

17 December 2007. |

| Expense Ratio |

0.39% (net). |

| Net Assets |

Approximately USD 13.8 billion to USD 14.8 billion. |

| Number of Holdings |

~650 holdings. |

| 30 Day SEC Yield |

Roughly 5.5% to 6.1% depending on the recent reporting date. |

| Effective Duration |

Approximately 6.9 years. |

| Weighted Average Coupon |

Around 5.4% to 5.9%. |

Top Country Exposures And Composition

Understanding country concentration is central to any allocation decision in emerging market debt. The fund combines sovereign, quasi-sovereign and some corporate issuance denominated in US dollars.

The table below summarises a recent snapshot of the top country exposures. Percentages will shift through time with bond issuance, index reweighting and market moves.

| Top Country Exposures (snapshot) |

Approximate Weight |

| Mexico |

~9% |

| Indonesia |

~8% |

| Brazil |

~7% |

| Philippines |

~6% |

| Colombia |

~5% |

| South Africa |

~5% |

| Chile |

~4% |

| Peru |

~4% |

| Poland |

~3% |

| Hungary |

~3% |

This country list is indicative and comes from the ETF product brief and fact sheet which publish country weights on a monthly or quarterly basis. Investors should check the latest holdings report for the exact percentages on the trading date.

What Drives EMB ETF Performance

There are a small number of dominant drivers that explain most of EMB ETF returns over normal market cycles.

1. Income and nominal spreads

The primary source of return for EMB ETF is coupon income and spread compression or widening relative to US Treasuries.

Emerging market bonds typically yield a premium over developed market sovereign debt to compensate investors for additional credit and liquidity risk. When spreads tighten, total return improves.

2. US dollar moves

Because the bonds are denominated in US dollars, direct currency translation is not a driver of coupon receipts or principal for a US dollar investor.

However, the exchange rate can affect emerging market fundamentals. A weaker US dollar tends to reduce local currency debt servicing pressure for many issuers and can be supportive for spreads. Conversely, a stronger dollar can create stress and push spreads wider.

3. Global risk appetite and liquidity

Emerging market debt is sensitive to global sentiment.

In risk-on episodes, flows into credit and EM ETFs frequently improve liquidity and compress spreads.

In risk-off episodes, investors withdraw funds rapidly which can lead to widened bid-ask spreads and heightened volatility.

4. Interest rate environment in developed markets.

Changes in US policy rates and Treasury yields influence the absolute level of yields required by investors and therefore affect returns through both duration and spread channels.

Rising global yields are usually a headwind for fixed income ETFs with multi-year duration.

5. Idiosyncratic country events.

Sovereign crises, credit downgrades or geopolitical shocks in key countries may create concentrated drawdowns even when global EM sentiment is neutral.

Fund diversification reduces but does not eliminate these risks.

Principal Risks And How To Think About Them

Every investment in emerging market debt carries a mixture of reward and risk. The most material risks to consider are described below.

1. Credit Risk

Some issuers in the index are lower rated and carry non trivial default risk. Though the index includes many investment grade issuers, a meaningful portion is non-investment grade. Credit events materially affect total return.

2. Liquidity Risk.

Individual emerging market bonds can be less liquid than sovereign debt of developed countries. During stress periods liquidity can evaporate and bid-ask spreads widen. The ETF wrapper improves tradability for smaller investors but liquidity in the underlying market still matters.

3. Concentration and Event Risk.

Country weights can be significant. Adverse events in a large constituent country can cause outsized volatility.

4. Interest Rate and Duration Risk.

The fund has a multi-year effective duration, which implies sensitivity to changes in global yields. Rising yields depress the market value of the bonds.

5. Tracking Error and Index Rules.

The ETF follows an index with specific inclusion rules and caps. Deviations between the index and the ETF caused by costs and sampling may produce tracking error.

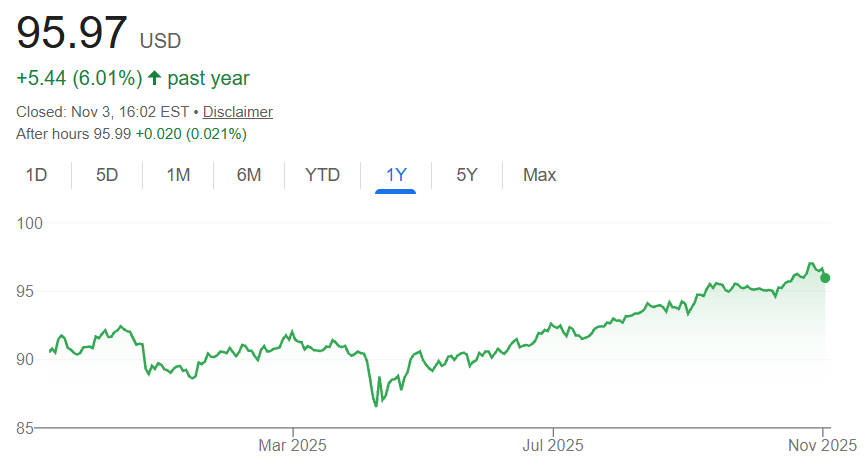

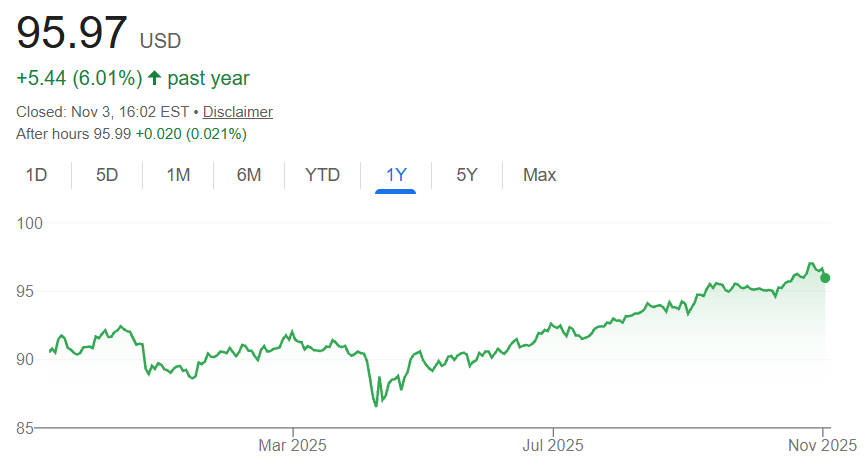

Performance Context And Comparative Metrics

Performance varies by time horizon and is inherently backward looking. The following high level points provide context for how EMB ETF has performed relative to typical benchmarks.

Year to date returns and one year trailing returns for EMB have outperformed the ordinary emerging market bond category in periods when spreads tightened and yields remained attractive.

For example, year to date performance figures in recent months ranged near low double digits for the current calendar year in many data feeds. That performance reflects a combination of high coupon income and spread compression.

Where EMB ETF Fits Inside A Portfolio

Investors typically use EMB ETF for one or more of the following purposes.

A pragmatic rule is to size EMB consistently with risk appetite and to treat it as a higher risk fixed income exposure rather than a direct substitute for sovereign Treasury allocations.

Practical Implementation Notes: Trading, Taxation And Execution

Trading and liquidity

EMB typically trades with healthy volume relative to many single-country bond ETFs, and the market maker network for iShares products generally makes execution straightforward for retail and institutional investors.

Nevertheless, check the bid-ask spread at the time of trade, particularly for large orders.

Transaction costs and market impact

The total cost of ownership comprises the expense ratio, the bid-ask spread you pay when trading, and possible tracking error. Smaller traders should focus on spread and timing to minimise market impact.

Taxation

Taxation varies materially by domicile and account type.

Distributions from the ETF are generally taxed as ordinary income in many jurisdictions, but local rules, withholding and treaty relief can change the net outcome.

Consult a tax adviser for personalised guidance.

| Cost And Risk Snapshot |

Figure or Note |

| Expense Ratio |

0.39% net. |

| 30 Day SEC Yield |

5.5% to 6.1% depending on report date. |

| Effective Duration |

~6.9 years. |

| Number of Holdings |

~650. |

| Net Assets |

~USD 13.8bn to 14.8bn. |

| Recent Performance Metrics |

Figure |

| Year to date total return (most recent calendar year) |

~12% (varies by vendor and date). |

| 1 Year Total Return |

~10% to 12% depending on data source. |

| 3 Year Annualised Return |

Varies, consult current fund data for exact figure. |

Scenarios That Will Matter Over The Next 12 To 24 Months

US Dollar Weakening. If the US dollar weakens materially, many emerging market issuers will face fewer local currency pressures relative to their dollar obligations, which can be pro-cyclical for spreads and supportive for fund returns.

Global Rate Volatility. A sustained rise in Treasury yields would push longer duration assets lower and may offset the income advantage of EMB. Investors should pay attention to both the level of US yields and the credit spread component.

Country Specific Shocks. Political turmoil or sovereign fiscal stress in a large constituent could cause a short sharp shock to returns. Diversification reduces but does not remove this risk.

Large Fund Flows. Rapid inflows into or out of ETF products can magnify price moves in short windows, especially if underlying bond market liquidity is constrained. Monitor flows in periods of market stress.

Frequently Asked Questions About EMB ETF

Q1. What does EMB ETF actually hold?

EMB holds US dollar denominated sovereign and quasi-sovereign bonds from emerging market countries and seeks to replicate the J.P. Morgan EMBI Global Core Index. Holdings are diversified across many issuers and typically number in the several hundreds.

Q2. Does EMB carry currency risk for a US dollar investor?

Directly no, because holdings are denominated in US dollars. Indirectly yes, because currency moves affect local economies and can influence credit spreads and issuer solvency.

Q3. How liquid is EMB ETF for trading purposes?

EMB trades with substantial average daily volume relative to many bond ETFs and benefits from iShares market making. However, traders should check the live bid-ask spread at order time and avoid large orders without execution strategy.

Q4. How does EMB differ from local currency emerging market bond ETFs?

EMB focuses on US dollar external debt while local currency ETFs hold bonds denominated in local currencies. Local currency funds expose investors to FX volatility and different macro drivers. EMB delivers dollar income and avoids direct FX translation risk for US dollar investors.

Q5. What is the best way to use EMB in a balanced portfolio?

Use EMB as an income and diversification sleeve sized to your risk tolerance. Consider 5 to 15 per cent of a diversified portfolio for investors comfortable with credit and sovereign risk, but always tailor allocation to personal objectives and constraints. Past allocations are not a guarantee of future returns.

Q6. Where should I check for the most current figures?

Consult the official iShares EMB fund page and the latest fund fact sheet or product brief. Brokers and data vendors provide live NAV, yields and holdings. The fund fact sheet is the authoritative source for fund characteristics at a given reporting date.

Conclusion

EMB ETF offers an efficient, low cost way to access US dollar emerging market debt with the potential for higher income and useful diversification. Investors benefit from a broad index approach, a long running track record and the tradability of an ETF structure. The trade off is elevated credit, liquidity and event risk relative to developed market sovereign bonds.

The decision to include EMB in a portfolio should be based on clear allocation rules, an understanding of the yield-for-risk trade off, and a plan for managing liquidity events and rebalancing. For precise live metrics and holdings consult the fund fact sheet on the issuer website before trading.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.