JEPQ can be a compelling choice for investors who prioritise regular income from large-cap US technology exposure and accept reduced upside and sector concentration in return.

This article examines JEPQ's strategy, income potential, growth outlook, key risks, peer comparisons and investor suitability.

What JEPQ is and how it works

JEPQ is the JPMorgan Nasdaq Equity Premium Income ETF. It combines a fundamentally driven equity portfolio concentrated in large-cap US growth names (largely Nasdaq-oriented) with a disciplined options overlay that sells call options to generate option premium income.

The fund therefore aims to deliver a material monthly distribution while maintaining some prospect for capital appreciation. The fund prospectus and factsheet describe this as a two-block approach: an equity sleeve plus a covered-call/options overlay.

Key mechanics to understand:

The manager selects a basket of Nasdaq-style large caps and writes call options against (some of) those holdings to collect premiums.

Option premiums provide distributable income, but writing calls caps upside above the strike price, so the strategy trades off some participation in strong rallies for higher current income.

Fund Overview and Key Structural Metrics of JEPQ

| Item |

JEPQ (JPMorgan Nasdaq Equity Premium Income ETF) |

| Inception |

May 2022 (ETF share class launched 2022). |

| Primary objective |

Current income with prospects for capital appreciation via equity selection + options overlay. |

| Expense ratio |

0.35% (gross expense). |

| Distribution frequency |

Monthly. |

| Distribution yield (approx., Oct 2025) |

Around 9–11% range across data providers (varies by source and date). |

| Strategy risks highlighted by issuer |

Forgoing some upside due to call writing; sector concentration; options counterparty and liquidity considerations. |

Notes on the figures: the distribution yield quoted by different aggregators will vary with timing and calculation method (trailing 12-month dividends, SEC yield, or distribution rate). The factsheet describes the strategy; the expense ratio is published by ETF data services.

Income: how large and how reliable is JEPQ's yield?

1. Magnitude:

JEPQ pays monthly distributions and, through October 2025. market data providers reported yields in the high single digits to low double digits (roughly 9–11% depending on the methodology).

These are driven largely by option premium receipts plus any dividends from the underlying equities.

2. Reliability and variability:

Option premium income depends on implied volatility and manager positioning. In periods of elevated volatility the premium available increases, which can lift distributions; conversely, very quiet markets compress option income.

The manager's ability to maintain a monthly distribution is supported by the options overlay and active position management, but payments can fluctuate month to month. The fund's factsheet makes clear that premiums vary with market conditions.

3. Tax treatment:

Income derived from option premiums is typically treated as ordinary income for US taxable investors, which may be less tax-efficient than qualified dividends. Investors should consult a tax advisor for their jurisdiction.

Growth potential and performance dynamics

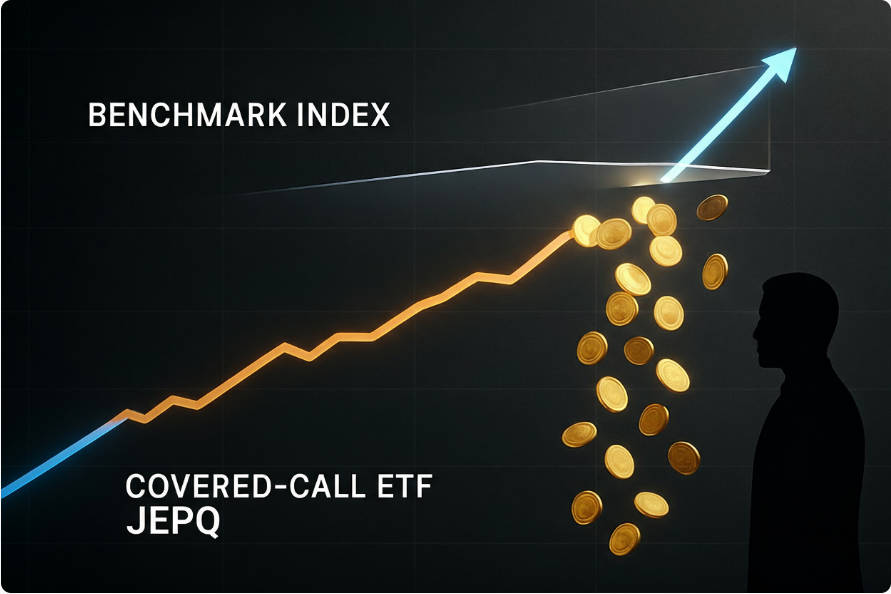

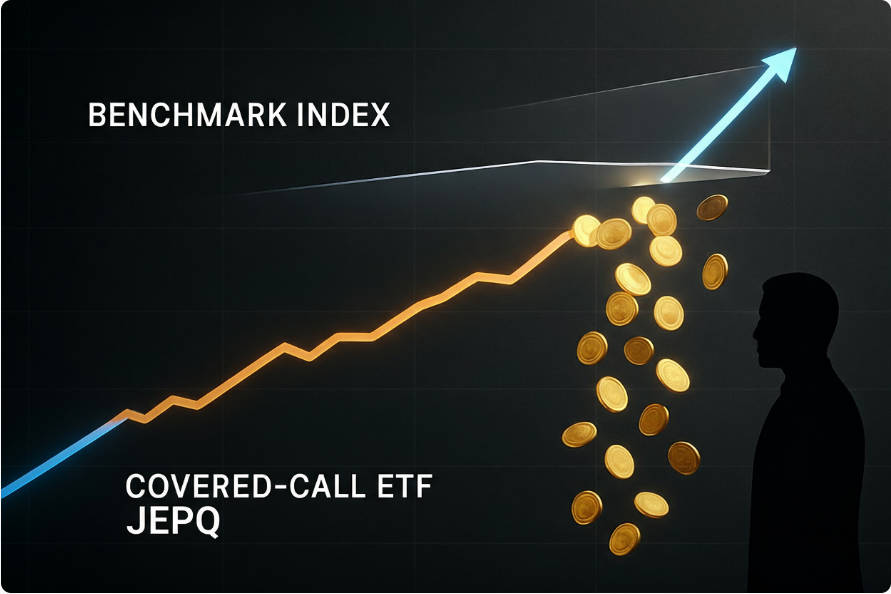

Covered-call or equity-premium funds like JEPQ typically produce two observable effects on returns:

Higher current yield than an un-overlaid equity index because of option premium captured.

Capped upside in strong bull markets since sold calls limit participation above strike prices.

Empirical performance (May 2022 to 24 Oct 2025. illustration across similar ETFs) shows:

JEPQ total return since inception (May 2022) compared with peers: JEPQ delivered strong cumulative returns but lagged the raw Nasdaq index (QQQ) over the full sample because calls constrained upside in the strongest rallies.

Comparative numbers from aggregated total return charts show JEPQ +67.4% versus QQQ +91.5% over the same interval; QYLG (another Nasdaq covered-call ETF) returned about +59.7% in that period. These differences reflect the trade-off between yield capture and index participation.

Comparative Performance and Structural Metrics: JEPQ vs QYLG vs QQQ

| Metric |

JEPQ |

QYLG (Global X Nasdaq 100 Covered Call & Growth) |

QQQ (Invesco QQQ Trust) |

| Strategy |

Active equity selection + options overlay (income focus). |

Covered-call overlay on Nasdaq-100 (income + growth). |

Passive Nasdaq-100 index replication (pure growth exposure). |

| Expense ratio |

0.35% (JEPQ). |

~0.60% (QYLG typical). |

~0.20% (QQQ typical; check provider). |

| Distribution frequency |

Monthly. |

Monthly. |

Quarterly (dividends) but total return dominated by capital gains. |

| Approx. cumulative return (May 2022 → 24 Oct 2025) |

+67.4% (JEPQ). |

+59.7% (QYLG). |

+91.5% (QQQ). |

| Typical investor use |

Income sleeve with tech exposure. |

Income + partial growth sleeve. |

Core growth exposure to large-cap tech and growth names. |

Interpretation: JEPQ offers materially higher current income than a plain index fund but will often underperform in strong bull markets because of the options overlay. Expense ratios, distribution cadence and the active management element are important differentiators.

Risk profile — what can go wrong

The principal risks are:

a) Forgone upside / cap on gains

By selling calls, JEPQ can limit the fund's participation above call strike prices. In sustained rallies, this reduces total return compared with an un-overlaid index. The prospectus and independent analyses emphasise this constraint.

b) Sector concentration

JEPQ's equity sleeve is skewed toward large US growth names. This concentration increases sensitivity to regulatory developments, sector rotation away from tech, or idiosyncratic shocks to mega-caps. The issuer notes sector concentration as a design feature and risk.

c) Volatility and distribution variability

Option premium income fluctuates with market volatility and positioning. Distributions are not guaranteed and can vary month to month. Historical monthly dividends show variation in payout amounts.

d) Tax & structural risks

The tax treatment of option income is often ordinary income. Additionally, options involve counterparty and liquidity considerations; the fund uses established structures to manage these but the prospectus warns investors of the specific mechanics and risks.

Who should consider JEPQ?

JEPQ can suit investors who:

Need a regular monthly income stream and prioritise current yield over maximum capital appreciation.

Want concentrated exposure to large-cap US growth names while receiving cash flow from option writing.

Accept volatility and understand that their upside will be limited in strong rallies.

JEPQ may be unsuitable for investors who:

Require maximum long-term capital appreciation and do not need large distributions.

Need broad sector diversification or have a low tolerance for concentrated sector risk.

Wish to maximise tax efficiency from dividends (option income may be taxed less favourably).

Practical portfolio implementation notes

1) Position sizing:

Because of concentration and strategy risk, consider sizing JEPQ as a distinct income sleeve rather than your entire equity allocation. A typical approach is to combine a covered-call income ETF with a core passive growth holding (for example QQQ) to retain participation in rallies.

2) Rebalancing:

Treat distributions as income to be reinvested or used as cash flow depending on objectives. Rebalance periodically to manage concentration.

3) Tax planning:

Review how option premium and distributions are taxed in your jurisdiction with a tax professional. This is material to net returns.

Two short case vignettes

Income-first retiree: A retiree seeking monthly cash flow may use JEPQ to replace part of fixed income, accepting some capital variability for higher current income. They should, however, keep diversification via bonds or other equity sleeves.

Growth-oriented investor with yield overlay: An investor who wants growth but also income may hold both QQQ and JEPQ; the core QQQ preserves upside while JEPQ supplies income and cushions some downside via collected premiums.

Frequently asked questions

Q1: How often does JEPQ pay distributions?

Monthly. The fund publishes a regular dividend history and ex-dividend dates.

Q2: Is JEPQ safer than owning QQQ?

Not necessarily safer; JEPQ typically experiences lower upside in strong rallies and some downside cushioning from option income in declines, but it retains equity market risk and concentration risk. Safety depends on your definition and risk tolerance.

Q3: How is the yield generated?

Primarily by selling call options (option premium) on the equity sleeve and collecting dividends from underlying holdings. Option premium fluctuates with market volatility.

Q4: Are distributions guaranteed?

No. Distributions arise from realised option premiums and dividends; they can vary month to month. The fund's factsheet and prospectus make clear distributions are not guaranteed.

Q5: How does tax affect net returns?

Option premium income is usually taxed as ordinary income for US taxable investors; international or non-US tax treatment will vary. Consult a tax advisor.

Conclusion

JEPQ is a well-designed, actively managed ETF that delivers a high level of current income by blending Nasdaq-style large-cap equity exposure with an options income overlay.

For investors whose primary goal is regular income and who accept capped upside and sector concentration, JEPQ is a sensible candidate for an income sleeve.

For investors seeking maximum total return and full participation in tech rallies, a plain Nasdaq index ETF (for example QQQ) will generally be a superior choice.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.