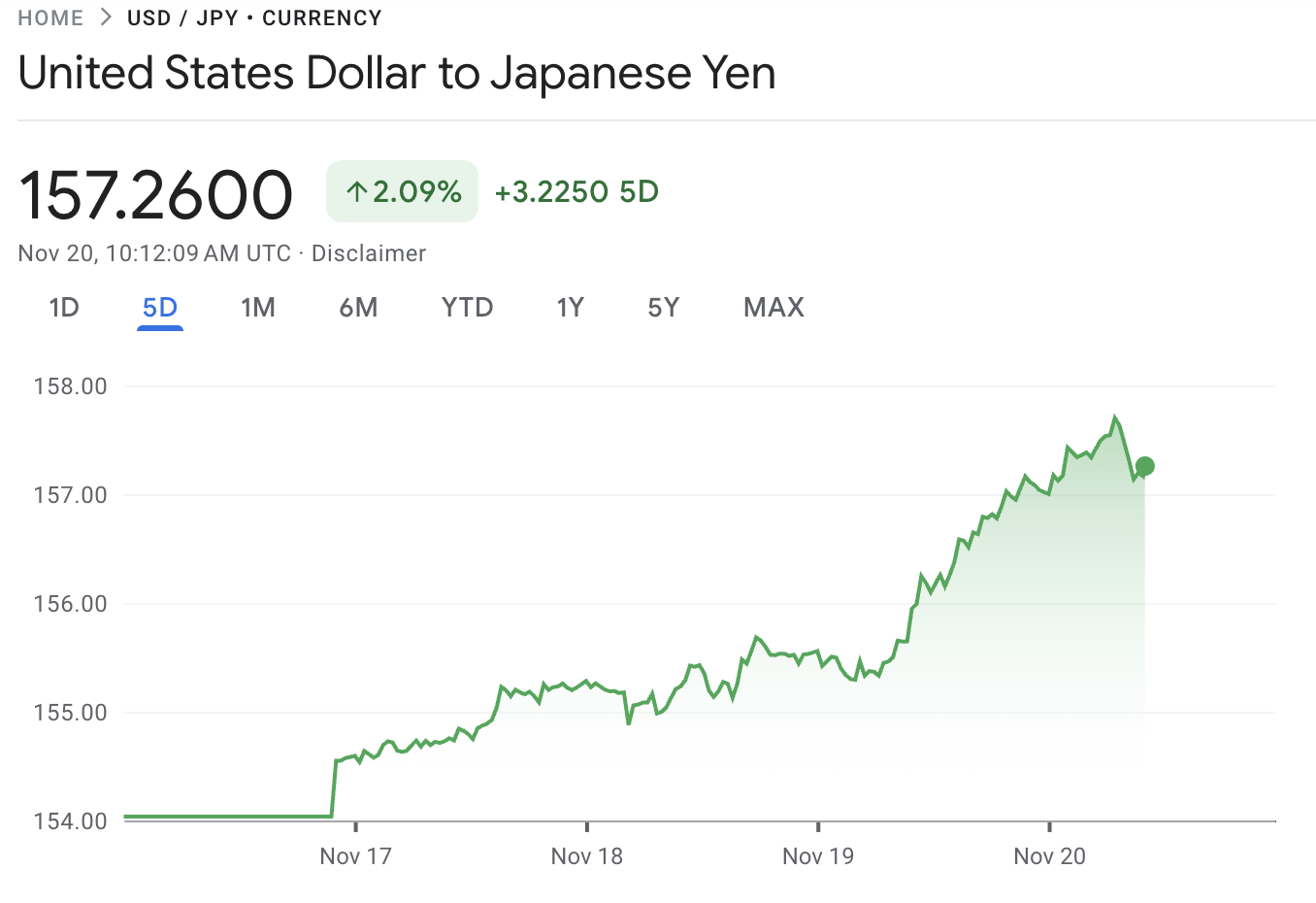

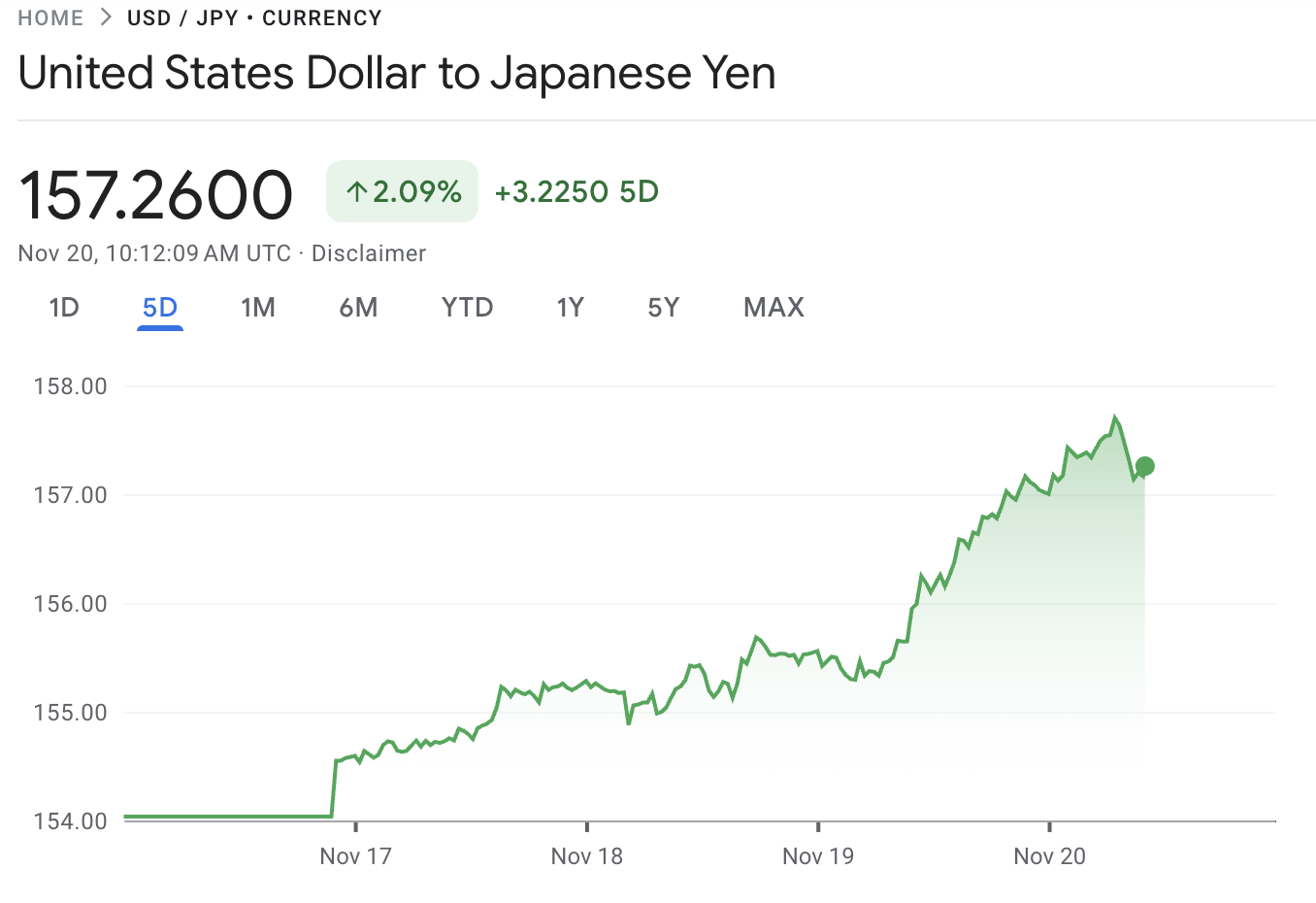

USDJPY has pushed above the 157.00 handle for the first time since January, putting the yen back under serious pressure.

The move caps a strong multi-week rally where dollar buyers have stayed in control, supported by firm US yields and a still very cautious Bank of Japan.

What makes this breakout different is the mix of macro tension and political noise behind it.

Fed minutes have cooled expectations for a quick easing cycle, while Japan is juggling weak growth, expensive stimulus and a central bank that is only talking about normalising policy.

For now, that keeps the dollar-yen trend pointing higher, but at levels where Tokyo’s tolerance is being tested.

Where USD/JPY Stands After the 157 Break

USD/JPY has pushed to roughly ¥157.2-157.7 today, marking its highest levels since mid-January, when the pair briefly traded into the high-157s and low-158s.

Over the past week the pair has gained more than 1.7%, and over the last month it’s up roughly 3-4%, underscoring a steady, macro-driven trend rather than a one-day spike.

The breakout follows a sustained rally from late October’s low near 151.9, with price now more than five yen above that pivot. Several bank and broker desks had flagged the 154.50-155.00 area as key resistance; once that gave way, the path toward 157-158 opened rapidly.

Importantly, the move through 157 places USD/JPY in the same postcode that many analysts labelled a “danger zone” for potential Japanese intervention, roughly 157–160.

That doesn’t mean action is imminent, but it does mean every extra figure higher will feel heavier for late buyers.

Why the USD/JPY Break Above 157 Matters

The 157.00 level is important for three reasons.

First, it’s a clear psychological line in the sand. When a pair trades above a big figure after months of failing, it tells you the underlying trend is strong and confident.

Second, this area sits not far below the zone where Japan has previously intervened to support the yen. That means every extra push higher comes with rising political and headline risk.

Third, the break confirms the broader bullish structure that has been building for months. Earlier resistance around 154.50-155.00 has now flipped into support, giving dollar bulls a clear “ladder” of levels underneath the market.

Macro Drivers Behind the Yen Weakness

1. Fed Policy Keeps the Dollar Supported

On the US side, the Federal Reserve has stepped away from the idea of rapid, aggressive rate cuts. Even if we are past the peak in US rates, the key point is that borrowing costs are likely to stay relatively high for longer.

For FX traders, that means the dollar still pays better than most major currencies, especially the yen. As long as US yields hold up and markets don’t fully price in a deep cutting cycle, the dollar side of USD/JPY stays attractive.

2. Bank of Japan Still Moving Very Slowly

The Bank of Japan has nudged policy away from the ultra-easy stance of previous years, but it is doing so in very small steps. Rates are still near zero, and the BoJ continues to signal that any further tightening will be cautious and data-dependent.

That leaves a very wide rate gap between the US and Japan. For global investors, the yen remains a classic “funding currency”, something that you borrow to buy higher-yielding assets elsewhere, including the US dollar.

This structural rate gap is a key pillar under the current USD/JPY uptrend.

3. Japan’s Economy and Fiscal Policy Weigh on the Yen

Japan’s growth profile is mixed at best. There are signs of weak demand in some sectors, and the government continues to rely on fiscal stimulus to support households and businesses.

When you combine slow growth, big spending and still-easy monetary policy, you usually don’t get a strong currency. In this case, it reinforces the view that yen weakness is tolerated, if not openly welcomed, as a way to support inflation and exporters.

Intervention Risk Between 157 and 160

As USD/JPY climbs deeper into the high-150s, talk of intervention naturally grows louder. Traders broadly see the 157-160 band as a danger zone where Japanese authorities may feel forced to act if moves become too fast or look speculative.

Intervention rarely comes out of nowhere. The usual sequence is clear: stronger verbal warnings from the Ministry of Finance, hints of coordination with G7 partners, and only then actual yen-buying flows in the market.

But once it happens, the price action can be brutal, with drops of two or three yen in a very short time.

For traders, that means the risk profile changes as we move higher. The Upside is still open, but it is no longer “clean”. Each push toward 158-160 carries the possibility of a sharp air-pocket lower on a single headline.

Technical Picture: Trend, Levels and Momentum

Trend and Moving Averages

Technically, USD/JPY remains in a clear uptrend on the daily chart. Price is trading comfortably above both the 50-day and 200-day moving averages, which are now sloping higher. That tells us the broader bias is still bullish.

The previous resistance area around 154.50-155.00 has turned into a key support zone. As long as the pair holds above this band on daily closes, the current breakout above 157.00 is considered valid and healthy.

Key Support and Resistance Levels

From a levels perspective, the market now has a well-defined map:

Immediate resistance sits in the 157.50-158.00 region, where recent highs and option interest tend to cluster.

Above that, the next big upside reference is the 158.50-159.00 area, linked to prior swing highs and likely profit-taking.

The major psychological barrier remains 160.00, where intervention risk is at its highest and where the last big reversal zone sits.

On the downside, the first support is around 156.20-156.50, the initial breakout and retest zone. Deeper support lies at 155.00-155.50, the former ceiling that bulls will want to defend.

A clean daily close below 153.50-154.00 would be the first real sign that this uptrend is losing momentum rather than simply correcting.

Momentum and RSI/MACD Signals

Momentum indicators back the bullish story but also flash a note of caution. Daily RSI is in or near overbought territory, which is normal in a strong move but warns that the market is “hot”.

We are also starting to see early signs of bearish divergence on some timeframes; price making new highs while RSI or MACD does not fully confirm.

This doesn’t shout “reversal now”, but it does suggest that upside from here is likely to be choppier, with sharp intraday pullbacks rather than a smooth grind.

Short-Term Forecast for USD/JPY

Over the next 1 to 4 weeks, the bias for USD/JPY remains to the upside as long as price holds above roughly 155.00 on a daily closing basis. The fundamental story; wide rate differentials, slow BoJ tightening, and a still-firm dollar, supports this view.

A realistic short-term range is 155.50 - 158.50, with occasional spikes toward the high-150s or even a test of 160.00 if US data surprises to the upside or markets scale back expectations for Fed cuts.

At the same time, traders should respect the risk of a sharp pullback from elevated levels. Overbought momentum, crowded positioning and the constant threat of Japanese jawboning mean any push into the high-157s or above could trigger fast, headline-driven corrections.

What Traders Should Focus On

For swing traders, buying fresh highs above 157.00 only makes sense if you are very clear on your time frame and stop loss. Many will prefer to look for dips into the 156.50 or 155.50 areas and wait for price to show a clear bounce before getting involved.

Day traders and scalpers can still trade the long bias, but this is not the place for oversized positions. Around these levels, comments from the BoJ or the Ministry of Finance can flip sentiment in minutes, so tight risk control and flexible trade management are essential.

In simple terms: the trend is bullish, but it is late in the move and politically sensitive. Respect the levels, respect the newsflow, and avoid assuming that today’s calm will last.

Frequently Asked Questions (FAQ)

1. Is USD/JPY likely to hit 160 soon?

It’s possible but not guaranteed. A move to 160 would likely need strong US data, sticky inflation and a Fed that stays cautious on cuts. If we approach 160, intervention risk from Japan rises sharply, which could cap the move.

2. Is USD/JPY overbought at current levels?

Yes, momentum indicators show overbought conditions, but markets can stay overbought in a strong trend. It mainly means new long positions should be sized carefully, with clear exits in case a sharp correction hits.

3. What could trigger a deeper drop in USD/JPY?

A combination of softer US data, more dovish Fed expectations, stronger hints of BoJ tightening and louder intervention threats from Tokyo could all drive a deeper move back toward the mid-150s.

4. Does the yen still act as a safe haven?

Much less than before. Very low Japanese rates mean investors often prefer the US dollar or Swiss franc in risk-off moves. The yen now behaves more like a funding currency used in carry trades.

Conclusion

USD/JPY breaking above 157.00 is a clear sign that dollar bulls still run the show, powered by the Fed-BoJ policy gap and a weak domestic backdrop for the yen.

The technical picture, with price above key moving averages and old resistance now acting as support, also points to a market that remains in an uptrend.

But this strength comes with strings attached. The pair is now trading in a politically sensitive zone, momentum is stretched, and intervention chatter is never far away.

For traders, the message is straightforward: respect the bullish structure, but treat these levels with caution and disciplined risk management.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.