The dollar traded around 156.48 yen on 25 November 2025 as investors absorbed a stronger than expected Japanese inflation print, a rapid rise in long Japanese yields and renewed public warnings from Tokyo about possible yen support.

Over the past week the pair moved between 155.03 and 157.73. reflecting heightened intraday volatility and heavy attention to policy signals.

Market Snapshot And Immediate Drivers For USDJPY

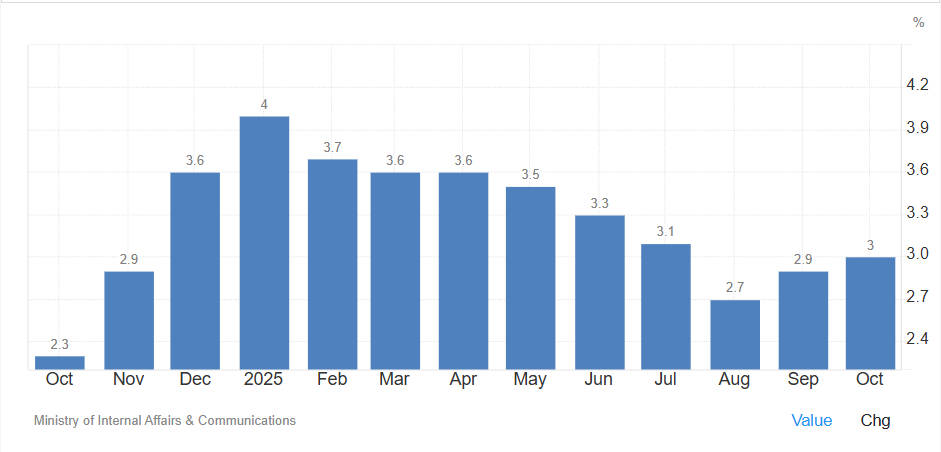

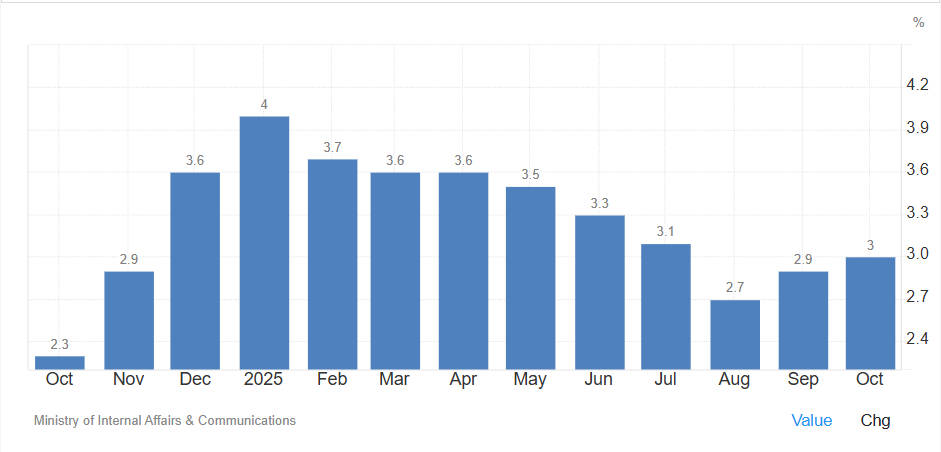

Japan's nationwide core consumer price index rose 3.0 per cent year on year in October, up from 2.9 per cent in September and well above the Bank of Japan's 2.0 per cent target. [1]

That persistent inflation reading has helped push the benchmark 10 year Japanese government bond yield higher, which stood near 1.80 per cent on 25 November after reaching intraday prints above 1.84 per cent earlier in the week. Those two developments have been the primary domestic drivers for the yen this month.

At the same time, Tokyo officials have signalled readiness to act if currency moves become disorderly, with officials and analysts commonly identifying the 160 yen per dollar area as a policy relevant threshold.

Officials emphasised coordinated action with the United States where appropriate. Market participants are therefore balancing a faster normalisation of Japanese rates against a realistic intervention risk.

How Japan Inflation, JGB Yields And Yield Differentials Influence USDJPY

The mechanism linking domestic data to the exchange rate is straightforward. Stronger inflation raises the probability of earlier Bank of Japan tightening, which pushes up JGB yields. On 25 November the 10 year JGB printed around 1.80 per cent, roughly 40 to 60 basis points higher than levels seen only a few weeks earlier. [2]

When JGB yields move up relative to US yields the interest rate gap narrows, which can either cap further dollar gains or encourage yen appreciation depending on the US side of the equation.

Markets are watching the US side closely too. The cancellation of the US October CPI release owing to a recent lapse in appropriations reduced the number of near term data points for Fed assessment, increasing uncertainty about the timing of any Fed easing and contributing to higher implied volatility in FX markets. The Bureau of Labor Statistics has posted revised release guidance while regulators determine which outputs can be produced.

Positioning, Flows And The Amplification Mechanism

Speculative positioning in yen futures remains material and able to amplify moves.

CFTC derived metrics indicate that non commercial net positions for the yen fell from around 79.500 contracts in September to roughly 46.300 contracts in the most recent published week, signalling a meaningful reduction in one directional positioning but leaving room for sharp adjustments if new information triggers rapid rebalancing.

Large option skews and rising hedging costs have accompanied the move, making one way bets more expensive.

Corporate flows and Japan repatriation needs at quarter ends also matter. With the Ministry of Finance indicating an appetite to act if necessary, the combination of heavy speculative flows and government readiness creates the possibility of sudden, policy driven volatility spikes.

Technical Framework And Key Levels For Traders

Technically the pair has traded in a short term range from about 155 to 157.7 this week, with immediate support clustered in the low 150s and resistance in the mid to high 150s. Market participants cite 160 as the psychological and policy sensitive barrier where intervention chatter coalesces.

A sustained break above 157.5 would raise the probability of an accelerated run to 160 within weeks, whereas a decisive move below 152 would point to renewed yen strength and a reversion in yield expectations. Short term option-implied volatility has risen noticeably, pricing in a higher probability of sizeable moves.

Intervention Risk, Policy Tools And Historical Context

Tokyo retains substantial foreign exchange reserves and a range of tools including verbal intervention, coordinated action with the United States and direct market operations to buy yen. Senior advisers to the prime minister and finance ministry members have reiterated that Japan can be active in using reserves to conduct yen buying if required.

Historical episodes show intervention can be effective at shifting short term momentum but may not alter longer term equilibria without simultaneous policy adjustments. Market pricing now embeds both a higher probability of rate normalisation and a non trivial chance of official intervention should USDJPY breach and hold above the 160 area.

Three Plausible Scenarios For The Next Three To Six Months

Bull Case for USDJPY

If US growth surprises to the upside and global risk appetite weakens, the dollar could push higher and test 160 to 165. especially if BOJ tightening is slow and Tokyo refrains from large scale intervention. Option hedging costs will escalate in that environment.

Base Case for USDJPY

Consolidation between 152 and 158 is the most probable path. Markets will await rescheduled US inflation data, the BOJ December deliberations and clearer signals on the scale of any intervention. Range trading, punctuated by headline driven spikes, is likely.

Bear Case for USDJPY

If US data surprises to the downside when released or if Tokyo acts early and credibly to support the yen while BOJ signals slower normalisation, USDJPY could fall back toward the low 150s, relieving some near term pressure.

Each scenario should be sized relative to probable volatility and competitor central bank developments.

Practical Recommendations For Traders And Corporate Treasurers

Reassess hedge tenors given higher implied volatility and the possibility of sudden policy moves.

Consider option structures to manage tail risk where outright hedges are expensive.

Monitor daily JGB moves, US Treasury yields and CFTC positioning updates to detect shifts in speculative flow.

Keep an eye on official comments from the Ministry of Finance and BOJ speeches as well as auction results that could alter liquidity. Recent MOF auction schedules show ongoing issuance and buy back programmes that influence curve dynamics.

Calendar: Data And Events To Watch

Bank of Japan commentary and any policy meeting notes ahead of the December window.

Rescheduled US inflation releases and subsequent employment data which will reset Fed expectations.

JGB auctions and issuance calendar, including November issuance figures near ¥250 billion noted in recent MOF publications.

Conclusion: Elevated Volatility With Policy At The Forefront

USDJPY is trading in an environment where domestic Japanese inflation and rising JGB yields have reclaimed influence, while Tokyo's explicit readiness to act has raised the political premium attached to any break above the 160 mark.

The cancellation of the US October CPI increases near term uncertainty on the Fed path, making both range bound trading and abrupt headline driven moves plausible. Market participants should prioritise robust risk management, frequent revaluation of hedge costs and careful monitoring of official commentary and positioning metrics.

Frequently Asked Questions

What is Japan's latest core CPI and how does it affect USDJPY?

Japan's nationwide core CPI rose 3.0 per cent year on year in October. That persistent inflation raises the odds of Bank of Japan tightening, pushes JGB yields up and therefore directly influences USDJPY through yield differentials.

What level of USDJPY raises intervention risk from Tokyo?

Market participants often cite around 160 yen per dollar as the intervention threshold. Tokyo has signalled a willingness to act if moves threaten stability, making sustained breaches of that area more politically sensitive.

How did the cancelled US CPI affect FX markets and USDJPY?

The cancellation of the US October CPI removed a near term Fed anchor, increasing uncertainty on rate timing and raising implied volatility in FX markets. Traders must rely on subsequent releases to reprice expectations.

How should corporate treasurers adjust hedging amid current USDJPY risks?

Treasurers should reassess hedge tenors, consider option based protections to limit tail exposure and monitor yield moves and official comments closely to avoid being caught by sudden policy driven volatility. Layered strategies help manage cost.

Sources:

[1]https://tradingeconomics.com/japan/consumer-price-index-cpi

[2]https://tradingeconomics.com/japan/inflation-cpi

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.