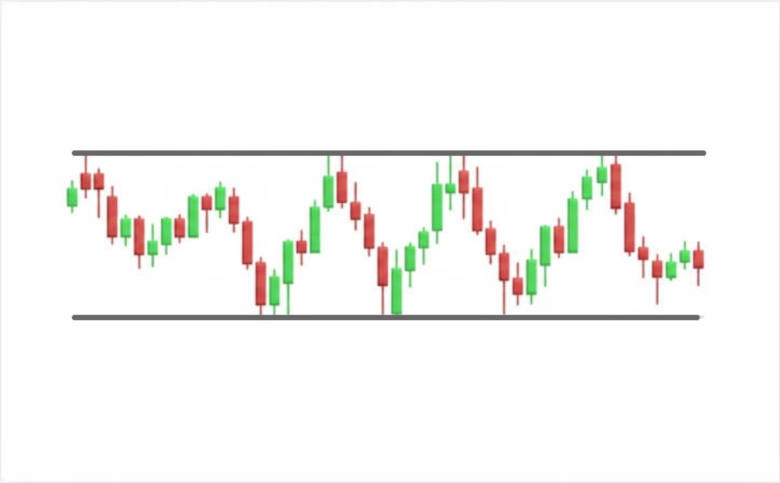

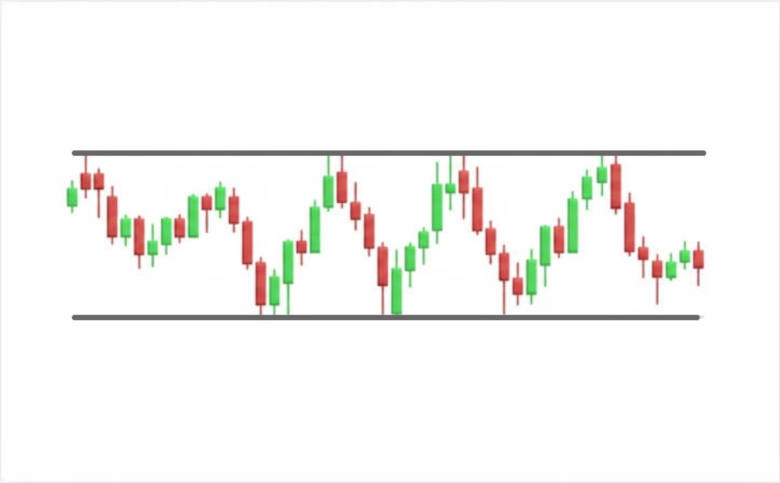

The rectangle pattern is a chart‑formation where price oscillates between parallel horizontal support and resistance lines during consolidation, then breaks out with renewed trend momentum.

In the paragraphs ahead, we will transition from defining what the rectangle pattern truly is, into a full breakdown of its identification, types, trading strategy, common pitfalls, real‑life applications, integration into your broader framework and a useful checklist for your trading.

What the Rectangle Pattern Represents: A Pause in Trend Momentum

The rectangle pattern is a hallmark of market indecision, where supply and demand reach a temporary equilibrium and price moves sideways within a defined range.

Key features of this phase include:

Horizontal lines of support and resistance that approximate the top and bottom of the trading range.

Multiple tests of each boundary: at least two swing highs touching the resistance and two swing lows touching support.

A prior trend (up or down) preceding the consolidation period; the rectangle then may either continue the trend or in some circumstances reverse it.

Volume typically declines during the consolidation, reflecting diminishing conviction, until the breakout occurs.

From a psychological viewpoint, the rectangle pattern is a truce between buyers and sellers: neither side can push the price beyond the boundaries and so the market "stalls".

Once one side wins out through a breakout, the prior trend often resumes or reverses, making the rectangle a formation that technical analysts find particularly useful to monitor.

How to Identify a True Rectangle Pattern on the Chart

Identifying a valid rectangle pattern correctly is essential if you wish to trade it with confidence. Below are detailed criteria, followed by a summary in table form.

1. Identification criteria

A close outside the rectangle boundary (not just a wick).

A surge in volume relative to the consolidation phase.

How to Identify a True Rectangle Pattern

| Feature |

Requirement / Guideline |

| Boundaries |

Two nearly horizontal lines (support & resistance) |

| Touches |

Minimum 2 touches on each line |

| Preceding trend |

Clear trend direction exists (uptrend or downtrend) |

| Duration |

Consolidation spans meaningful time (weeks to months) |

| Breakout confirmation |

Close outside boundary + increased volume |

Types of Rectangle Patterns: Bullish vs Bearish

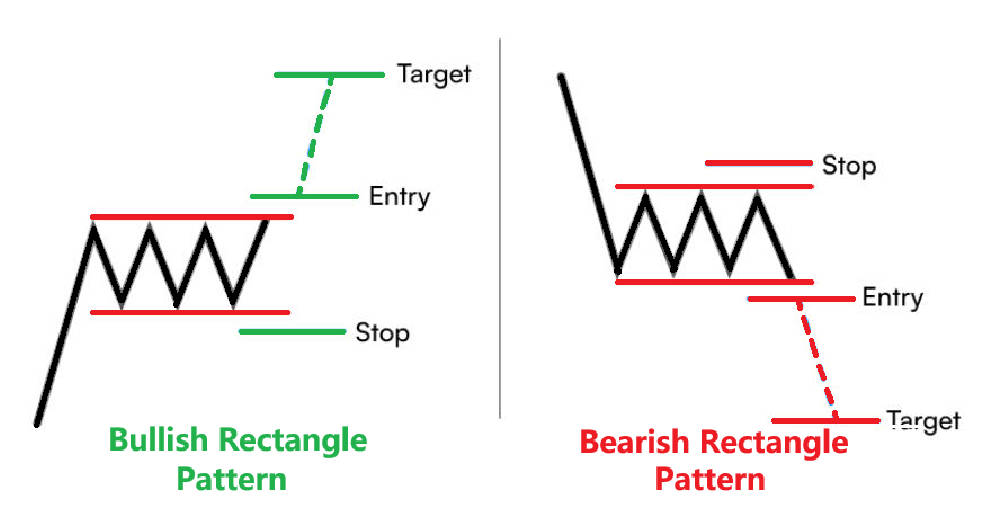

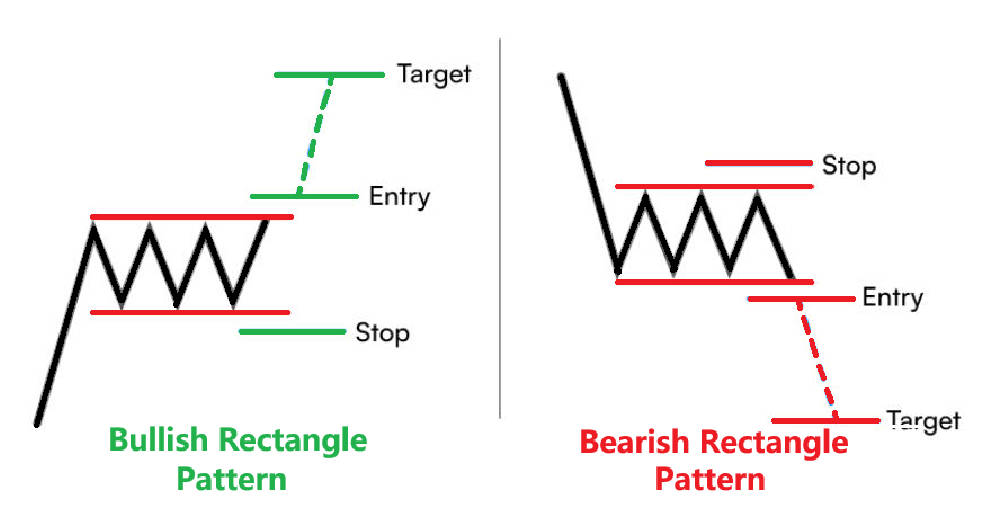

Though the same geometric structure applies, the context (trend direction) and the breakout direction define two major types of rectangle patterns.

Occurs following an uptrend. Price then enters a consolidation phase forming the rectangle.

The expectation is a breakout to the upside (above the resistance line).

After breakout the target is often the height of the rectangle projected upward from the breakout point.

Stop‑loss is typically placed just below the breakout point or just below the rectangle's support line.

2. Bearish Rectangle (Continuation in down‑trend)

Occurs after a downtrend. The market pauses and forms a rectangle consolidation.

The expectation is a break‑down (below the support line), leading to further decline.

The target is the height of the rectangle projected downward from the breakout point.

Stop‑loss is typically just above the rectangle's resistance line or the breakout point.

3. Reversal Possibility

While rectangles are more commonly continuation patterns, they can occasionally act as reversal formations—especially when the prior trend is exhausted.

Hence context matters: look at volume, market sentiment, preceding trend strength, and broader market conditions.

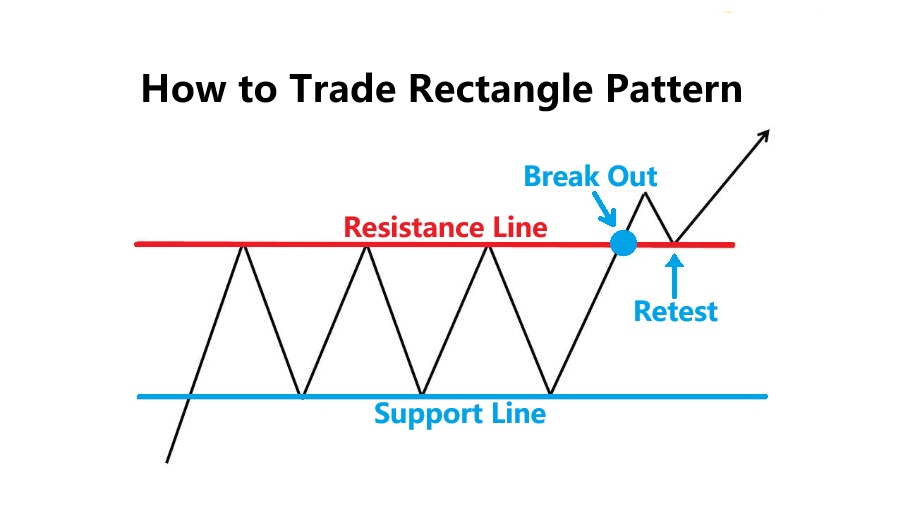

Step‑by‑Step Trading Strategy: From Identification to Execution

Once you have identified a valid rectangle pattern, the next stage is structured execution. The following provides a detailed strategy, incorporating entry rules, stop‑loss, target setting, and confirmation filters.

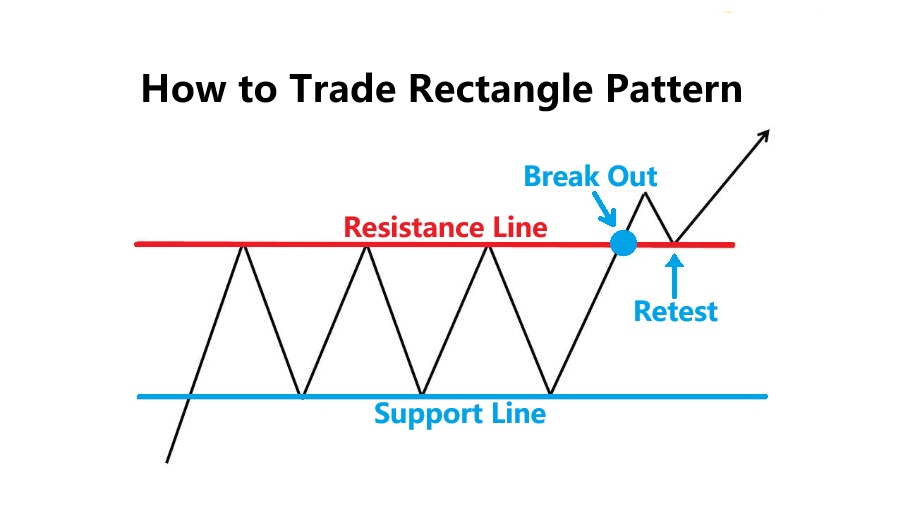

1. Entry Signals

Wait for price to close outside the rectangle boundary rather than entering on a mere wick.

Confirm breakout via higher‑than‑average volume. This volume spike signals commitment to the breakout.

Ideally, the breakout is in the direction of the preceding trend, reinforcing the continuation logic.

2. Stop‑loss Placement

For bullish breakout: place stop just below the breakout point or below the support line of the rectangle.

For bearish breakout: place stop just above the breakout point or above the resistance line.

The stop should be sized to reflect your risk tolerance and account size.

3. Price Target Estimation

Measure the height of the rectangle (resistance level minus support level).

Project that height from the breakout point in the breakout direction to estimate target.

Example: If the rectangle spans from 50 to 55 (height = 5), and breakout occurs at 55. target would be around 60 for a bullish breakout.

4. Supporting Filters and Indicators

Use momentum indicators such as RSI or MACD to assess strength. A rising RSI during consolidation and breakout adds weight.

Check volume trend — declining volume during consolidation followed by volume surge at breakout increases credibility.

Consider broader market trends and fundamentals to ensure the breakout is aligned (not purely technical in isolation).

5. Risk/Reward and Timing

Aim for a risk/reward ratio of at least 1:2 (i.e., potential reward at least twice your risk) when feasible.

Time‑horizon: On daily charts, rectangle patterns often span three months (approx. 90 days) on average before breakout.

Summary of Strategy Steps

Identify preceding trend.

Draw support and resistance lines with at least two touches each.

Confirm consolidation duration and volume decline.

Wait for breakout close + volume surge.

Enter trade (buy or sell) in breakout direction.

Set stop‑loss and project target.

Monitor trade, adjust stop if applicable, and be ready for false breakout.

Common Pitfalls & How to Avoid False Breakouts

Even well‑identified rectangle patterns can fail — the key is to reduce risk by recognising and avoiding common errors.

Frequent mistakes

Premature entries: Entering before clear breakout confirmation (close outside, volume surge) often leads to losses.

Weak volume at breakout: Without volume support, breakouts have a high chance of reversing.

Misidentification of boundaries: Drawing support/resistance lines incorrectly or with only one touch on a line weakens the pattern.

Ignoring broader context: A rectangle pattern in a highly volatile market or with no prior trend can become unreliable.

Poor risk‑reward: If the rectangle is too narrow, the target may be small and not justify the risk.

How to avoid false signals

Require a strong close outside the rectangle boundary, not just a spike or wick.

Insist on a volume surge relative to recent averages at breakout.

Ensure that the pattern appears in a context of trend and credible consolidation (not erratic sideways movement).

Keep stop‑loss tight enough to limit damage if the breakout fails.

Use additional indicators (RSI, MACD) to confirm momentum direction.

Be prepared to exit promptly if the price falls back into the rectangle (i.e., the breakout fails).

Integrating Rectangle Patterns Into Your Broader Trading Framework

For long‑term investor who nonetheless monitors frequently and aims for both steady growth and growth in hot markets, here is how rectangle patterns can fit in:

Use rectangles as set‑ups for tactical trades within your broader portfolio.

They are not necessarily long‑term holds but can offer defined risk‑reward opportunities.

Because you check your portfolio frequently (you noted you may check net value hundreds of times a day), rectangle breakouts offer clear triggers for entry/exit rather than ambiguous setups.

Combine the rectangle pattern with your existing discipline:

Use it to define entries with clarity (breakout occurs) rather than impulsive trades.

Use it to set stop‑losses and targets in advance, aligning with your budgeting of risk and reward.

Use it to complement your long‑term funds strategy: while your funds accumulate slowly, rectangle trades can be shorter‑term, disciplined plays.

Ensure you maintain risk control:

Do not let rectangle breakout trades consume excessive portion of your idle money — aim for smaller size, clear stop‑loss, and documented strategy.

Log outcomes of your rectangle trades (good and bad) to refine your recognition criteria and timing.

Over time you'll develop an internal "template" of what a high‑quality rectangle looks like for your markets (e.g., Chinese‑oriented stocks or funds, if that's your focus).

Checklist Before You Trade a Rectangle Pattern

Before committing capital to a trade based on a rectangle pattern, check each item below:

Is there a preceding trend (uptrend for bullish rectangle, downtrend for bearish)?

Are there two or more touches of the upper boundary (resistance) and lower boundary (support)?

Are the support and resistance boundaries clearly horizontal or near‐horizontal?

Has consolidation lasted a meaningful period (days/weeks) rather than a couple of bars?

Is volume declining during the consolidation (suggesting equilibrium)?

Has a breakout close occurred outside the rectangle line (not just a wick)?

Has a volume increase accompanied the breakout (confirmation)?

Have you drawn the stop‑loss just beyond the opposite boundary?

Have you calculated a target using the measuring principle (height of rectangle)?

Is the risk‑reward ratio acceptable (e.g., at least 1:2)?

Have you considered overall market context (broader trend, news, sentiment)?

Are you ready to exit if price falls back into the rectangle (breakout failure)?

Treat this checklist as your final gate before you click "enter".

Conclusion

The rectangle pattern provides clear boundaries, breakout signals, measurable targets, and disciplined risk control. When used properly, it complements both active monitoring and long‑term investing.

It is not foolproof, as false breakouts and subjective line‑drawing occur, and market context matters. With disciplined execution, it becomes a structured tool.

Start with demo trades, refine your approach, and apply the same careful mindset to live markets as you do to your fund portfolio.

Frequently Asked Questions

Q1: What is a rectangle pattern?

A rectangle pattern is a consolidation where price moves sideways between horizontal support and resistance, indicating temporary market indecision before a breakout occurs.

Q2: How can I identify a rectangle pattern?

A rectangle pattern is identified by parallel support and resistance lines with at least two touches each, a preceding trend in either direction, and declining volume during the consolidation phase.

Q3: What types of rectangle patterns exist?

There are bullish rectangles, which follow an uptrend and typically break upward; bearish rectangles, which follow a downtrend and usually break downward; and reversal rectangles, which are less common and appear when the prior trend is exhausted.

Q4: How should I trade rectangle patterns?

Trades should only be entered after a confirmed breakout with a volume surge, using a stop-loss just beyond the opposite boundary, and projecting the target based on the rectangle's height. Momentum indicators such as RSI or MACD can be used to confirm the breakout direction.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.