Movies can teach what charts and textbooks sometimes miss. For instance, how feelings affect markets, the importance of incentives, the locations of risk, and which ethical oversights ruin careers.

For India's rapidly growing retail-investor community, from first-time SIP investors to active traders on the NSE/BSE, a well-picked list of finance films is a fast, engaging way to sharpen instincts and spot real-world pitfalls.

Here is a carefully selected, described, and current compilation of the Top 10 trading films that every investor must see, along with actionable insights on how each film relates to investment behaviour and market dynamics.

Top 10 Trading Movies Every Investor in India Should Watch to Learn

| Movie |

Theme |

Key Lesson for Investors |

| Wall Street |

Ethics & Greed |

Incentives drive outcomes |

| The Big Short |

Complexity Risk |

Always question models |

| Margin Call |

Liquidity Crisis |

Manage leverage |

| Boiler Room |

Sales Manipulation |

Avoid hype |

| Wolf of Wall Street |

Psychology & Excess |

Stay disciplined |

| Rogue Trader |

Oversight Failures |

Strengthen controls |

| Inside Job |

Systemic Incentives |

Follow institutional motives |

| Enron |

Accounting Fraud |

Read the footnotes |

| Too Big to Fail |

Policy & Systemic Risk |

Consider macro context |

| Moneyball |

Data & Process |

Build repeatable strategies |

1. Wall Street (1987): Greed, Corporate Raiders and the Ethics of Profit

Oliver Stone's Wall Street remains the archetypal finance film. Michael Douglas's Gordon Gekko, "Greed, for lack of a better word, is good", is shorthand for the culture of short-term profit and the moral compromises that can follow.

For investors, the movie shows how insider information, takeover dynamics, and the pressure to deliver short-term returns can warp decision-making. It's a primer on incentives: when managers and traders chase deals, shareholder value can be both created and destroyed.

Investor takeaways: Prioritise governance checks, question unusually opaque deals, and remember that charisma (Gekko) is not a substitute for alignment of long-term incentives.

2. The Big Short (2015): How Blind Rules, Ratings and Leverage Create Systemic Collapse

Michael Lewis's book, The Big Short, clarifies the 2007–08 mortgage crisis with remarkable sharpness. For example, it details structured products, the failures of ratings, and how rational motivations of various individuals can lead to disaster.

For investors, the film is a study in complexity risk. Just because something is modelled doesn't mean the model captures reality.

Investor takeaways: Never outsource understanding to third parties (ratings, models); always stress-test the tail risks and ask how your position behaves under extreme scenarios.

3. Margin Call (2011): Liquidity, Risk Limits and the Cost of Short Horizons

A tense 24-hour drama inside an investment bank, Margin Call focuses on an overnight discovery of a solvency problem. The movie demonstrates how swiftly liquidity can diminish and emphasises the importance of risk limits, transparent accounting, and effective communication.

For Indian investors, it highlights the danger of crowded trades and the domino effect of forced deleveraging.

Investor takeaways: Maintain liquidity cushions, set stop-loss rules you can actually execute, and avoid relying on counterparties' goodwill when markets move.

4. Boiler Room (2000): Sales Pressure, Pump-And-Dump and the Ethics of Selling

Boiler Room follows young brokers at a shady brokerage that sells worthless stocks to inexperienced buyers. It's effectively a fictionalised primer on high-pressure selling, conflicts of interest, and how unscrupulous distribution can inflate tiny companies into temporary illusions.

In India, where small-cap fluctuations and microcap scams occasionally arise, the film serves as a valuable warning sign.

Investor takeaways: Exercise caution with unsolicited "hot tips," confirm the trustworthiness of brokerages, and diligently examine small-cap fundamentals before purchasing assets.

5. The Wolf of Wall Street (2013): Excess, Manipulation and Investor Psychology

Scorsese's biopic about Jordan Belfort is not a how-to for trading; it's a how-not-to. The film exposes pump-and-dump schemes, manipulation, and the intoxicating feedback loop of short-term profits.

Both entertaining and cautionary, the story serves as a reminder that arrogance and moral failings can derail careers and portfolios.

Investor takeaways: Stay disciplined, don't let early wins morph into reckless overconfidence, and use governance checks to prevent groupthink.

6. Rogue Trader (1999): Rogue Positions, Operational Controls and the Cost of Weak Oversight

Inspired by the true tale of Nick Leeson and the downfall of Barings Bank, Rogue Trader illustrates how one trader can conceal losses due to inadequate controls and oversight.

For those involved in the Indian market, the movie highlights the importance of dividing responsibilities, clear reconciliation, and the operational aspects of risk, beyond solely market risk.

Investor takeaways: Validate broker and prime-broker controls, insist on third-party clearing where possible, and monitor settlement/ reconciliation risk.

7. Inside Job (2010): Documentary on the Crisis

Inside Job is a documentary investigation into the causes of the 2008 financial crisis. It connects the dots between compensation structures, regulatory capture, conflicts of interest, and the systemic consequences of those incentives.

For investors, the movie serves as an invitation to analyse the larger institutional influences altering market results.

Investor takeaways: track the incentives of institutions that influence asset prices (brokers, rating agencies, major funds), and pay attention when policy or regulation shifts.

8. Enron: The Smartest Guys in the Room (2005): Accounting Games and Corporate Fraud

This documentary details Enron's fall and the creative accounting that hid problems from shareholders.

It's a crucial viewing for stock investors and credit analysts, as you understand how to interpret financial statements and be cautious of management that prioritises immediate profits while overlooking rising operational issues.

Investor takeaways: Scrutinise revenue recognition, understand related-party transactions, and use forensic checks when corporate metrics seem "too good to be true."

9. Too Big to Fail (2011): Systemic Risk and the Government's Crisis Decisions

HBO's Too Big to Fail dramatises the frantic policy and private-sector decisions during the 2008 crash. The film is helpful to understand how systemic risks propagate and why some institutions become "too interconnected to fail."

For investors, the film illustrates the interaction of markets, politics, and public policy, particularly significant if you deal in financials or systemically vital securities.

Investor takeaways: Consider systemic risk in portfolios during crises, since market outcomes are affected by both market dynamics and policy choices.

10. Moneyball (2011): Data-Driven Advantage, Contrarian Thinking and Long-Term Edges

Although it's more related to baseball, Moneyball is popular with investors as it narrates the journey of uncovering statistical inefficiencies and adhering to a disciplined, unconventional strategy.

For Indian investors learning value and quantitative approaches, the film demonstrates how data, process and patience can beat conventional wisdom.

Investor takeaways: Build repeatable processes, avoid noisy short-term signals, and use data to surface underappreciated opportunities rather than chase headlines.

Why These Trading Movies Matter for Indian Investors

1. Behavioural Lessons Beat Formulas

Markets are human systems. Many losses arise from cognitive biases, such as overconfidence, conformity, and fear, illustrated clearly on screen. Movies condense those teachings into unforgettable moments.

2. Structural risks scale globally.

Issues in mortgage tranches, failures of rating agencies, or leverage mechanics originating elsewhere are still significant for India, as capital flows and financial innovations quickly transcend borders.

Understanding the mechanics helps you judge new products (e.g., leverage ETFs, alternative credit) that may reach India's markets.

3. Operational & Governance Checks Are Local and Practical

Rogue traders, boiler-room operations, and accounting fraud are not exclusive to Wall Street; similar issues can arise in local brokerage firms, small-cap businesses, and non-banking financial companies (NBFCs). The films help you build an instinct for what to scrutinise.

Recommended Viewing Order for Maximum Learning

Start with Wall Street (ethics), then Boiler Room (sales risk), Rogue Trader (ops controls), Margin Call (liquidity), The Big Short (systemic risk), Inside Job and Enron (structural and accounting failures), Too Big to Fail (policy), Wolf of Wall Street (behavioral extremes) and finish with Moneyball (process & data).

This order moves from human incentives to systemic lessons to disciplined strategy.

Frequently Asked Questions

Q1: Are These Films Relevant for Beginners in India?

Yes, they teach behavioural and structural lessons applicable globally.

Q2: Where Can I Watch Them From India?

Local streaming platforms and legal rental platforms.

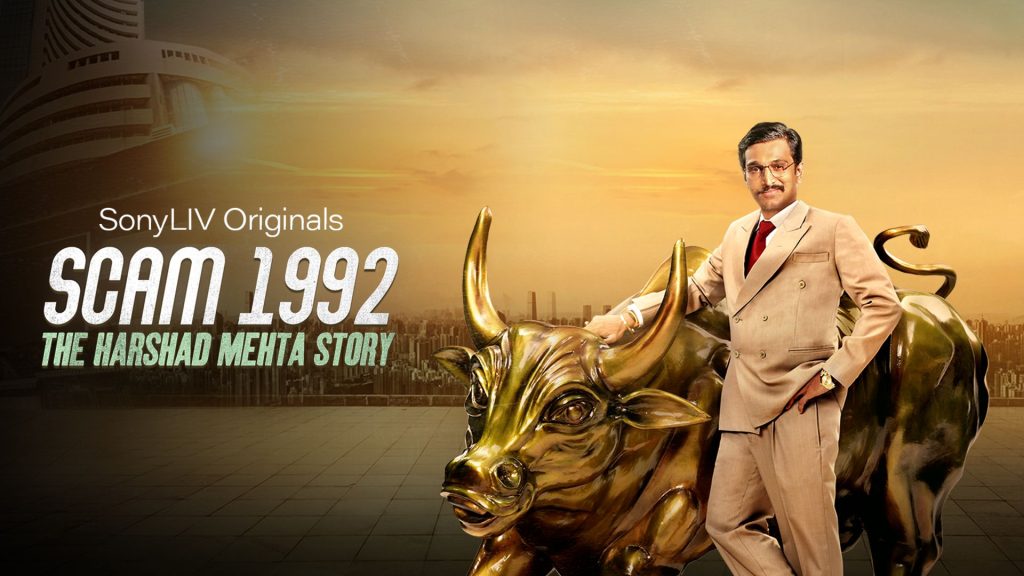

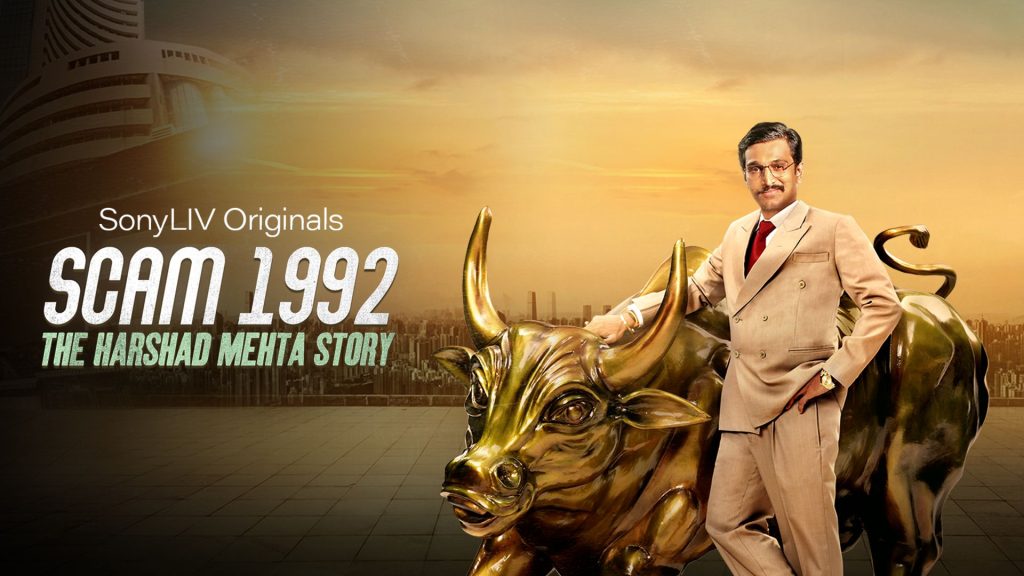

Q3: Any Indian Films or Series About Markets?

The web series Scam 1992 (about Harshad Mehta) is a highly regarded dramatisation of an Indian market scandal and is worth watching as complementary material to this list.

Conclusion

In conclusion, the 10 trading movies listed above serve as more than just entertainment; they act as scenario exercises for typical market breakdowns.

For Indian investors aiming for long-term wealth, the true essence lies in transforming memorable moments into principles you adhere to amid market turbulence.

Watch critically, pick one lesson per film, and apply it the next time you consider an investment. That tiny habit will accumulate into much better decision-making than any singular overnight expert.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.