After governments (notably the U.S. and Australia) accelerated plans to onshore and secure critical minerals supply chains, spot shortages and export curbs from China tightened markets, and investors rotated into miners, refiners and magnet makers, rare earth stocks have surged to new highs.

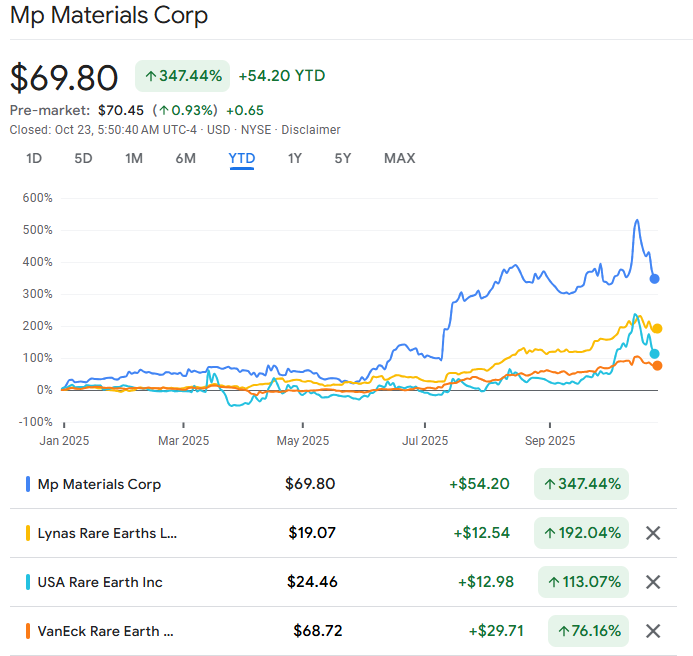

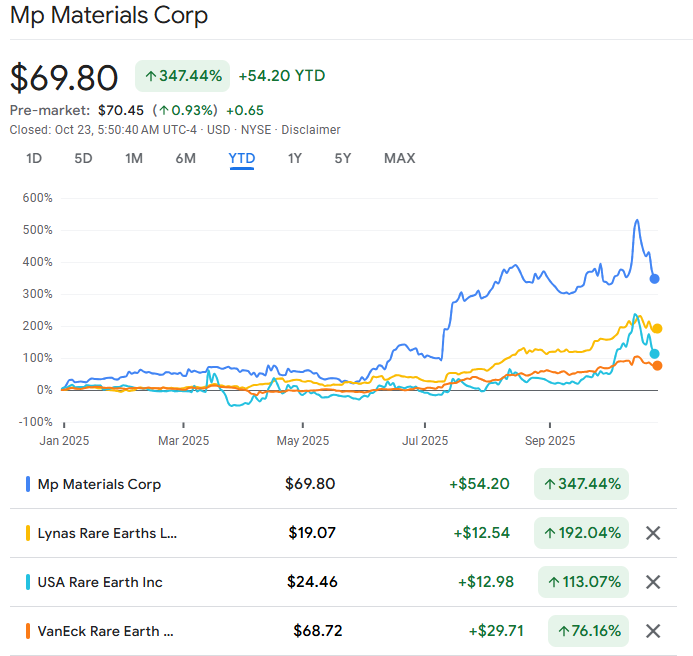

Market leaders such as MP Materials, Lynas Rare Earths and newer U.S. entrants (USA Rare Earth, Ramaco) saw massive gains, while thematic ETFs like REMX attracted attention as a simple way to play the theme.

That said, the sector is volatile, policy-sensitive and capital-intensive, and it's worth following the wave only with strict position sizing, a time horizon beyond short-term speculation, and an eye on policy announcements, downstream magnet demand (EVs/defence), China export policy, project timelines (refineries), and financing/permit risk.

What Triggered the Rare Earth Stocks Surge in 2025?

In 2025, rare-earth stocks experienced significant fluctuations, marked by surges followed by sudden declines. Several catalysts converged:

1) Supply Concentration in China

China still controls the lion's share of refining and magnet manufacturing, so any sign of export restrictions or policy tightening produces immediate supply-shock fears. That dynamic makes global buyers desperate to diversify.

2) Demand Explosion (EVs, Wind, Defence)

Electric vehicles, permanent magnets, wind turbines, and defence technology are all significant consumers of heavy rare earth materials. As the penetration of electric vehicles increases, the demand for magnets also rises, establishing a strong long-term demand trajectory.

3) Government Industrial Policy & Financing

The U.S. government, in particular, has launched multiple initiatives to develop domestic mining and processing capacity for REEs, aiming to reduce dependence on Chinese supply chains. These policies include direct investment, subsidies, and regulatory reforms that favour domestic rare earth projects. [1]

The previous Trump administration set the groundwork with policies that deemed rare earths a national security concern, and later administrations have maintained or enhanced these efforts.

For investors, this creates a strong tailwind, as companies with government ties or approvals often enjoy easier access to capital and project approvals.

4) Time-To-Market and Project Risk

Building refining capacity, magnet plants, or deep-processing lines requires years and significant capital. While short squeezes or policy headlines can temporarily push prices higher, sustainable supply necessitates capital expenditures, permits, and skilled labour.

This long lead time is why prices and equities swing massively when policy de-risking happens.

This resulted in a sector that was once a niche in mining becoming a significant aspect of geopolitical and industrial policy.

Which Rare Earth Stocks Moved the Most?

| Company |

Listed Country |

YTD Performance |

Key Catalyst |

Primary Risk |

| MP Materials (MP) |

U.S. |

~+347% (YTD) |

DoD contract, domestic magnet build-out |

Execution & financing risk |

| Lynas Rare Earths (LYC) |

Australia |

~+190-250% (YTD) |

Largest non-China producer |

Project delays & cost overruns |

| USA Rare Earth (USAR) |

U.S. |

~+215%+ (YTD) |

Early-stage U.S. industrial policy play |

Very early stage, high operational risk |

| REMX (ETF) |

U.S. |

~+75-82% (YTD) |

Diversified rare-earth & strategic metals theme |

Broad exposure, less focus on individual big winners |

As of October 2025, companies like MP Materials, USA Rare Earth, and Lynas Rare Earths have posted impressive stock price gains in 2025, with MP Materials leading the pack with gains approaching nearly 400% year-to-date.

1) MP Materials (MP)

The U.S. heavyweight: MP runs the Mountain Pass mine and processing assets in the U.S., making it a strategic domestic source of rare-earth oxides and, increasingly, downstream magnet capability. [2]

MP's stock saw a multi-fold move in 2025 as DoD/U.S. government procurement and domestic magnet demand were signalled. MP's market position makes it the bellwether for Western rare-earth hopes.

2) Lynas Rare Earths (LYC / LYSCF)

Lynas is the largest producer of rare earths outside China, with operations at Mount Weld in Australia and various refining routes. When automakers warned of potential export restrictions from China, Lynas shares surged as buyers sought alternative suppliers. [3]

Lynas' quarterly results and project timelines (and any downstream expansion) remain the key data points for investors.

3) USA Rare Earth (USAR)

The new U.S. entrant drew speculative flows after analyst coverage and positive headlines about U.S. industrial policy. It is still in an earlier stage but can rally rapidly on potential offtake or government support; conversely, it is the most operationally risky.

4) REMX & Thematic ETFs

For many investors, the easiest way to gain exposure is through thematic ETFs such as VanEck's REMX, which includes companies involved in mining, refining, and strategic metals.

While REMX offers diversified exposure, it combines pure rare-earth plays with broader strategic metals firms.

Why the Theme Is Tempting and Why It's Dangerous

The positive scenario is clear: as rare earths are essential, there is steady demand for magnets, and political support indicates that governments may fund projects and secure contracts. That combination can produce long, multi-year secular returns for correctly chosen firms that can scale refining or downstream manufacturing.

However, the danger is equally real:

1. Operational & Permitting Risk:

Mines and refineries require substantial capital investment and often experience delays, cost overruns, and scrutiny regarding their environmental impact. Many small juniors promise supply but fail to deliver.

2. China's Response:

Beijing can reduce exports or inundate downstream markets with lower-cost products, temporarily undermining non-Chinese profit margins. That "swing policy" risk is asymmetric and politically charged.

3. Valuation & Momentum Swings:

Rapid rallies can overshoot fundamentals; companies often trade on headlines rather than demonstrated production growth. That makes the sector prone to violent reversals.

4. Concentration & Liquidity:

A few names dominate listings and holdings; ETFs help diversification, but sometimes overweight single companies, amplifying concentration risk.

How to Approach Investing in Rare Earth Stocks? Practical Guide

For investors intrigued by rare earth stocks in 2025, a balanced and informed approach is essential. Diversification across several companies with varying operational stages, geopolitical footprints, and technological positioning can help mitigate company-specific risks.

Consider also blending direct rare earth stocks with ETFs or mutual funds focused on critical minerals, which may provide broader exposure to the sector's upside while spreading risk.

Thorough due diligence on project status, government policy developments, and financial health remains critical. Investors should track supply chain news, geopolitical shifts, and commodity price trends to time entry and exit points more effectively.

Lastly, adopting a medium to long-term investment horizon aligns well with this sector's typical project timelines and macro drivers.

Red Flags and Checklists Before You Buy Any Rare-Earth Stock

Before you buy any equity, run this simple checklist:

Government framework announcements

Company contract wins or offtake MOUs

China's export policy, quotas and tariffs

ETF flows & REMX NAV moves

Project timelines

For example:

1) MP Materials

Watchlist: confirmed magnet contracts, ramping downstream capacity, capex schedules, and any U.S. government purchase agreements.

2) Lynas Rare Earths

Watchlist: quarterly processing volumes, project timelines (e.g., new refineries), and contracts with OEMs or governments.

If a stock fails more than two of these tests, reconsider size or skip the position.

Frequently Asked Questions

1. Which Are the Best-Performing Rare Earth Stocks Right Now?

As of October 2025, MP Materials (NYSE: MP) and Lynas Rare Earths (ASX: LYC) remain the top-performing large-cap players.

2. How Dependent Is the World on China for Rare Earths?

China still controls around 70% of global rare earth production and over 85% of refining capacity in 2025.

3. Is It Too Late to Invest in Rare Earth Stocks After the 2025 Rally?

Not necessarily, but caution is needed. While 2025's rally has priced in some optimism, demand from EVs and clean energy is still in its early growth phase.

4. How Are Governments Supporting Rare Earth Production in 2025?

The U.S. Department of Defence provided funding to MP Materials and Lynas for domestic processing. Australia and Japan renewed long-term supply deals. The EU launched the Critical Raw Materials Act, aimed at securing 10% of domestic supply by 2030

Conclusion

In conclusion, rare-earth stocks in 2025 present a genuine, policy-driven thematic opportunity. The combination of strategic demand, government willingness to underwrite supply, and thin near-term refining capacity outside China creates a plausible multi-year upside for successful producers and downstream fabricators.

That said, the sector is uniquely exposed to execution risk, policy whiplash, and valuation momentum. If you decide to participate, limit exposure, prefer cash-flowing producers or firms with binding offtakes, use ETFs (like REMX) to diversify, and monitor the indicators.

In short: follow the wave, but surf small and know where the rocks are.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.abc.net.au/news/2025-10-22/critical-minerals-industry-us-china-deal-rare-earths-stocks/105915274

[2] https://www.barrons.com/articles/usar-stock-buy-usa-rare-earth-mp-materials-35548a41

[3] https://www.reuters.com/world/china/australias-lynas-surges-automakers-flag-risks-chinas-rare-earth-export-curbs-2025-06-05/