In today's evolving investment landscape, new investors face a pivotal decision: should they start with ETFs (Exchange-Traded Funds) or dive into mutual funds?

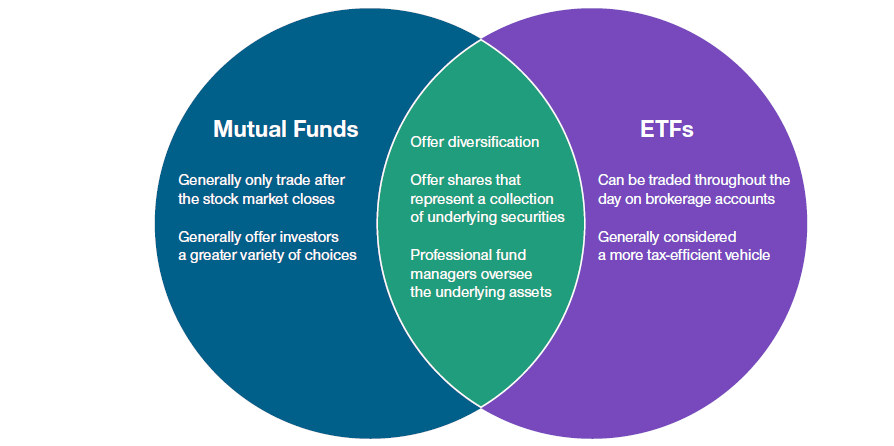

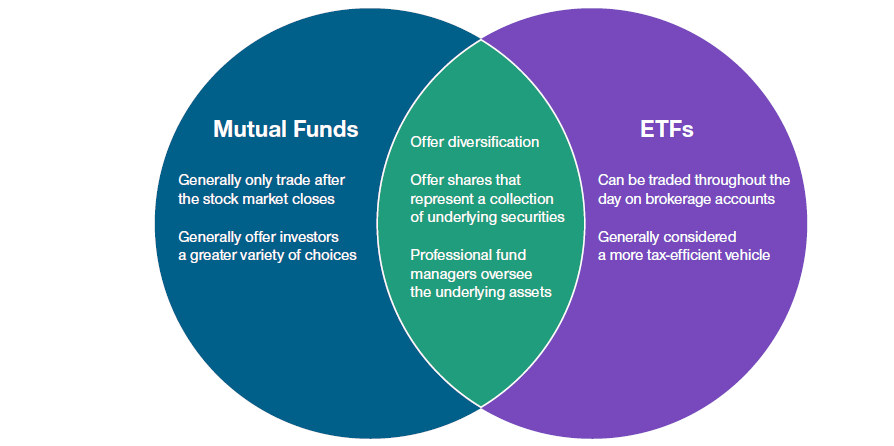

Both offer easy access to diversified portfolios, but differences in cost, liquidity, tax efficiency, and simplicity can impact a beginning investor's experience and long‑term outcomes.

This article examines both options in the context of 2025, helping you decide which suits beginners best.

What Are ETFs and Mutual Funds?

Before comparing ETFs and mutual funds, let's clarify all aspects of both investment options.

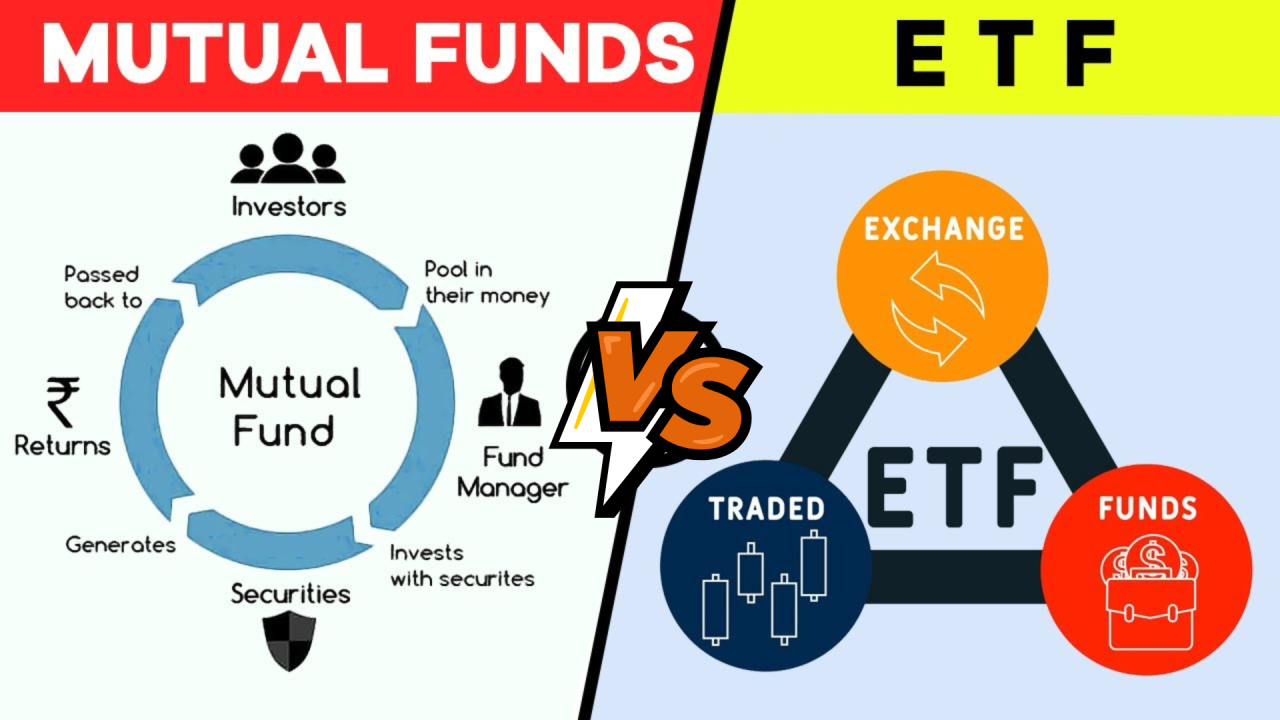

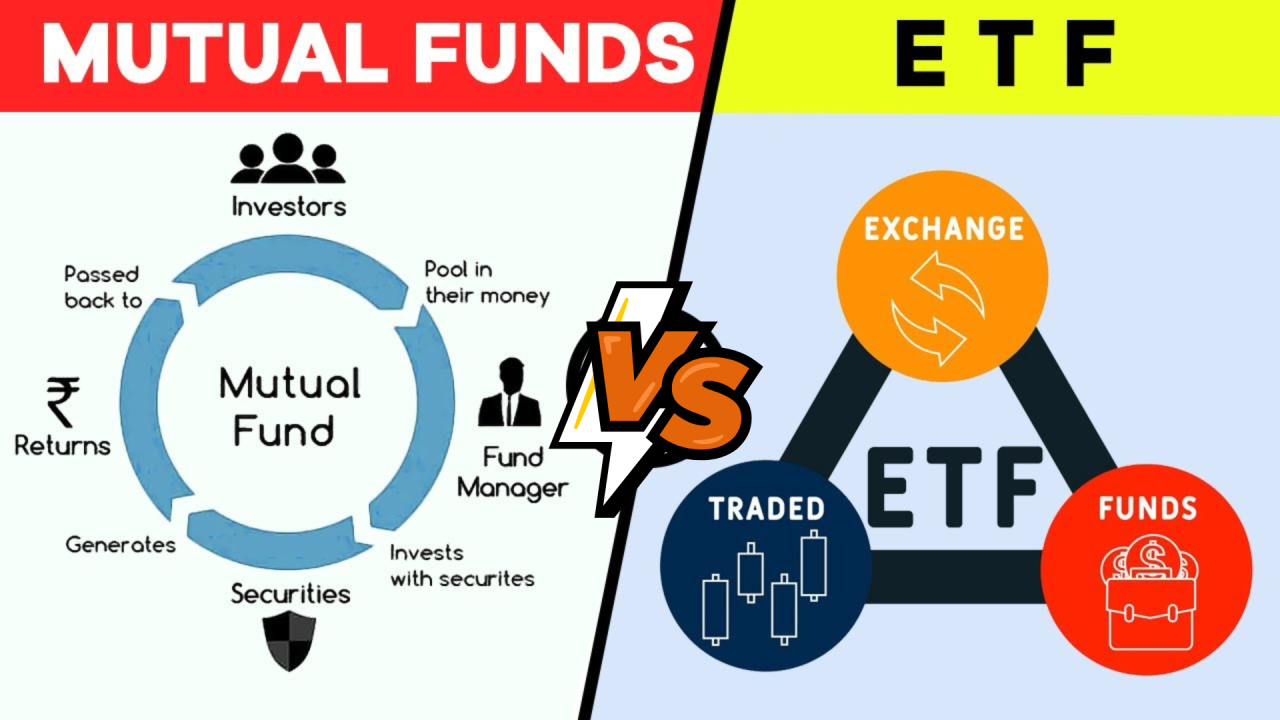

Firstly, an ETF is like a basket of investments, stocks, bonds, or commodities that tracks a specific index or strategy. All trading happens on stock exchanges, allowing investors to buy or sell ETF shares throughout the trading day at market prices. This intraday tradability makes ETFs behave much like individual stocks, while offering diversification across many assets.

A mutual fund, on the other hand, gathers funds from numerous investors to allocate to stocks, bonds, or active strategies. Orders are executed once daily, after markets close, at the fund's Net Asset Value (NAV). Mutual funds can be passively indexed or actively managed, with differing degrees of hands-on portfolio decisions by fund managers.

Key Advantages of ETFs for Beginner Investors

1. Intraday Liquidity and Flexibility

ETFs can be bought or sold at any time during trading hours. Beginners can enter or exit positions based on real-time prices, set limit or stop orders, and even use margin or shorting if desired. This access isn't possible with mutual funds, as they transact at the day's end NAV.

2. Lower Fees and Expense Ratios

Many ETFs are passively managed, often tracking broad indices with minimal overhead. As a result, expense ratios for ETFs commonly fall below 0.5%. While equivalent mutual funds, particularly actively managed ones, can exceed 0.9%. Over the decades, these cost differences compound to impact wealth accumulation.

3. Superior Tax Efficiency

ETFs benefit from a unique "in-kind redemption" structure, enabling asset exchanges that reduce taxable distributions. The majority of ETF investors incur capital gains tax only when they sell their shares.

Mutual funds, notably actively managed ones, distribute gains to all investors, even if they don't sell, creating surprise tax liabilities for beginners.

4. Transparency and Accessibility

ETF portfolios are typically disclosed daily, offering visibility into exactly what you're holding at any time. Meanwhile, mutual funds reveal holdings only quarterly.

Moreover, ETFs can be purchased with small amounts, often a single share or fractional share, while mutual funds frequently require a minimum investment ($500–$3,000 or more).

5. Broad Investment Options and Growth of Active ETFs

In 2025, passive index ETFs will dominate global assets managed. Nevertheless, active ETFs that integrate active strategies within the ETF framework are growing swiftly.

Investors, including beginners, now have access to niche strategies, structured exposures, or buffered products that were once available only in mutual funds. This innovation offers both flexibility and cost-efficiency in one package.

What Mutual Funds Offer Beginners That ETFs Don't

1) Simplified Investment Process and Planned Contributions

Many investors prefer mutual funds for systematic investing: SIPs (Systematic Investment Plans) or automatic contributions are easier to set up directly through mutual fund platforms.

This simplicity suits beginners who want fully automated investing without a brokerage account.

2) Professional Active Management

Actively managed mutual funds aim to outperform the market through research-based security selection.

For investors who prefer a hands-off, expert-managed approach or are investing in areas where active management may add value, mutual funds offer diverse options.

3) No Trading Anxiety or Real-Time Decision Making

Because mutual fund orders execute at NAV, investors don't need to monitor intraday price movements or worry about bid-ask spreads. For less experienced users, avoiding the complexity of intraday trading may reduce stress and errors.

ETF vs Mutual Funds: Simplify for Beginners

| Feature |

ETFs |

Mutual Funds |

| Trading Flexibility |

Traded intraday; use limit/stop orders, margin, shorting |

Executed once daily at NAV; no intraday trading |

| Expense Ratio |

Typically low (0.03‑0.5%) |

Often higher, especially active funds (0.6‑1.1%) |

| Tax Efficiency |

High – fewer capital gains distributions via in-kind redemptions |

Lower – may distribute capital gains annually |

| Minimum Investment |

As low as one share or fraction |

Often requires $500 or more initial investment |

| Transparency |

Holdings disclosed daily |

Holdings disclosed quarterly |

| Automation & SIPs |

Requires brokerage setup; may lack automatic SIP features |

Built-in SIP structure; convenient for automatic investing |

| Management Style |

Mostly passive; active ETFs emerging |

Active or passive; professionally managed |

| Bid-Ask Spread Exposure |

Subject to spreads on trade |

No spread; priced at NAV at close |

Risks and Pitfalls Beginners Should Know

ETFs: Trading Costs and Liquidity Concerns

While ETFs have low management fees, brokerage commissions and bid-ask spreads may erode returns if you trade them frequently.

Additionally, niche ETFs with low volume may suffer from illiquidity or wider spreads, which novice investors often underestimate.

Tracking Errors

In certain regions, such as Indian stock markets, some ETFs have consistently underperformed their benchmark index due to tracking error.

This gap can effectively raise the real cost of ETF ownership and frustrate investors relying on benchmark returns.

Mutual Funds: Hidden Fees and Tax Implications

Mutual funds may carry front-end or back-end loads, 12b-1 fees, transaction costs, and high turnover, all of which increase effective expense ratios.

These fees, combined with capital gains distributions, can significantly reduce long‑term returns, even if stated expense ratios appear modest.

Timing and NAV Exposure

Because mutual fund trades execute at day's end, NAV, investors creating or redeeming large positions may experience price changes during the trading day, but cannot react until NAV is posted.

Beginners may find this delayed settlement confusing or frustrating when markets shift suddenly.

Which Is Best for Beginners in 2025? A Balanced Perspective

ETFs Shine for Most New Investors

For beginners, prioritising low cost, flexibility, tax efficiency, and transparency, ETFs are increasingly the preferred choice.

The shift toward passive portfolios, notably through model ETF portfolios built by robo-advisors, has democratised access and simplified portfolio construction for novices.

Mutual Funds Still Hold Value in Certain Scenarios

If you prefer a hands-off approach, want automatic monthly investments directly through a fund house, or wish to rely on active management, mutual funds retain advantages. They appeal to investors less concerned about intraday pricing or trading autonomy.

The Middle Way: Index Mutual Funds

Passive index mutual funds blend low-cost indexing with simplified features, like SIP setup and fund management, serving as an alternative when ETF access is limited or brokerage setup is too complex.

How to Choose Wisely as a Beginner?

1. Define Your Goals

Are you saving for retirement, wealth accumulation, or short-term needs?

Select based on your needs: ETFs for agility and low fees, mutual funds for ease and automatic management.

2. Assess Cost vs Benefit

Compare expense ratios, trading fees, and potential hidden charges. In taxable accounts, tax efficiency is more important.

3. Start Small and Simple

Begin with core broad-market index ETFs or no-load index mutual funds. Steer clear of niche, leveraged, or unstable products until you feel at ease.

4. Use Automated Investing Tools

Numerous brokers and robo-advisors allow recurring ETF investments, achieving SIP-like ease while retaining the benefits of ETFs.

5. Stay Patient and Review Performance

Track the management style, fees, tax events, and how well your fund tracks the benchmark over time. Adjust choices if performance consistently lags benchmarks.

Frequently Asked Questions

1. Which Is Better for Long-Term Investing: ETFs or Mutual Funds?

Answer:

For long-term investing, ETFs often offer better tax efficiency and lower fees, especially when held in taxable accounts. Nonetheless, mutual funds can be more suitable for investors who utilise automatic contributions or desire professional active management.

For most beginners aiming to build wealth steadily over time, low-cost index ETFs are a strong starting point.

2. Can I Set Up Automatic Investments (SIP) With ETFs Like I Can With Mutual Funds?

Answer:

Yes, numerous contemporary brokerages and robo-advisors now enable automatic investments in ETFs, mirroring a mutual fund SIP experience.

Conventional mutual funds offer integrated SIP options directly from fund companies, while ETFs require brokers to facilitate recurring buys; nonetheless, the result is unchanged: efficient, consistent investing.

3. Are ETFs Safer Than Mutual Funds for Beginners?

Answer:

Both ETFs and mutual funds are generally safe when diversified and used appropriately. However, ETFs can feel riskier due to real-time price fluctuations and trading options.

Beginners should avoid complex ETFs (like leveraged or thematic ones) and start with broad-market ETFs or index mutual funds, which offer low cost and low risk through diversification.

Conclusion

In conclusion, if you're new to long-term investing and seeking a cost‑effective, flexible, and tax‑efficient way to build wealth, ETFs are likely the better starting point. They provide immediate trading, low costs, daily portfolio access, and straightforward diversification, even with limited funds.

Meanwhile, mutual funds remain relevant for investors wanting automatic investment features, active management options, or hands-off convenience.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.