In times of economic uncertainty or volatile market conditions, many investors seek stability in their portfolios. One popular strategy is to invest in defensive stocks—a category of equities that tend to outperform the market during downturns.

But what exactly are defensive stocks? How do they work? And why are they often referred to as "safe havens"?

In this comprehensive guide, we will explore everything you need to know about defensive stocks, including examples, characteristics, benefits, risks, and strategies for 2025.

What Are Defensive Stocks?

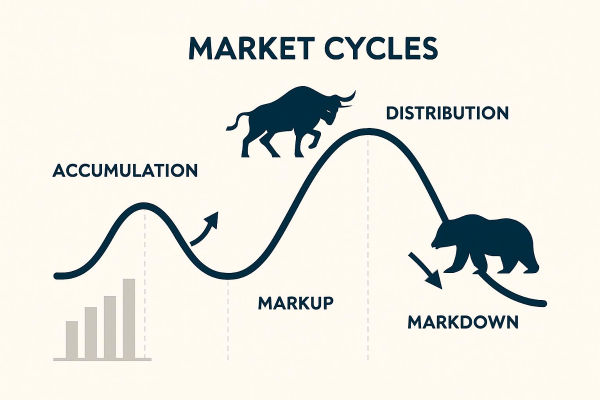

Defensive stocks are shares of companies that provide essential goods and services—products that people continue to buy regardless of economic conditions. These stocks tend to be less sensitive to economic cycles, making them more stable during recessions or bear markets.

Key Traits:

These stocks are not necessarily immune to losses, but they typically decline less than the broader market during downturns.

Understanding the Different Sectors

1. Consumer Staples

These are everyday necessities like food, beverages, toiletries, and cleaning products. People buy them no matter the economic climate.

2. Healthcare

Medical services, pharmaceuticals, and insurance are always in demand, regardless of economic cycles.

3. Utilities

Water, gas, and electricity are basic needs. Utility companies enjoy stable revenues due to regulated pricing.

4. Telecommunications

Phones and internet services are now considered essential for both personal and business use.

Why Are Defensive Stocks Called "Safe Havens"?

1. Resilience in Recessions

During economic contractions, consumer spending often declines—except on essentials like groceries, medicine, and electricity. Defensive companies continue to generate revenue.

2. Steady Dividend Income

Many defensive companies have strong balance sheets and a long history of dividend payments, offering a reliable income stream.

3. Lower Beta

Defensive stocks generally have a beta

4. Preservation of Capital

Investors seek defensive stocks to protect their investments during turbulent markets, especially when other assets become too risky.

Historical Example

During massive market declines, defensive stocks have historically held up better than the broader indices.

Case Study 1: 2008 Financial Crisis

Case Study 2: 2020 COVID Crash

S&P 500 fell ~34% in early 2020

Healthcare and utilities fell less than 20%

Defensive ETFs rebounded quickly

These stats underscore their reputation as safe havens during risk-off periods.

Top Defensive Stocks to Watch in 2025

| Company |

Sector |

Dividend Yield |

Stability Score |

| Procter & Gamble (PG) |

Consumer Staples |

~2.5% |

High |

| Johnson & Johnson (JNJ) |

Healthcare |

~3.0% |

High |

| NextEra Energy (NEE) |

Utilities |

~2.4% |

Medium |

| Coca-Cola (KO) |

Beverages |

~3.1% |

High |

| Verizon (VZ) |

Telecom |

~6.5% |

Medium |

Defensive ETFs and Mutual Funds

If you prefer a passive approach, consider investing in ETFs that track defensive sectors.

Popular Defensive ETFs:

XLP – Consumer Staples Select Sector SPDR Fund

XLV – Health Care Select Sector SPDR Fund

XLU – Utilities Select Sector SPDR Fund

VDC – Vanguard Consumer Staples ETF

IDU – iShares U.S. Utilities ETF

These funds offer instant diversification, low fees, and dividend income.

Risks of Investing

While defensive stocks are considered safer, they are not risk-free.

1. Lower Growth Potential

These companies often operate in mature industries with limited opportunities to expand.

2. Interest Rate Sensitivity

As rates rise, dividend-paying stocks may underperform compared to bonds or savings instruments.

3. Sector-Specific Risks

Regulatory changes (especially in healthcare and utilities)

Disruptive technology (telecom)

Pricing pressure in consumer goods

When Do Defensive Stocks Underperform?

Strong economic expansions

Tech or innovation booms

Rising interest rates (hurts dividend stocks)

Investor appetite for risk

Conclusion

In conclusion, defensive stocks are not just for bear markets—they're a core component of any balanced portfolio. They provide protection, stability, and income when markets become unpredictable.

Whether you're a conservative investor seeking lower risk, a retiree looking for steady income or a trader balancing volatility in 2025's choppy market, defensive stocks offer proven tools to weather the storm.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.