US stocks are heading for modest weekly gains after a major retreat, while

gold hit $3,400 amid a barrage of tariff changes. There are signs of increasing

caution in favour of safe-havens.

As of last Friday, the S&P 500's forward PE ratio was 23.11, around

5-month highs, according to LSEG. The gauge was 30% higher than their recent

decade average despite still-high Treasury yields.

Hedge funds fled technology stocks at the fastest pace in 12 months in the

latest week, a note to Goldman Sachs clients said. Meanwhile, shares in consumer

staples were among the most net bought sector.

Elsewhere Japanese investors significantly sold foreign stocks in the week to

2 August. They also net sold foreign long-term bonds for the second successive

week on the run.

Global gold demand rose to a record $132 billion inQ2, driven by surging

investor appetite and the highest average gold price ever recorded in a quarter,

according to the WGC.

Looking to the second half of 2025, the WGC expects investment demand to

remain firm, though possibly at a slower pace due to short-term dollar strength

and resilient equity markets.

Bullion held in warehouses linked to the Shanghai Futures Exchange has jumped

to an all-time high due to high future premium. That indicates strong bullish

sentiment on gold in China.

Checkmate

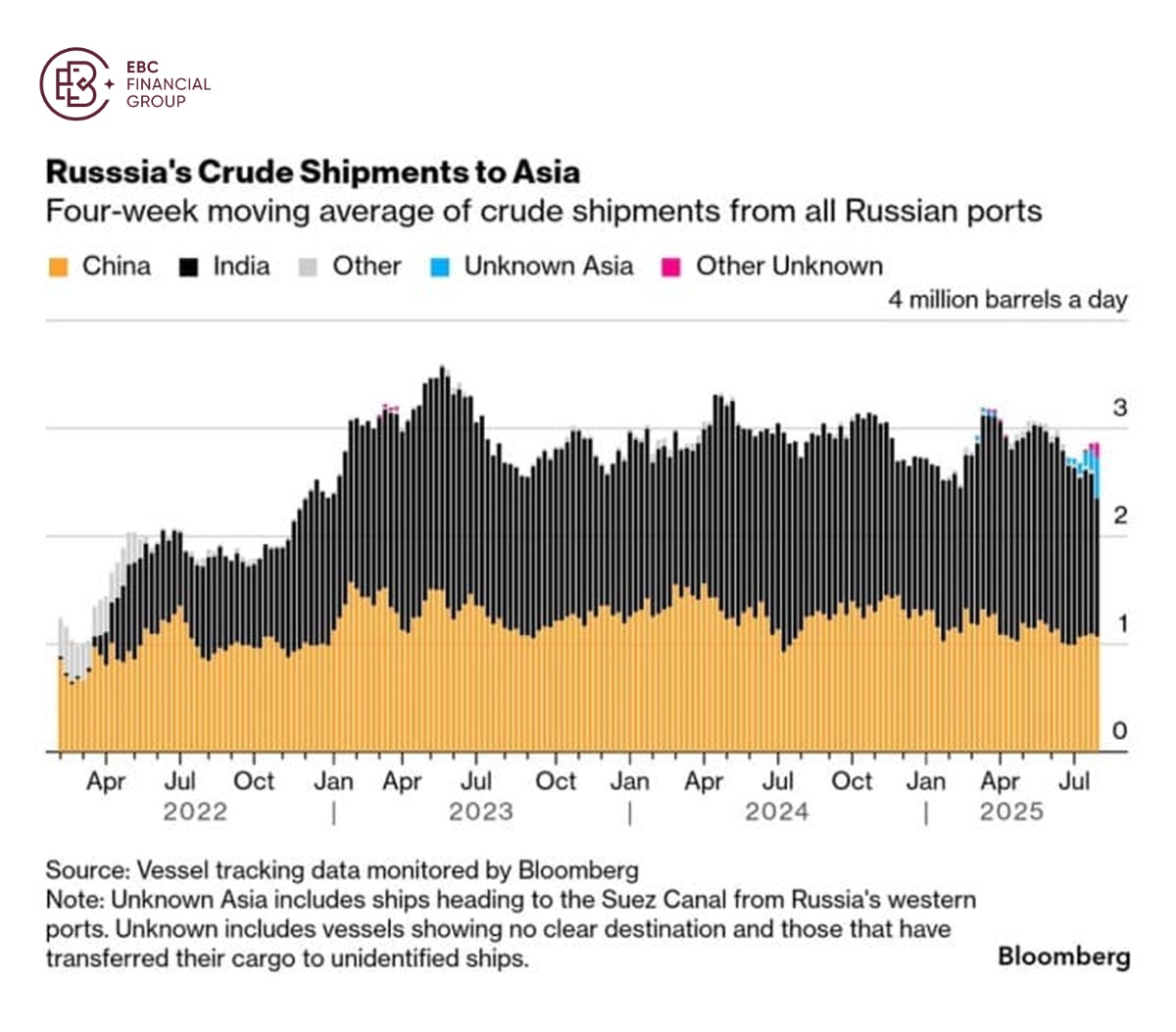

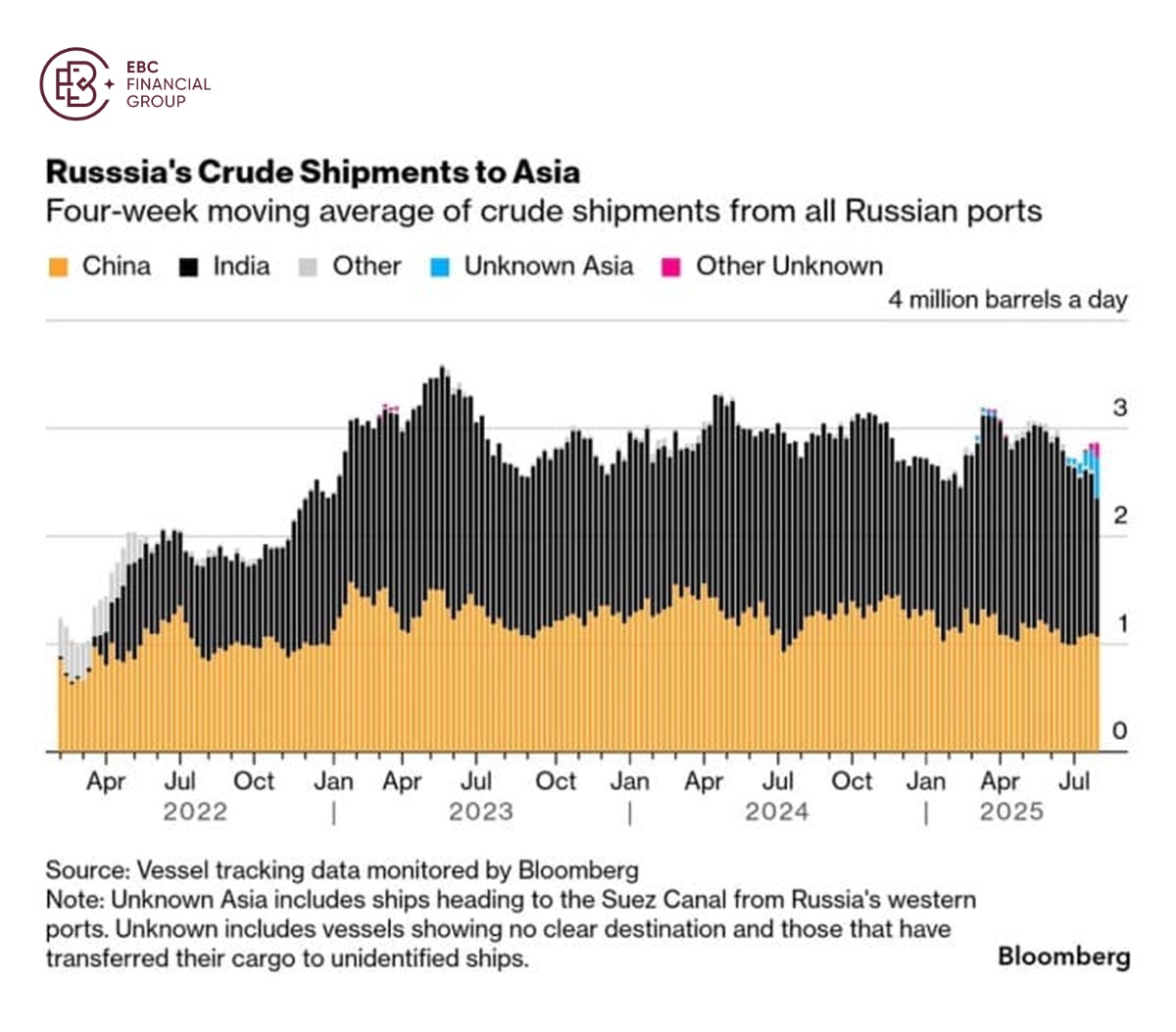

The White House announced Wednesday that it is imposing an additional 25%

tariff on India, the latest sign that Trump is following through on his threat

to punish countries that buy Russian oil.

India has to suffer one of the highest levies Washington has imposed on its

trading partners. Its petroleum minister last month said that oil price would

have gone up to 130 dollars without the purchase.

The country was once encouraged to buy Russian crude by the Biden

administration as Russian crude has not been sanctioned, but traded under a

price cap to limit Moscow's ability to profit from its sale.

The cap was set at $60, below the current benchmark levels markedly. So New

Delhi is still hesitant to seek alternative energy sources after trade deficits

saw a substantial rise during FY 2024-25.

Sara Vakhshouri, president of SVB Energy International, said Trump is trying

to "reclaiming lost US oil market share in India and oil export declines since

2022, and securing equivalent export of other commodity to India."

Trump on Wednesday said he could announce further tariffs on China for the

same reason. Still China's chokehold on the supply of rare earth minerals may

serve as a lever to temper his stance.

Even with oil cartel OPEC recently increasing output, replacing such a large

volume would be exceptionally difficult in the short term, given limited spare

capacity and logistical constraints.

Speed bump

The Fed estimated that in a worst-case scenario, if prices were to climb to

$110-$120 per barrel, a roughly one percentage point inflation rise would drive

up costs for consumers and businesses.

The new cudgel could hit America's own economy through more expensive

consumer goods, lower profit margins for American companies, according to

International Studies, a bipartisan US think tank.

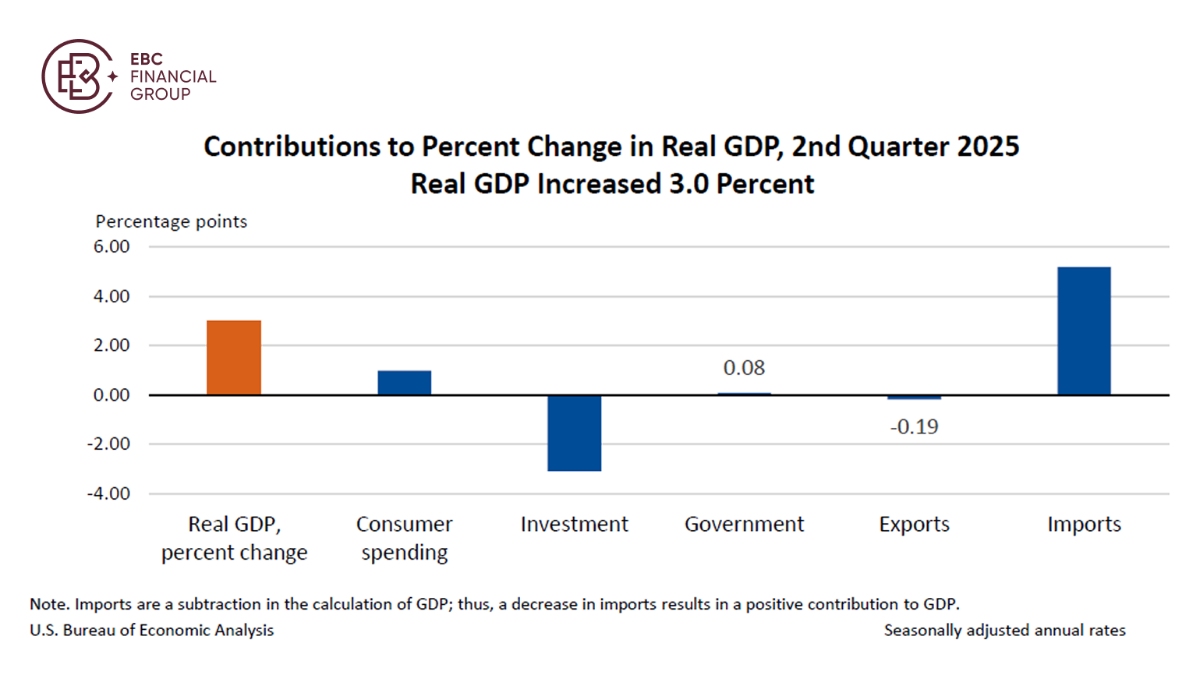

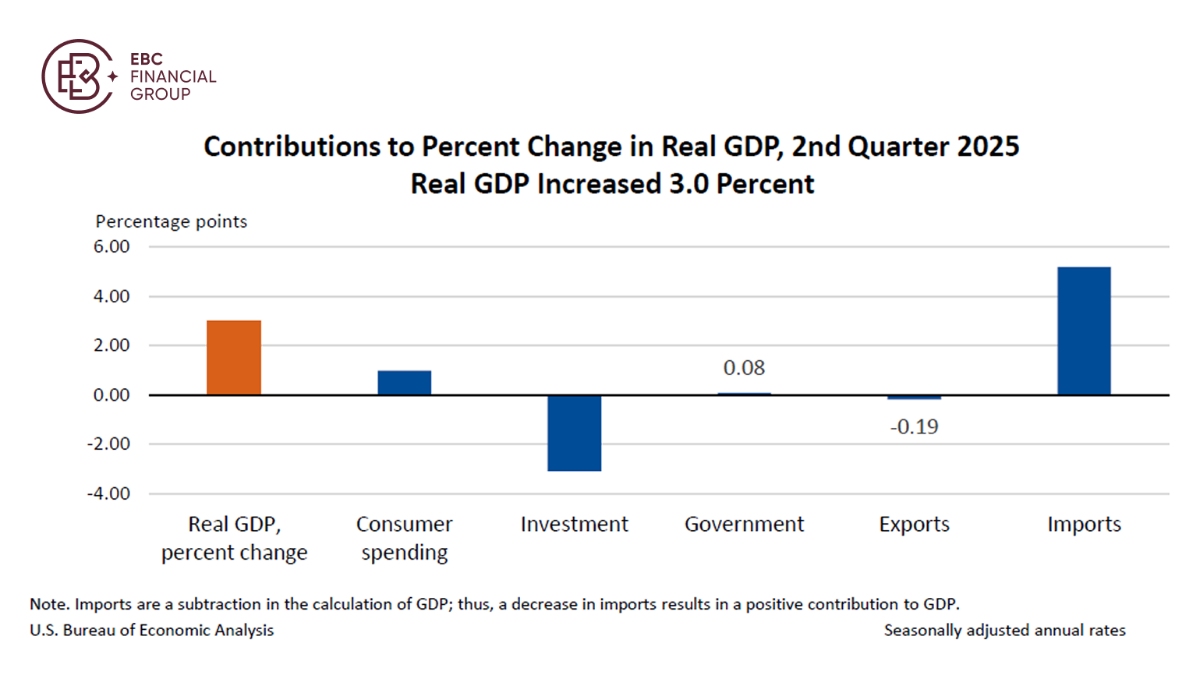

US GDP rebounded more than expected in Q2, but the growth was largely due to

declining imports accounted for the bulk of the improvement and domestic demand

increased at its slowest pace in over 2 years.

Businesses and household s are grappling with trade policy uncertainty. After

months of seesaw negotiations, the trade terns with some countries such as

Canada and Mexico are yet to be finalised.

Final sales to private domestic purchasers – a barometer of underlying

economic growth - grew at a 1.2% rate. That marked the slowest increase in

domestic demand since the Q4 2022.

Economists expected a lacklustre second half, which would limit growth to

about 1.5% for the full year. A softening labour market has reinforced the

gloomy view, in line with the call for rate cuts.

The Russell 2000 remains in red as of Thursday, reflecting deeper concerns

about stagflation. But bullion prices could hit a speed bump as stimulus begins

to kick in and as new trade landscape becomes evident.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.