Imagine walking into a busy marketplace where traders don't shout their prices in public but instead whisper them in corners, making private deals. You know the goods are real, but the process feels less structured than the bright lights and loud bells of a stock exchange.

This is precisely how the OTC (Over-the-Counter) market works in the financial world. For beginners, the term OTC can feel mysterious or even intimidating, but it doesn't have to be.

In this guide, we will explore the meaning of OTC in the stock market, its functioning, the benefits and risks involved, and whether we should advise beginner traders to enter this realm.

What Is the OTC Full Form Meaning in the Stock Market?

The complete form of OTC in the stock market is Over-the-Counter.

In this context, Over-the-Counter means that a security is traded “over the counter,” which is a way of buying and selling shares through a network of broker-dealers instead of a centralized stock exchange.

Unlike the NYSE (New York Stock Exchange) or NASDAQ, which are centralised and heavily regulated exchanges, OTC trading happens directly between two parties, usually via broker-dealers or electronic networks.

Think of it as bypassing the supermarket (exchange) and instead buying produce directly from the farmer. The product remains valid, but the buying and selling process is less formal and less visible.

How Does OTC Trading Work?

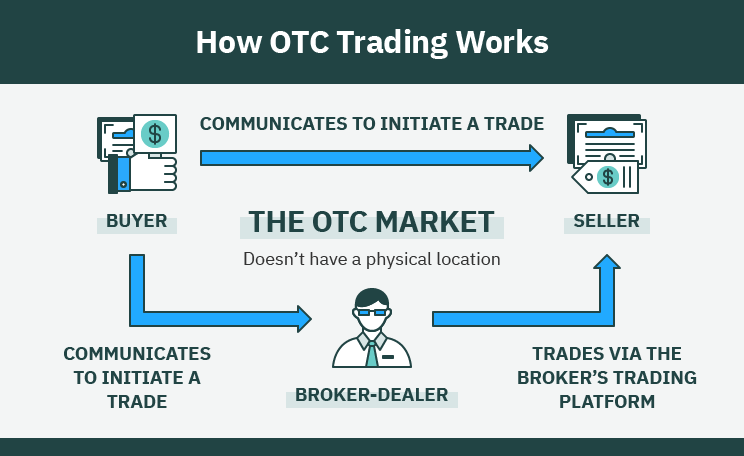

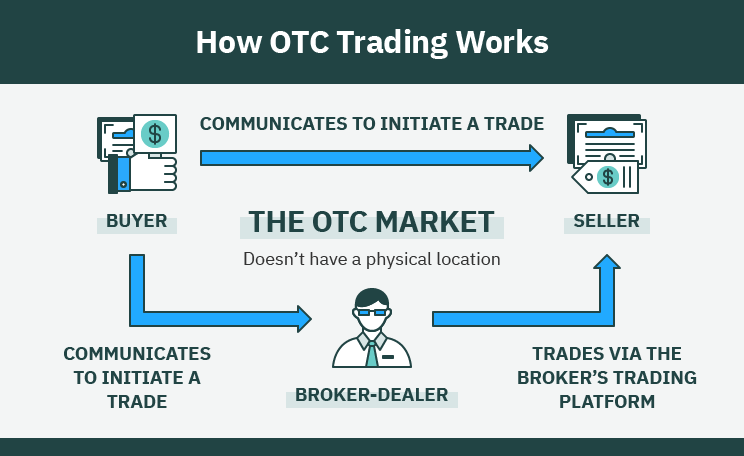

In OTC markets, buyers and sellers don't meet on a public exchange board. Instead:

Trades are negotiated privately.

Prices can differ depending on the broker or dealer.

Securities are not always subject to the same strict regulations as listed stocks.

For example, if you want to buy shares of a small startup that isn't big enough to list on NASDAQ, you might find it in the OTC market. Brokers act as intermediaries, quoting buy and sell prices.

What Is The Role of OTC Markets in Global Finance?

Even though OTC sounds like the "back door" of trading, it plays a crucial role in global finance.

-

Access to Small Companies: Many emerging companies, especially startups and foreign firms, rely on OTC to raise capital without the expensive process of listing on big exchanges.

-

Diversity of Instruments: OTC isn't just for stocks. Derivatives, bonds, currencies, and even crypto-related securities are often traded OTC.

Flexibility for Institutions: Large institutions utilise OTC to negotiate custom contracts, like swaps and options, that don't fit into exchange rulebooks.

The OTC derivatives market is enormous. Industry data indicate a notional outstanding amount in the hundreds of trillions of dollars (ISDA reported roughly $700 trillion at the end of 2024), and the BIS's 2025 Triennial Survey, whose detailed outstanding figures are due to be released later in 2025, will provide updated official estimates. [1]

OTC Stocks vs Exchange-Listed Stocks

To make everything clear, let's compare the two:

| Feature |

OTC Stocks |

Exchange-Listed Stocks |

| Visibility |

Less transparent |

Highly transparent |

| Regulation |

Light to moderate |

Strict (SEC, etc.) |

| Liquidity |

Often low |

High |

| Risk Level |

Higher |

Relatively lower |

| Accessibility |

Available through brokers/dealers |

Directly available on exchanges |

In short: Exchange stocks = highways with traffic rules. OTC = backroads with fewer rules but more bumps.

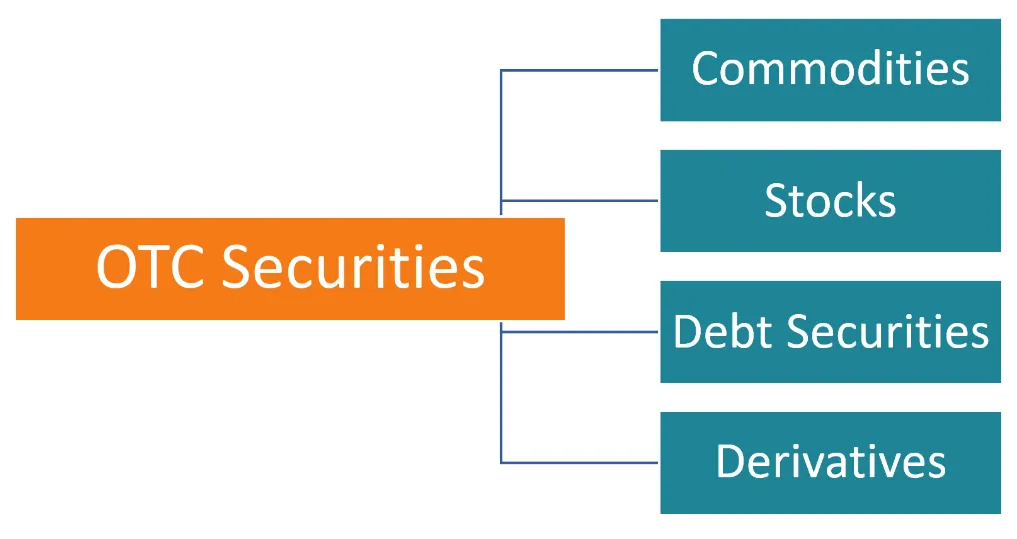

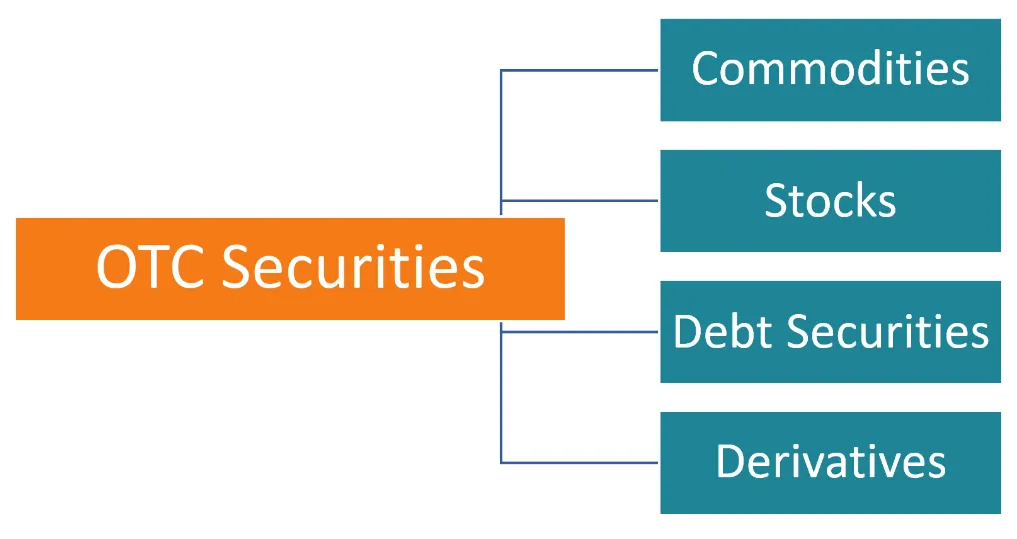

Are there Other Types of OTC Securities?

Yes. OTC is not limited to "penny stocks." Listed below is what you'll commonly find:

OTC Stocks: Small-cap or micro-cap companies not listed on exchanges.

OTC Derivatives: Swaps, forwards, and other tailor-made contracts.

OTC Bonds: Corporate or municipal bonds traded directly between parties.

OTC Forex: Much of the global currency market is OTC, with trillions traded daily.

Real-World Examples of OTC Trading in 2025

Penny Stocks in the U.S.: Many micro-cap stocks are traded on OTC Markets Group's platforms.

Forex: The $7.5 trillion daily forex market is largely OTC, handled by banks and dealers.

Crypto OTC Desks: Institutional investors utilise OTC desks to buy Bitcoin in bulk without affecting exchange prices.

Large Bitcoin trades are frequently executed off-exchange through institutional OTC desks because they help avoid market impact and preserve confidentiality. Industry commentary in 2024–25 shows a substantial and growing share of block trades moving through OTC channels, though exact percentages vary by data provider and trade size. [2]

Advantages and Risks of OTC Trading

| Advantages |

Risks |

| Access to early-stage companies |

Higher volatility |

| Wider range of instruments |

Lower transparency |

| Lower listing costs for firms |

Risk of scams or manipulation |

| Potential for higher rewards |

Low liquidity |

Should Beginners Invest in OTC Stocks?

It depends on your risk appetite.

For cautious beginners: The stocks listed on exchanges are more secure due to their transparency and liquidity.

For risk-takers: OTC offers opportunities to invest in companies at an early stage, but you must do thorough research and never invest money you cannot afford to lose.

The Future of OTC Markets in 2025 and Beyond

OTC markets are quietly reshaping themselves for the next phase. Digital platforms are streamlining trade execution and narrowing the old information gaps that once defined the space.

Large funds continue to use OTC desks for crypto because block-size orders slip through more cleanly outside public order books.

Regulators, meanwhile, are tightening disclosure and suitability standards, bringing these markets closer to the structure of traditional exchanges without stripping away their flexibility.

The result is an OTC landscape that’s becoming more transparent, more tech-driven, and still essential for assets that don’t fit neatly on mainstream exchanges.

Frequently Asked Questions

1. What Is the Full Form of OTC in the Stock Market?

OTC stands for Over-the-Counter, referring to securities traded directly between two parties rather than through a centralised exchange like the NYSE or NSE.

2. How Is OTC Trading Different From Exchange Trading?

In exchange trading, all buyers and sellers meet in a regulated, transparent marketplace. In OTC, transactions are conducted privately with brokers or dealers, featuring reduced transparency and occasionally increased risks.

3. Are OTC Stocks the Same as Penny Stocks?

Not always. While many penny stocks trade OTC, the OTC market also includes foreign company shares, corporate bonds, derivatives, and even large institutional deals.

4. Is OTC Trading Safer for Beginners?

No. OTC trading carries higher risks because of lower transparency, liquidity issues, and potential fraud.

5. Do OTC Markets Exist in India?

Yes, India once had the OTC Exchange of India (OTCEI), though it is inactive now.

Conclusion

In conclusion, the full form of OTC is Over-the-Counter, and it represents an alternative trading avenue outside traditional exchanges. For beginners, OTC trading may feel like exploring backroads instead of sticking to the main highway. It has more freedom, but also more risks.

Thus, if you're starting, it's wise to focus on well-known, exchange-listed stocks first.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.isda.org/a/1rjgE/Key-Trends-in-the-Size-and-Composition-of-OTC-Derivatives-Markets-in-the-Second-Half-of-2024.pdf

[2] https://vocal.media/trader/why-otc-trading-is-the-preferred-option-for-large-crypto-transactions-in-2025