A cross currency denotes any currency pair or transaction that does not include the US dollar.

Understanding cross currency relationships is essential for institutional treasuries, FX traders and multinational corporations because these pairs express direct relative value between two non-USD economies, drive hedging and funding costs, and reveal stress in global dollar funding through the cross-currency basis.

Concept and formal definition of "cross currency"

A cross currency is a currency pair or transaction in which neither leg is the US dollar (USD). Examples include EUR/JPY, EUR/GBP and AUD/NZD. The term also applies to non-USD transactions such as invoicing, loans or hedges settled in two non-USD currencies.

Cross currencies are commonly called crosses or cross pairs in FX markets; they sit between the most liquid USD majors and the less liquid exotic pairs.

How cross currency rates are determined

1. Triangular relationship and calculation

Cross rates are usually derived from two USD-quoted pairs. The most common method uses the USD as an intermediary (the "triangular" relationship):

2. Quoting and interbank role

Interbank market makers and electronic liquidity providers quote cross rates directly when liquidity suffices, or compute them from USD legs if direct market quotes are thin. Trade executions may use direct cross quotes or route via USD on the back of triangular arbitrage.

3. Principal drivers of cross rate moves

Relative interest rates and yield differentials between the two currencies.

Monetary policy divergence (central bank actions, forward guidance).

Trade flows and current-account balances.

Capital flows and risk sentiment (flight-to-quality, carry unwind).

Liquidity and market microstructure (order-book depth in the specific cross).

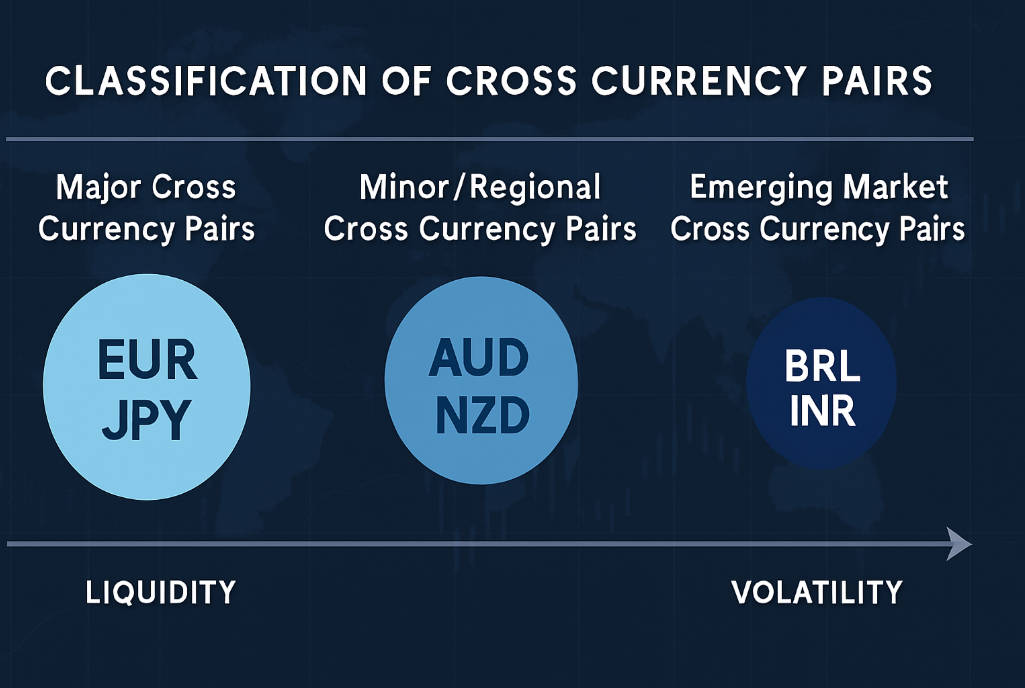

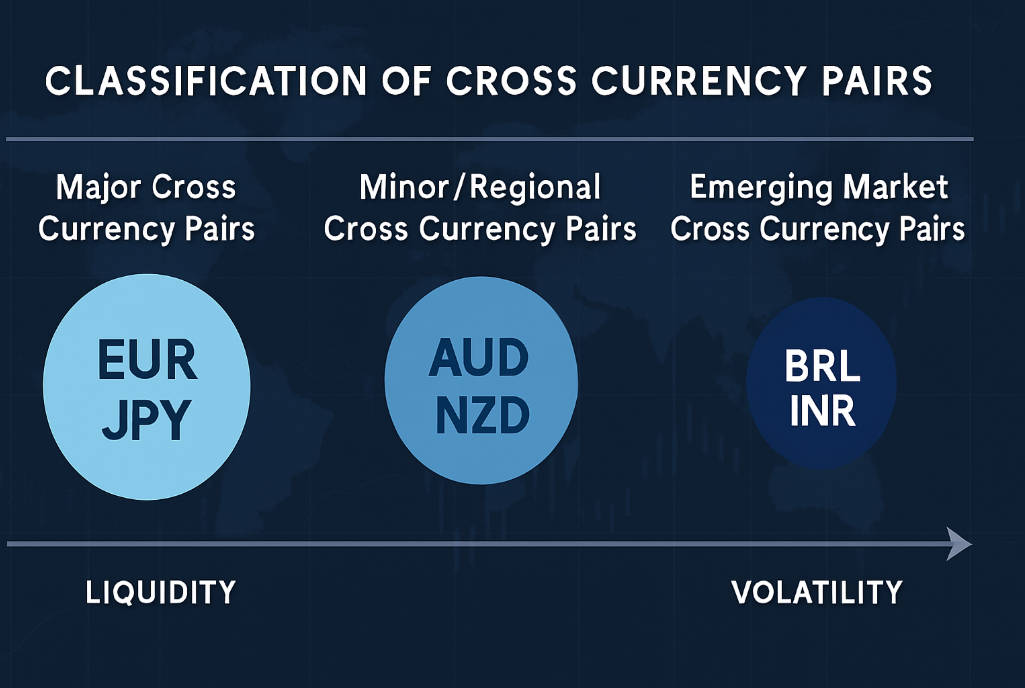

Classification of cross currency pairs

1. Categories

Major crosses — highly traded crosses with deep liquidity (e.g. EUR/JPY, EUR/GBP, GBP/JPY, AUD/JPY).

Minor / regional crosses — moderate liquidity, often used for regional exposure (e.g. AUD/NZD, EUR/NZD, CAD/JPY).

Emerging-market crosses — involve EM currencies without the USD leg (e.g. BRL/INR, ZAR/TRY); these are usually less liquid and more volatile.

2. Typical characteristics

Liquidity decreases and bid-ask spreads widen as you move from major crosses to regional then emerging crosses.

Volatility patterns differ: commodity-linked crosses (AUD/CAD, AUD/NZD) often correlate with commodity prices; yen crosses (EUR/JPY, GBP/JPY) can show larger intra-day moves due to carry and risk sentiment.

Why market participants trade cross currency pairs

Express a direct relative view — investors may have convictions about the relative strength of two non-USD economies (e.g. believing the euro will outperform the yen).

Avoid USD exposure — corporates and funds sometimes want to hedge or take positions without introducing USD currency risk.

Carry and yield strategies — capture interest differentials between two non-USD interest rates (carry trades).

Arbitrage and triangular opportunities — statistical or execution arbitrage when direct cross quotes diverge from implied cross rates.

Cross currency instruments: spot, forwards, swaps and basis

1. Spot and forwards

2. Cross-currency swaps

A cross-currency swap combines exchanges of principal and interest in two currencies and is used for long-dated funding or hedging between two non-USD currencies. While swaps are a distinct instrument, they are part of the broader cross-currency ecosystem because they influence funding costs and hedging behaviour.

3. Cross-currency basis

-

The cross-currency basis is the spread that reconciles the forward rate implied by covered interest parity (CIP) and the market-observed forward rate.

A non-zero basis reflects funding imbalances, counterparty credit concerns, regulatory costs or scarcity of a particular currency in FX-swap markets. The basis is an important market signal of dollar (or other currency) funding stress.

Pricing, valuation and market infrastructure

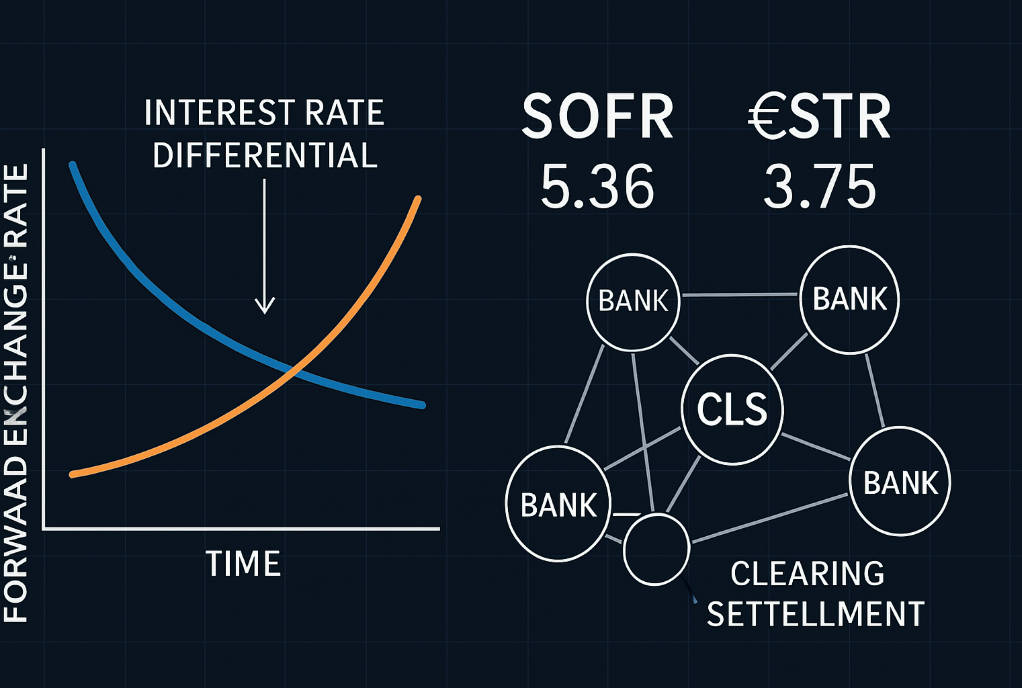

1. Pricing mechanics

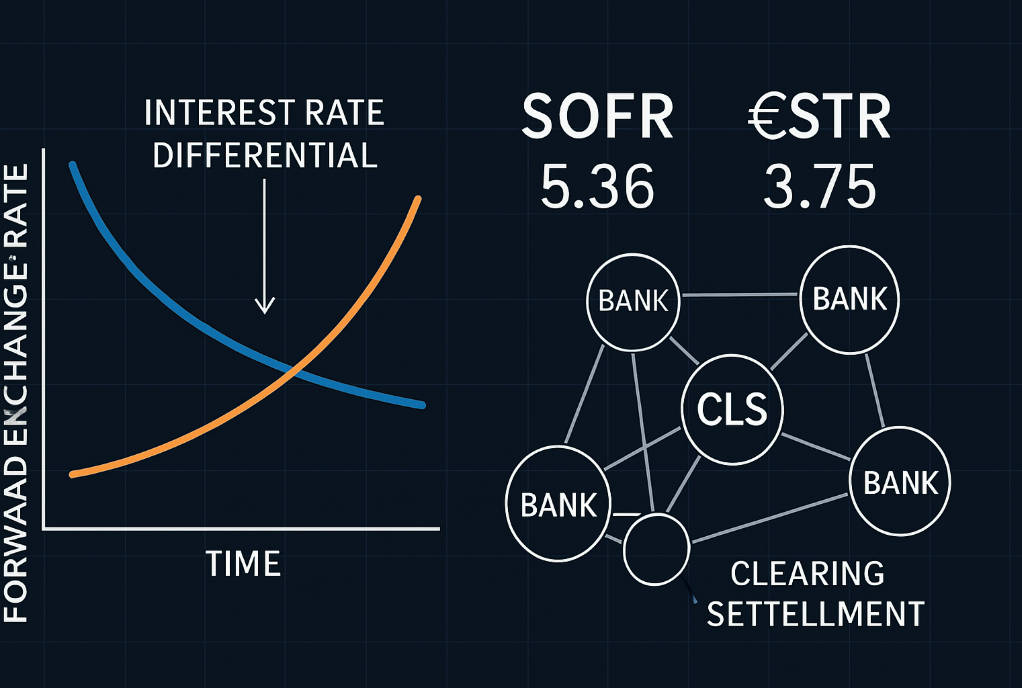

Forward pricing for a cross is a function of the spot rate and the interest-rate differential of the two currencies (via forward points); when banks price forwards and swaps they include the cross basis where markets demand it.

2. Benchmarks and reference rates

Major overnight and term benchmark rates (SOFR, €STR, TONAR, SONIA, etc.) are used in valuation of the floating legs of swaps and in constructing forward curves.

3. Clearing and settlement

Large banks and CCPs (central counterparties) have expanded clearing for interest rate and FX derivatives; settlement systems such as CLS reduce settlement risk for multi-currency payments.

Common cross pairs and their implied USD relationships

| Cross Pair |

Implied USD legs (for calculation) |

Typical use case |

| EUR/JPY |

EUR/USD × USD/JPY |

Hedging euro exposure in yen liabilities |

| EUR/GBP |

EUR/USD ÷ GBP/USD |

Relative euro–sterling positioning |

| AUD/NZD |

AUD/USD ÷ NZD/USD |

Australasia commodity/regional exposure |

| GBP/CHF |

GBP/USD × USD/CHF |

Express sterling vs Swiss franc view |

(Derivation: use quoted USD pairs to compute implied cross.)

Market size, liquidity and recent trends

-

FX markets are vast: the BIS triennial survey reported a record daily average FX turnover of $9.6 trillion in April 2025. a 28% increase from 2022.

The US dollar remained on one side of roughly 89% of all trades, underlining the USD's continued centrality even as cross trading grows. These statistics emphasise that, while crosses are important, the USD's intermediation continues to shape the market.

-

Cross-currency basis behaviour has been a notable structural theme.

The basis widened sharply during the COVID-19 market stress in March 2020 and—more recently—has been used to explain demand to hedge dollar exposures during episodes of dollar weakness or scarcity. The basis therefore serves both as an indicator of funding pressure and a determinant of cross pricing.

-

Electronification and regionalisation: trading in crosses has migrated to electronic platforms and algo execution, while regional hubs (London, Tokyo, Singapore) continue to shape liquidity provision.

Growth of the Chinese renminbi and regional currency usage has also increased the number of active cross pairs.

Risks and prudent controls for cross currency activity

Market risk — two non-USD currencies can move independently, creating significant relative volatility.

Liquidity risk — many crosses have thinner books than major USD pairs; slippage and wider spreads occur in stressed markets.

Basis and funding risk — adverse shifts in the cross-currency basis increase hedging or funding costs.

Credit and counterparty risk — swaps and forward trades expose institutions to counterparty default risk if not centrally cleared or collateralised.

Operational and legal risk — documentation (ISDA schedules, collateral agreements) and settlement timing across time zones must be managed carefully.

Mitigations: robust liquidity limits, central clearing where practical, dynamic hedging strategies, and routine monitoring of the cross-currency basis and funding curves.

Practical guidance for traders, treasuries and risk managers

Triangulation checks — always verify implied cross rates against direct market quotes to detect arbitrage or broken prices.

Monitor the basis — changes in the cross-currency basis can make forwards and swap hedges more or less costly; include basis scenarios in stress tests.

Diversify execution — use multiple liquidity venues (bank OTC, EBS/Refinitiv, and electronic platforms) to reduce execution risk in thin crosses.

Hedge dynamically — where exposure is temporary, prefer shorter-dated forwards or NDFs (non-deliverable forwards) in restricted-currency environments.

Document and collateralise — ensure ISDA terms and collateral arrangements reflect chosen clearing and counterparty preferences.

Outlook and structural themes to watch

Continued USD dominance: even as cross trading grows, the USD remains the central currency for pricing and intermediation; cross liquidity will therefore often reflect USD market conditions.

Persistent basis dynamics: regulatory capital costs, bank balance-sheet constraints and episodic funding pressures mean the cross-currency basis may remain a persistent structural factor in pricing.

Technology and market structure: greater electronification and algos will likely reduce execution cost in many crosses, but stress events can still cause abrupt liquidity withdrawal.

Regional currency ascent: rising share of Chinese renminbi and regional currency pools may increase the number of liquid non-USD crosses over time.

Conclusion

The cross currency market stands at the intersection of global liquidity, interest rate differentials, and capital flow dynamics. It is more than a pricing mechanism — it is a real-time reflection of how nations fund, hedge, and balance their economic power beyond the dollar's reach.

For investors and institutions, understanding cross currency relationships is not optional but essential. Whether managing portfolio exposure, assessing funding risks, or reading market sentiment, cross currency signals often reveal the truth of global finance long before the headlines do.

Frequently asked questions

1. What is a cross currency?

A pair or transaction not involving USD (e.g. EUR/JPY).

2. How is a cross rate calculated?

Typically from two USD-quoted legs using triangular arithmetic (EUR/JPY = EUR/USD × USD/JPY).

3. Why does the cross-currency basis matter?

It shows funding imbalances and affects forward and swap pricing; a wider basis implies higher funding or hedging costs.

4. Which crosses are most liquid?

EUR/JPY, EUR/GBP, GBP/JPY and AUD/JPY are among the most liquid crosses.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.