In 2025, global equity markets remain the primary drivers of investment returns and risk.

Monitoring the most influential exchanges allows investors to anticipate liquidity shifts, track emerging IPOs, identify sector leadership, and interpret cross-border capital flows before they influence broader markets.

This guide highlights the ten critical markets shaping portfolios today, with insights into their market impact and strategic opportunities.

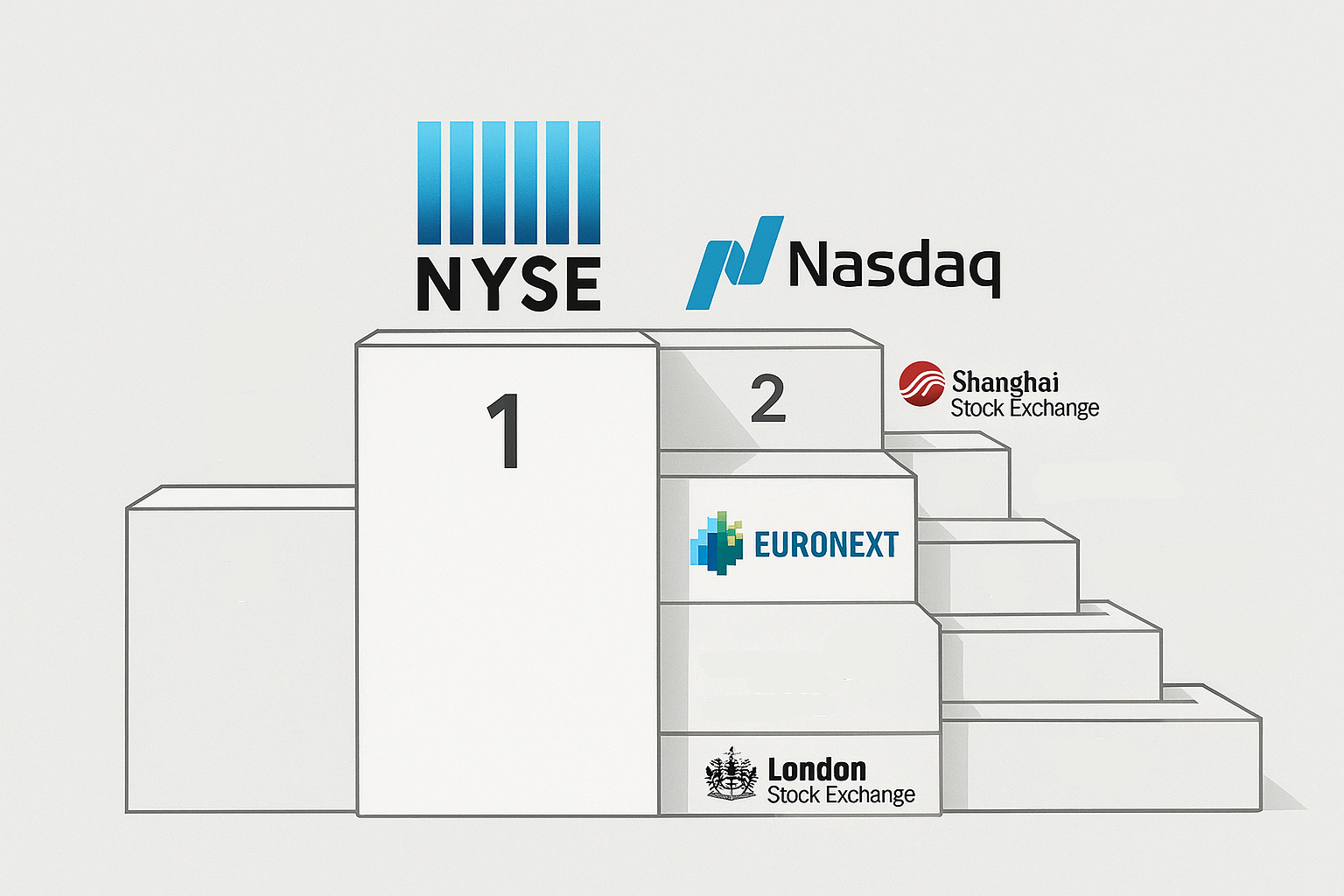

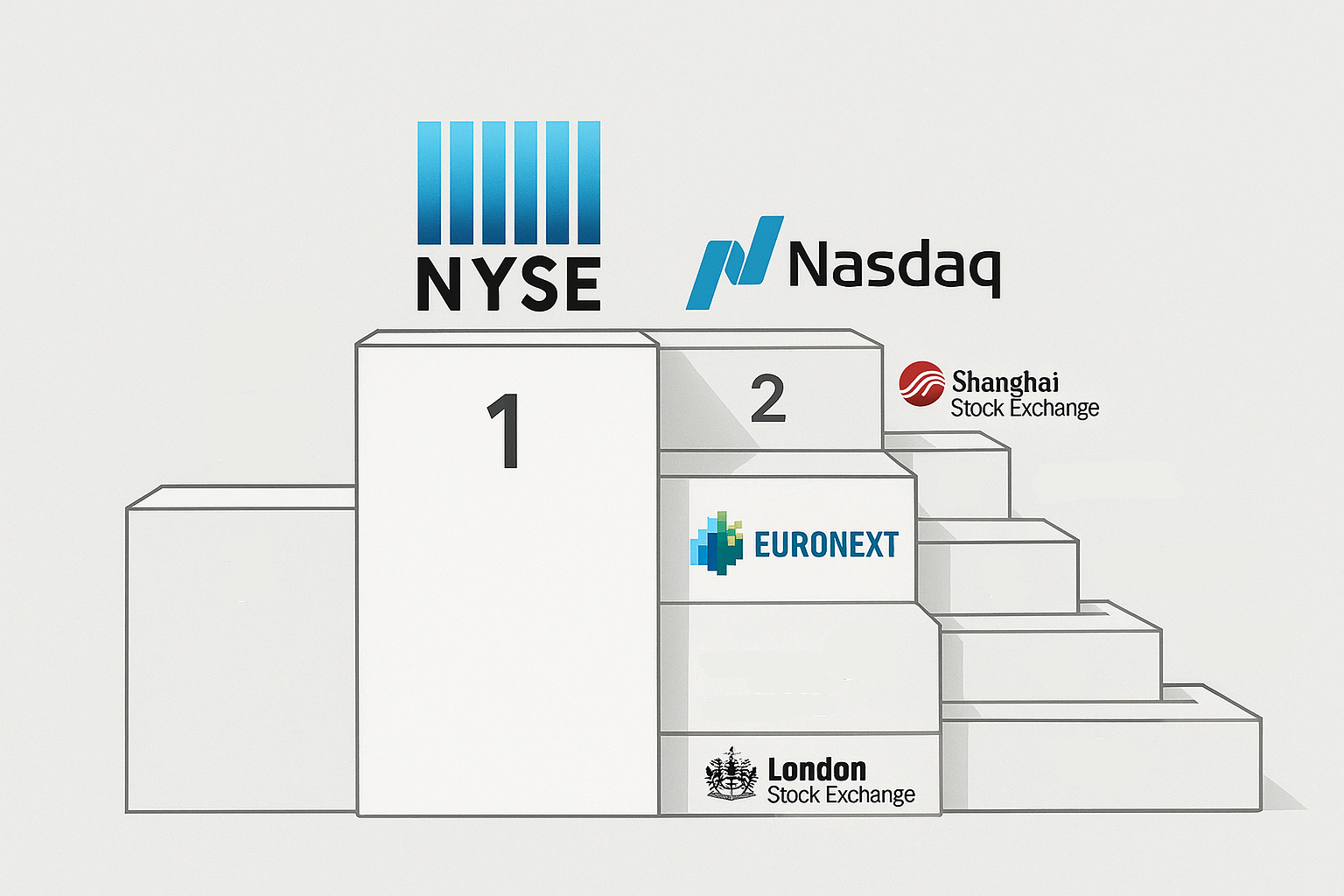

Top Stock Markets in the World by Market Capitalisation (2025)

| Rank |

Stock Exchange |

Country / Region |

Market Cap (USD) |

Primary Focus / Broker's Note |

| 1 |

New York Stock Exchange (NYSE) |

🇺🇸 USA |

31.71 T |

Global anchor for blue-chip, industrial, and financial capital. |

| 2 |

Nasdaq Stock Market |

🇺🇸 USA |

28.50 T |

The definitive liquidity pool for Tech, Biotech, and Growth. |

| 3 |

Shanghai Stock Exchange (SSE) |

🇨🇳 China |

7.96 T |

Dominated by large State-Owned Enterprises (SOEs) and banks. |

| 4 |

Japan Exchange Group (JPX) |

🇯🇵 Japan |

7.06 T |

Key hub for automotive and advanced manufacturing. |

| 5 |

Euronext |

🇪🇺 Pan-Europe |

5.61 T |

Aggregates Eurozone capital (Paris, Amsterdam, Milan). |

| 6 |

National Stock Exchange (NSE) |

🇮🇳 India |

5.33 T |

High Growth: Highest P/E premiums; driven by demographics. |

| 7 |

Hong Kong Exchanges (HKEX) |

🇭🇰 Hong Kong |

5.22 T |

Primary gateway for offshore Chinese equity and derivatives. |

| 8 |

Shenzhen Stock Exchange (SZSE) |

🇨🇳 China |

5.11 T |

"China’s Nasdaq" – Focused on private sector innovation/tech. |

| 9 |

TMX Group (Toronto) |

🇨🇦 Canada |

4.00 T |

Global heavyweight in Energy, Mining, and Materials. |

| 10 |

London Stock Exchange (LSE) |

🇬🇧 UK |

3.80 T |

High-yield defensive sectors (Energy/Utilities); low valuations. |

Note: Market capitalization figures are highly dynamic and based on the most reliable, publicly sourced data points as of or near November 19, 2025. Specific values can fluctuate daily.

1. New York Stock Exchange (NYSE)

Market Cap: ~USD 31.71

Exp: The NYSE remains the world’s deepest equity market, anchored by large U.S. corporations and strong institutional participation. It continues to provide the infrastructure mainstay for global capital deployment.

2025 Snapshot: Recent U.S. equity weakness has weighed on benchmark indexes, as concerns over AI over-hype and a fading rate-cut optimism by the Federal Reserve have triggered multiple days of asset-revaluations.

Why It Matters: Offers exposure to the most liquid global equities benchmark and remains central for global portfolio flows.

2. Nasdaq Stock Market

Market Cap: ~USD 28.50T

Exp: Nasdaq serves as the growth-and-innovation hub of equities, with heavy representation of tech, biotech and other high-duration businesses. Market movements here can signal broader risk appetite shifts.

2025 Snapshot: The index recently declined ~0.8% in a session, driven by sector-wide declines and elevated volatility (VIX up ~13 %). Ten of 11 sectors ended in the red as investors dialled back “AI trade” exposure.

Why It Matters: Provides targeted access to the highest-growth end of global equity markets; useful for thematic allocations.

3. Shanghai Stock Exchange (SSE)

Market Cap: ~USD 7.96T

Exp: As the primary venue for China’s massive State-Owned Enterprises (SOEs), the SSE is heavily weighted toward banking, energy, and industrial sectors. It is a barometer for the health of the mainland Chinese economy and government policy transmission.

2025 Snapshot: The SSE is currently reacting to Beijing's latest fiscal stimulus package. While industrial output remains tepid, volume has spiked in infrastructure-related stocks as investors bet on government-led floor support.

Why It Matters: Essential for exposure to the "China Reopening 2.0" trade and understanding mainland capital flows.

4. Japan Exchange Group (JPX)

Market Cap: ~USD 7.06T

Exp: Combining the Tokyo and Osaka exchanges, JPX is a critical hub for Asian industrial and automotive capital. It is deeply integrated with global supply chains and is heavily influenced by the Yen's carry trade dynamics.

2025 Snapshot: JPX valuations have faced headwinds due to the Bank of Japan's (BoJ) continued yield curve control adjustments. A strengthening Yen has compressed exporter earnings, causing a rotation from automotive stocks into domestic financials.

Why It Matters: A key defensive market for value investors looking for corporate governance reforms and stable yield.

5. Euronext

Market Cap: ~USD 5.61T

Exp: The primary pan-European exchange (aggregating Paris, Amsterdam, Milan, etc.), Euronext is the home of Europe’s "Luxury Heavyweights" and major financial institutions. It represents the consolidated economic output of the Eurozone.

2025 Snapshot: Performance has been mixed as the ECB diverges from the Fed. While the luxury sector faces softening demand from Asia, European financials are outperforming due to higher net interest margins.

Why It Matters: The most efficient vehicle for broad exposure to the European Common Market without single-country risk.

6. National Stock Exchange of India (NSE)

Market Cap: ~USD 5.33T

Exp: The NSE has structurally flipped Hong Kong to become the undisputed growth engine of emerging Asia. Driven by a massive domestic retail investor boom and the "China+1" supply chain shift, it trades at a premium to its peers.

2025 Snapshot: The Nifty 50 continues to test new highs despite global volatility. Institutional Foreign Portfolio Investors (FPIs) are aggressively overweighting Indian manufacturing and digital infrastructure stocks.

Why It Matters: Offers the highest organic growth profile among major exchanges; a pure-play on the "Rising India" demographic dividend.

7. Hong Kong Exchanges & Clearing (HKEX)

Market Cap: ~USD 5.22T

Exp: HKEX remains the critical financial gateway connecting mainland China to the world. While it has lost its volume crown to India, it remains dominant in IPOs for Chinese tech firms seeking offshore capital.

2025 Snapshot: Liquidity remains constrained as the Hang Seng Index struggles with property sector debt overhangs. However, the "Southbound Connect" trading channel is seeing record inflows from mainland investors hunting for undervalued yield.

Why It Matters: The primary arbitrage mechanism for Chinese assets and a critical hub for derivatives trading in Asia.

8. Shenzhen Stock Exchange (SZSE)

Market Cap: ~USD 5.11T

Exp: Often called "China's Nasdaq," Shenzhen hosts smaller, private-sector tech and manufacturing companies. It is more volatile than Shanghai but offers higher alpha potential in fields like EV batteries and green energy.

2025 Snapshot: The exchange is seeing high volatility as regulatory scrutiny on the tech sector stabilizes. Clean energy stocks listed here are currently outperforming the broader Chinese market.

Why It Matters: The best proxy for China’s private sector innovation and the "New Economy" transition.

9. TMX Group (Toronto Stock Exchange)

Market Cap: ~USD 4.00T

Exp: TMX is a resource-heavy exchange, globally dominant in mining, oil & gas, and clean technology listings, complemented by a stable oligopoly of Canadian banking giants.

2025 Snapshot: Energy sector resilience is buoying the TSX despite broader North American weakness. Gold miners are seeing renewed interest as a hedge against global sovereign debt concerns.

Why It Matters: A vital diversification tool for commodities exposure and high-dividend yield strategies.

10. London Stock Exchange (LSE)

Market Cap: ~USD 3.80T

Exp: The LSE is a "Value" heavy market, dominated by old-economy sectors like energy, mining, and tobacco. It suffers from a "valuation discount" compared to the US, making it attractive for M&A and private equity takeovers.

2025 Snapshot: The FTSE 100 is trading at historically low P/E multiples. While IPO activity remains sluggish post-Brexit, share buybacks from major listed energy firms are providing a floor for the index.

Why It Matters: Offers some of the highest dividend yields globally and serves as a hedge against US tech valuation bubbling.

How Investors Follow the Stock Market

Firstly, they create a "follow framework" centred on trading hours as market dominance shifts from Asia to Europe to North America.

Price action in HKEX, SSE/SZSE, and JPX sets the overnight tone. Euronext and LSE refine risk at the open in Europe, then the baton passes to NYSE/Nasdaq, where volume peaks.

Following that rhythm helps you place news and earnings into context.

Map Each Exchange to a Macro Theme:

NYSE/Nasdaq = Global growth and tech risk.

SSE/SZSE/HKEX = China policy cycles, manufacturing, and Asia consumer demand.

JPX = Corporate reform momentum plus FX-sensitive exporters.

Euronext/LSE = European rate path, luxury/industrial cycle, and commodities.

TMX = energy/metals beta, North American defensives.

NSE = India's structural growth, domestic flows, and capex-led cycle.

Lastly, use market-cap leadership as a breadth signal. When the combined market capitalisation of the NYSE/Nasdaq increases compared to others, global risk frequently shifts toward U.S. growth technology.

When Euronext/LSE leads, defensives and value may be in favour. Surges in JPX or NSE can flag regional leadership shifts, portfolio re-weights, and ETF flows into those markets.

Frequently Asked Questions (FAQ)

1. Why should I track multiple global stock markets?

Different markets lead at different times and sectors, providing early signals on liquidity, risk appetite, IPOs, and sector trends that affect global portfolios.

2. How does market-cap leadership influence investment decisions?

Rising market-cap in a region or exchange often indicates where capital and sector rotations are headed, helping investors anticipate growth, value, or defensive trends.

3. Can these insights be used for short-term trading?

Yes, tracking trading rhythms, macro themes, and market-cap shifts can guide short-term positioning, but combining them with risk management is essential.

Conclusion

For a focused investment strategy, tracking these key markets is essential.

They provide the clearest signals on global risk, drive the IPO and M&A cycle, and offer insight into macro and sector trends from technology and innovation to industrials, commodities, reform-driven reratings, and policy-sensitive regions.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.