14 October Market Snapshot:

S&P 500 futures: -0.7% | Nasdaq: -1.0% | Nikkei: -3.0%

Gold: Reversed from $4,138 high | Silver: Down from $53.50 record

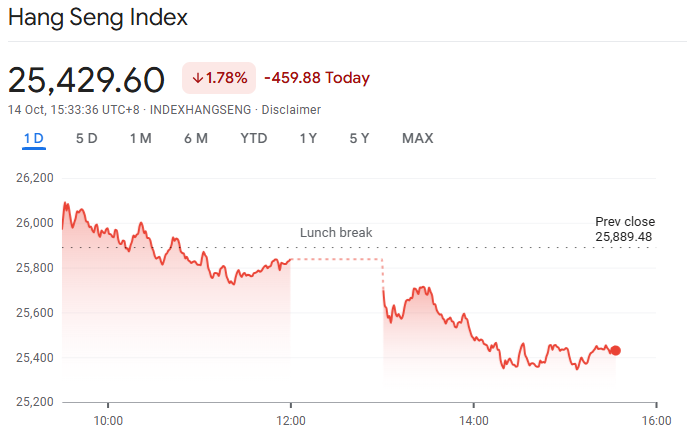

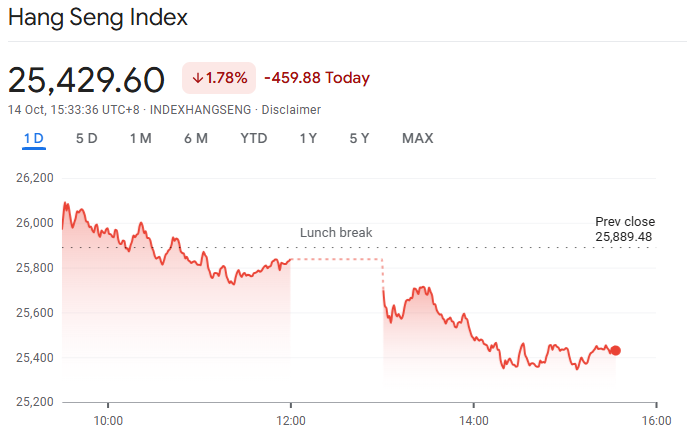

Hang Seng: -0.2% (down 5.1% past week)

Trigger: China port fees + Hanwha sanctions effective today

Global markets tumbled on 14 October as China struck back against the United States with concrete retaliatory measures that began today, sending stocks, precious metals, and cryptocurrencies into sharp declines.

The selloff was triggered by China imposing port fees of 400 yuan ($56) per net tonne on American vessels starting today, sanctioning South Korean shipbuilder Hanwha Ocean's American entities, and declaring it's ready to "fight to the end" in response to President Trump's threat of 100% tariffs on Chinese goods. [1]

China Retaliation: Port Fees and Sanctions Hit Today

Beijing launched two major countermeasures on 14 October that caught markets off guard.

| China's Retaliation (14 Oct) |

Details |

| Port fees on US ships |

400 yuan ($56) per net tonne; gradual increases until April 2028 |

| Vessels affected |

All US-owned, operated, built, or flagged ships docking in China |

| Hanwha Ocean sanctions |

American entities of South Korean shipbuilder targeted |

| Threat of escalation |

Beijing warns "more retaliatory measures" coming |

| US equivalent |

$50/tonne fee on Chinese ships (also started today) |

The port fee retaliation directly matches America's charges on Chinese vessels, creating a tit-for-tat escalation that adds significant costs to trans-Pacific shipping. The sanctions on Hanwha Ocean signal China's willingness to target third-country companies with American ties, expanding the battlefield beyond direct US-China commerce.

China 'Fight to the End' Warning Shocks Markets

China's Commerce Ministry stated on 13 October it's prepared to "fight to the end" in the escalating trade war.

China Commerce Ministry, 13 October:

"If you wish to fight, we shall fight to the end; if you wish to negotiate, our door remains open."

The defiant tone came after Trump threatened 100% tariffs on all Chinese imports starting 1 November, wiping $2 trillion from U.S. stock markets in a single day last Friday.

China accused the United States of a "textbook double standard," stating Washington "cannot simultaneously seek dialogue whilst threatening new restrictive measures".

The harsh language dashed hopes that Trump's Sunday evening social media post claiming "it will all be fine" would calm tensions.

Trade War Selloff: Stocks, Metals, Crypto Fall

Today's selloff hit virtually every corner of global markets, with even traditional safe havens failing to hold gains.

| Asset Class |

Today's Move (Latest Price) |

Previous Level |

Note |

| S&P 500 futures |

↓ 0.7% to ~5,810 |

~5,850 |

Extends Friday's 2.7% crash |

| Nasdaq 100 |

↓ 1.0% to ~20,200 |

~20,400 |

Tech leads decline |

| Nikkei 225 |

↓ 3.0% to ~38,300 |

~39,500 |

Worst regional performer |

| Hang Seng |

↓ 0.2% to ~21,750 |

~21,800 |

Seventh consecutive day of losses |

| Asian shares |

↓ 1.3% to 2-week low |

Lowest in 2+ weeks |

Broad-based weakness |

| Gold |

↓ to ~$4,020 |

From $4,138 high |

Safe-haven bid failed |

| Silver |

↓ to ~$50.80 |

From $53.50 ATH |

Extreme volatility |

| Bitcoin |

↓ to ~$111,500 |

~$114,000 |

Risk-off dominates |

| Japanese yen |

↑ to ¥143.2 / USD |

vs dollar |

Flight to quality |

The failure of gold and silver to hold their morning gains despite escalating trade war fears suggests investors are prioritising liquidity over safe-haven assets, a bearish signal for risk appetite.

Trade War Timeline: September to Today

The current escalation builds on months of rising tensions between Washington and Beijing. [2]

| Date |

Event |

Market Impact |

| Late Sept |

Trump imposes export restrictions on China chips |

Initial tensions rise |

| 9 Oct |

China announces rare earth export controls |

Supply chain fears escalate |

| 11 Oct (Fri) |

Trump threatens 100% tariffs effective 1 Nov |

S&P 500 worst day in 6 months, $2T loss |

| 13 Oct (Sun) |

Trump posts "It will all be fine" on social media |

Brief market optimism |

| 13 Oct (Mon) |

China declares "fight to the end" stance |

Optimism evaporates |

| 14 Oct (Tue) |

China port fees start + Hanwha sanctions imposed |

Markets tumble again |

| 14 Oct (Tue) |

Trump enacts 10-50% tariffs on lumber, furniture |

Additional trade pressure |

Conclusion

The trade war enters a critical phase as the 1 November deadline for Trump's threatened 100% tariffs approaches. With China vowing to "fight to the end" and concrete retaliatory measures now in effect, markets face weeks of heightened volatility.

A planned Trump-Xi summit later in October offers potential for de-escalation, but China's Commerce Ministry stated it hasn't received an official invitation, casting doubt on near-term diplomatic progress.

Treasury Secretary Scott Bessent indicated talks are scheduled for the "coming weeks," though he acknowledged the 100% tariff "is not inevitable".

Until either side blinks or negotiators reach a breakthrough, investors should brace for continued market turbulence as the world's two largest economies escalate their economic confrontation. [3]

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Sources

[1] https://www.scmp.com/business/china-business/article/3328885/hong-kong-stocks-snap-6-day-losing-streak-taco-trade-returns

[2] https://www.nytimes.com/2025/10/14/business/economy/trump-ramps-up-trade-war-as-tariffs-on-lumber-and-furniture-kick-in.html

[3] https://www.channelnewsasia.com/east-asia/china-us-trade-war-fight-end-trump-tariffs-5399996