U.S. natural gas just reminded traders why it is one of the most explosive markets in the world. After spending much of the winter pricing in a reasonably regular storage cushion, the front-month contract snapped higher in a matter of sessions as Arctic cold returned to the forecast.

As of January 26, 2026, the NYMEX Henry Hub natural gas February 2026 (NGG26) was trading around $6.20 per MMBtu, after reaching an intraday peak of $6.288.

That is a level the market has not seen in roughly three years, and the reason is not complicated. The U.S. is facing widespread extreme cold, and the gas market is pricing two things simultaneously: A surge in heating demand and a higher risk of supply problems when temperatures plunge deep below freezing

Natural Gas Price Recent Performance: 1 Week, 1 Month, 6 Months

Before diving deeper, it's crucial to understand how quickly this move came about.

Natural Gas Last Week

It was not a slow climb. U.S. natural gas futures surged as weather forecasts turned colder and storm risks rose, with some coverage describing the move as the largest two-day gain on record.

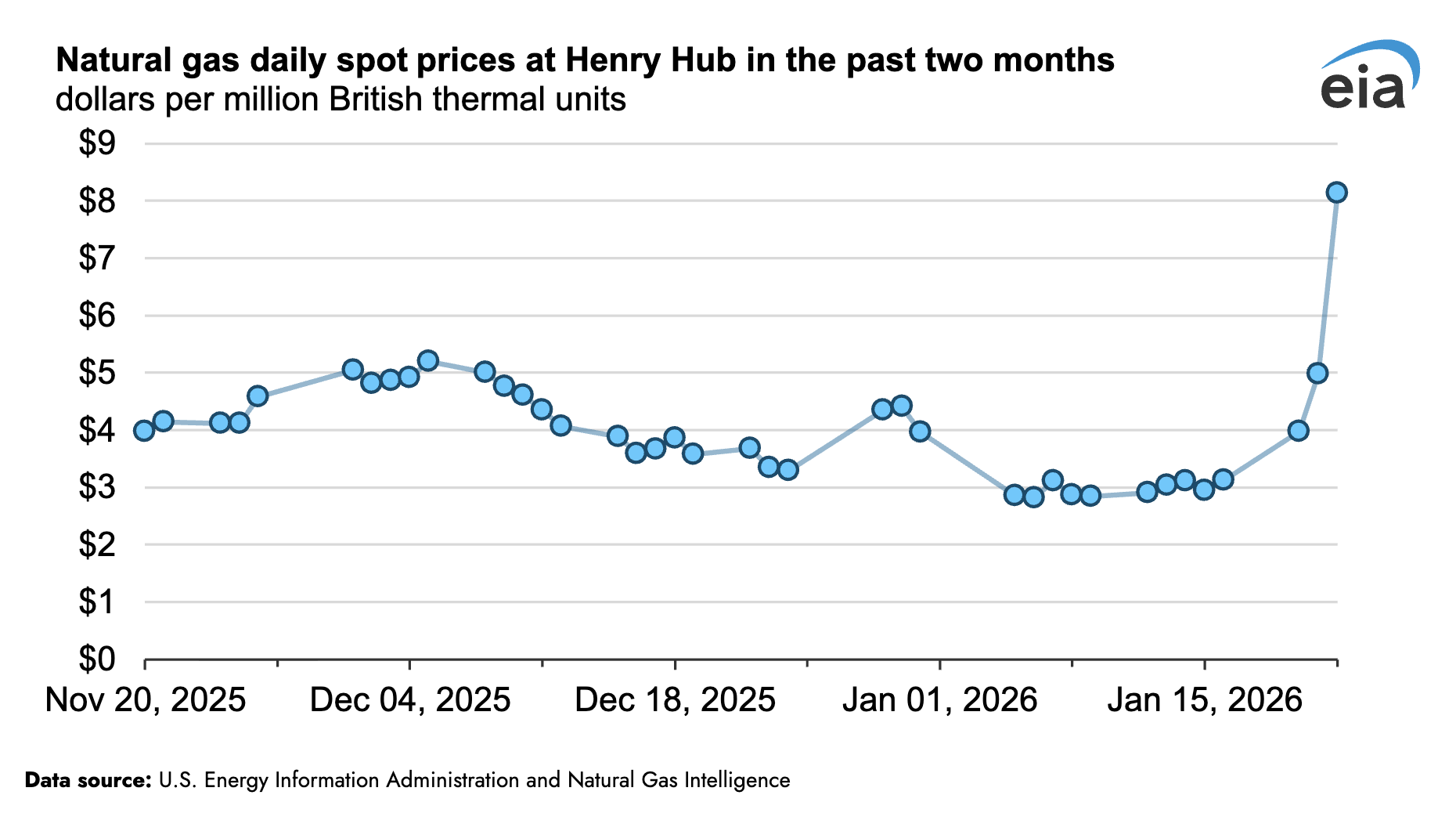

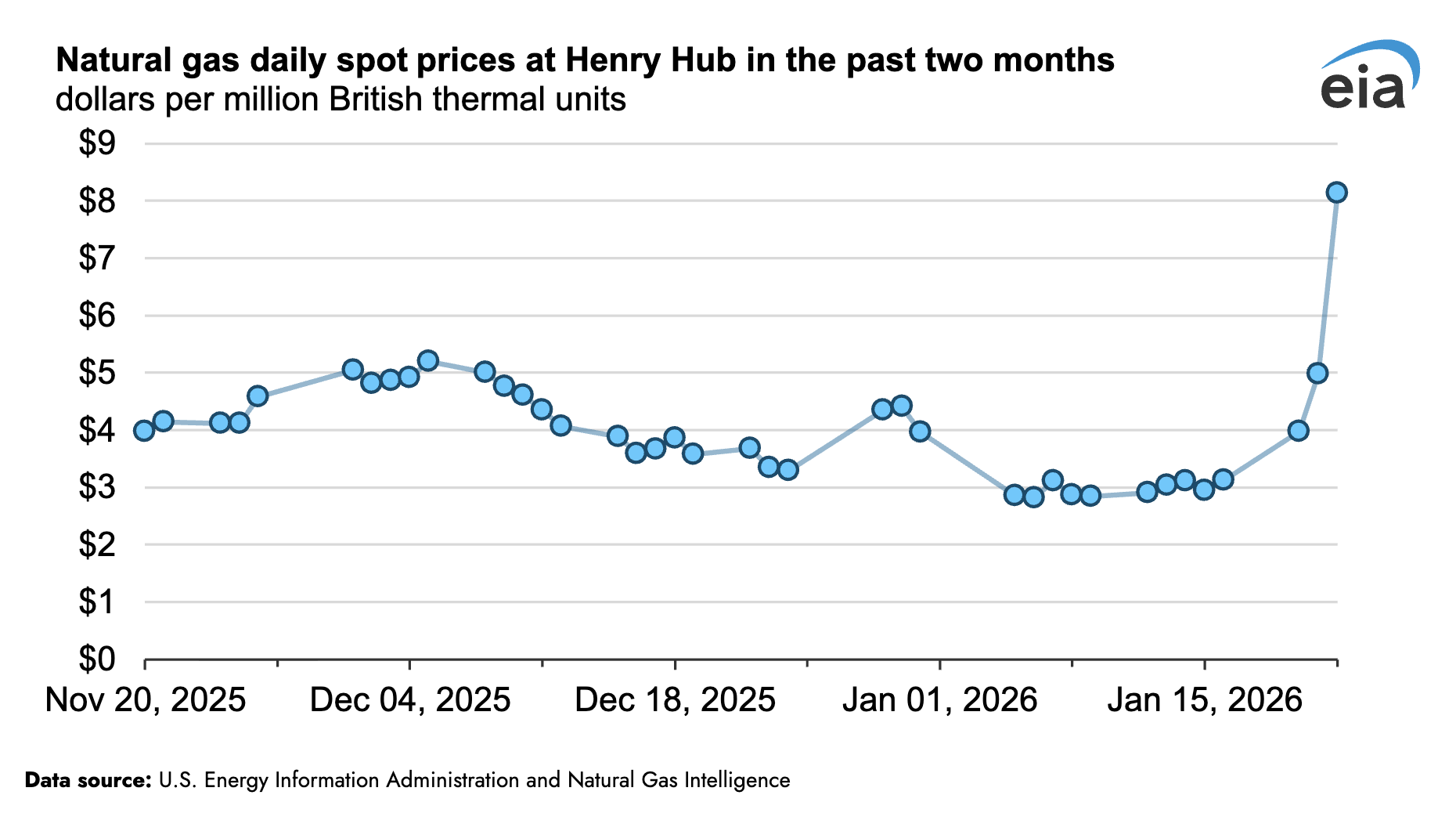

For example, EIA noted that Henry Hub daily spot prices jumped to nearly $8.15/MMBtu on January 22, as colder weather boosted space-heating demand.

Natural Gas Last 1 Month

Over the past month, the February 2026 NYMEX contract (NGG26) has shifted from the low-$4s to above $6.00, topping out at $6.288.

That speed is why the move has felt less like a steady trend and more like a rapid repricing.

Natural Gas in the Last 6 Months

Zooming out, storage has remained above seasonal norms. EIA reported working gas at 3,065 Bcf for the week ending January 16, about 177 Bcf above the five-year average.

That backdrop supports the idea that the spike is primarily a short-term weather shock. EIA's baseline still expects Henry Hub to average just under $3.50 in 2026, before rising in 2027 as balances tighten.

Why Did Natural Gas Price Spike? 5 Key Drivers

1. The U.S. Is Pricing a Demand Shock From Extreme Cold

Cold weather changes gas demand fast. When large areas turn frigid simultaneously, heating loads and power demand rise, and utilities draw more gas.

As mentioned above, EIA's latest market note was direct: Henry Hub daily spot prices jumped sharply, hitting nearly $8.15 per MMBtu on January 22, as colder weather lifted space-heating demand.

Natural gas futures also surged sharply during the cold wave, highlighting how forecasts stretched colder-than-normal through the end of January.

2. Supply Disruption Risk Rises When Pipelines and Equipment Freeze

In winter spikes, the market is not only worried about demand. It is concerned about supply interruptions.

For example, freezing temperatures can trigger freeze-offs and other equipment issues that curb production and constrain deliverability, even if storage is still ample.

This is why the front month can surge even when storage is still "fine." The market is buying protection against a short, ugly window where flows get messy.

3. The Physical Market Moved First, and Futures Followed

One clear signal was how fast spot (cash) prices repriced. For example, Henry Hub daily spot was near $8.15 on January 22, and tight regions often see even bigger moves when cold strains the system.

When spot markets explode, futures traders stop arguing about "fair value." They focus on whether they are exposed the wrong way.

4. Positioning Flipped, and Short Covering Turned It Into a Squeeze

A significant portion of the speed originated from positioning. When traders take short positions and the weather gets colder, they must cover quickly, which can trigger a rally.

It is a "winter-driven squeeze" as the weather shifts came soon after hedge funds turned more bearish, which left the market set up for a sharp rebound.

5. LNG Exports Keep the U.S. Market Tied to Global Demand

The U.S. gas market is more global than it used to be, and that matters most during tight weather windows. For context, the U.S. is the world's biggest LNG exporter, and global cold can lift competition for molecules.

EIA's weekly update reported 37 LNG vessels with a combined capacity of 139 Bcf departing U.S. ports between January 15 and January 21.

Natural Gas Technical Analysis: Key Levels Traders Are Watching

From a technical standpoint, NGG26 is in a sharp short-term uptrend, but it is also trading like a stretched rubber band. The move has been fast, and fast moves can retrace just as quickly when forecasts shift.

Natural Gas Technical Levels: Support and Resistance

| Zone |

Level |

Why it matters |

| Near-term resistance |

6.29 |

Recent intraday high area. |

| Psychological resistance |

6.50 |

Round-number level where profit-taking often appears. |

| First support |

6.00 |

Round-number level that often acts as a "line in the sand." |

| Key support |

5.05–5.10 |

Area tied to the earlier multi-day surge zone in the first leg of the rally. |

| Deeper support |

4.88–4.90 |

Area where the contract traded before the late-week acceleration. |

Many traders monitor these levels because they correspond with recent extremes and round-number psychology.

What Bulls and Bears Are Looking For

Bulls Typically Want:

Price to hold above $6.00, which would signal the breakout is sticking.

Spot markets to remain high, indicating genuine demand rather than speculative buying.

Bears Typically Want:

A clear drop back below $6.00, followed by weaker bounces.

A warmer turn in forecasts that pulls the "fear premium" out of February.

Frequently Asked Questions

1. Why Did the Natural Gas Price Spike to Its Highest Level Since Late 2022?

Natural gas surged because Arctic cold lifted heating demand expectations, spot prices jumped sharply, and traders rushed to cover short positions as the weather outlook worsened.

2. Is This Rally Driven by Low Storage?

Storage is not low by recent standards. EIA reported 3,065 Bcf in storage for mid-January, which was above the five-year average. Thus, the rally was primarily due to short-term weather and supply risks.

3. Could Natural Gas Prices Fall Quickly From Here?

Yes. Natural gas can reverse fast if forecasts turn warmer or if supply holds steady. The same weather-driven premium that pushed prices up can evaporate when model runs change.

Conclusion

In conclusion, natural gas is not rallying because the U.S. suddenly "ran out" of fuel. It is rallying because extreme winter weather is forcing the market to price short-term stress, including higher demand, higher disruption risk, and a rush to re-balance positions.

The forecasts and storage reality will likely decide the next few sessions. If cold stays locked in and freeze-offs appear, prices can stay elevated. If forecasts soften, this market can drop just as quickly as it climbed.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.