Gold prices extended its historic plunge on Monday on a firmer dollar and

profit-taking drains momentum. Trump plans to nominate Kevin Warsh as the next

chair of the central bank.

Confirmation process will likely be made much more difficult as a result of

the pressure campaign Trump has waged against Powell and the bank to drastically

lower interest rates.

Trump said over the weekend Iran was "seriously talking" with Washington,

signalling de-escalation in the Middle East after risks of a military strike

drove prices to multi-month highs.

Gold investment allocations are being underpinned by a broad mix of

overlapping geopolitical and economic risks, but around half of the risk may

fade later this year, Citi said on Friday.

The WGC affirms that gold-backed ETFs saw another year of strong inflows into

in 2025 and demand for bars and coins jumped 16% to a 12-year high.

But it expects record-high prices to hit jewellery demand this year and will

slow down purchases by central banks, even though their buying remains elevated

when compared to the pre-2022 level.

Gold prices showed no signs of recovery, so they are likely to retest the

support around $4537. If the level does not hold, we see further declines

towards $4,300.

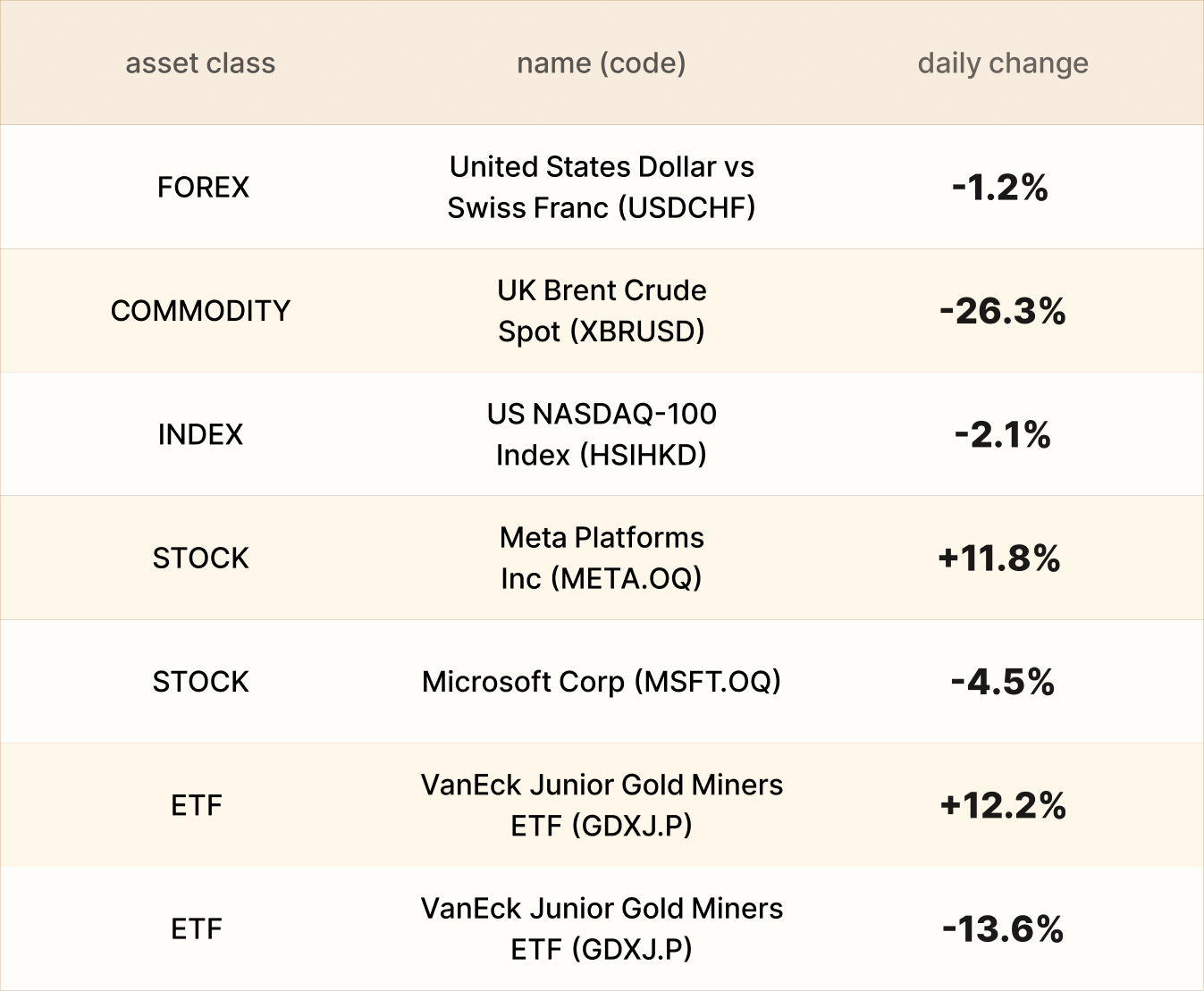

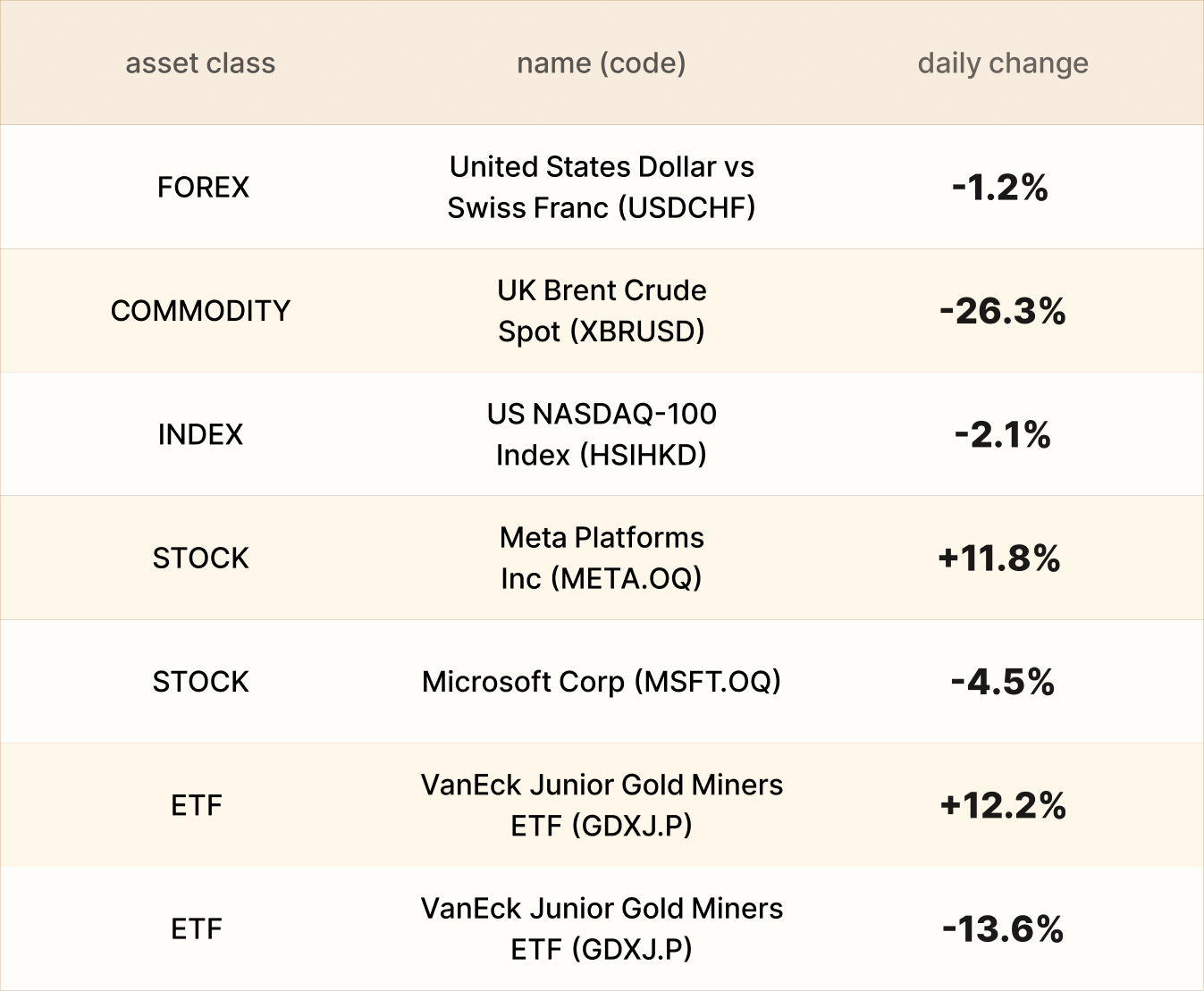

Asset recap

As of market close on 30 January, among EBC products, United States Natural

Gas Fund ETF after EIA inventory report that showed a larger-than-expected draw

in gas storage levels.

Verizon's strategy over the past few years has centred around using price

increases to drive revenue higher. With CEO Dan Schulman now a few months into

his tenure, that strategy is getting a big shake-up.

Intel has been behaving more like a rates stock recently. Potential

manufacturing work for Apple and Nvidia, if it materializes, would signal

growing customer interest in the company's foundry offering.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.