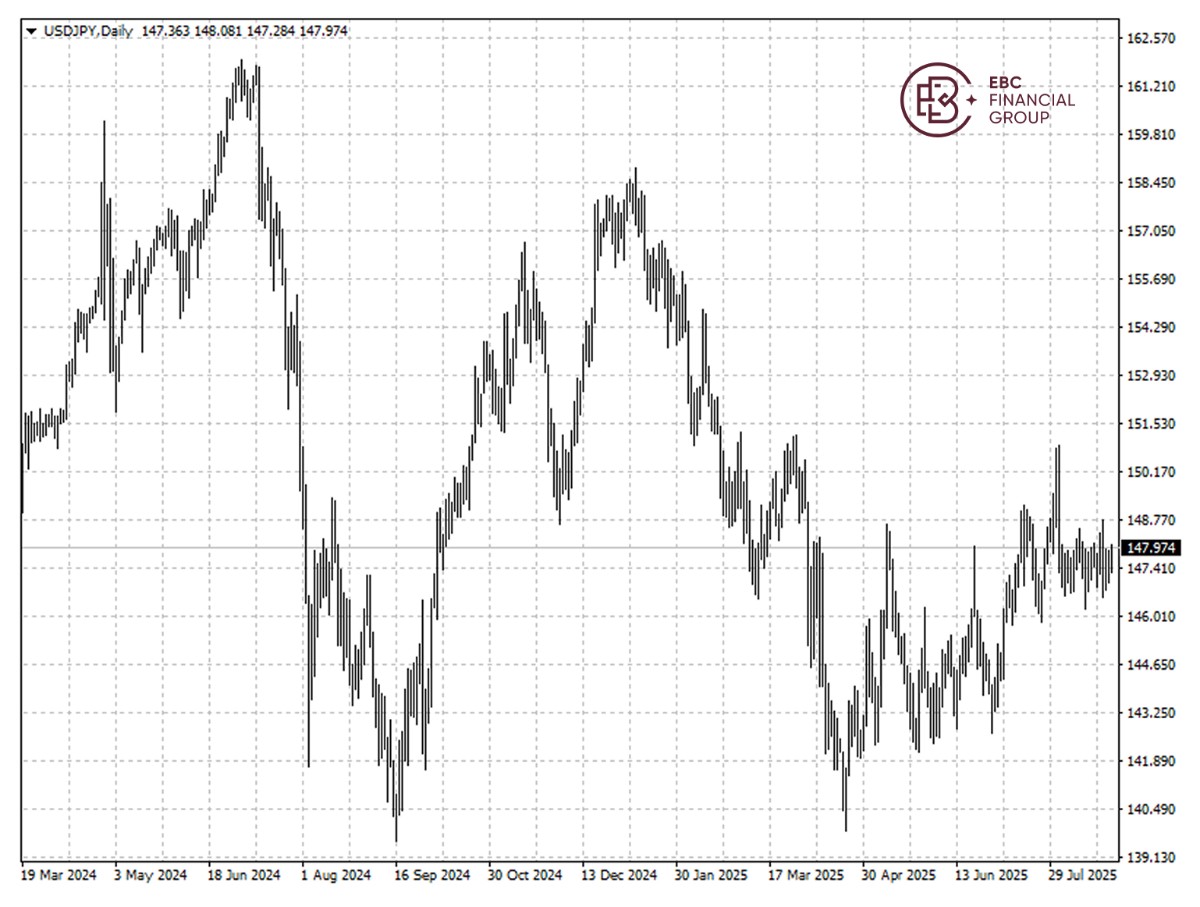

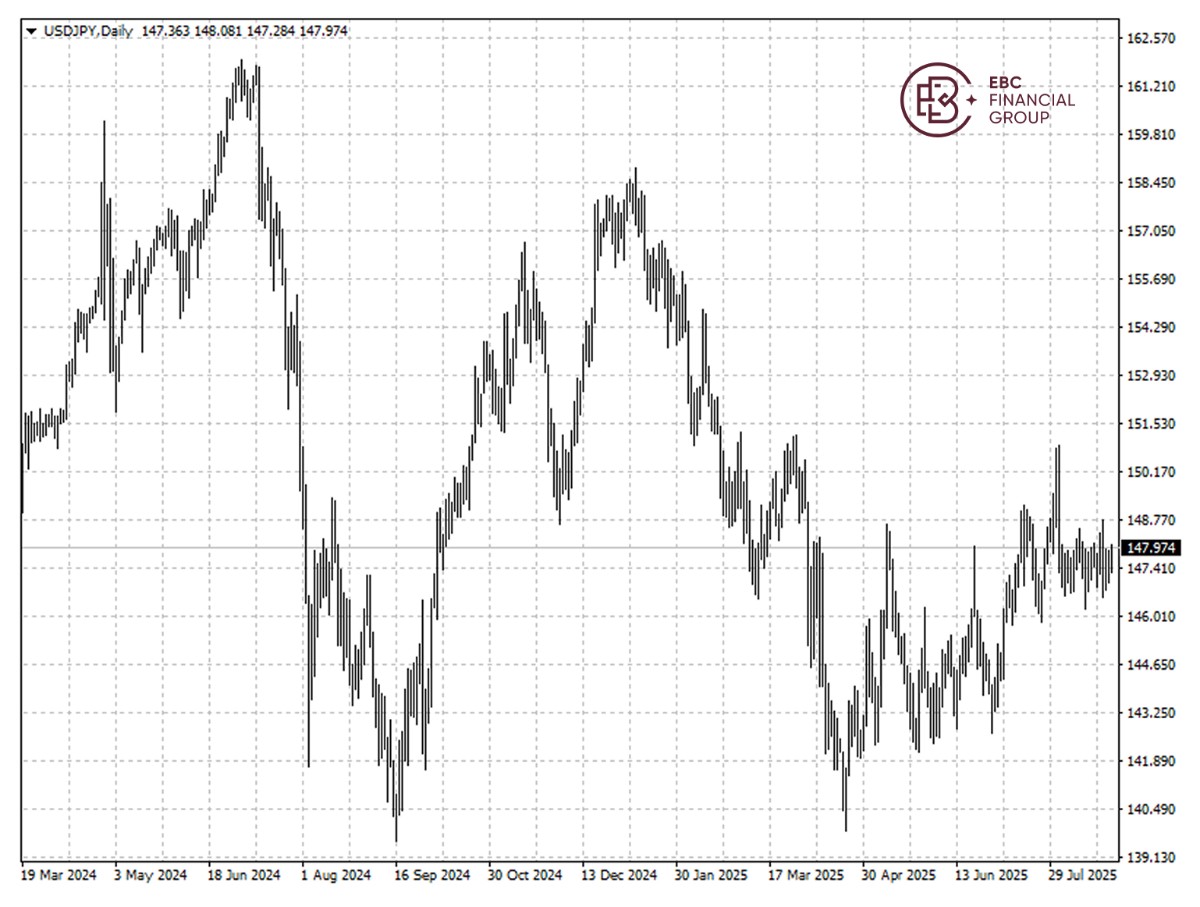

The yen has been moving sideways so far this month as inflation expectations

helps offset tariff jitters. The benchmark 10-year yield reached a 17-year high

earlier this week, partly due to outflow to stocks.

In a rare move, investors are getting so desperate to lighten their holdings

of Japanese government bonds that some are willing to sell the securities at a

discount to the central bank.

The former Shinzo Abe blasted then central bank governor Masaaki Shirakawa

for doing too little to beat deflation It seems the other way around now as real

wage has been stuck in a downward spiral.

Core inflation rate cooled to 3.1% in July, coming down from 3.3% the month

before as rice inflation continued to ease - the 40th straight month that it was

above the 2% target.

The BOJ upgraded its inflation forecasts in its economic outlook report

released in July, saying that core inflation would come in at 2.7% for its 2025

fiscal year which ends March 2026.

Governor Kazuo Ueda said in Jackson Hole that wage hikes are spreading beyond

large firms and likely to keep accelerating due to a tightening job market,

signalling willingness to resume rate hike.

Nearly two-thirds of economists polled by Reuters in August expect

policymakers to raise its key interest rate by at least 25 bps again later this

year, up from just over half a month ago.

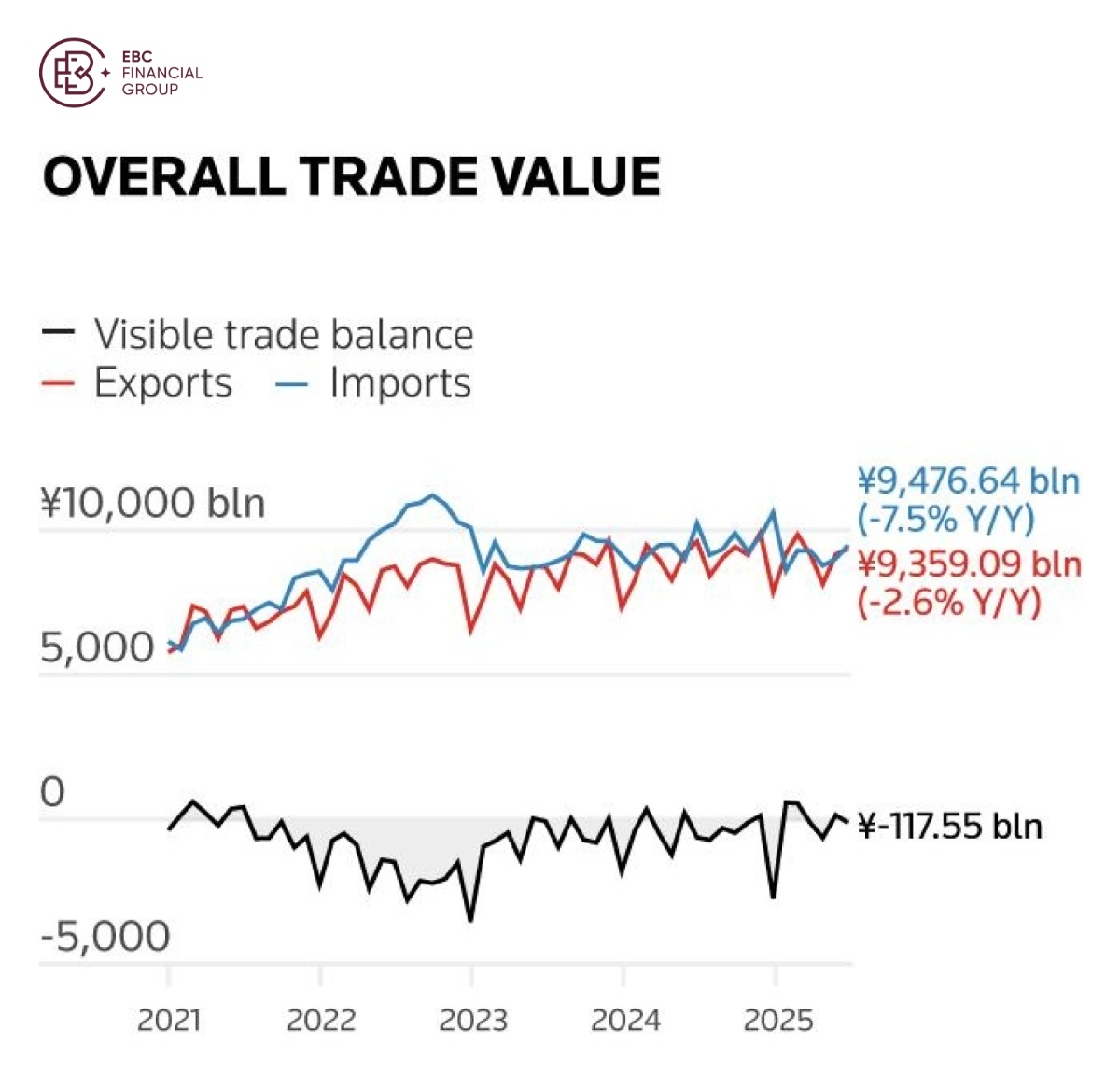

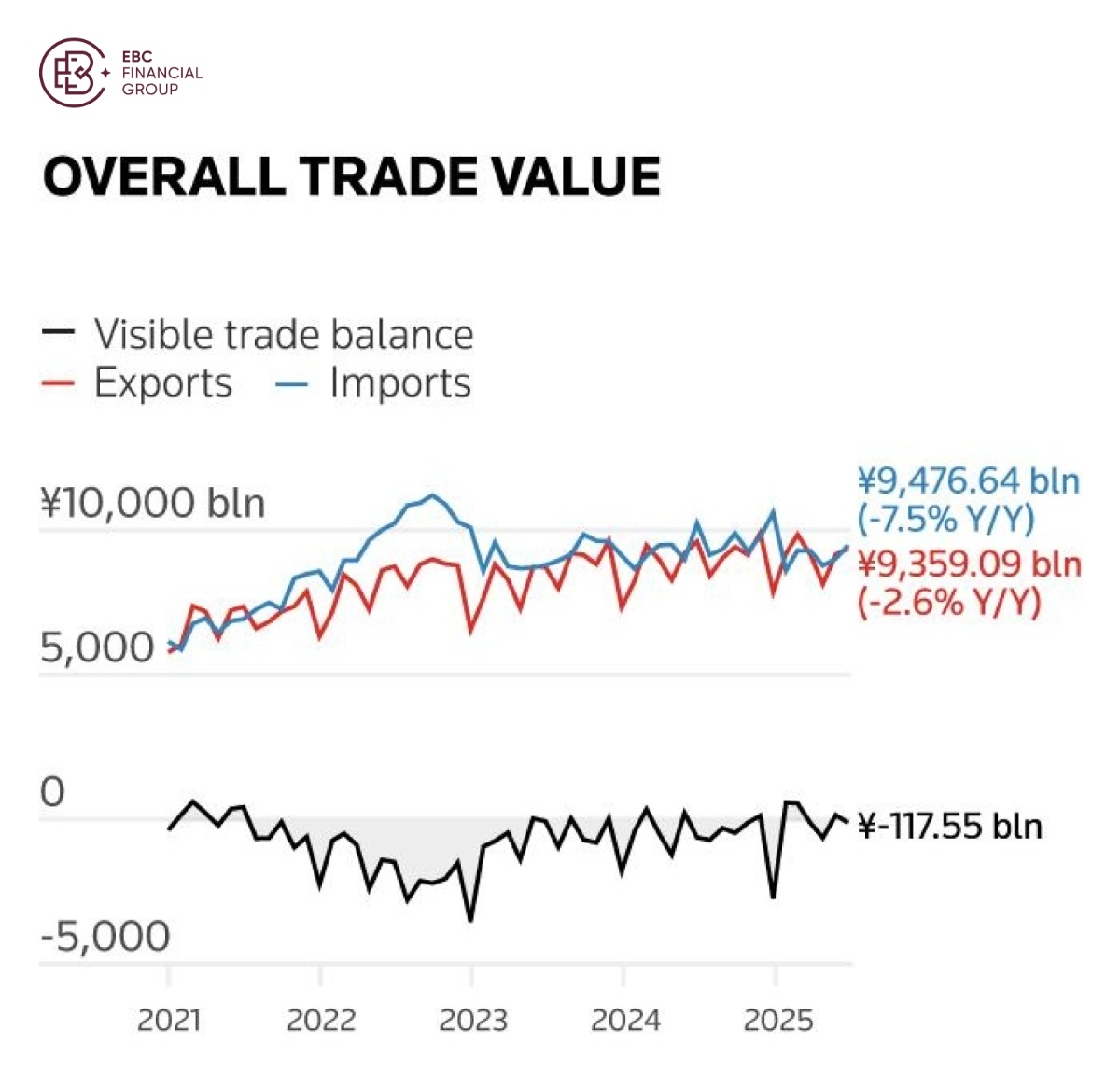

Puzzle of trade

Japan's exports posted the biggest monthly drop in about four years in July,

government data showed, as higher tariffs caused a slump in shipment to one of

its major trade partners - the US.

The reading marks a third straight month of decline. However, car exports

fell just 3.2% in volume terms, suggesting price cuts and efforts to absorb

additional tariffs have come off.

Meanwhile, total imports dropped 7.5% from a year earlier, resulting in a

deficit of 117.5 billion yen, compared with forecasts for 196.2 billion. That

pains a mixed picture of economic conditions.

GDP expanded 1.2% in Q2 on an annual basis, outpacing forecast due to

resilience in exports. Throughout the quarter, Japan bore the brunt of the 25%

duties on its key car industry.

Notably the country reached a trade deal with the US last month with the

"reciprocal" tariff rate set at 15%. Washington will implement the lower rate on

Japanese carmakers in mid-September, US sources say.

That means the BOJ can hardly measure its impacts before Q4. Senior economist

Masato Koike at Sompo Institute Plus said in a note earlier this month that a

recession could lie ahead.

Personal consumption is likely to continue on an upward trend as real wages

recover on the back of wage increases, he said, but the trend will likely be

short-lived if wage hike is constrained by higher tariffs.

Turn right

The ruling LDP is considering postponing the completion of its review of the

results of last month's parliamentary election to early September from this

month, people familiar with the matter said Thursday.

The extension may affect efforts by some in the party to oust Ishiba as the

LDP is expected to consider whether to hold an early presidential election after

the review concludes.

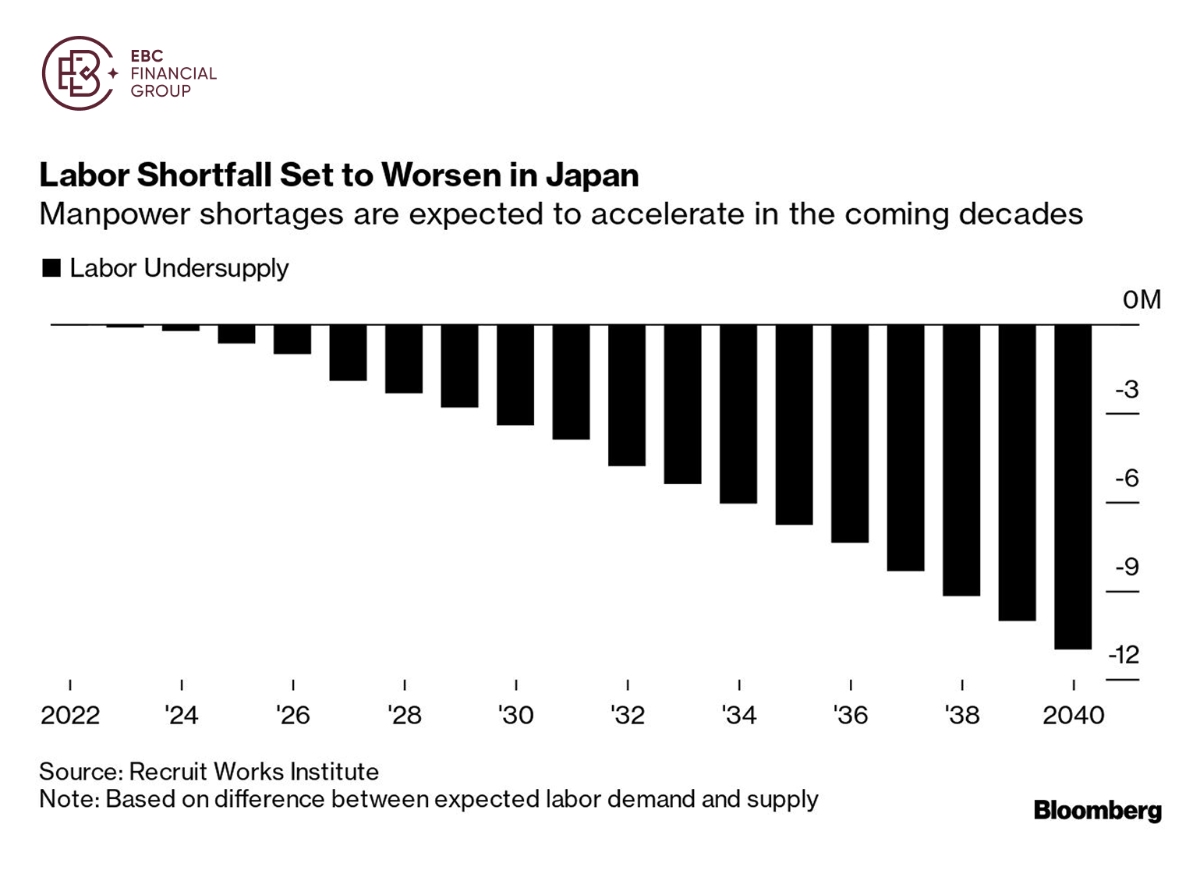

The biggest winners in the latest election were two far-right parties that

did not exist five years ag, having made broader inroads among younger voters,

who were drawn by their pledges to lift wages and curb foreign workers.

That has raised the question if the global wave of anti-establishment

political movements has finally reached the country. Unfortunately, a potential

pivot towards "Japan first" will only intensify price crisis.

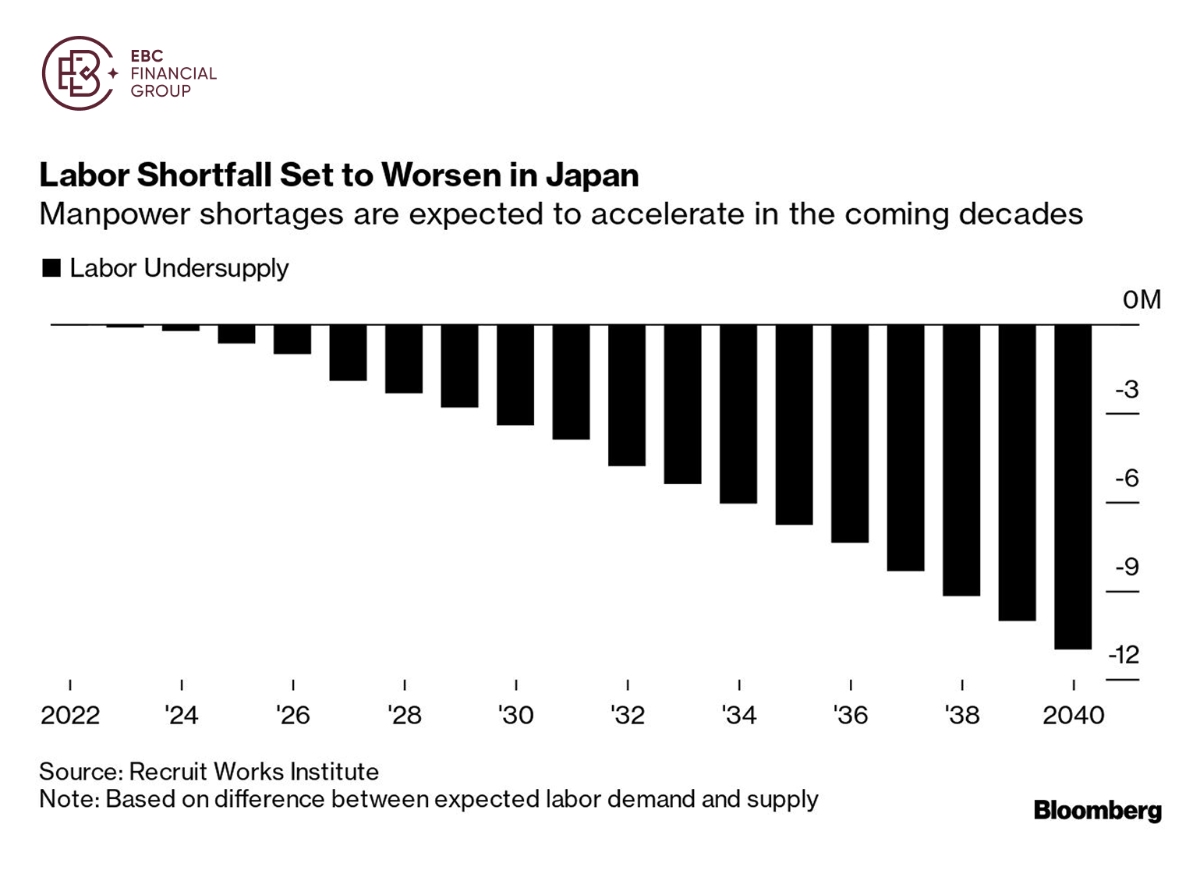

Two-thirds of Japanese companies are experiencing a serious business impact

from a shortage of workers, a Reuters survey showed in January, as the country's

population continues to shrink and age rapidly.

Labour shortages, particularly among non-manufacturers and small firms, are

reaching historic levels, the government has said, stoking concerns that this

supply-side constraint could stifle economic growth.

Yens risk are skewed towards the downside as the BOJ tends to hold off on

action in the near future. Further down the line, persistent political mayhem in

the post-Abe era will also deter speculative buyers.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.