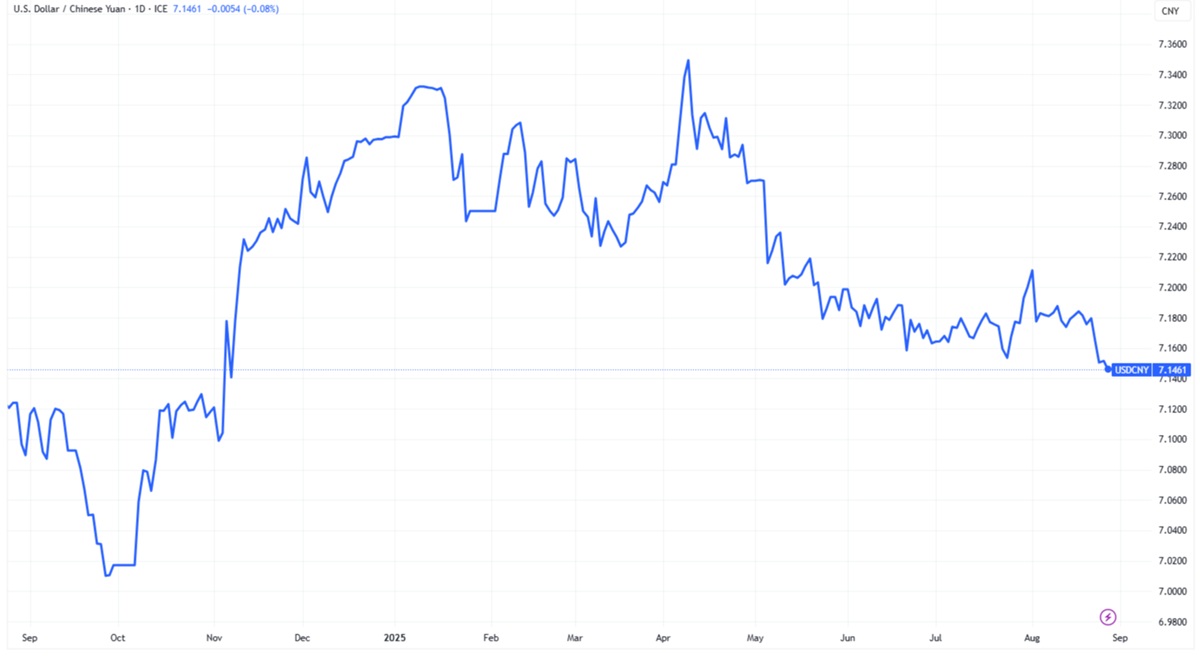

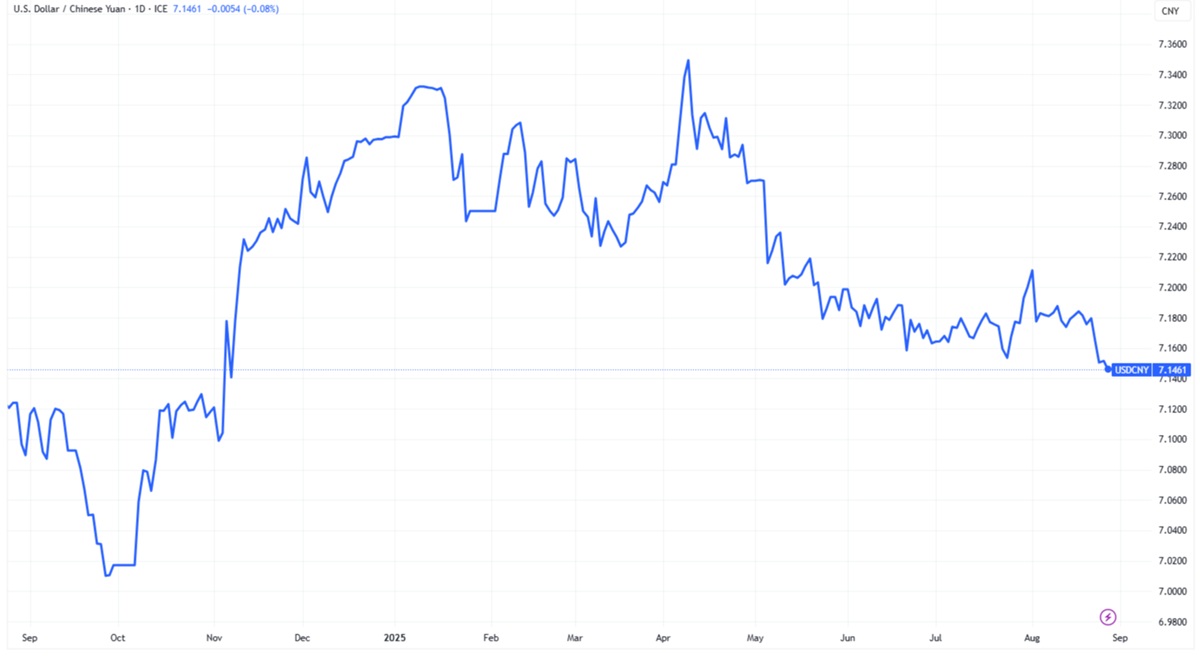

The USD/CNY exchange rate has been a focal point for global investors, policymakers, and economists alike. As of August 27. 2025. the onshore Chinese yuan (CNY) strengthened against the U.S. dollar (USD), reaching a nine-month high of 7.1453. This appreciation has sparked discussions about the underlying factors and the potential trajectory of the yuan.

Factors Influencing the USD/CNY Exchange Rate

Several key factors contribute to the fluctuations in the USD/CNY exchange rate:

Monetary Policy Divergence: The U.S. Federal Reserve's monetary policy decisions, particularly regarding interest rates, play a significant role. Expectations of rate cuts in the U.S. have led to a weakening of the USD, thereby supporting the CNY's appreciation .

Capital Flows and Foreign Investment: China's stock market has experienced a robust rally, with the Shanghai Composite Index reaching decade-high levels. This surge has attracted foreign investments, increasing demand for the yuan and contributing to its appreciation .

Policy Signals from the People's Bank of China (PBOC): The PBOC's actions, such as setting the daily reference rate, influence the yuan's value. A series of adjustments in the yuan's reference rate have signaled the PBOC's stance on currency valuation .

Economic Indicators: China's economic performance, including GDP growth, trade balances, and inflation rates, impacts investor confidence and currency valuation. Positive economic indicators can lead to a stronger yuan.

Recent Developments

In late August 2025. the USD/CNY exchange rate saw significant movements:

August 26: The onshore yuan traded at 7.1529 against the USD, marking a notable appreciation from previous levels .

August 27: The rate further strengthened to 7.1453. reaching a nine-month high .

These movements reflect a combination of factors, including market reactions to U.S. monetary policy expectations and China's economic performance.

Future Outlook

Forecasts for the USD/CNY exchange rate vary:

Potential for Further Appreciation: Some analysts suggest that if the U.S. Federal Reserve continues to signal dovish policies, the yuan could appreciate further, potentially breaching the 7.10 level .

Risks and Uncertainties: Conversely, uncertainties such as geopolitical tensions, trade policies, and global economic conditions could exert downward pressure on the yuan.

Conclusion

The USD/CNY exchange rate remains influenced by a complex interplay of domestic policies, international economic conditions, and market sentiments. While recent trends indicate a strengthening of the yuan, future movements will depend on various factors, including U.S. monetary policies and China's economic performance.

Frequently Asked Questions(FAQ)

Q1: What factors influence the USD/CNY exchange rate?

The USD/CNY exchange rate is influenced by U.S. monetary policies, China's economic performance, capital flows, and actions by the People's Bank of China.

Q2: How does the Federal Reserve's policy affect the USD/CNY rate?

Expectations of interest rate changes by the Federal Reserve can lead to fluctuations in the USD, impacting the USD/CNY exchange rate.

Q3: What is the outlook for the USD/CNY exchange rate?

While some forecasts suggest potential further appreciation of the yuan, uncertainties such as geopolitical tensions and global economic conditions could influence future movements.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.