Intel earnings today put Intel (INTC) in the spotlight as the stock has already repriced the "turnaround" narrative ahead of the print. INTC stock last traded around $54 after a sharp single-day jump of roughly 11.7%, suggesting the market is entering the report with elevated expectations and less patience for any stumble.

The report is set to be released after the market closes on January 22, 2026, followed by an earnings call at 2:00 p.m. PT. Thus, the first significant reaction will occur after-hours trading and continue into the next regular session.

Options pricing suggests traders are braced for a move of about 8% in either direction around the event, which is large for a mega-cap name and a reminder that the "details" will matter as much as the headline EPS number.

What Time Is Intel's Earnings Report Today?

Intel said it will release results promptly after the market close on Thursday, January 22, 2026, and it will hold its earnings call at 2:00 p.m. Pacific Time on the same day.

Why This Intel Earnings Report Feels Different?

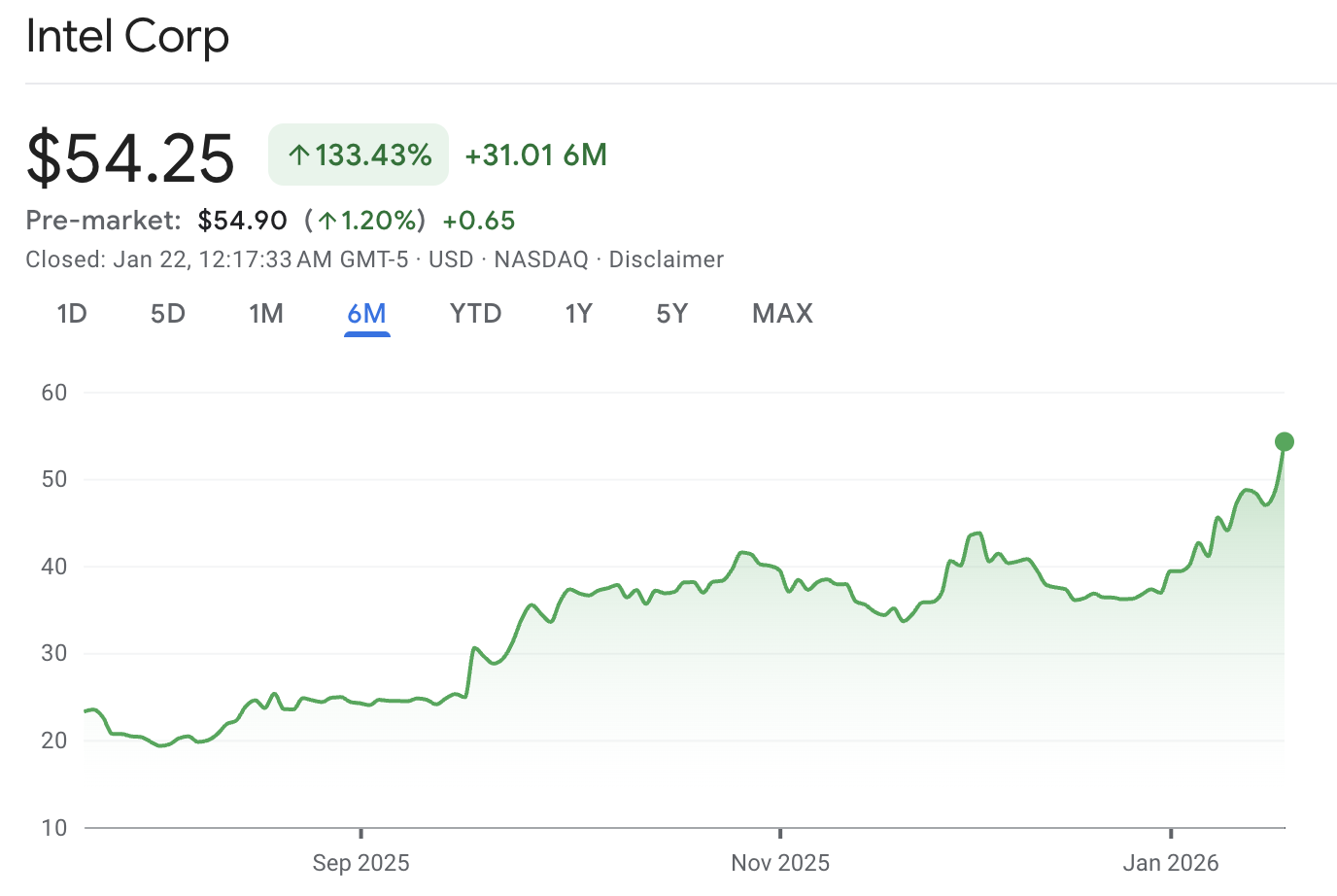

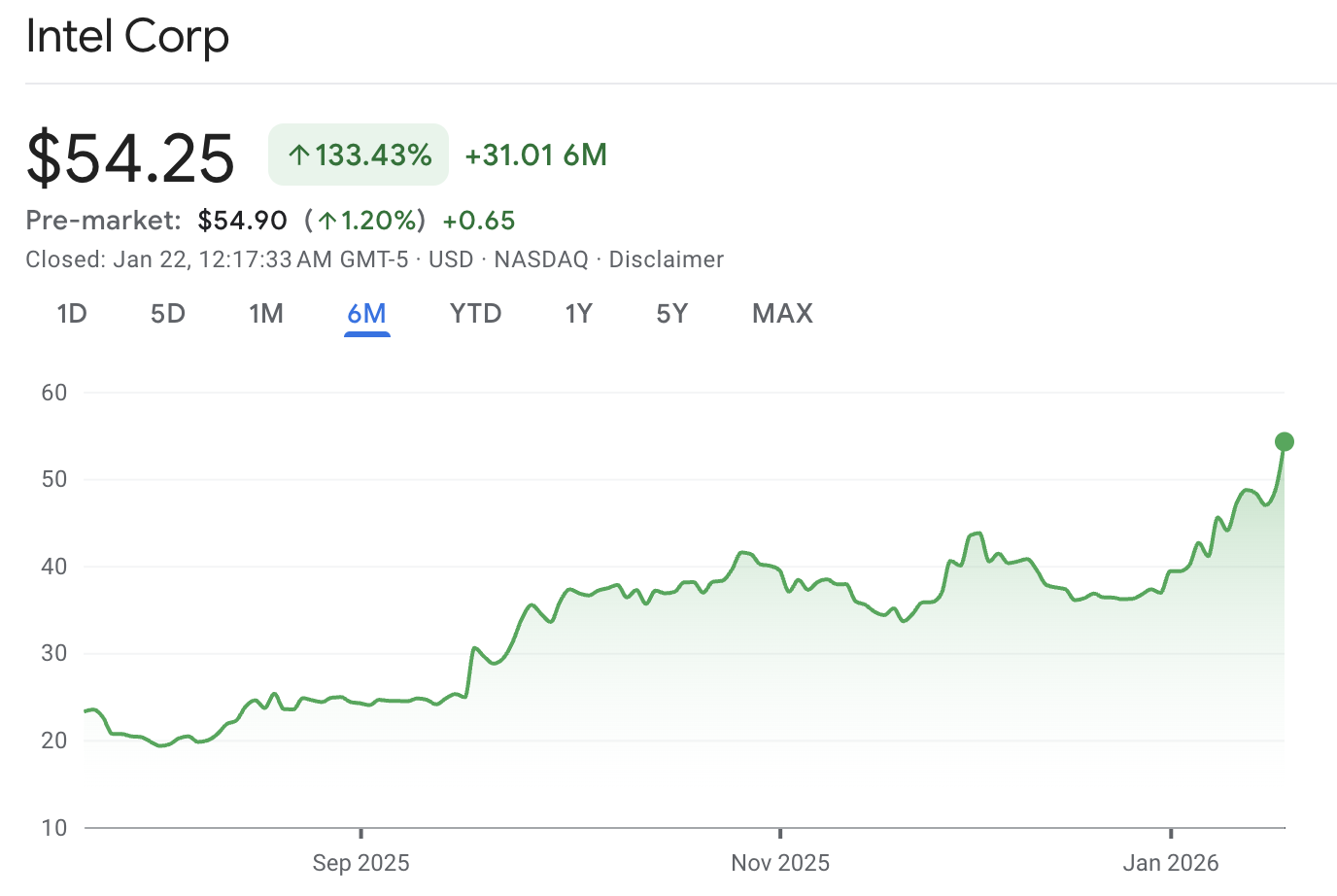

As mentioned above, INTC stock has moved sharply higher into earnings, which changes what "good" looks like. Intel closed at $54.25 on Wednesday after a one-day jump of about 11.7%, a four-year high.

That rally has been linked to rising optimism around Intel's server CPU cycle and its newer PC roadmap, including attention on Granite Rapids and Panther Lake.

When a stock runs up this fast, the market often stops asking, "Did you beat?" and starts asking, "Can you keep beating?" That is why guidance, margins, and credible execution signals matter most tonight.

What Intel Results Will Move INTC Stock Today?

The factors most likely to influence INTC stock are forward guidance, gross margin, and updates regarding Intel Foundry customers, as these elements shape the narrative for 2026 more significantly than a minor EPS beat.

1) Guidance That Supports the Rally, or Breaks It

Guidance is likely to be the first thing traders check because the stock has already moved strongly ahead of the report.

If Intel's outlook suggests steady demand and improving profitability, the rally can extend. If guidance is cautious or points to weaker margins, the market can treat the run-up as "priced in" and sell the news.

2) Gross Margin and Cost Control

Margins are significant because they indicate whether Intel is achieving operating leverage or if rising costs are undermining the benefits of increased demand.

Additionally, rising memory costs pose a risk to PC demand and profitability, making Intel's margin commentary particularly important.

3) Data Center Strength, Especially Around Server CPU Demand

A lot of the renewed optimism has centered on Intel's server CPU cycle, including demand tied to AI-heavy data center workloads.

Simply put, traders want to know two things

A compelling server story can compensate for weaker aspects in other areas.

4) PC Demand and the Panther Lake Roadmap

The PC market is still central to Intel's earnings power, and recent excitement has also focused on Panther Lake as part of Intel's broader product and process narrative.

If Intel signals stable PC demand and a clear path for next-generation products, it supports the "turnaround is working" view. If PC demand looks shaky, it can cap upside even if EPS meets expectations.

5) Foundry Progress and Any Sign of Meaningful External Customers

This is the potential headline that can outweigh everything else, as confirmation of major foundry customers would be a major catalyst.

Reports have mentioned market speculation about large customers, but they also note that no formal announcement has been made.

For traders, the key point is practical. If Intel can cite credible external demand or demonstrate strong engagement tied to its process roadmap, it can change how investors view the foundry losses and the timeline to profitability.

6) Cash Flow and Spending Discipline

Even if revenue improves, the stock can react poorly if cash burn is high or spending ramps faster than investors expect.

Intel's capital intensity is part of the story, and the market tends to reward clearer spending plans and credible targets.

Recent Performance of INTC Stock: 1 Week, 1 Month, 6 Months

After understanding what results can move the stock, it's time to see how far the stock has already traveled.

| Timeframe |

Reported performance |

What it tells you |

| 5D |

+11.46% |

The move has been fast, and sentiment has been aggressive. |

| 1M |

+49.16% |

The market has repriced Intel’s near-term outlook quickly. |

| 6M |

+133.43% |

The stock is in a major rebound, and expectations are no longer low. |

Performance data shows a strong run across multiple timeframes, including a steep six-month gain.

Intel Earnings Expectations: What Wall Street Is Looking For

| Item |

Market expectations cited in reports |

Intel’s prior guidance |

| Revenue |

About $13.4B |

$12.8B to $13.8B |

| Adjusted EPS |

About $0.08 |

$0.08 |

Consensus estimates approximately $13.4 billion in revenue and $0.08 in adjusted EPS for the quarter.

Intel also gave its own Q4 ranges in its prior quarterly update, including revenue guidance of $12.8 billion to $13.8 billion and non-GAAP EPS guidance of $0.08.

If Intel lands near these numbers, the market's reaction often depends on the quality of guidance and the tone around demand and execution.

How Big a Move Are Traders Already Pricing In?

Options pricing suggested a potential movement of approximately 8% in either direction leading up to the earnings event.

To put that into a simple range using Wednesday's close near $54.25, an 8% move is roughly $4.34.

| Measure |

Approximate value |

| 8% of $54.25 |

$4.34 |

| Rough downside band |

$49.91 |

| Rough upside band |

$58.59 |

This is not a forecast. This translates implied volatility into price space, revealing market expectations.

Intel Stock Technical Analysis

| Indicator / Level |

Latest Value |

Signal / Comment |

| 50-day Moving Average |

$48.30 |

Price is well above the 50-day, which supports the uptrend, but also shows the rally is extended. |

| 200-day Moving Average |

$40.94 |

Long-term trend remains constructive while price stays above this level. |

| RSI (14, Daily) |

75.927 |

Overbought, which increases the risk of a post-earnings pullback even if results are "fine." |

| MACD (12,26) |

1.66 |

Positive momentum, consistent with a strong trend into the event. |

| ATR (14) |

1.2835 |

Volatility is elevated, which aligns with an earnings week that can gap in either direction. |

| Key Support (near-term) |

$53.30–$52.50 |

Pivot support zone that can decide whether bulls defend the breakout or step aside. |

| Key Resistance / Target |

$54.90–$55.70 |

Immediate supply area from pivot resistance, and a logical first take-profit zone on a positive surprise. |

From a technical analysis perspective, INTC is in a strong uptrend on the daily chart, but momentum is stretched after a sharp run. Daily indicators show a 14-day RSI near 75.9, which is considered overbought.

Support and Resistance Zones to Watch

These levels combine recent price action with pivot areas shown in the same technical snapshot:

Immediate Support Levels

$53.30–$53.70: This is the first support zone because it sits near key pivot levels and often becomes the first "defend or fail" area after a gap move.

$52.50–$52.10: This is the next support band and a reasonable retest area if the initial reaction is negative but not catastrophic.

$50.00–$50.90: This zone is significant because it aligns with a previous consolidation area and is closer to shorter moving averages, which can attract buyers if the market enters a "wait and see" mode.

Resistance & Upside Targets

$54.90–$55.70: This is the first resistance zone where momentum buyers often take profit, particularly if the earnings reaction is positive but guidance is only modestly better.

$58.00–$59.00 (event-driven): If INTC delivers a clear upside surprise, the options-implied move suggests price can plausibly explore the high-$50s quickly.

Invalidation Level

A sustained daily close below $48.30 would weaken the bullish technical framework because it would put the price back under the 50-day moving average and signal that the post-earnings repricing is turning into a trend change.

Frequently Asked Questions

1. When Does Intel Earnings Release Today, and When Is the Call?

Intel is scheduled to release its fourth-quarter and full-year 2025 results after the market close on January 22, 2026, followed by an earnings call at 2:00 p.m. PT.

2. What Revenue and EPS Are Expected for Intel's Report?

Consensus expectations point to roughly $13.4 billion in revenue and about $0.08 in adjusted EPS for the quarter.

3. How Much Could INTC Stock Move After Earnings?

Traders anticipate an approximate 8% movement in either direction.

Conclusion

In conclusion, Intel earnings today are not only about whether the company hits $0.08 in adjusted EPS. This report examines whether Intel can justify its stock, which has already sprinted to a four-year high.

If Intel delivers steady guidance, protects margins, and reinforces confidence in its product and foundry roadmaps, the rally can continue.

If guidance is cautious, or if the call fails to support the long-term story, a pullback can happen quickly because momentum is already stretched.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.