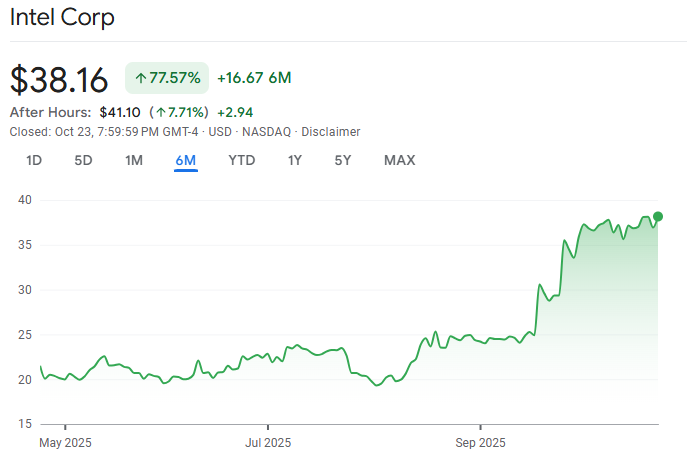

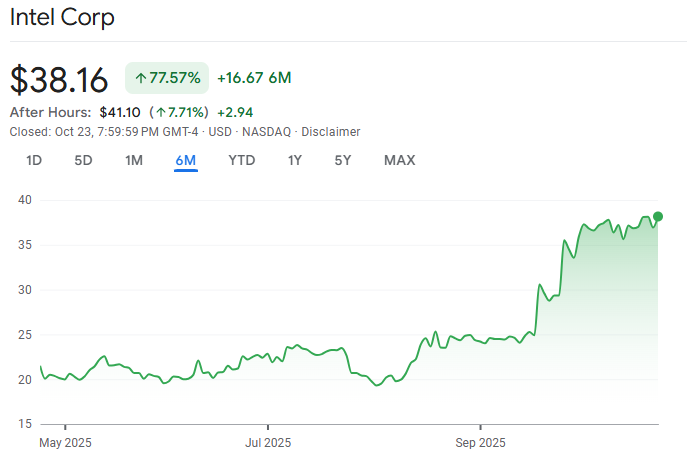

Intel Corporation (NASDAQ: INTC) has long been a cornerstone of the semiconductor industry. However, as of October 2025, Intel's share price hovers near $35–$42, rebounding sharply from its mid-year lows around $20 but still behind peers such as AMD and NVIDIA.

This partial recovery reflects improving fundamentals after years of missed opportunities and heavy capital spending. Following a surprise profit in Q3 2025, many investors are reassessing whether Intel is still "cheap" or beginning a genuine turnaround.

Intel's Financial Overview

| Metric |

Q3 2025 Figure |

Year-over-Year Change |

| Revenue |

$13.7 billion |

+3% vs Q3 2024 ($13.3 billion) |

| Net Income |

$4.1 billion |

Reversal from $16.6 billion loss in Q3 2024 |

| Earnings Per Share (EPS) |

$0.90 (GAAP) / $0.23 (Non-GAAP) |

GAAP EPS improved substantially; Non-GAAP EPS turned positive |

| Gross Margin |

38.2% (GAAP) / 40.0% (Non-GAAP) |

Up from 15.0% in Q3 2024 (+23.2pp GAAP) |

| Operating Margin |

5.0% (GAAP) / 11.2% (Non-GAAP) |

Improved from -68.2% (GAAP) and -17.8% (Non-GAAP) |

Intel's latest earnings marked a turning point.

Intel reported a Q3 2025 revenue of $13.7 billion, a 3% increase from the previous year, and net income of $4.1 billion ($0.90 per share), a significant recovery from a loss of $16.6 billion in Q3 2024.

This return to profitability follows several painful quarters of restructuring and asset write-downs. Shares rose by almost 8% after earnings as investors responded favourably to Intel's improved cost management and progress in AI.

For historical comparison, Intel's FY 2024 results were bleak:

Now, 2025 guidance projects revenues of $55–56 billion (+6% YoY) and an EPS recovery to $0.95–$1.00 by year-end, suggesting Intel may finally be stabilising.

Why Is Intel Stock So Cheap? 4 Key Drivers

1) Competitive Pressures and Market Share Erosion

Intel was formerly the unquestioned leader in CPUs. However, over the past decade, AMD, NVIDIA, and TSMC have seized market share through faster innovation and advanced manufacturing.

AMD's 4 nm Ryzen and EPYC chips continue to outperform Intel's older architectures, while NVIDIA's dominance in AI accelerators has redefined the high-performance segment.

Intel's answer, the Gaudi 3 AI accelerator and Core Ultra 200V chips, finally began shipping in 2025 and have shown promising benchmarks, but they remain early-stage competitors to NVIDIA's H200 and Blackwell GPUs.

Still, Intel's regained traction in the data-centre segment (up ~12% YoY in Q3 2025) signals that its turnaround is gaining modest credibility.

2) Financial Performance and Investor Sentiment

Intel's financial recovery is underway, but it remains fragile.

Intel's financial recovery is underway but still fragile, as free cash flow remains constrained by over $25 billion in annual foundry investments despite a profitable Q3 2025.

Investors remain cautious after years of uneven execution and restructuring setbacks, which many analysts labelled "execution fatigue." Many funds treat Intel as a value trap until sustained profitability is proven.

However, recent institutional confidence, including NVIDIA's $5 billion equity stake (≈ 4%) and a 9.9% U.S. government holding under the CHIPS Act, has boosted credibility. [1]

These capital injections alleviate bankruptcy and enhance liquidity, but the market still undervalues Intel due to uncertainty regarding execution quality and long-term competitiveness.

3) Organisational Restructuring and Cost-Cutting Measures

Intel's aggressive restructuring continues under CEO Pat Gelsinger (and executive chair Lip-Bu Tan). Companies cut roughly 22,000 positions and sold non-core assets, trimming annual operating expenses by over $3 billion.

CapEx has been reprioritised: Intel is slowing fab construction timelines in Ohio and Arizona while focusing resources on its core foundry operations and advanced packaging leadership (e.g., Intel 18A and 20A nodes).

These measures have improved short-term margins, but the turnaround depends on maintaining foundry contracts and avoiding new execution delays.

4) Geopolitical Factors and Trade Tensions

Intel remains deeply exposed to U.S.–China trade frictions. Restrictions on AI and server chip exports continue to cap Chinese revenue contributions.

At the same time, the U.S. CHIPS Act's funding rollout has accelerated in 2025, with Intel already receiving $8.5 billion in subsidies for its U.S. fabs, a welcome offset to geopolitical risk.

Still, geopolitical exposure, supply-chain reshoring costs, and security-driven export limits keep Intel's risk premium higher than that of peers such as TSMC or Samsung.

What Keeps Intel in the "Cheap" Stock Narrative?

1. Strategic Capital Injections & Government Support

The U.S. government's 9.9% passive stake acquisition under the CHIPS Act has sent a strong confidence signal to markets. [2]

In parallel, NVIDIA's $5 billion investment and SoftBank's $2 billion backing further strengthen Intel's liquidity and partnership network.

Together, these moves provide financial breathing room and strategic credibility.

2. The Q3 Profit Reversal Was Convincing

Intel's $4.1 billion Q3 profit in 2025, following a multi-billion-dollar loss in 2024, represents more than symbolic recovery; it proves that operational changes are taking hold under CEO Pat Gelsinger. [3]

3. AI & Data Centre Momentum

Intel's Data Centre & AI (DCAI) division is gaining traction, driven by Gaudi 3 accelerators and Core Ultra 200V chips.

Analysts (e.g., Zacks) expect stronger revenue contributions from this segment in 2026, validating Intel's AI-focused turnaround plan.

4. Reduced CapEx & Efficiency Focus

Intel has decreased capital expenditures and focused on enhancing operational efficiency.

This restructuring phase, though painful, aligns the company's cost base with sustainable profitability.

Collectively, these shifts are reducing Intel's "cheap for good reason" discount and reframing it as a potential early-stage recovery play.

Why Intel Stock May No Longer Be "Cheap"

Valuation multiples are expanding as investors price in renewed growth expectations and early signs of execution discipline.

However, risk premiums persist:

Foundry execution delays

Licensing and geopolitical complexity

Ongoing competition from AMD, TSMC, and ARM

Intel is shifting from a deep value trap to a credible turnaround story, still discounted, but now backed by tangible progress.

Intel Stock Forecast 2025 and Beyond

2025 Projections

2026 and Beyond

WalletInvestor: Bearish, ~$18 by end-2026

CoinPriceForecast: Neutral, ~$36 by end-2026

Gov Capital: Optimistic, ~$120 by 2026 (end)

Analysts now see upside if Intel sustains profitable execution, but warn that one more manufacturing delay could erase gains.

Frequently Asked Questions

Q1: Why Does Intel Stock Trade at a Low Valuation Despite Recent Earnings?

It is due to historical distrust, heavy capital spending, execution risk, and structural challenges that still weigh on the valuation.

Q2: Is Intel Still Considered a "Cheap" Stock Compared to Peers?

Yes, in relative terms. Intel trades at lower multiples (e.g. P/B ~1.19×) and investors still view its upside as constrained by legacy burdens.

Q3: Is Intel Stock Undervalued or Fairly Priced in 2025?

Based on current multiples (P/E ~31×, P/B ~1.19×) and improved earnings guidance, Intel appears moderately undervalued if execution continues.

Q4: Can Intel Sustain Its Recovery and Move Out of "Cheap Stock" Territory?

Potentially, if it consistently delivers profits, captures AI/data centre contracts, and executes its foundry roadmap without delays.

Q5: How Should Investors Approach Intel Stock Now That the Cheap Narrative Is Shifting?

By being selective: scale in as milestones are hit, monitor guidance (Q4 2025), and compare with peers (NVIDIA, AMD, TSMC).

Conclusion

In conclusion, Intel's stock remains labelled "cheap," but the reasons are evolving. The company has moved from crisis to cautious recovery, from chronic underperformance to a viable turnaround story backed by government and institutional capital.

Execution remains the decisive variable. If Intel delivers consistently across AI, foundry, and manufacturing nodes, the market could reprice its valuation upward. Until then, the stock trades in a trust-but-verify zone. Discounted, but no longer dismissed.

For investors, Intel stock offers a rare mix of value and volatility, best suited for patient, fundamentals-driven buyers.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.reuters.com/world/asia-pacific/nvidia-bets-big-intel-with-5-billion-stake-chip-partnership-2025-09-18/

[2] https://www.barrons.com/articles/intel-stock-us-trump-stake-901d516f

[3] https://techcrunch.com/2025/10/23/with-an-intel-recovery-underway-all-eyes-turn-to-its-foundry-business/