In addition to making money by investing in a stock and waiting for its price to rise, you can also receive dividend payouts. The potential for profit from both price appreciation and dividends is why stock investments are appealing to so many people. However, predicting stock price movements can be challenging for beginners. In contrast, forecasting dividend income is generally easier, especially if you understand the dividend yield.

Understanfing Dividend Yeild

Known as dividend yield in English, it is a measure of the dividends paid by a stock relative to its current share price. It is usually expressed as a percentage and provides investors with an indication of the return on their investment. Specifically, it is the ratio of total annual dividends to the current share price. Generally, the higher its value, the higher the dividend return, and the lower its value, the lower the dividend return.

Dividends, also known as dividends or bonuses, are the amount of money that a joint stock company pays back to its shareholders for a portion of the profits it has made. This is one of the earnings that belongs to the shareholders' investment in the company, and the company pays back to the investors.

Generally, the company will disclose the ex-dividend trading date and the dividend payment date for the current year. Dividends will only be paid to investors who hold the stock on the day before the ex-dividend date, that is, who hold the stock until the date of the dividend payment. The company's surplus will naturally decrease because it is paying out profits to its shareholders.

Types of Dividends Payments

On the day the investor receives the dividend, the stock price will fall according to the stock market. Dividends are usually paid once a year in Taiwan, while in the United States, it is possible to receive dividends four times a year. Dividends are paid in two ways: cash incentives and stock incentives.

Let's say that today there are two companies, Company A and Company B, both of which pay a one-dollar dividend to their shareholders, and they hold exactly 1.000 shares of stock in each company. The board of directors of company A decides to pay out cash incentives, which would be $1.000 in cash incentives.

And company B chooses to pay it out as a stock incentive, and it would get a stock incentive of $1.000 divided by the par value of the stock. That is, assuming that company B's stock has a par value of $50. then it would get 1000/50. which is 20 shares. So the total number of shares held would become 1020.

Remember not to spend the dividend payout right away, but you can also automate the cash incentive you receive to help investors put it into the market to buy stock. Let's say you own a $10 share of C stock and receive a cash dividend of $25 when the dividend is paid. And by selecting Dividend Auto Reinvest at this time, another 2.5 shares of c-stock will automatically be bought. You don't have to place your own orders at all, and you don't have to pay a commission, so over time you'll have more and more c-stocks in your hand.

Through long-term accumulation to create compound interest, although the dividends received at this stage may not be enough to support daily expenses, over time, with the support of compound interest, they may become a stable passive income. Therefore, the general choice of dividend investment is for stable investors who want to clarify the return of dividend investment and need dividend yield as an indicator.

Evaluating Dividend Stocks

That is, take each dividend share from the past year and divide it by the current share price. For example, if the dividend per share for one year was $5 and the current stock price was $100. you would get a 5% yield. This means that if the dividend on the stock stays the same over the next year, buying it at this price will give you a 5% rate of return.

Note that it is based on the past year's dividend divided by the current price, and if the past year's dividend was paid in a particularly large amount in that year, it would appear that the ratio is very high. However, the fact that the ratio is high because of one special dividend is unlikely to maintain the same high level in the future, so don't buy a stock based on one year's dividend alone.

If you're looking for a dividend stock, look for a company that pays a steady annual dividend. For example, if the dividend has been one dollar for the past five years, and if the dividend has grown every year, that's even better. That's better than a formula that doesn't have one every year and then all of a sudden gives a $5 dividend one year.

On top of that, the company's earnings per share (EPS) must be higher than the dividend. Because EPS is the money the company makes, the company has to make that much money to be able to share that money. If it doesn't, then it is the company taking the money it made before and dividing it up, in which case the dividend won't last and the company's money will surely shoot up one day.

What is A Good Dividend Yield?

| Range (%) |

evaluations |

Characteristics |

| > 5 per cent |

High |

It is usually a high-risk, high-reward industry accompanied by high volatility. |

| 3% - 5% |

Medium |

Suitable for investors looking for higher returns but relatively low risk. |

|

Low |

Suitable for investors seeking relatively stable returns and capital appreciation. |

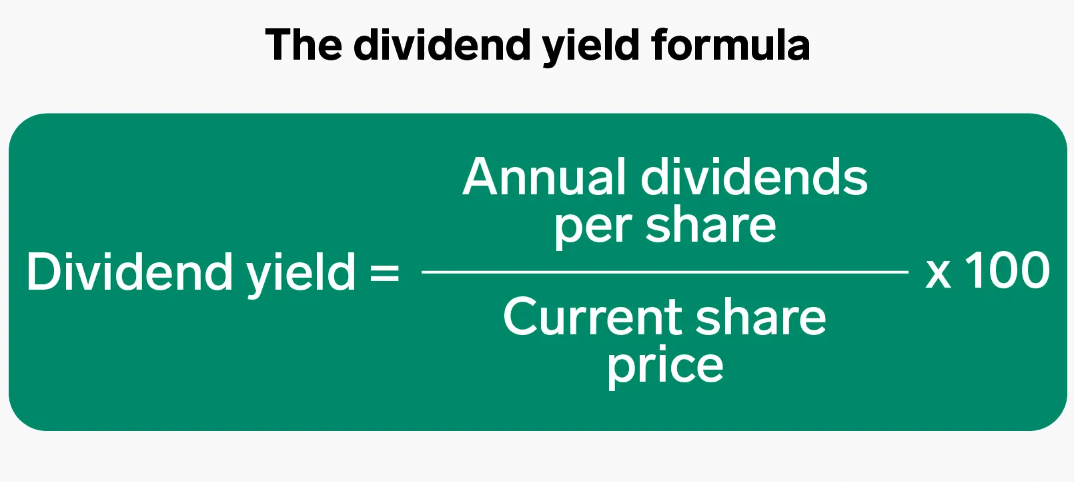

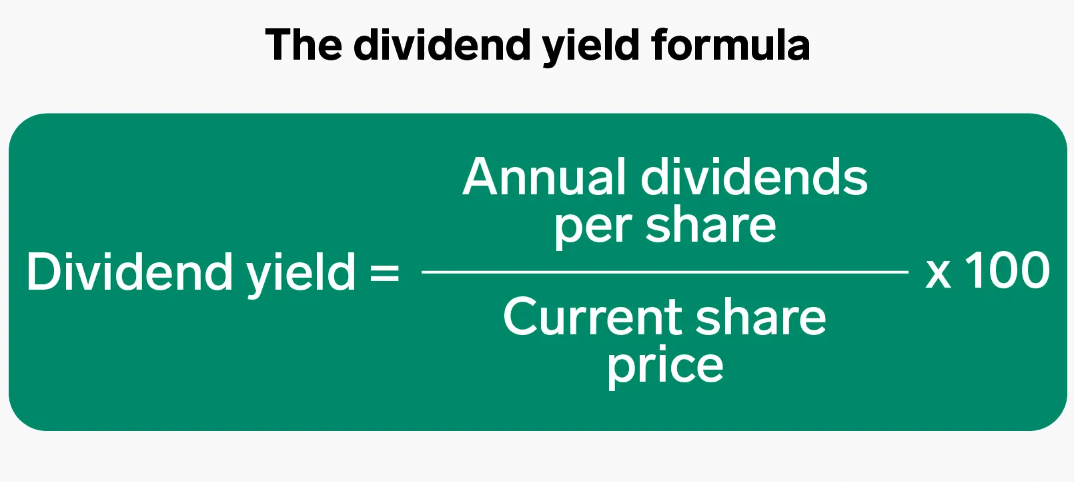

Dividend Yield Formula

Dividend yield = (total annual dividend ÷ current share price) x 100

Among them:

Total Annual Dividends (Annual Dividends) refers to the sum of all dividends paid by the company to shareholders in the past year.

Current Stock Price (current stock price) refers to the current price of the stock in the market.

Using this formula, a percentage is obtained, which represents the ratio of annual dividends to the current stock price. Assuming that Company A pays a yearly dividend of 50 cents and the current stock price is $10. then its dividend return is 5%, which means that it can get a 5% return on the current stock price every year.

Of course, this return is likely to vary depending on the dividend payout. Since the share price of all stocks moves daily, it is also going to follow the share price and fluctuate with it. If a company's rate of return remains stable or increases every year, it will become larger and larger as the company's share price falls more.

If Company A paid a dividend of 5 cents last year and the stock price was a dollar, the rate of return would be 5%. Suppose this year it still pays the same 5-cent dividend, but the stock price has fallen to 80 cents. Then the value now becomes 6.25 percent, and the rate of return becomes higher. On the other hand, if the same 5-cent dividend is paid this year but the stock price rises to $2.00. then the value becomes 2.5 percent and the rate of return becomes lower. This is where the dividend does not change, but the share price fluctuates, causing it to become a larger or smaller percentage.

But the same dividend is also subject to change. For example, if the same company A paid a dividend of 5 cents last year and the share price was a dollar, the return would be 5%. And if the company decides to pay only a 2 cent dividend because it made less money this year, the stock price is still the same at a dollar, but its return has dropped to 2%. Conversely, if company A makes a lot of money this year and decides to raise the stock market to eight cents, And if the stock price is still a dollar, then the return will rise to 8 percent. So the dividend yield is volatile; it is affected by the payout ratio and the stock price going up and down.

If the first consideration in investing in stocks is the dividend, then we should look for companies that have a consistent and stable dividend payout, preferably one that increases gradually each year. The best way to find companies with stable dividend payouts is to look for companies that have been on the market for at least 10 years, such as blue-chip stocks or bank stocks.

Is a High or Low Dividend Yield Better?

There is no one-size-fits-all answer to whether it is high or low for investors, as it depends on their investment objectives and personal risk appetite. The advantage of a high dividend yield is that it has a stable income, meaning that investors may be rewarded with a relatively high cash flow, which may be appealing to investors looking for a stable income.

However, care also needs to be taken, as excessive returns may also be the result of a fall in the price of the stock. Or it could be nothing more than something special, such as the sale of some assets and then the payment of a special dividend. And most of them are only given once, after which the dividend goes back to the previous level.

For example, Air Asia suddenly announced a super-high dividend of 90 cents in 2019. sending investors into a frenzy. Knowing that its share price was in the mid-to-high two-dollar range at the time, that's a pretty high return. But that was the only year, after which it also lost money for many quarters because of the New Crown epidemic, and the company hasn't paid any dividends since 2019. If one only sees his dividend return for that one year and assumes that it is that high every year and then invests a large sum of money, one will definitely end up regretting it.

With this in mind, a low dividend yield would not necessarily be a bad thing. This is because it could mean that the company is more inclined to use its earnings for internal investment, leading to growth, which could have a positive impact on the share price. There may be more capital available for expansion and innovation, contributing to future growth.

But it could also reflect market concerns about the company's future earnings potential, requiring investors to do more in-depth research.

Of course, to choose a stock with a high dividend, you can't just look at it but also consider a combination of other criteria. For example, there are stocks with high dividend returns, but the business model barriers are not so high or high debt, cash flow is not so stable, and the company's sudden operational difficulties may make their hands held in the positive shares suffer losses and finally earn interest lost principal. This situation is commonly known as the dividend trap.

Ranking of Stocks with the Highest Dividend Yield

| Company |

Dividend |

Sector |

| Annaly Capital Manag |

12.83% |

Real Estate Investment Trusts |

| Altria Group |

8.50% |

Tobacco |

| Walgreens Boots Alli |

7.59% |

Food and Drug Retailers |

| AT&T |

7.51% |

Fixed Line Telecommunications |

|

verizon Comms. |

7.46% |

Fixed Line Telecommunications |

| Keycorp |

7.24% |

Banks |

| Truist Financial Corporation |

6.81% |

Banks |

| WP Carey Inc |

6.57% |

Real Estate Investment Trusts |

| Kinder Morgan |

6.56% |

Oil Equipment Services and Distrib. |

| Simon Property Group |

6.52% |

Real Estate Investment Trusts |

| Crown Castle Intl Co |

6.23% |

Real Estate Investment Trusts |

| Citizens Financial G |

5.97% |

Banks |

| Boston Property |

5.87% |

Real Estate Investment Trusts |

| ONEOK Inc |

5.86% |

Gas Water and Multiutilities |

| Healthpeak Properties Inc |

5.83% |

Real Estate Investment Trusts |

| Devon Energy |

5.64% |

Oil and Gas Producers |

| MMM Company |

5.62% |

General Industrials |

| Pioneer Natural Res |

5.62% |

Oil and Gas Producers |

| Huntington Bancshare |

5.59% |

Banks |

| Dominion Resources |

5.50% |

Electricity |

| Realty Income |

5.47% |

Real Estate Investment Trusts |

| International Paper |

5.30% |

Forestry and Paper |

| Philip Morris Intern |

5.29% |

Tobacco |

| Prudential Financial |

5.28% |

Life Insurance |

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.