The Australian dollar saw a moderate increase on Wednesday after the

finalised deal between the US and UK marks a good start to a string a trade

talks. However, Iran-Israel conflict capped its gains.

Iron ore headed for the lowest close since September on a slowdown in demand.

The rainy season in southern China, as well as high temperatures in the north,

is slowing construction, Shanghai Metals Market said.

China's factory output growth hit a six-month low in May, while new home

prices extended a two-year long stagnation. The 3.3% decrease in PPI also

highlight challenges to the metal.

Citigroup has cut prompt-to-three month price forecast to $90 a ton from

$100, while the six-to-twelve month target was scaled back to $85 from $90. US

tariff pose additional risks to Australia.

Australians are distrustful of Trump, according to a new survey released by

the Lowy Institute think tank, complicating Canberra's task of managing ties

with the world's largest economy.

In May, the country's seasonally adjusted balance on goods and services saw a

surplus increase of A$1,337 million, as a notable rise in beef and wheat exports

offset the decline in commodity exports.

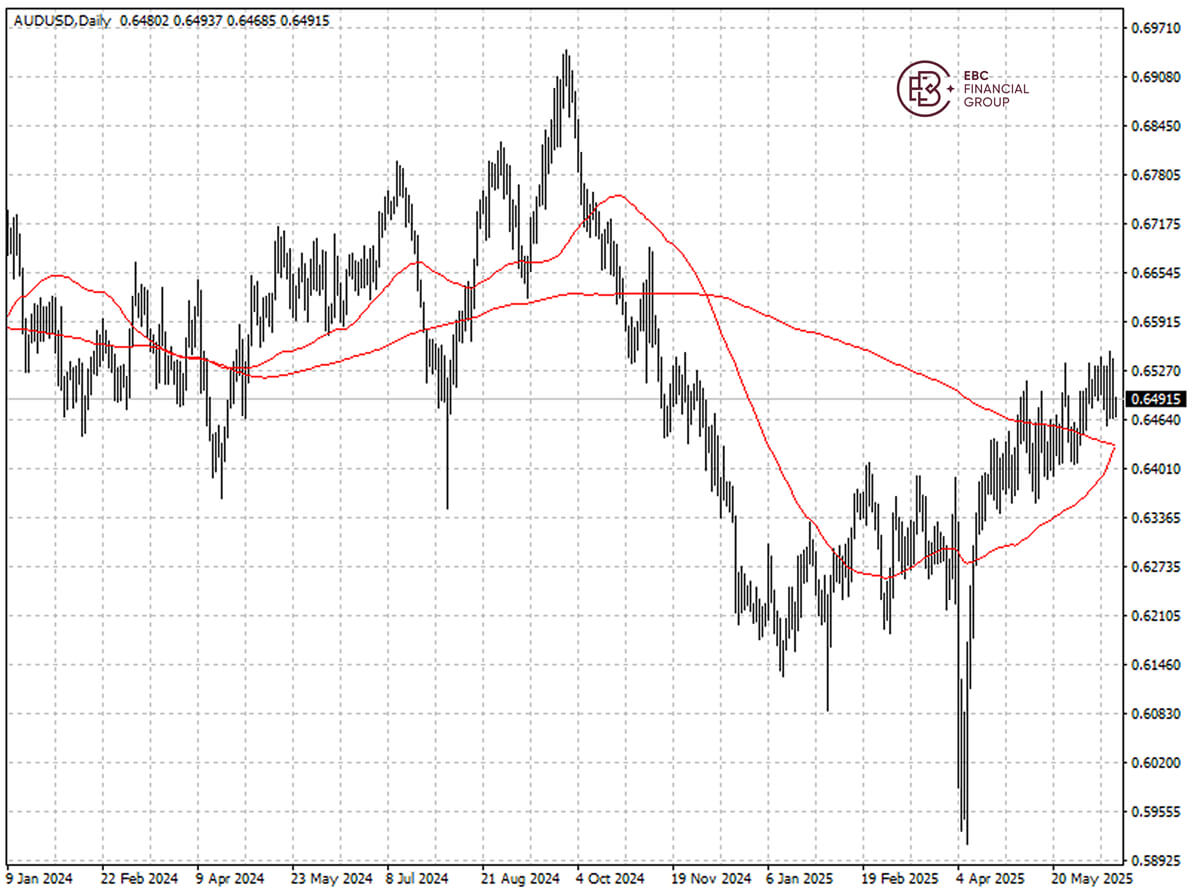

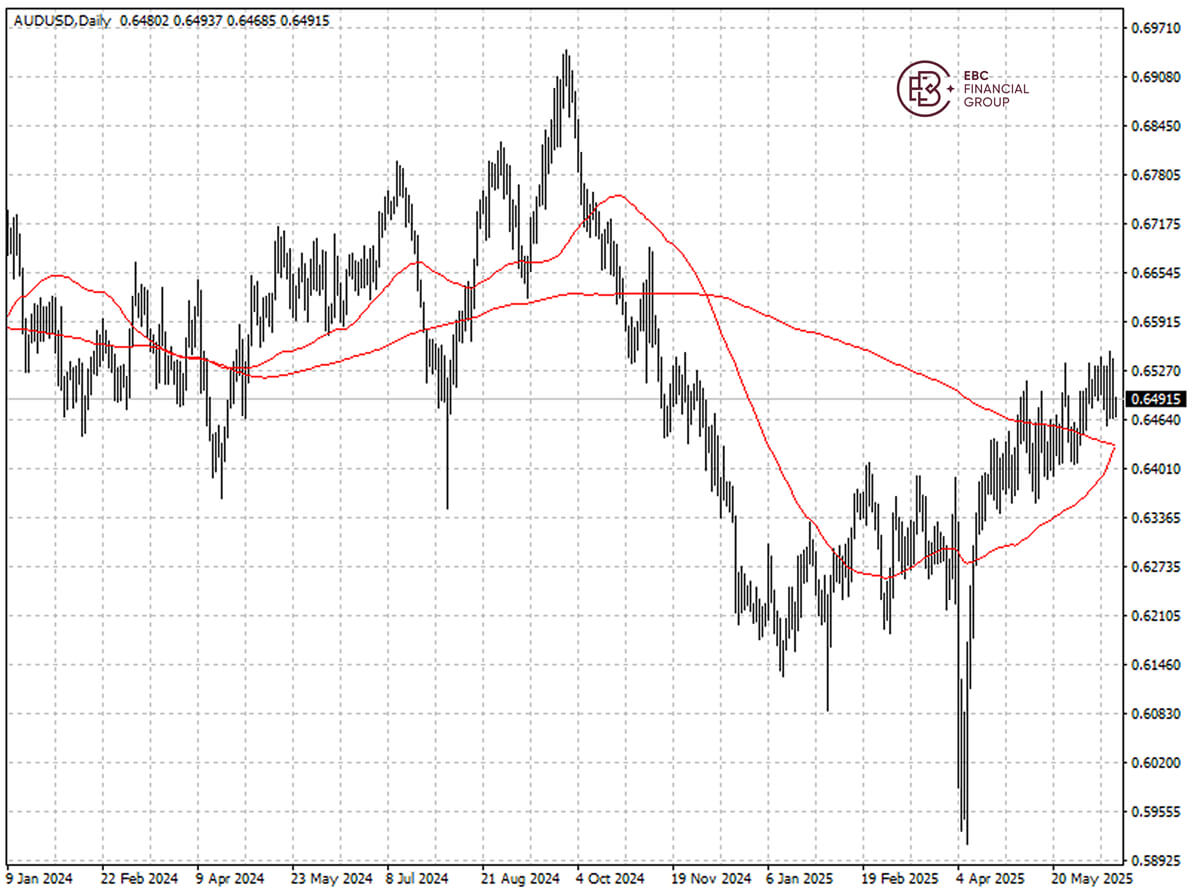

The Aussie dollar is about to show the golden cross. If that happens, we

expect another leg higher which could lead to 0.6600, last seen in November

2024.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.