In options trading, understanding theta options is essential for refining your strategy and increasing your chances of success. Theta is one of the "Greeks" used by traders to measure how sensitive an option's price is to time decay. Simply put, theta options tell you how much value an option loses each day as time passes, assuming all other factors—like the price of the underlying asset—remain constant.

For those who are unfamiliar with time decay, it's important to know that theta options are a key component of options pricing. As the expiration date of an option draws nearer, the time value of the option decreases, and this can either work for or against a trader depending on whether they are buying or selling options.

Understanding how theta options work and incorporating them into your trading strategy can help you manage risk and maximise profits.

What Are Theta Options?

Theta options refer to the time decay inherent in options contracts. Time decay is the gradual erosion of an option's value as it approaches its expiration date. Theta is a measure of this decay, quantifying the daily loss in value. For example, if an option has a theta of -0.05, it will lose 5 cents in value per day, assuming no other changes in market conditions.

For long options positions—whether buying calls or puts—theta options will result in a daily loss of value. This is a key reason why options traders who hold long positions are typically concerned about time decay, as their options lose value the longer they are held, especially if the price of the underlying asset does not move favourably.

Conversely, for option sellers, theta options work in their favour because they benefit from the time decay. As the option loses value over time, sellers can potentially buy back the options at a lower price, pocketing the difference.

The Role of Theta Options in Pricing

The theta options of a given contract play a crucial role in determining its price, but they don't act alone. Other Greeks—such as delta, gamma, and vega—also affect pricing. However, time decay becomes a particularly dominant factor as an option nears expiration.

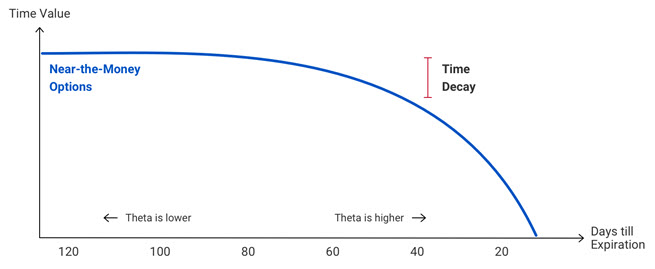

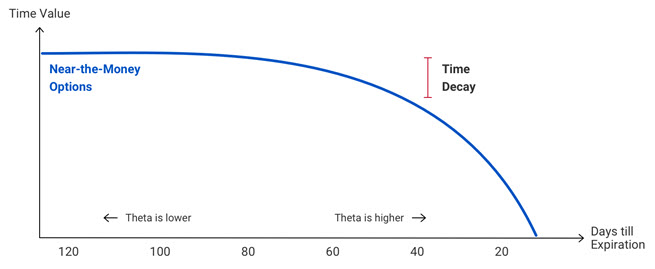

When you're trading options, you'll notice that theta options have a larger impact on at-the-money options, as these options have the greatest time value to lose. For example, an option with a high theta will lose value faster as expiration approaches, meaning time decay can substantially erode the option's premium.

In short, the closer an option gets to its expiration date, the more sensitive it becomes to theta options. This is particularly important for options traders to monitor, as failing to account for time decay can lead to unexpected losses.

How to Maximise Your Strategy with Theta Options

Incorporating theta options into your strategy allows you to either capitalise on time decay or manage it effectively. For traders who want to benefit from time decay, selling options is a common strategy. When you sell options, you take on the obligation to potentially deliver the underlying asset (in the case of calls) or buy it (in the case of puts), but in exchange, you collect the premium.

As time passes, the value of the options decays, and as long as the price of the underlying asset stays favourable, you can keep the premium without taking any further action.

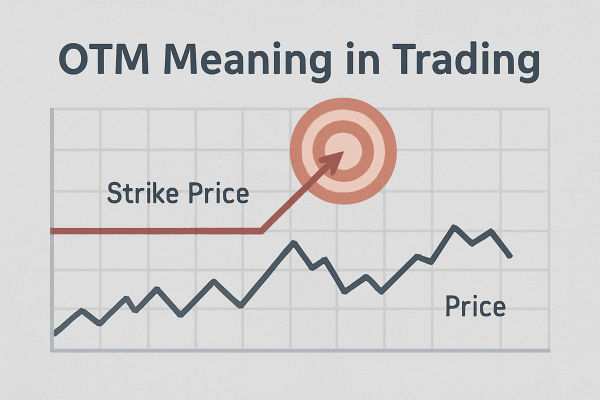

If you're an option buyer, the impact of theta options can work against you. Since the time value of your options is decaying, you need the underlying asset to move significantly in your favour to offset the losses from time decay. For example, if you're holding an out-of-the-money call option, the price of the asset must rise significantly to overcome the daily loss in value from theta options.

One of the strategies that can help you manage theta options effectively is by using spreads. A spread involves buying and selling options at different strike prices or expiration dates, and it allows you to balance time decay. For instance, in a bull put spread, you sell a short put and buy a longer-dated put. This lets you collect premium from the short option while limiting risk with the longer option, effectively managing the effects of theta options.

The Impact of Theta Options as Expiration Nears

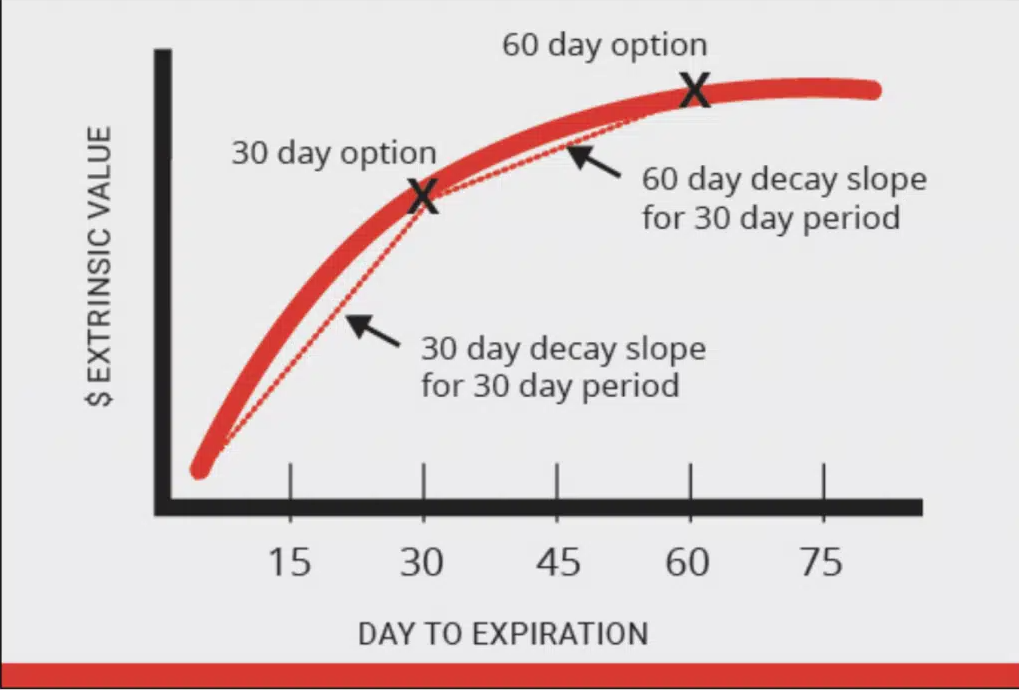

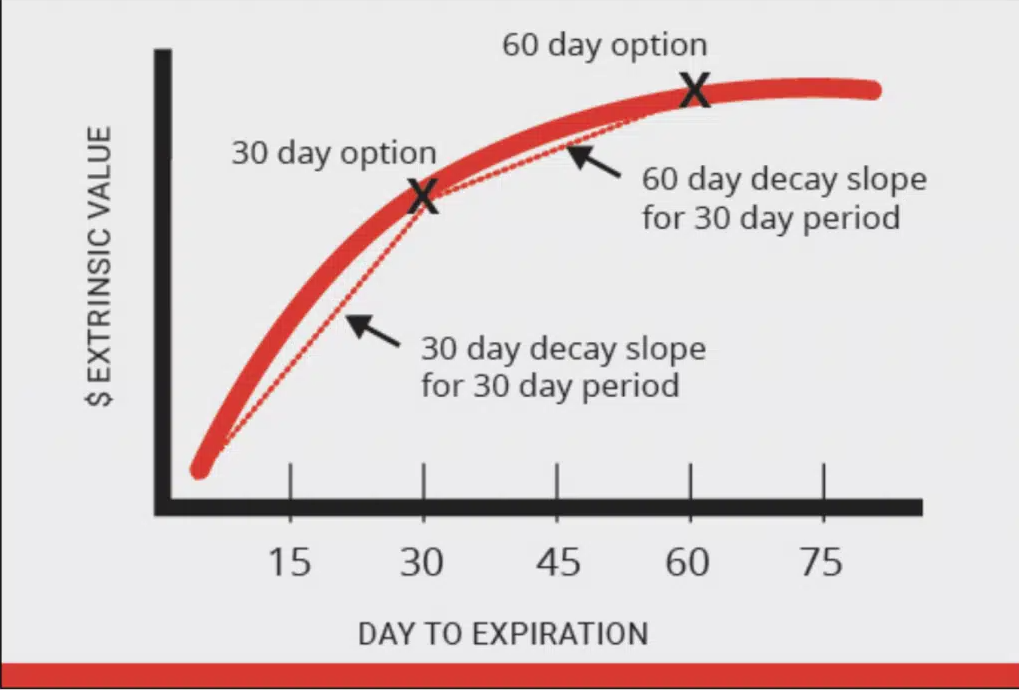

As expiration draws closer, the impact of theta options increases. Options lose value more rapidly in the final days before expiration, and this acceleration of time decay can be particularly challenging for option buyers. If you're holding long options, the closer you get to expiration, the less time you have for the underlying asset to move in your favour.

For example, an out-of-the-money option that has several weeks before expiration may still have time value, which is vulnerable to time decay. However, as the expiration date nears, the time decay intensifies, and the option's premium can erode at a faster rate. This is why many traders prefer to exit their positions before expiration to minimise the effects of theta options.

In contrast, for options sellers, the approaching expiration is an opportunity to profit from time decay. As theta options increase, the premium on the options you've sold declines, and you can either buy back the options at a lower price or let them expire worthless, keeping the entire premium.

Common Strategies to Profit from Theta Options

There are a few strategies that traders often use to take advantage of theta options. For those looking to profit from time decay, selling options is the most straightforward way to do so. By selling options, especially options with a shorter time until expiration, you can capture the value erosion caused by theta options.

A simple strategy is the covered call, where you sell call options on stock you already own. As the options approach expiration, time decay will work in your favour, and you can keep the premium from selling the call.

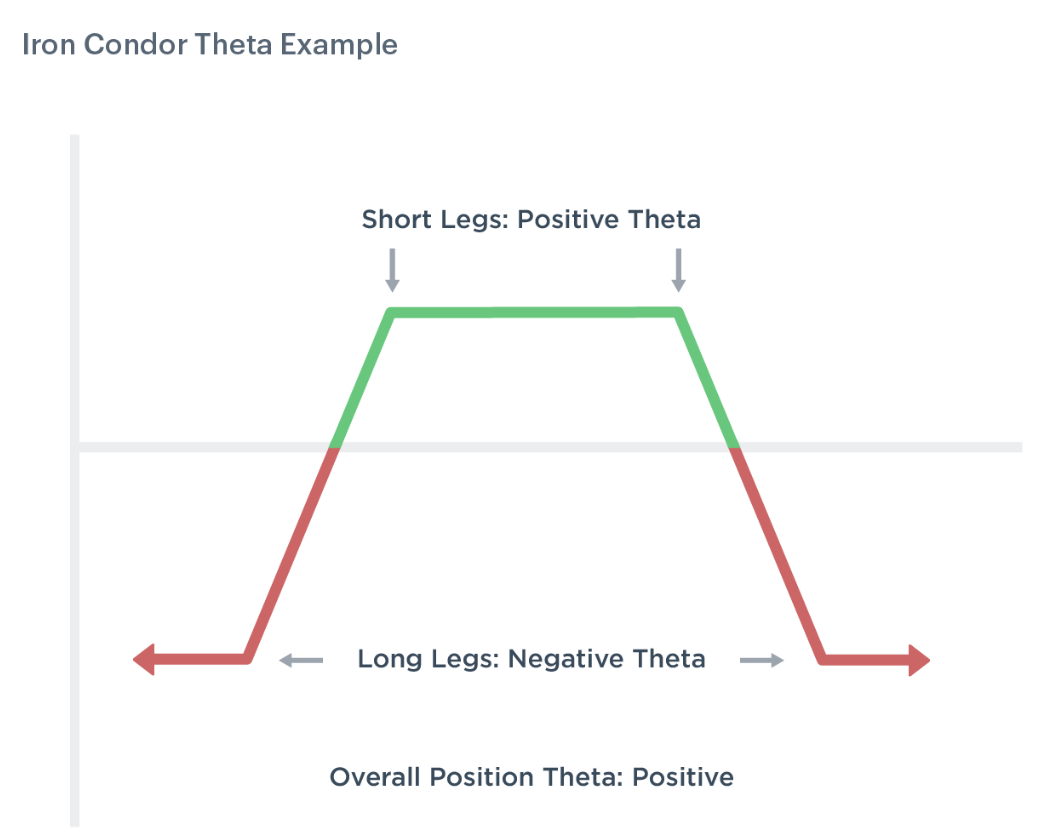

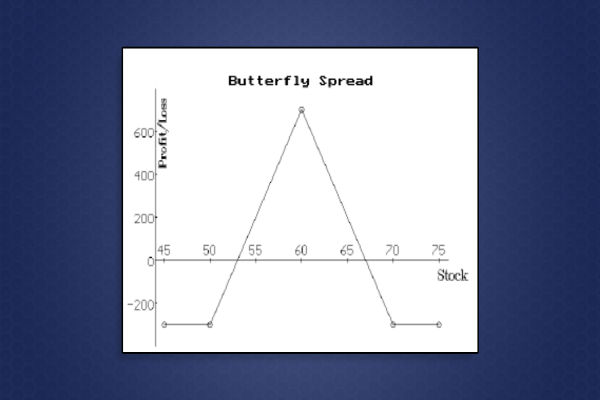

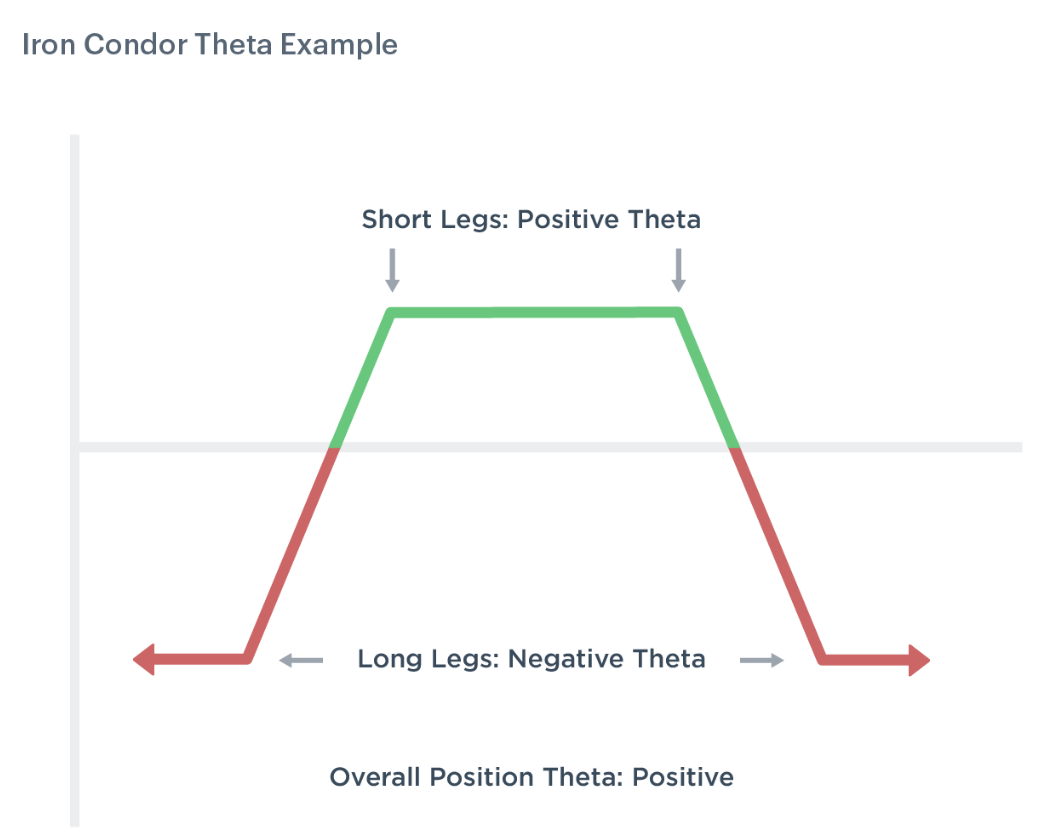

Another strategy that can help you benefit from theta options is trading iron condors or iron butterflies. These strategies involve selling both a call and a put while buying options further out of the money for protection. The goal is to take advantage of time decay as the options lose value over time. If the underlying asset stays within a specific range, the time decay from the short options will work in your favour.

Conclusion

In summary, understanding theta options is crucial for anyone who trades options. Time decay has a significant impact on the pricing and profitability of options, and by managing theta options effectively, traders can maximise their returns and minimise risks. Whether you're an option buyer or seller, incorporating theta options into your trading strategy is key to making informed, profitable decisions.

For those looking to capitalise on time decay, selling options and using spread strategies can be highly effective. For option buyers, it's essential to be aware of how theta options work and adjust your strategy accordingly to mitigate the effects of time decay. Ultimately, a deep understanding of theta options allows you to navigate the complexities of options trading more effectively.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.