Imagine watching the market like a hawk, waiting for it to make a big move up or down, only for it to do absolutely nothing. It just drifts sideways, yawning. For most traders, that's frustrating. But for an Iron Condor trader, that's the dream.

The Iron Condor strategy is akin to setting up two invisible fences around a stagnant market. As long as prices fluctuate quietly within your boundaries, you collect profit, like renting out a house where the tenant never leaves.

Sounds too calm to be true? Let's dive deep and see how this "quiet market" strategy really works, why professional traders love it, and what beginners should know before spreading their wings.

What Is an Iron Condor in Options Trading?

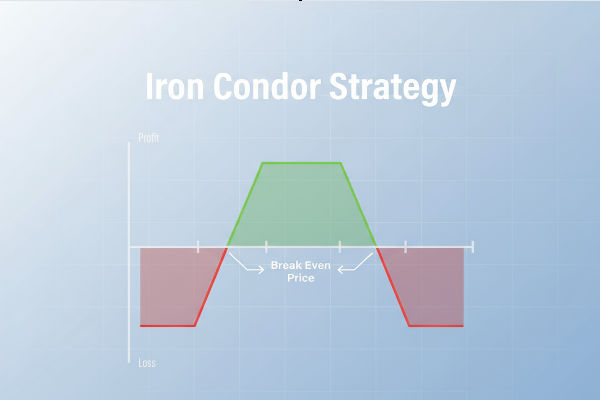

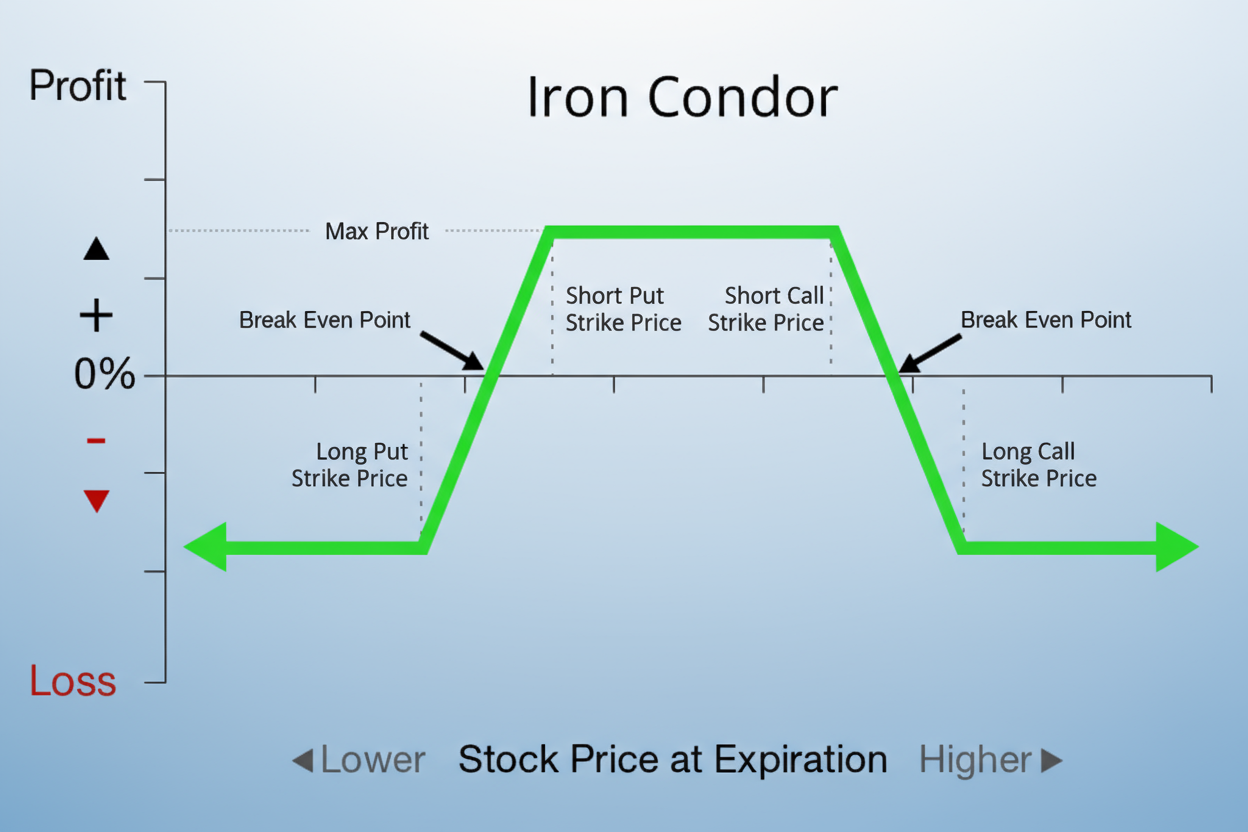

An Iron Condor is an options trading strategy designed to profit from low volatility when you expect the market to remain within a specific range for an extended period.

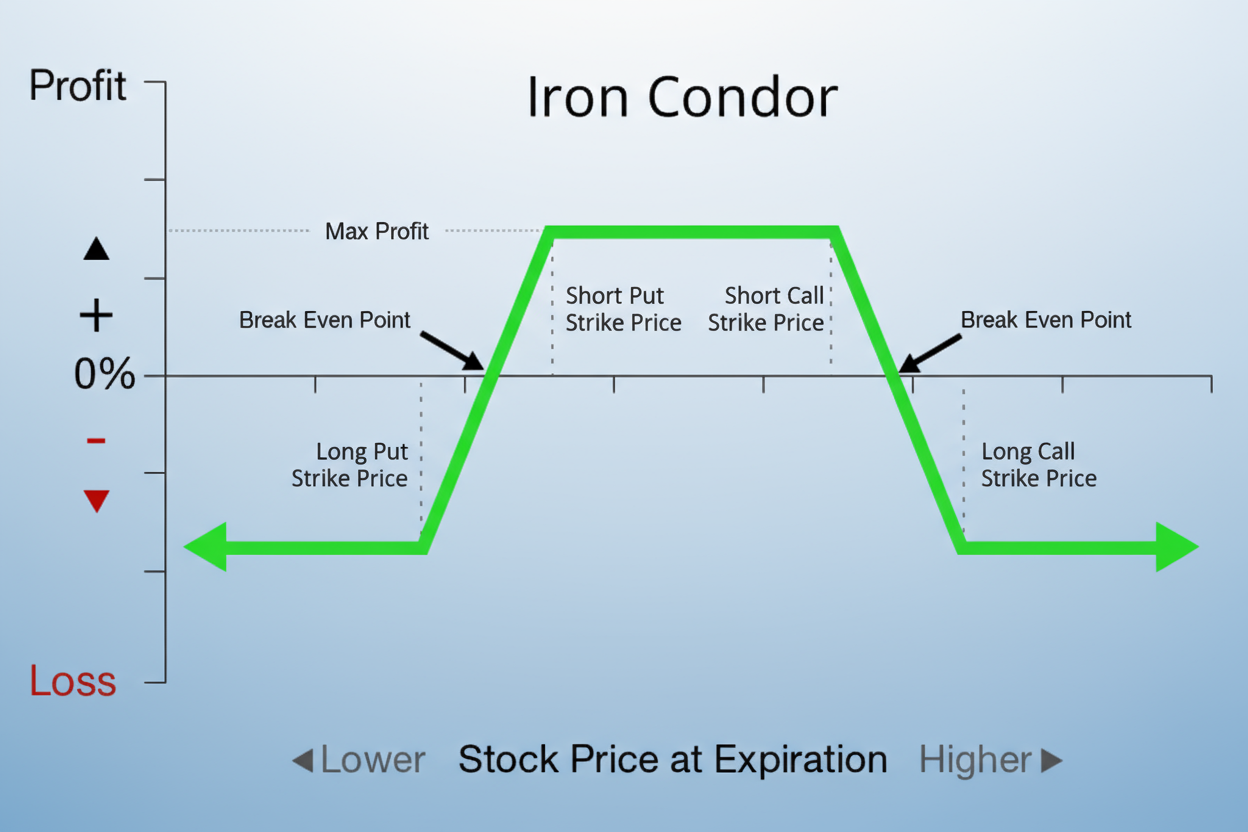

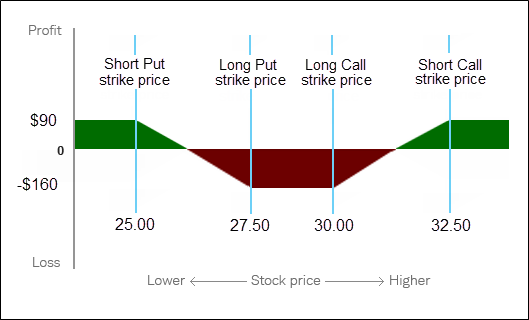

Think of it as a combination of two spreads:

By combining both, you create a profit zone: a sweet spot between two prices. If the underlying asset (like a stock, index, or ETF) stays inside that zone until expiration, you keep most of the premium you collected upfront.

Iron Condor vs Iron Butterfly

Numerous beginners mix up these two birds in the options jungle.

| Feature |

Iron Condor |

Iron Butterfly |

| Short strikes |

Spread apart |

Same strike price |

| Profit zone |

Wider |

Narrower |

| Potential profit |

Smaller |

Larger |

| Probability of profit |

Higher |

Lower |

| Ideal market |

Very quiet |

Extremely quiet |

In essence:

Iron Condor = more room, less reward

Iron Butterfly = tighter range, bigger reward

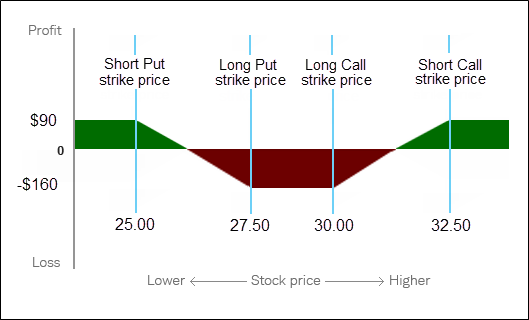

How the Iron Condor Works

Let's break it down step-by-step with simple numbers:

Imagine you are investing in a growth stock presently valued at $100.

Sell a call option at $110 (anticipating the price won't increase significantly).

Buy another call at $115 to protect against unlimited upside loss.

Sell a put option at $90 (expecting the price won't fall that low).

Buy another put at $85 to limit downside loss.

You've now created two spreads:

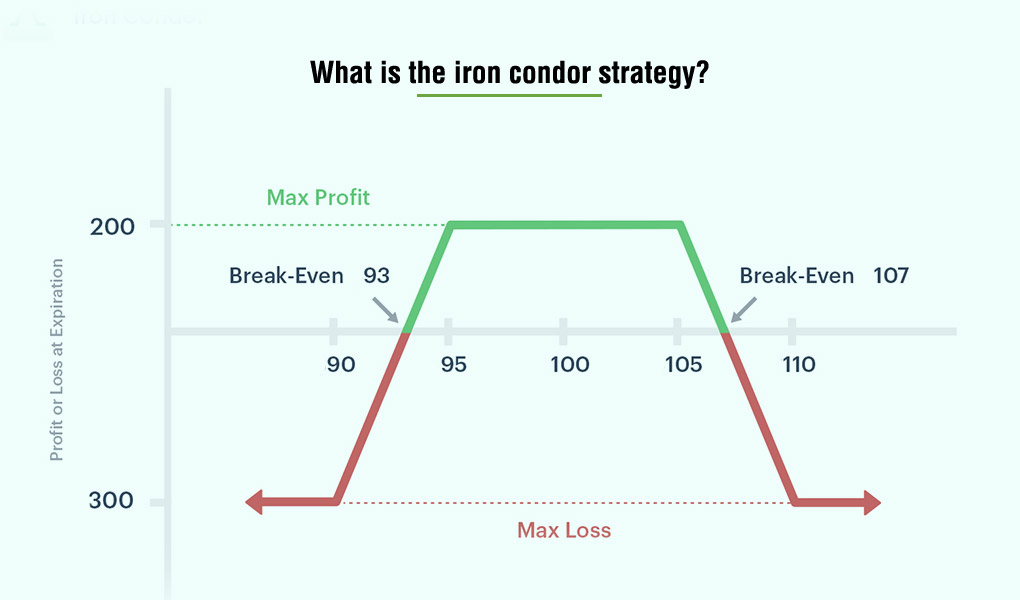

You receive a net credit: the total premium from selling the two options minus what you paid for the protective ones.

If the stock price stays between $90 and $110 until expiration, all options expire worthless, and you keep the credit as profit.

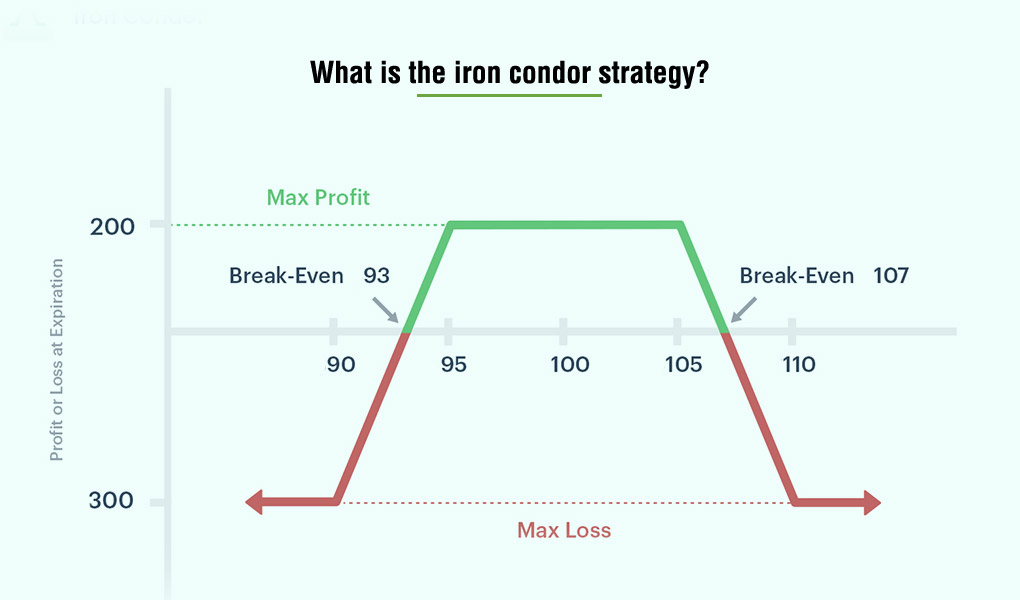

Profit and Loss in an Iron Condor

The Iron Condor is all about balance: limited risk, limited reward.

Example:

So:

When to Use the Iron Condor Strategy

Iron Condors work best when:

The market is sideways or range-bound.

Volatility is elevated but projected to decrease.

Massive events (like earnings or Fed announcements) are over, and the market calms down.

In short:

Use an Iron Condor when you think the market will breathe, not sprint.

When to Adjust the Iron Condor

Even calm markets can get stormy. Skilled traders "adjust their wings" when the price threatens to escape.

Here's how:

Roll the losing side closer or further out in time.

Close one side (the threatened spread) to limit loss.

Convert into a different strategy, such as a broken-wing condor or a strangle, if volatility shifts.

The goal is to defend profits and minimise damage, not to predict every move.

Example of Traders Applying the Iron Condor Strategy (2025)

| Year & Market Context |

Verified S&P 500 Level |

Volatility Environment (VIX) |

Example Iron Condor Setup |

Net Credit (Approx.) |

Max Risk |

Profit Zone (Short Strikes) |

Outcome / Commentary |

| Aug 2025: Record highs, calm market |

~6,449 (SPX close Aug 15 2025) |

Low (14 to 17) |

Sell 6,500 Call / Buy 6,550 Call • Sell 6,300 Put / Buy 6,250 Put |

$15 credit ($1,500 per contract) |

$35 risk ($3,500 per contract) |

6,300 to 6,500 |

Market stayed within range → full profit likely; ideal low-volatility setup. |

1) August 2025 (Calm Market, Low VIX)

In mid-August 2025, SPX was trading around the 6,400–6,480 range (e.g., close 6,449.80 on August 15, 2025).

VIX (Cboe Volatility Index) in August 2025 fell to the mid-teens (a calm market backdrop). Reports indicated that VIX was approximately 14–17 around the middle of August 2025.

Illustrative Iron Condor (realistic setup):

Underlying (SPX): ~6,450 (mid-Aug 2025)

Structure (monthly expiry ~30 days out):

Sell 6,500 call (short call)

Buy 6,550 call (long call for protection)

Sell 6,300 put (short put)

Buy 6,250 put (long put for protection)

Example net credit collected: $15 (i.e., $15.00 index points → $1,500 per standard contract).

Maximum risk per contract: width ($50) − credit ($15) = $35 (i.e., $3,500).

Max profit: $15 (i.e., $1,500).

Iron Condor Strategy: Advantages vs Drawbacks

| Advantages |

Drawbacks |

|

Profit in still waters: Earn returns even when the market stays flat or moves within a tight range. |

Limited profit potential: Maximum gains are capped by the credit received, no matter how perfect the setup. |

|

Defined risk and reward: Both potential gain and loss are known upfront, helping traders manage exposure. |

Vulnerability to volatility spikes: Unexpected market news or economic events can push prices beyond your strike range. |

|

High probability of success: Works best in calm or sideways markets, making it appealing for steady returns. |

Requires active management: Positions need monitoring; adjustments may be needed if prices drift too close to short strikes. |

Is the Iron Condor Suitable for Beginners?

Yes, with caution.

Beginners should first understand:

How options pricing works

How to read volatility

How to manage spreads

Paper trading or simulated accounts are great ways to test the waters before risking real money.

Risk Management Tips for Iron Condors

Even with defined risk, Iron Condors need smart management.

Never risk more than 2–3% of your trading capital per trade.

Use stop-loss levels based on delta or price thresholds.

Avoid earnings weeks as volatility can explode unexpectedly.

Take profits early, as many traders close when 50–75% of max profit is reached.

Don't double down if the trade goes bad; roll or exit gracefully.

Frequently Asked Questions

1. How Much Capital Do I Need for an Iron Condor?

It depends on strike width and broker margin rules, but typically ranges from $500 to $2,000 per spread.

2. How Much Profit Can You Make With an Iron Condor?

Typically, traders target 10–20% of their margin risk per month, depending on volatility and strike width.

3. Can I Use Iron Condors on Crypto or Forex Markets?

Yes, where options are available. The same logic applies, but account for higher volatility.

4. What Happens if the Market Breaks Out of the Range?

You'll face a limited loss. The purchased options serve as protection, limiting your potential losses.

Conclusion

In conclusion, trading doesn't always mean chasing sudden profits. Sometimes, the most powerful strategy is to profit from stillness, to thrive when others are impatient.

That's the essence of the Iron Condor. It's about crafting a calm, calculated approach and letting time and discipline work in your favour.

Like a real condor gliding effortlessly across the sky, your goal isn't to flap wildly but to ride the air currents of probability. With practice, patience, and risk control, you'll learn how to turn market calm into consistent opportunity.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.