Compound trading means reinvesting your trading profits so your capital grows—and your future trades start with more "fuel'. It transforms flat returns into exponential growth with discipline and strategy.

What is Compound Trading

In trading contexts, compound trading refers to the systematic reinvestment of profits from prior trades into new trades. The key difference from simple trading is this reinvestment step: you don't just take the profit and stop, you roll it into future trades so your base grows.

For example, a trader starting with US$1.000 who earns a 5 % monthly return but reinvests each month will grow their base each month—resulting in much higher end‑balance than if they withdrew profits each time.

In effect, compound trading treats your trading account not merely as a vehicle for discrete trades but as a "snowball" that grows in size, ideally expanding your capacity and potential gain per trade.

The Mechanics of Compound Trading

1. How the process works

Begin with initial capital (P)

Make a profit in a trading period (r)

Rather than withdraw, reinvest the profit so next period you trade with P × (1 + r)

Repeat over multiple periods (n).

Thus growth accelerates because each period’s return is applied to a larger base.

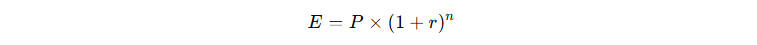

2. The formula

A general compound‑growth formula is:

where:

EEE = ending balance,

PPP = starting principal,

rrr = return rate per period (as decimal),

nnn = number of periods.

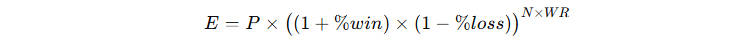

In trading, you could adapt it to include win‑rate (WR) and risk‑to‑reward metrics. E.g., one source gives

for N trades and a given win‑rate.

Example scenario for Compound Trading

| Period |

Monthly Return |

Balance (begin) |

Balance (end) |

| Month 0 |

— |

US$1,000 |

US$1,000 |

| Month 1 |

5 % |

US$1,000 |

US$1,050 |

| Month 2 |

5 % |

US$1,050 |

US$1,102.50 |

| … |

… |

… |

… |

| Month 12 |

~5 % average |

US$1,000 |

~US$1,795.86 |

| In contrast, if you simply earned US$50 each month (5 % of US$1,000) but did not reinvest, you would have US$1,600 after 12 months rather than ~US$1,795, showing the power of compounding. |

|

|

|

Why Traders Use Compound Trading: Benefits and Appeal

There are several compelling reasons traders adopt a compounding mindset:

Exponential growth potential:

As your base grows, so does the absolute size of your returns (given the same percentage gain).

Maximise the use of existing capital:

Rather than needing constant fresh deposits, reinvestment allows growth from what you already have.

Encourages discipline and consistency:

Because compounding rewards regular modest gains rather than chasing massive wins, it promotes steadier behaviour.

Scalable growth:

In principle, as your account enlarges, your trade size or number can expand proportionally (with risk controls), offering more reward potential.

In short, compound trading can shift your mindset from "profit then quit" to "grow and expand".

The Risks and Pitfalls of Compound Trading: What to Watch Out For

While compounding offers attractive possibilities, it is far from risk‑free. Key risks include:

Losses also compound:

Just as profits accumulate, so can drawdowns, which damage the base from which future trades derive.

Larger capital means larger stakes:

As your base increases, the same percentage risk means a larger absolute amount at risk—so tolerance for error shrinks.

Overconfidence and strategy drift:

Growing profits may tempt bigger risk or deviation from the original plan, undermining consistency.

Market conditions change:

A strategy that permitted compounding in one regime may fail in another; compounding amplifies both success and failure.

Withdrawals interrupt the compounding process:

If you pull profits out frequently, you reduce the base and slow or stop the compounding effect.

In summary, compounding elevates both reward potential and risk magnitude. It demands disciplined risk management and realistic expectations.

How to Begin Compound Trading: Step‑by‑Step Implementation

To adopt a compound‑trading approach responsibly, consider the following steps:

Step 1: Define your capital and goals

Step 3: Choose your reinvestment policy

Step 4: Set position‑sizing and risk controls

Step 5: Monitor and adjust

Keep a trading journal and log monthly growth, drawdowns, and any deviations from the plan.

If you experience an above‑normal drawdown or strategy performance deteriorates, consider pausing compounding or resetting the base.

Step 6: Maintain discipline in reinvestment

How to Begin Compound Trading

| Step |

Action |

Recommended Practice |

| 1 |

Capital & goal setting |

Be realistic: e.g. 3‑5 % monthly |

| 2 |

Strategy development |

Backtest, aim for consistency |

| 3 |

Reinvestment policy |

Decide full vs partial reinvestment |

| 4 |

Risk & position‑sizing |

Risk 1‑2 % per trade; maintain risk‑reward ratio |

| 5 |

Monitoring & review |

Use journal, track drawdowns & performance |

| 6 |

Discipline |

Resist early withdrawals; stay consistent |

Adapting Strategy for Compound Trading: Variations and Enhancements

When applying compounding, strategy design requires adaptation:

Partial versus full reinvestment:

Some traders reinvest a certain percentage of profits rather than all, offering buffer against risk escalation.

Scaling up systematically:

As the base grows, trade size can increase proportionally—but ensure risk per trade remains constant as a percentage of account.

Diversification of trades:

While compounding, consider spreading across different markets or instruments to avoid concentration risk.

Periodic review and reset:

If you incur a sizeable drawdown (for example 20 %), it may be prudent to pause compounding, reassess strategy, and reset your base.

Use of automation/algorithms:

To maintain consistent reinvestment and avoid emotional deviations, some traders utilise algorithmic scaling or expert advisors.

In essence, compounding is not merely "do same trades bigger" but "scale with discipline".

When Compound Trading Works and When It Does Not

1. Conditions that support successful compounding

You have a strategy that consistently delivers modest profits with manageable drawdowns.

You maintain strict risk management and do not let growth lead to recklessness.

You reinvest systematically and resist withdrawal temptation.

Market environments remain sufficiently favourable (trendable, liquidity present).

2. Conditions where compounding may fail

A strategy produces large profits randomly but also large losses: compounding will magnify the losses.

You increase risk as your account grows (e.g. moving from 2 % risk to 5 %) — this undermines the compounding logic.

You withdraw profits frequently, interrupting the base‑growth.

Market regime changes render your strategy ineffective and you experience sustained drawdown.

3. Realistic expectations

While compounding can generate growth faster than linear returns, it is not a guarantee of massive returns in short time. For example, a monthly return of 5 % compounded gives ~79.6 % annual growth in ideal conditions.

Traders should therefore aim for disciplined steady growth rather than unrealistic "double account in six months" promises.

Frequently Asked Questions (FAQ)

Q1: What exactly is compound trading?

A1: Compound trading is the practice of reinvesting profits from your trades into your trading capital so that the base grows, enabling future trades to start with a larger amount.

Q2: How much return is needed for compounding to make a big difference?

A2: Even modest returns—say 3‑5 % per month—can compound appreciably over a year. For example, at 5 % monthly you could nearly double your capital in ~14 months under ideal conditions.

Q3: Is compound trading suitable for beginners?

A3: Yes, but cautiously. Beginners should prioritise strategy development, risk control, and consistent modest gains. Starting small and reinvesting partially may be wise until you build confidence and track record.

Q4: What are the biggest risks?

A4: The main risk is that losses also compound—if your account grows and you maintain large risk per trade, a drawdown will hit harder. Another is overconfidence or changing strategy mid‑growth.

Q5: Do I need to withdraw profits at all?

A5: Not necessarily. The pure compounding model suggests full reinvestment to maximise growth—but many traders adopt hybrid approaches (e.g. withdraw a portion, reinvest the rest) to lock in gains and reduce risk.

Conclusion

Compound trading offers a structured method of growing your trading capital by reinvesting profits and allowing your base to expand.

Executed with discipline, consistent strategy, and prudent risk management, it transforms modest recurring gains into significant long‑term growth. However, it is not a shortcut—it demands consistency, control, and the humility to respect market risk.

Approach it as a growth‑engine for your trading account, not a ticket to overnight riches, and you give yourself a chance to harness the snowball effect in your favour.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.