In the stock market, no investor relies on a single share to secure their future. Instead, they build a portfolio – a carefully chosen mix of assets that balances risk, rewards, and long-term goals.

A portfolio is more than just a list of investments; it is a strategy, a safeguard, and a reflection of an investor's approach to wealth creation. Understanding how portfolios work is the first step towards navigating the market with confidence.

This article explains what a stock market portfolio is, its types, how it manages risk and reward, and strategies to build it effectively.

Highlights:

A stock market portfolio is a mix of assets aimed at balancing risk and reward.

Common portfolio types include growth, income, defensive, balanced, and diversified.

Diversification is key to reducing risk and supporting long-term stability.

Strategies range from conservative safety to aggressive growth, shaped by goals and risk tolerance.

Successful portfolio management avoids common pitfalls and requires regular review and discipline.

The Anatomy of a Portfolio

A stock market portfolio is essentially a curated collection of investments. It can include:

Equities – individual shares or equity funds.

Bonds – government or corporate debt for stability.

Cash and equivalents – liquidity for emergencies or opportunities.

Exchange-Traded Funds (ETFs) & Mutual Funds – pooled vehicles that spread exposure.

Alternative assets – property, commodities, or even digital currencies.

At its core, a portfolio balances ambition and safety, enabling investors to seek returns while protecting against the unpredictable.

Portfolios with Personality: Types & Styles

1) Growth Hunters

Growth portfolios are designed for those willing to embrace volatility in pursuit of higher returns. They often focus on tech, biotech, and emerging markets—areas bursting with potential but equally fraught with swings.

2) Dividend Collectors

Income portfolios tilt towards companies with a steady record of paying dividends. Think of them as the salary earners of investing, offering predictable cash flow.

3) Safety Seekers

Conservative portfolios prioritise stability. They emphasise bonds, defensive shares, and low-volatility funds. Returns may be modest, but so too is the stress.

4) Balancers in the Middle

Balanced portfolios combine elements of growth and income, diversifying across asset classes to reduce shocks while still participating in market upside.

5) Specialists and Niche Explorers

Some portfolios zoom in on value investing, sector-specific themes, or passive strategies that mirror an index. Others mix in international assets or alternatives for a global twist.

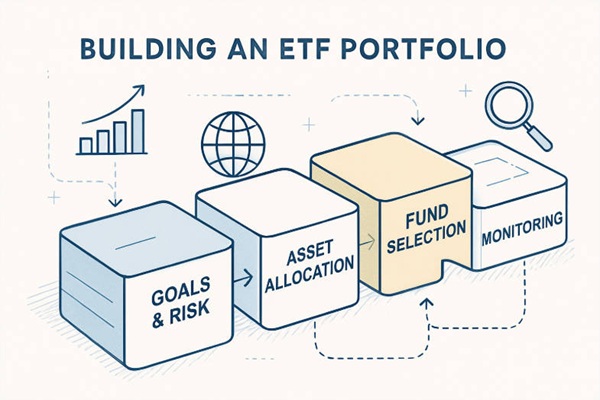

How to Build a Strong Portfolio in Stock Market

Spreading capital across sectors, geographies, and asset classes reduces the risk of one setback wiping out gains.

Deciding how much weight to give stocks, bonds, and other assets is a cornerstone of portfolio design. A 25-year-old with decades ahead may favour equities, while a retiree might prioritise bonds and income.

Keeping some holdings in cash or equivalents ensures flexibility to seize opportunities or meet obligations without panic selling.

Assets that move differently in response to market events protect the portfolio when storms hit.

Portfolio Maintenance: More Than Just a Once-Off Job

Over time, winners run ahead and losers fall behind. Rebalancing realigns the portfolio with its original goals—trimming excesses and topping up laggards.

Success is not just about raw returns. Risk-adjusted metrics, such as the Sharpe ratio, reveal whether the gains are worth the turbulence endured.

Transaction fees, fund expenses, and taxes quietly erode wealth if ignored. Astute investors keep these in check.

Interest rates, inflation, elections, and geopolitical shocks can all shift portfolio dynamics. Monitoring the broader environment keeps strategies relevant.

Pitfalls on the Path: Mistakes Investors Make

Putting All Eggs in One Basket – overconcentration invites disaster.

Chasing Shiny Objects – jumping on fads often ends badly.

Neglecting the Garden – portfolios need ongoing attention, not blind faith.

Letting Emotions Drive the Wheel – fear and greed lead to poor decisions.

Forgetting the Fine Print – costs, taxes, and illiquidity all matter.

Illustrations in Action: Sample Portfolios in Stock Market

1) The Conservative Nest

60% bonds, 25% dividend stocks, 10% cash, 5% alternatives.

Focus: steady income, preservation of capital.

2) The Balanced Bridge

50% equities, 35% bonds, 10% alternatives, 5% cash.

Focus: growth with manageable risk.

3) The Growth Engine

80% equities, 10% bonds, 5% alternatives, 5% cash.

Focus: long-term capital appreciation, higher volatility accepted.

4) Passive Tracker

ETFs mirroring major indices, global exposure.

Focus: simplicity, lower fees, market-matching returns.

Stock Portfolio Strategies Compared

| Strategy Type |

Key Approach |

Strengths |

Weaknesses |

| Conservative |

Focus on safe assets |

Low risk, steady returns |

Limited growth |

| Moderate |

Balance growth & safety |

Good mix of risk & reward |

May underperform in bull market |

| Aggressive |

High-growth assets |

High return potential |

High volatility |

| Income-Focused |

Prioritises dividends/interest |

Steady income flow |

Lower capital appreciation |

| Diversified |

Spread across asset classes |

Risk reduction, flexibility |

Requires careful monitoring |

FAQs on Portfolios in the Stock Market

1. What is the ideal number of holdings in a portfolio?

There's no universal figure. A diversified portfolio may hold anywhere from 15 to 30 shares alongside other assets, but it depends on the investor's capacity to manage and monitor them.

2. How often should I rebalance my portfolio?

Many investors review annually or semi-annually, though significant shifts in allocation or life circumstances may demand earlier action.

3. Is active management better than passive investing?

Active management can outperform in niche areas, but passive investing often proves cost-effective and reliable over time. The choice depends on skill, time, and conviction.

4. How does my risk tolerance influence portfolio design?

Risk tolerance dictates the mix: higher tolerance = more equities and growth assets, lower tolerance = more bonds, income, and stability.

Closing Thoughts: Turning Chaos into a Canvas

A portfolio is more than numbers—it's a reflection of an investor's goals, fears, and dreams. Built wisely, it cushions against market shocks, captures opportunities, and evolves with life's chapters. The art lies not in chasing every rally, but in designing a portfolio that serves you, through every cycle of the market.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.