In a world of volatile markets, fiat currency devaluation, and economic uncertainty, few assets command the enduring respect of gold and silver. These precious metals are more than just commodities—they're symbols of wealth preservation, financial independence, and long-term security.

For centuries, individuals, institutions, and even nations have turned to physical gold and silver not just as investments, but as safeguards. Unlike paper assets, they offer no counterparty risk and require no promise to hold their value. The classic buy-and-hold approach—purchasing bullion and storing it securely—remains one of the simplest and most time-honoured strategies for protecting purchasing power across generations.

Understanding Physical Bullion: Coins and Bars

At the heart of the buy-and-hold strategy lies physical bullion, which refers to actual gold and silver in the form of bars or coins. Unlike "paper gold" (such as ETFs or mining shares), bullion gives you direct ownership of a tangible asset.

Why Invest in Physical Bullion?

Tangible Ownership: You're not relying on financial institutions—bullion is yours to keep.

Inflation Hedge: Precious metals historically retain value, especially during inflationary periods.

Privacy: Transactions can be more discreet than digital investments.

However, bullion also comes with a premium—an amount you pay above the market (or "spot") price. This covers manufacturing, distribution, and dealer mark-up, and tends to be higher for coins than bars.

Coins such as the American Gold Eagle or the Canadian Silver Maple Leaf are legal tender, often recognised globally and easy to sell. Bars, on the other hand, typically offer lower premiums and come in various weights, such as 1 oz, 10 oz, or 1 kg.

Finding Trusted Dealers and Mints

Once you've decided to invest in bullion, the next step is purchasing it from a reputable source. The market is full of dealers, but not all are equal in trustworthiness or transparency.

Where to Buy

Authorised Precious Metal Dealers: Look for dealers with certifications, positive reviews, and memberships in organisations like the LBMA (London Bullion Market Association).

National Mints: Buying directly from mints like the Royal Mint (UK), U.S. Mint, or Perth Mint (Australia) ensures authenticity.

Local Coin Shops or Shows: These can offer competitive pricing, especially if you develop a relationship with a trusted vendor.

Make sure you understand the terms and conditions of your purchase, including delivery methods, return policies, and guarantees of authenticity. Avoid high-pressure sales tactics or excessive mark-ups.

Storage and Safekeeping Solutions

Owning physical gold and silver means taking responsibility for its safekeeping. This is perhaps the most critical and often overlooked part of bullion investment.

Storage Options

Home Safes: Ideal for small to moderate holdings. Choose a fireproof, waterproof safe securely anchored to your property.

Bank Safety Deposit Boxes: Offer higher security but may be subject to accessibility issues, especially during emergencies or holidays.

Third-Party Vaulting Services: Specialist storage providers offer segregated or allocated storage with full insurance. Examples include Brinks, Loomis, or The Royal Mint's Vault.

Insurance is essential—ensure your bullion is covered against theft, fire, or natural disasters. Also, maintain discretion: the fewer people who know about your holdings, the safer they are.

Tracking Market Prices and Premiums

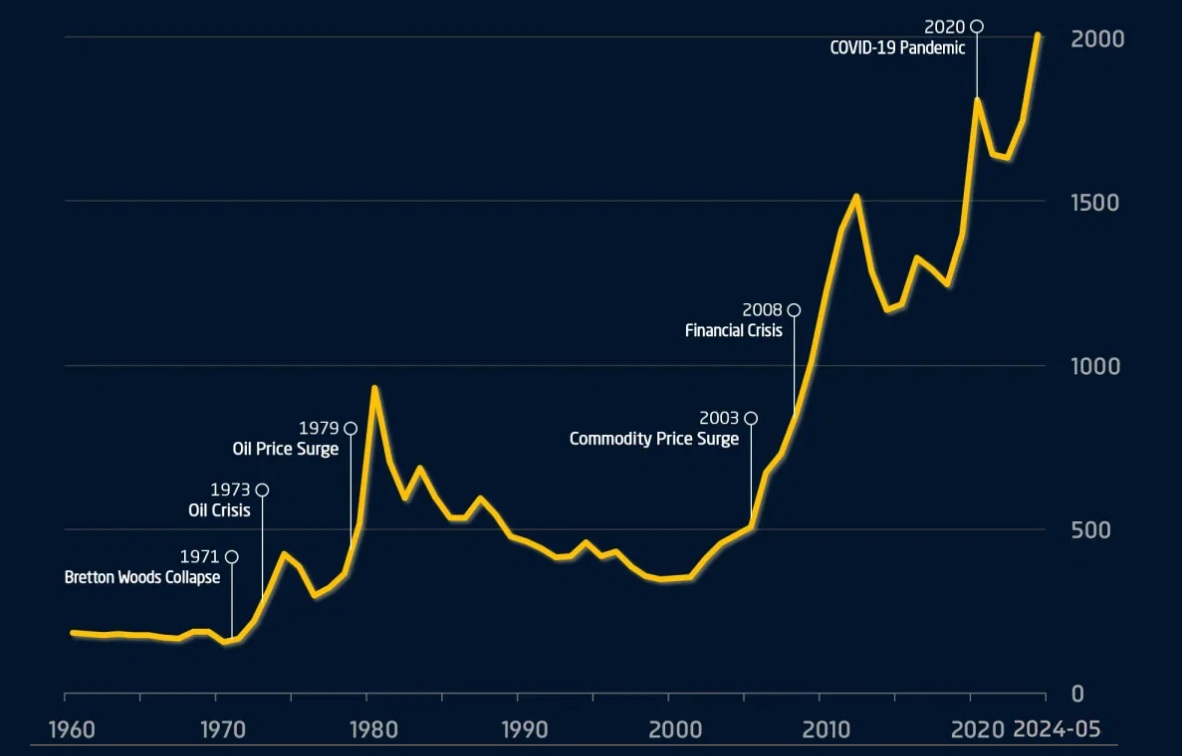

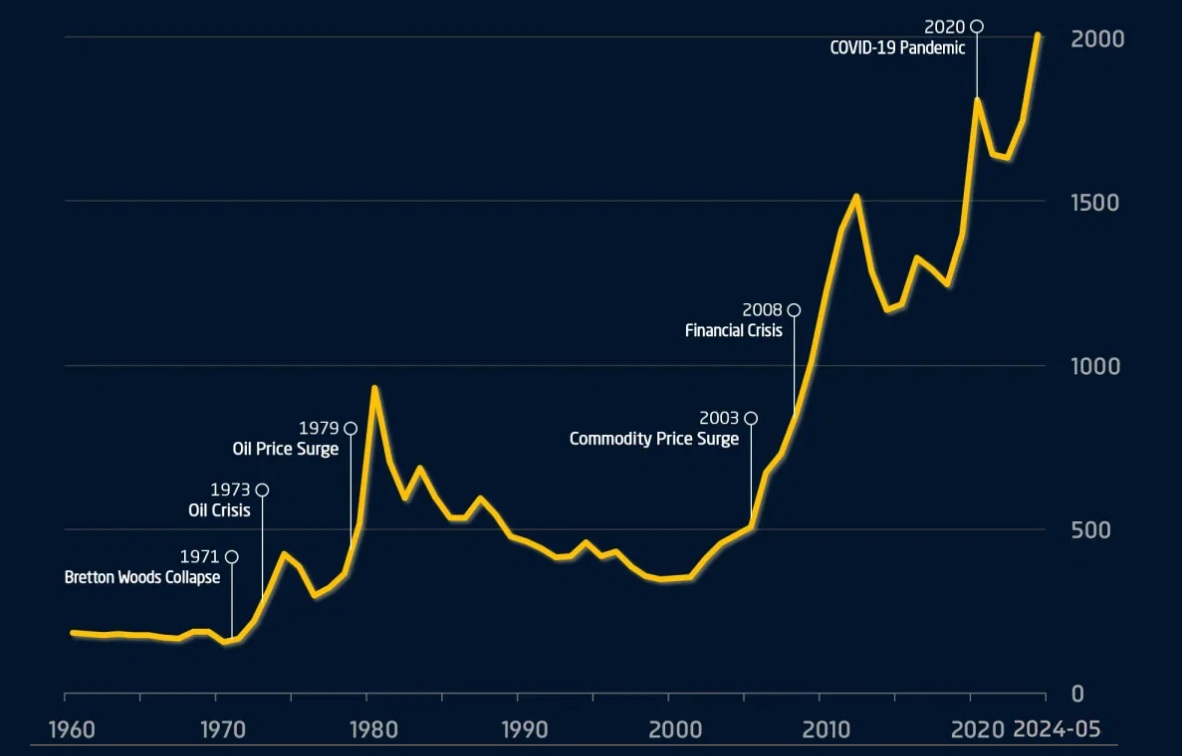

While the buy-and-hold strategy implies long-term thinking, it's still important to monitor market trends. Precious metal prices can be volatile in the short term, influenced by interest rates, geopolitical events, and currency strength (particularly the US dollar).

While the buy-and-hold strategy implies long-term thinking, it's still important to monitor market trends. Precious metal prices can be volatile in the short term, influenced by interest rates, geopolitical events, and currency strength (particularly the US dollar).

Spot Price vs. Premium

Generally, larger purchases (e.g., 1kg bars) come with smaller premiums per ounce. Regularly check reputable sources such as Kitco, BullionVault, or The Royal Mint for live pricing.

Some traders practise dollar-cost averaging, which involves purchasing small amounts at regular intervals. This strategy reduces the impact of price volatility and removes the pressure of trying to "time the market".

Just as important as your entry is your exit strategy—how and when you'll eventually sell your metals.

Selling Options

Back to Dealers: Many reputable dealers offer buyback programmes with competitive pricing.

Local Coin Shops: Often offer immediate payment but may pay slightly below spot.

Online Marketplaces: Platforms like eBay can yield better prices but come with risks and fees.

Bullion Exchanges: If your metals are stored with a vaulting service, you may be able to sell directly from the vault.

Before selling, factor in the spread—the difference between the buying and selling price. Also, consider capital gains tax implications, especially if your metals have appreciated significantly in value.

Maintaining good records of your purchases (receipts, certificates of authenticity, storage agreements) will make resale much smoother.

Final Thoughts

Investing in physical gold and silver using the classic buy-and-hold method is a tried-and-tested way to preserve wealth over the long term. While it may lack the instant gratification of high-frequency trading or tech stocks, it offers something far more enduring: stability, resilience, and a hedge against the unexpected.

By understanding the basics of bullion, choosing reputable dealers, securing your holdings, tracking prices, and having a clear exit strategy, you'll be well-positioned to benefit from one of the oldest and most reliable forms of investment.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

While the buy-and-hold strategy implies long-term thinking, it's still important to monitor market trends. Precious metal prices can be volatile in the short term, influenced by interest rates, geopolitical events, and currency strength (particularly the US dollar).

While the buy-and-hold strategy implies long-term thinking, it's still important to monitor market trends. Precious metal prices can be volatile in the short term, influenced by interest rates, geopolitical events, and currency strength (particularly the US dollar).