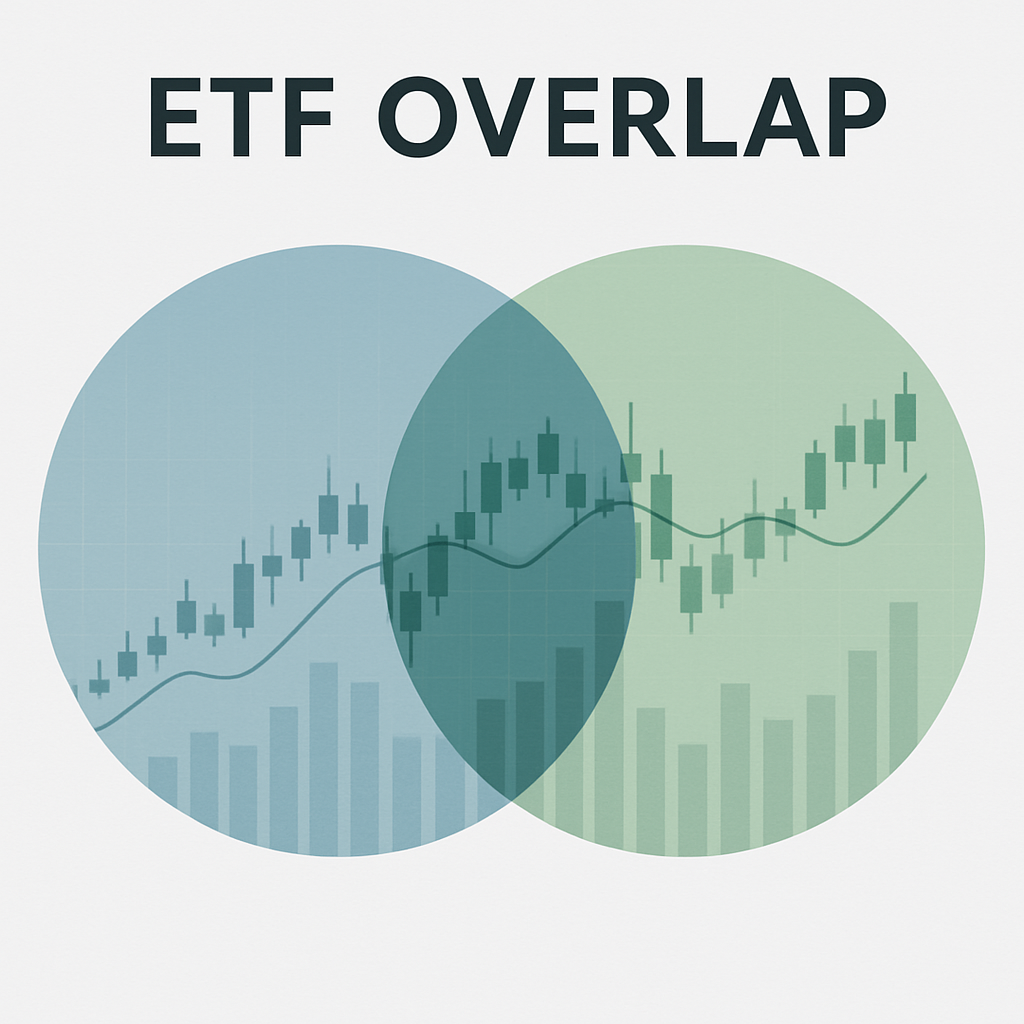

Ensuring proper diversification is a cornerstone of successful investing. For many, ETFs (exchange-traded funds) are an efficient way to get broad market exposure.

However, there's a catch: ETF overlap. Holding multiple ETFs without checking their underlying holdings can leave your portfolio concentrated in the same stocks or sectors, negating the diversification benefits you thought you'd achieved.

In this guide, we dive deep into what ETF overlap is, why it matters, and how to build a truly diversified portfolio that matches your goals.

What Is ETF Overlap?

ETF overlap occurs when two or more funds in your portfolio contain many of the same underlying assets—often top large-cap stocks, specific sectors, or geographic exposures. This hidden concentration runs counter to the diversification you're aiming for and can unintentionally magnify your portfolio's risk.

Consider owning a total-market ETF, an S&P 500 ETF, and a Nasdaq-100 ETF. Although these may seem diversified, they often share the very same mega-cap tech stocks—Apple, Microsoft, Nvidia—which can account for more than one-third of your entire portfolio, showing up multiple times.

Common ETF Overlap Examples

S&P 500 ETF + Total U.S. Market ETF: Nearly full overlap, as the S&P 500 makes up around 80% of the total U.S. market by capitalisation.

S&P 500 ETF + Nasdaq-100 ETF: Major tech names dominate both indices.

Total U.S. ETF + Sector or Growth ETF: The growth ETF may heavily replicate sector weightings embedded in the total-market fund.

These combinations might appear diversified, but often function like a single concentrated portfolio.

Why ETF Overlap Matters

1. Reduced Diversification

Instead of spreading risk across the market, overlap overweights the same companies. As InvestmentNews explains, combining ETFs like VTI, SPY, and QQQ could allocate nearly 40% of your portfolio to just ten stocks.

2. Unintended Concentration Risk

When multiple ETFs share the same holdings, your exposure to market downturns linked to those stocks increases significantly.

3. Duplicated Fees

You end up paying management fees multiple times for the same exposure, reducing net return.

4. Tax and Rebalancing Costs

Discovering hidden overlap may lead to fund sales, potentially triggering capital gains taxes, making your rebalancing more expensive.

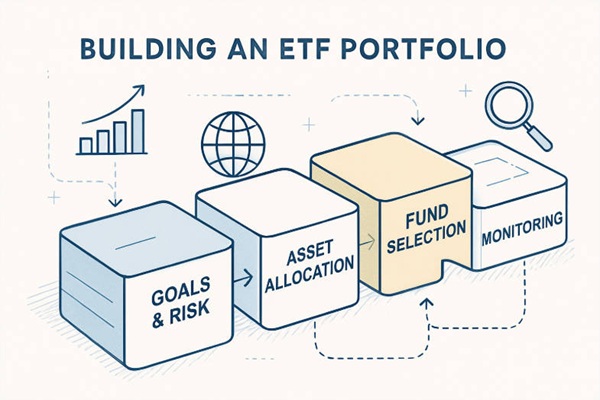

Building a Low‑Overlap Portfolio: Step-by-Step

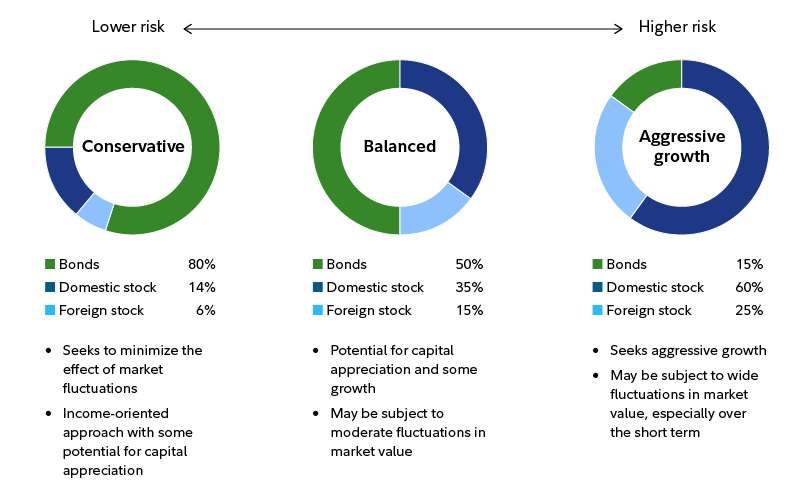

1. Define Your Allocation Goals

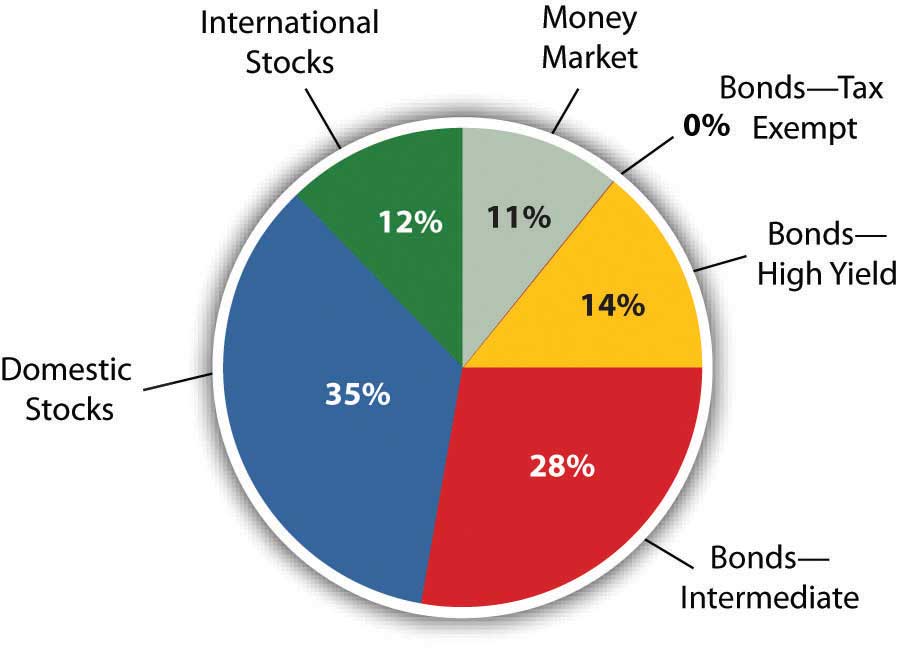

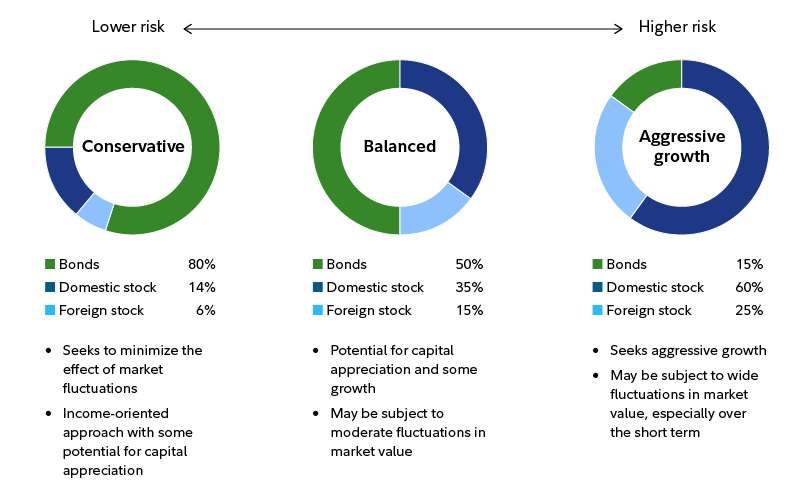

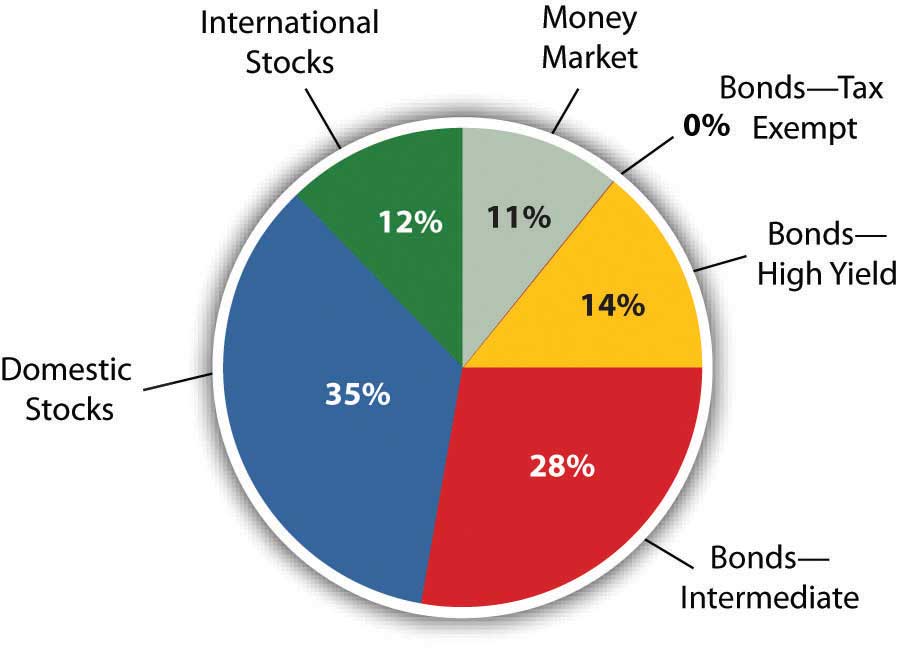

Decide your mix of U.S. stocks, international stocks, bonds, commodities, sectors, etc., based on your risk tolerance and time horizon.

2. Select Anchor ETFs

Choose broad-market core funds such as:

U.S. Stocks: Total market or S&P 500 ETF (e.g., VTI or SPY)

International Stocks: MSCI All-World ex-U.S. or EAFE index

Bonds: Aggregate domestic or global bond ETF

3. Add Satellite Funds Carefully

Include satellite ETFs (e.g., emerging-market, tech, value) purposely and monitor overlap. Use analytics tools to quantify shared holdings.

4. Optimise Overlap

If the overlap exceeds your comfort level, substitute overlapping ETFs with more distinct ones. For example, instead of using both S&P 500 and Total U.S., use a broader U.S. with a small-cap ETF for exposure balance.

5. Rebalance & Review Regularly

Market movements change your exposure. Conduct periodic reviews (semi-annually or annually) using overlap tools, and rebalance if certain asset weights drift by over 5%.

How Much Overlap Is Acceptable?

There's no hard threshold, but most experts advise minimising overlap. Some suggest limiting overlap to below 10–20%, while others find up to 30–50% acceptable, depending on your strategy. Your acceptable overlap depends on your risk tolerance and financial goals.

Real-World Scenarios

Scenario 1: Growth Tilt Overexposure

An investor owns VTI and VUG (growth). Since VUG includes many of the same stocks as VTI, overlap analysis might show 50%+ duplication. You can rebalance by swapping VTI for a more balanced U.S. fund or shifting satellite allocation to small-cap or value ETFs.

Scenario 2: Global vs Regional ETFs

Combining a global fund (Vanguard Total World) with regional funds (e.g., EAFE and emerging markets) often results in passive overlap. You can avoid duplication by selecting either a global all-in-one or an independent regional fund.

Beyond Overlap: Meaningful Diversification Tips

Diversify by Asset Class

Include asset classes with low or negative correlation—e.g., government bonds, commodity ETFs, REITs—to enhance resilience under Modern Portfolio Theory.

Balance Factor Exposure

Avoid unseen concentration in growth vs. value. Two growth ETFs may overlap heavily even across indices. Intentionally balance growth/value tilts.

Active Strategy Diversification

If using an active ETF (like risk-parity or managed futures), treat overlap differently—these often deliberately deviate from benchmarks for alpha-seeking.

FAQs on ETF Overlap

Q1: Is some overlap okay?

Yes. Strategic overlap—e.g., owning both U.S. and developed-market ETFs—is fine if it aligns with your investment goals and you're aware of the shared exposure.

Q2: Does overlap reduce returns?

Potentially. If you're paying multiple expense ratios for the same exposure, you're effectively re-paying for it, dragging net returns.

Q3: How many ETFs are ideal?

Quality over quantity—usually, 5–8 thoughtfully selected ETFs are sufficient to construct a well-diversified, easy-to-manage portfolio.

Conclusion

In conclusion, ETF overlap is a surprisingly common issue, but it is easy to fix once identified. By carefully selecting ETFs, employing overlap tools, diversifying thoughtfully, and staying disciplined with reviews and rebalancing, you can build a robust portfolio.

This approach ensures that you truly meet your investment objectives, minimise unintended risks, and enhance long-term returns through smart diversification.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.