The same core forces of monetary policy, economic growth, liquidity, and investor psychology drive market cycles across stocks, forex, and crypto. However, each asset class expresses those forces differently due to its structure.

Currently (August 2025), the worldwide scenario is influenced by varying central-bank strategies and liquidity trends, equity momentum susceptible to macroeconomic shocks, a declining U.S. dollar altering foreign exchange leadership, and a cryptocurrency cycle continuing to show significant volatility following its halving event.

This guide explains the mechanics, phases, signals to watch, and how to apply cycle thinking to trading and portfolio construction.

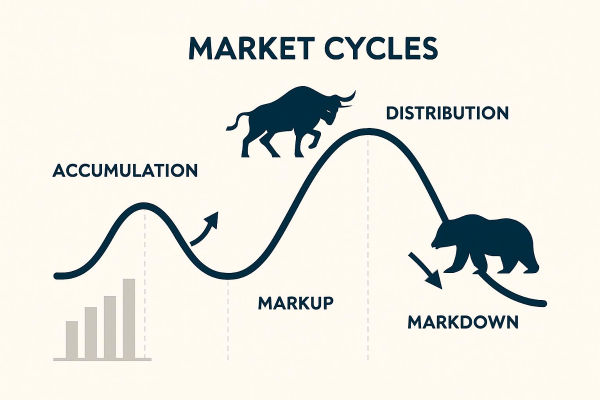

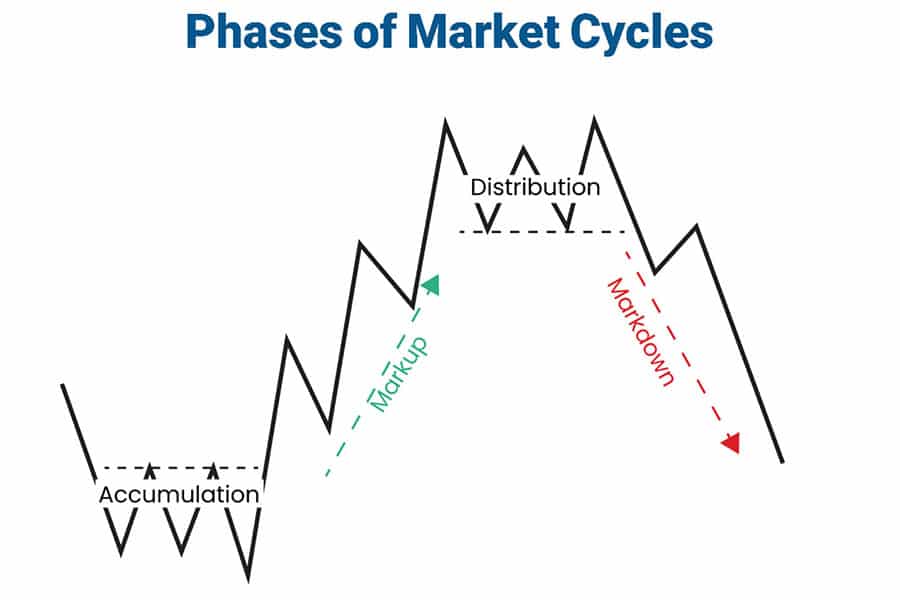

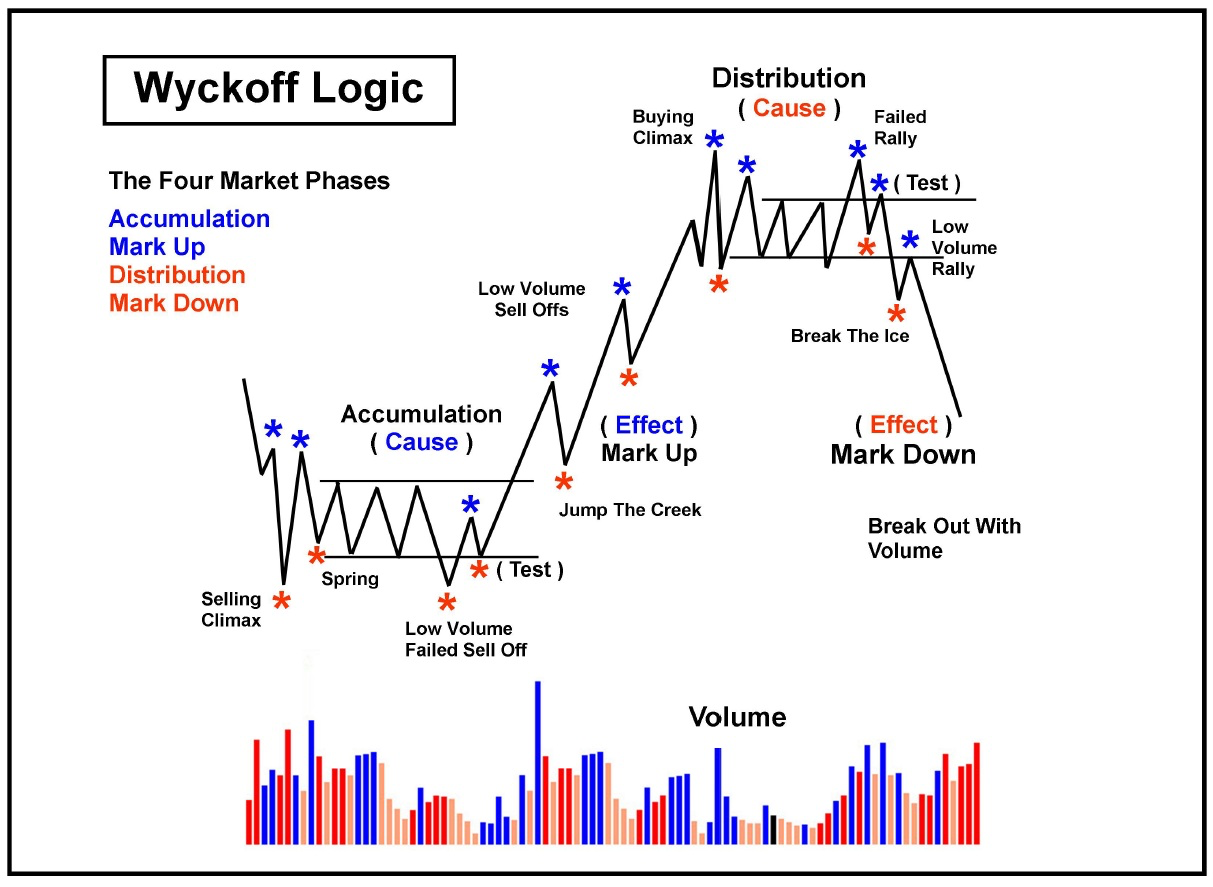

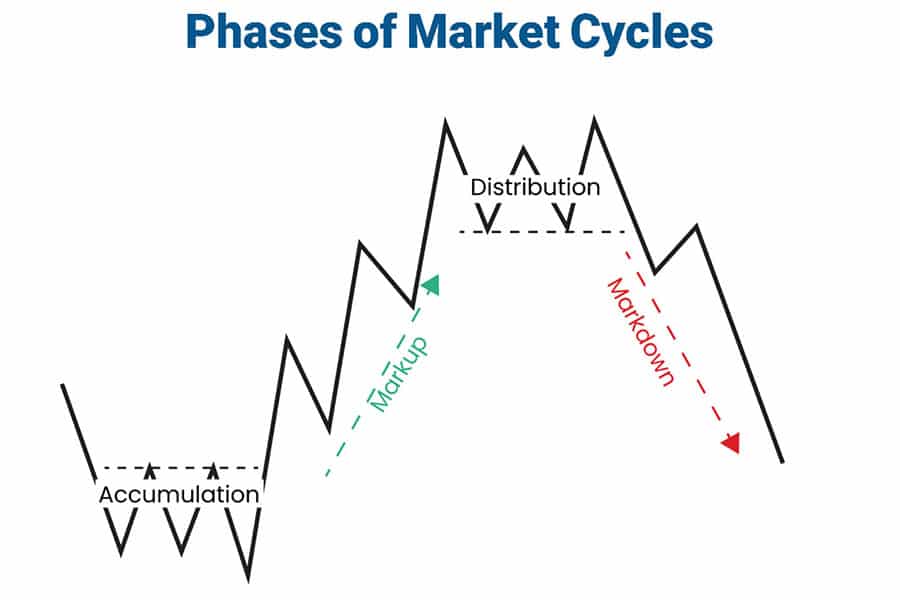

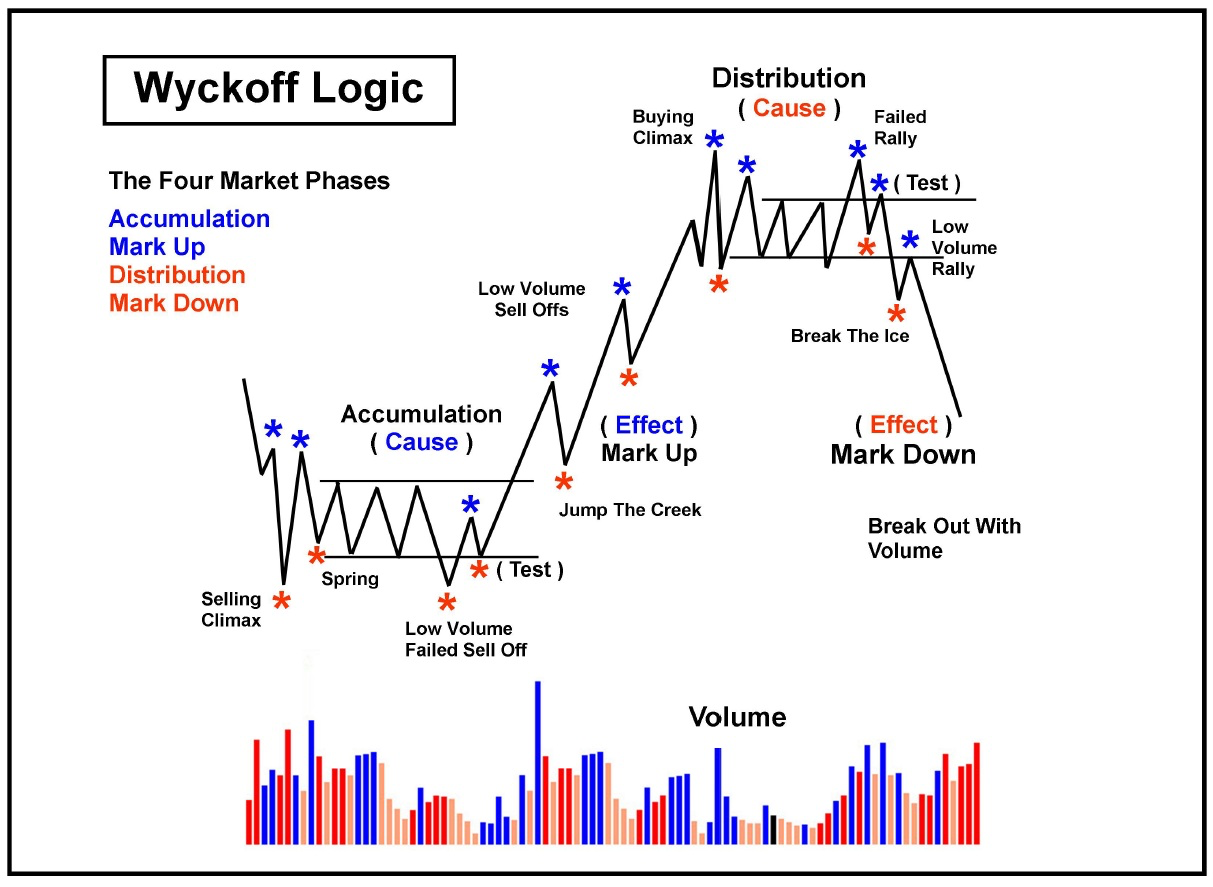

What Are the Four Phases of Market Cycles?

Most cycle frameworks break markets into four broad stages. Investors can use these phases as mental models for positioning:

Accumulation: After the worst is discounted, smart money starts to buy, and volume may be thin, but insider/long-term accumulation is detectable.

Mark-up (Bull run): Price and volume expand, leadership broadens, and optimism becomes mainstream.

Distribution: Early bulls sell to later buyers; breadth narrows despite rising headline indices, and divergences appear.

Mark-down (Bear market): Panic selling, negative feedback loops, and capitulation occur until the market finds a valuation trough.

These phases map reasonably well across stocks and crypto; in FX, market participants show accumulation and distribution differently, often expressing them as multi-month trend establishment and then reversal as monetary cycles shift.

Practical Application: Determine where you believe an asset belongs in these four stages and adjust position sizing and stop rules accordingly.

Why Market Cycles Are Important and Why They Differ Across Asset Classes?

Markets don't move in a straight line. Cycles compress time and help investors recognise that asset prices rotate through periods of expansion and contraction.

But recognising cycle phase in one asset class doesn't automatically translate to the others because:

Stocks are anchored to corporate profits and discount future cash flows.

Forex signifies the relative policies of central banks, trading movements, and risk tolerance.

Crypto is driven by network-specific supply dynamics (e.g., halvings), speculative liquidity, and regulatory news.

Understanding these structural differences is the first step toward applying cycle-based rules rather than emotional reactions.

What Are Stock Market Cycles?

Stock cycles are ultimately a present-value game with earnings expectations, interest rates, and the discount factor. When central banks tighten, equities must either deliver stronger earnings or see lower valuations. On the contrary, easy money and QE drive multiple growth.

Today's Context (Aug 2025)

Many global equity markets have recently rallied on resilient data and expectations for eventual rate cuts, but strategists warn the cycle could downshift if growth weakens or inflation revives.

JPMorgan and other banks updated mid-year outlooks pointing to slowing EM growth and continued central-bank adjustments that could affect earnings momentum. That makes the current equity cycle an earnings-sensitive one.

Signals to Watch

1) Macro Surprise Indices (GDP, PMI, Employment): Early indicators of earnings momentum.

2) Corporate Guidance and Buybacks: Aggressive buybacks can amplify bull phases; weak guidance signals distribution.

3) Breadth Measures: Advancing and declining lines, along with equal-weight versus cap-weight divergence, may limit leadership in an increasing market and frequently foreshadow a pullback.

4) Credit Spreads & High-Yield Performance: Expanding spreads typically indicate stock risk-averse situations.

Practical Posture

In accumulation, favour higher-quality cyclicals with improving earnings and call options for asymmetric upside.

In mark-up, broaden exposure but monitor breadth and valuation.

In distribution, tighten stops and harvest gains. Use sector rotation (from cyclicals to defensives) as a signal.

In mark-down, favour cash, high-quality bonds, and selectively buy into strong names when signs of capitulation appear.

What Are Forex Market Cycles?

Currencies are macro instruments. They rarely "follow earnings"; they follow interest-rate differentials, trade flows, geopolitical risk, and central-bank credibility.

Why FX Cycles Are Different

FX is a zero-sum game: A profit for one currency equals a loss for another.

Central-bank divergence creates durable trends (e.g., a currency may strengthen while its central bank maintains rates elevated compared to others).

Risk sentiment flips (risk-on vs. risk-off) often drive short-term FX moves independent of fundamentals.

August 2025 Snapshot

The U.S. dollar has been under pressure amid growing market bets that the Fed will be the first to cut, while other central banks (depending on inflation paths) have been less dovish, creating notable rotation in FX markets and "splits" among EMEA currencies.

FX strategists have highlighted how the FED/BoE/ECB timing differences are reshaping FX leadership.

Signals to Watch

1) Interest-Rate Differentials and Forward Rates: The market-implied trajectory for rates serves as one of the strongest indicators.

2) Positioning: Extreme net positions can lead to sudden reversals.

3) Geopolitical Shocks: These can trigger immediate flows into safe havens (USD, JPY, CHF) or commodity currencies.

4) Risk-On/Risk-off Proxies: Equity fluctuations, credit spread changes, and implied volatility adjustments affect FX risk premiums.

Practical Posture

Trend-following performs effectively when there is a clear divergence among central banks. Use carry trades when rate differentials favour a currency and volatility is low.

During geopolitical or macro shocks, switch to hedged positions and favour safe-haven currencies.

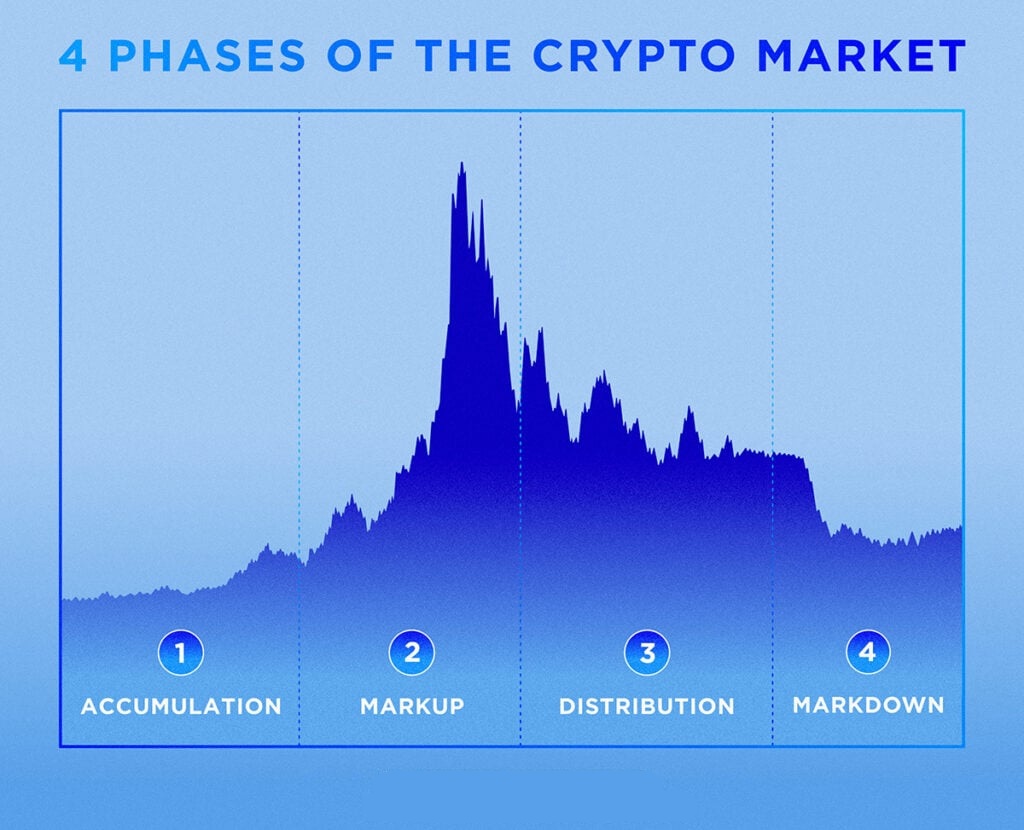

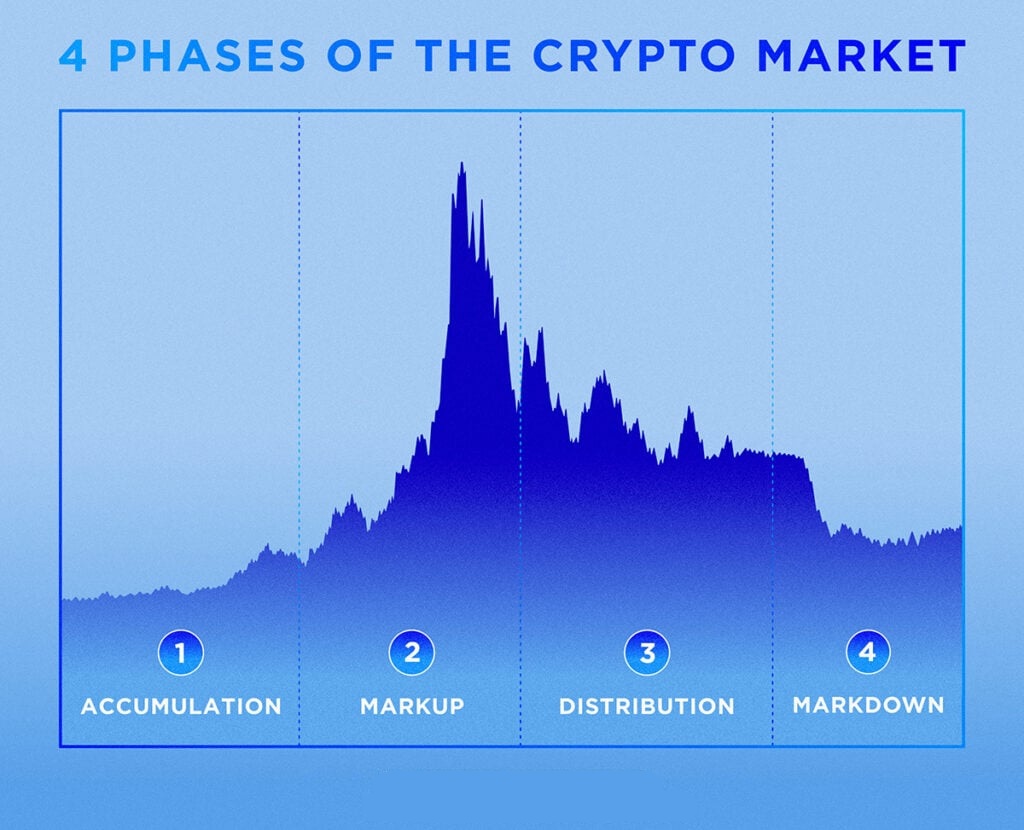

What Are Crypto Market Cycles?

Crypto cycles have features of both stocks and FX with unique supply mechanics (e.g., Bitcoin halvings) and regulatory sensitivity.

What Makes Crypto Cycles Special

Supply Shocks: Bitcoin's 2024 halving and subsequent issuance reduction are structural inputs that have historically preceded multi-stage bull runs and elevated volatility. Crypto cycles often follow these on-chain supply events.

Speculative Liquidity & Leverage: margin and derivatives amplify moves; liquidations can accelerate mark-downs.

Narrative-Driven Rallies: Technological or regulatory stories (such as ETF approvals or large institutions joining) can lead to rapid changes in sentiment.

Current Snapshot (Aug 2025):

Following the 2024 halving, cryptocurrency experienced significant surges heading into 2025.

However, various analysts caution about a possible correction period in late summer or early autumn, which is common in post-halving patterns, highlighting the need for attentiveness among short-term traders.

Media outlets and technical analysts suggest a possible pullback before a later cycle peak in late 2025.

Signals to Watch

1) On-Chain Metrics: Active addresses, realised volatility, exchange flows (massive outflows to cold wallets often signal accumulation).

2) Derivatives Open Interest & Funding Rates: Extremes often precede violent corrections.

3) Regulatory Headlines: Approvals, enforcement, or policy shifts move prices instantly.

4) Macro Liquidity: Crypto is sensitive to risk appetite and liquidity. When broader markets deleverage, crypto often leads the drop.

Practical Posture

In the mark-up stage, apply scaled entries and trend-following strategies while also monitoring funding rates.

In distribution or mark-down, reduce leverage, watch exchange flows, and consider safe-staking or cashing out into stablecoins.

Use on-chain data as a complement to technicals, as crypto has the advantage of transparent network information that can signal real shifts in participant behaviour.

Cross-Asset Interactions: How Cycles in One Market Transmit to Others

No market lives in isolation. Here are common transmission paths:

1) Monetary Policy Transmission

Central-bank moves hit rates → bond yields move → equity discount rates change → stock valuations reprice. The same rate moves alter FX carry trades and impact crypto liquidity.

2) Risk Sentiment Shocks

An unexpected equity sell-off reduces liquidity, increases credit spreads, and drives investors toward safe assets, which frequently boosts the dollar and depresses crypto.

3) Commodity/Currency Loops

Commodity price fluctuations influence foreign exchange (commodity currencies) and corporate profits, thereby impacting stock markets.

What Are the Trading and Portfolio Strategies That Respect Market Cycles?

For Investors (Multi-Year Horizon)

Align Allocation to Cycle Phase: Overweight equities in mark-up, rotate to quality and bonds in distribution, and increase cash/defensives in mark-down.

Diversify Across Uncorrelated Assets: Add FX carry or commodity exposure to smooth returns when equities weaken.

Use Laddered Entries: Build positions in tranches across phases rather than timing a single bottom.

For Traders (Shorter Horizon)

Trend Following in Distinct Policy Divergence Situations: In foreign exchange and stock markets, when central bank divergence is apparent.

Tight Risk Management in Crypto: Avoid high leverage near suspected distribution phases; use stop levels tied to funding and on-chain stress.

Event-Driven Plays: Utilise upcoming macro events (e.g., Jackson Hole, Fed rate decisions) while maintaining strict sizing since these events can trigger volatility spikes that present both opportunities and pitfalls.

Frequently Asked Questions

1. What Are the Four Main Stages of a Market Cycle?

The four stages are accumulation, uptrend (bull market), distribution, and downtrend (bear market).

2. How Long Does a Typical Market Cycle Last?

Market cycles can last from a few months to over a decade, depending on the market. For example, stock market cycles range from 4 to 10 years, whereas forex cycles tend to be shorter, and crypto cycles generally last 3 to 4 years, frequently linked to Bitcoin halving occurrences.

3. How Can Traders Identify Which Stage of the Market Cycle They Are In?

Traders often use a mix of technical indicators (moving averages, RSI, MACD), fundamental data (GDP, interest rates, earnings reports), and sentiment analysis (fear/greed indexes, volume trends) to determine the market's phase.

Conclusion

In conclusion, market cycles are unavoidable. The most successful market participants are not those who "predict" the top or bottom consistently, but those who use structured rules tied to indicators.

Thus, respect the cycles and treat each phase as a context for risk management rather than as a command to be either all-in or all-out.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.