The ECB (European Central Bank) Meeting on February 5 arrives with a rare tension in the euro’s macro story: inflation has slipped below target even as the currency is pressing near multi-month highs, tightening financial conditions without any formal policy move.

That combination raises the bar for a dovish pivot and increases the odds that today’s communication, not the rate decision itself, becomes the market-moving event.

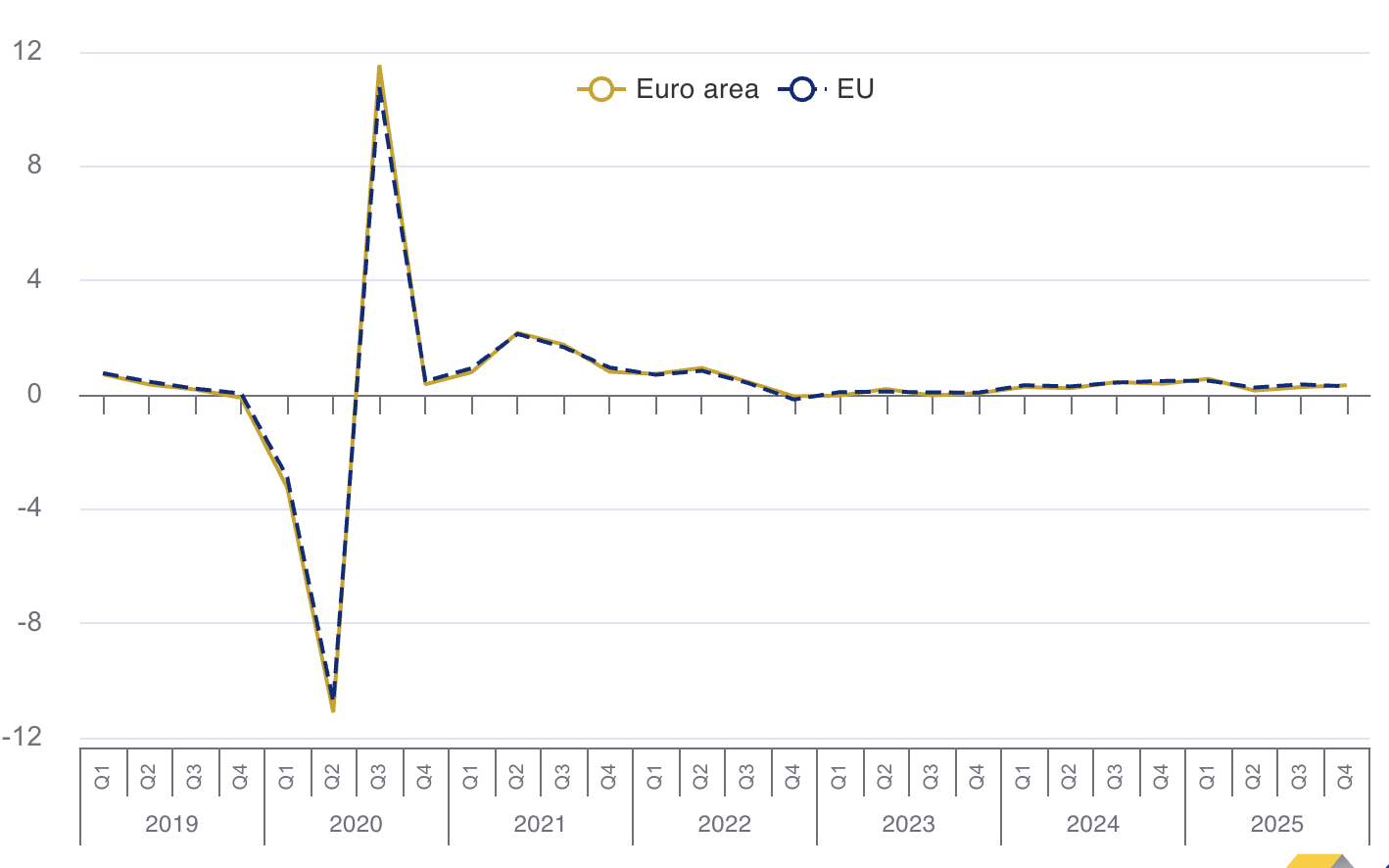

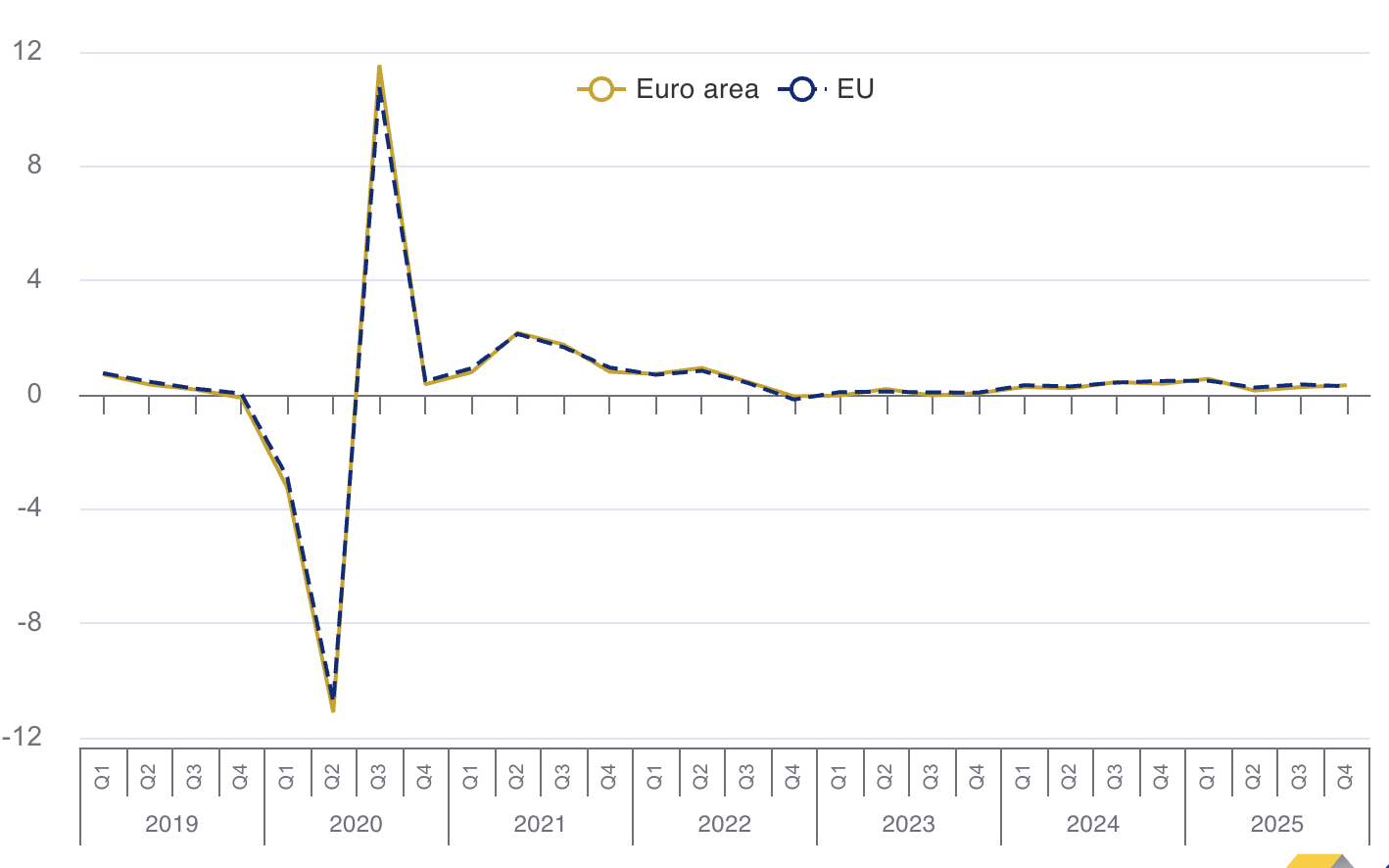

The setup is unusually clean. The deposit facility rate sits at 2.00%, unchanged since June 2025, while the euro area’s flash estimate shows headline inflation at 1.7% in January and core inflation at 2.2%. Growth is steady, with euro area GDP up 0.3% quarter-on-quarter in Q4 2025 and unemployment at 6.2% in December. The question for markets is whether the ECB frames the undershoot as temporary noise or as a reason to reopen the easing debate later in 2026.

Macro Snapshot Into the ECB Meeting

| Variable |

Latest reference |

Why it matters for the ECB Meeting |

| Deposit facility rate |

2.00% |

Current policy anchor and market baseline. |

| €STR |

1.931 |

Tracks effective overnight conditions and liquidity. |

| Euro area inflation (Jan) |

1.7% |

Below-target headline raises the “undershoot” debate. |

| Core inflation (Jan) |

2.2% |

Signals underlying pressures are easing but not dead. |

| Services inflation (Jan) |

3.2% |

Key stickiness risk for the ECB’s confidence. |

| GDP growth (Q4 2025) |

+0.3% q/q |

Resilience supports a long pause. |

| Unemployment (Dec) |

6.2% |

Labour tightness underpins wages and services. |

The constraint sits in credit transmission. The ECB’s bank lending survey for Q4 2025 reported an unexpected net tightening of credit standards for loans to firms, citing higher perceived risks and lower risk tolerance. This matters because it means “policy is still working” even with rates on hold. If the bank channel is tightening on its own, the ECB can argue that it does not need to cut simply because headline inflation dipped.

Why This ECB Meeting Matters More Than a Hold

A rates hold is the base case because the ECB already executed a full easing cycle: the deposit rate was cut to 2.00% effective June 11, 2025, and policy has been on pause since.

Today’s meeting is therefore a communications test: can the Governing Council maintain a “meeting-by-meeting” posture without letting markets price a fresh cutting wave simply because headline inflation dipped below 2%?

The ECB’s own December projections argue for patience. Staff forecasts published after the December 2025 meeting put average inflation at 1.9% in 2026 and 1.8% in 2027 before returning to 2.0% in 2028. That profile is not an emergency undershoot, but it is also not the kind of overshoot that demands restrictive policy.

The ECB’s job today is to keep the distribution of outcomes centred and to prevent the market from treating a single low print as a policy trigger.

Inflation Has Fallen Below Target, But the Composition Still Matters

The January flash estimate shows that disinflation is doing most of its work through energy and base effects. Energy prices were down 4.1% year-on-year, while food, alcohol and tobacco rose 2.3%. Core inflation fell to 2.2%, and services slowed to 3.2%.

The direction is ECB-friendly, but the level of services inflation still implies wage-driven persistence, which is exactly where the Governing Council wants to see clearer cooling before endorsing further easing.

The currency is back in the inflation model. EUR/USD peaked at 1.1974 on January 28 and remains elevated around 1.1820 in early February. That move tightens conditions at the margin, lowers imported-goods inflation, and tends to compress euro area traded-goods pricing power. If the ECB acknowledges that the exchange rate is materially contributing to downside inflation risk, the market will read it as a dovish signal even if the policy rate is unchanged.

Growth, Labour Markets, and the Bank Channel

The euro area is not flashing recession signals. GDP rose 0.3% quarter-on-quarter in Q4 2025, matching the prior quarter, with year-on-year growth at 1.3%. That is not a boom, but it is resilient enough to justify a long pause if the ECB believes inflation will return to target on its own.

Labour markets also remain tight by post-pandemic standards. Unemployment in the euro area fell to 6.2% in December 2025, with 10.792 million unemployed and youth unemployment at 14.3%. Stable employment reduces near-term downside tail risk, but it also makes wage-based services inflation harder to break.

For the ECB, that combination supports a patient stance: not cutting aggressively, not hiking, and waiting for clearer evidence that services will normalise.

What a “Hawkish Hold” Means at This ECB Meeting

A “hawkish hold” is not a threat to hike. It is a deliberate attempt to prevent markets from pulling forward rate cuts by insisting that the bar for easing has risen. In ECB terms, that stance usually shows up in three places:

Inflation narrative: whether the statement frames the undershoot as “temporary” and continues to emphasise services and wage persistence.

Reaction function: whether Lagarde stresses data dependence and refuses to validate market pricing for near-term cuts.

Financial conditions: whether the ECB treats euro strength as a downside inflation risk, or as a stabilising force that reduces the need for stimulus.

If markets are largely priced for a hold, then only guidance that shifts the expected path will generate follow-through. That is why today’s press conference often matters more than the policy line itself: it is where the ECB can cap expectations of further easing without sounding indifferent to an inflation undershoot.

Why the Euro Does Not Automatically Rally on an ECB Hold

EUR/USD trades on relative rates and on rate expectations. A hold at 2.00% is already the consensus. To keep the euro supported, the ECB needs to reduce the probability of future cuts or convince markets that policy is already close to neutral.

The other constraint is the US-euro yield gap. With US 10-year yields around 4.28% and Germany’s 10-year near 2.89%, the long-end differential remains roughly 140 basis points. That spread can continue to pull capital toward the US even if the ECB stays on hold, unless the ECB’s communication shifts the front-end differential in the euro’s favour.

Where Markets Are Positioned Ahead of the ECB Meeting

| Variable |

Latest reference |

Why traders care |

| ECB deposit facility rate |

2.00% |

Sets the anchor for euro short-rate expectations. |

| 10-year Bund yield |

2.89% |

Defines European term premium and risk appetite. |

| Italy 10-year yield |

3.49% |

Signals peripheral funding conditions. |

| BTP-Bund 10-year spread |

64 bp |

Fragmentation proxy, a stress trigger if it widens. |

| APP holdings (end-Jan) |

€2.527T |

Balance-sheet runoff path and liquidity outlook. |

| EUR/USD range (recent) |

1.149 to 1.197 |

Defines the current macro battleground. |

The calm in spreads is as important as the inflation print. A BTP-Bund spread in the mid-60s suggests the periphery is not forcing the ECB into an anti-fragmentation posture. That removes one of the usual reasons to lean dovish and supports a “higher-for-longer” pause even with headline inflation below target.

What to Watch During Today’s ECB Meeting

1) Does the ECB Treat 1.7% Inflation as a Signal or a Blip?

If Lagarde leans on the services component and refuses to engage with the undershoot, markets will interpret it as a hawkish hold. If she highlights the stronger euro and downside inflation risks, traders will begin rebuilding the case for a late-2026 cut.

2) How Directly Does the ECB Talk About the Euro?

A strong euro lowers inflation but also compresses exporters' profit margins and tightens conditions. Even a cautious acknowledgement that FX is “relevant” to the outlook can change the tone of the meeting. This is one of the cleanest tells because it links today’s market pricing directly to the ECB’s inflation mandate.

3) Balance Sheet and Liquidity: Does QT Become a Bigger Part of the Stance?

PEPP reinvestments ended at the end of 2024. APP holdings have continued to decline, with the APP bond stock at €2.527 trillion at end-January 2026 and sizable redemption months ahead, including an estimated €41.3 billion in February. If the ECB emphasises that passive runoff is tightening liquidity, it can justify holding rates steady even if inflation is soft.

4) Credit Conditions: Does the ECB Signal Comfort With Bank Tightening?

The bank lending survey shows a net tightening in lending to firms, even as housing credit eased slightly. If the ECB highlights this transmission channel, it strengthens the “pause” argument by implying that policy restraint is still feeding through the system.

EUR/USD Technical Levels Traders Are Watching

| Level zone |

Why it matters |

| 1.2000 |

Psychological resistance, close to late-January highs. |

| 1.1970 to 1.1980 |

Late-January peak area (recent cycle high). |

| 1.1720 to 1.1750 |

Pivot zone from early January, a common “retest” area. |

| 1.1620 to 1.1660 |

Mid-January base, breaks would signal momentum loss. |

| 1.1490 to 1.1520 |

Late-2025 support region, defines the downside range floor. |

The price action suggests the market has already tightened conditions for the ECB. That is why the euro’s reaction to the ECB Meeting is likely to be path-dependent: a hawkish hold that reduces cut pricing can keep the pair hovering near the highs, while any validation of downside inflation risks reopens the range and shifts focus back to the US rate premium.

What to Monitor After the ECB Meeting

The next data catalysts arrive quickly. Eurostat’s full January HICP release is scheduled for February 25, which will test whether the 1.7% print is confirmed or revised. The next GDP estimate for Q4 2025 is due February 13. Both releases can influence whether markets continue to assign only a small probability to a rate cut by September.

The next ECB policy meeting is already scheduled for March 18–19. If today’s press conference leaves ambiguity on the inflation undershoot, March becomes the next focal point for forward guidance and any shift in the reaction function.

Frequently Asked Questions (FAQ)

1) When is the ECB Meeting day?

The ECB Meeting concludes with the policy decision and the press conference on Thursday, February 5, 2026. The meeting itself runs over February 4–5, with markets typically reacting most strongly to the press conference tone and Q&A.

2) What is the ECB deposit facility rate right now?

The deposit facility rate is 2.00%, with the main refinancing operations rate at 2.15% and the marginal lending facility rate at 2.40%. These levels have been in place since June 11, 2025.

3) Why does inflation below 2% not automatically force the ECB to cut?

The ECB targets medium-term inflation, not a single monthly print. Services inflation remains elevated at 3.2%, and the ECB’s prior projections still showed inflation returning to 2.0% in 2028, which supports patience if the Governing Council believes the undershoot is temporary.

4) What is the most important signal in the ECB Meeting press conference?

Watch whether Lagarde treats the stronger euro as a material downside risk to inflation. If FX becomes a central part of the outlook, markets tend to price more easing even without an immediate rate cut.

5) What should investors watch besides rates?

Liquidity matters because, as PEPP reinvestments ended at the end of 2024, APP holdings are declining, and large redemption months can tighten reserves. The bank lending survey also matters because tighter credit standards can slow growth without any change in policy rates.

Conclusion

The most probable outcome of the ECB Meeting is a rate hold at 2.00%, but the market impact will come from the ECB’s interpretation of the inflation undershoot and the euro’s strength. With headline inflation at 1.7% and the currency near recent highs, the Governing Council must strike a narrow balance: acknowledge downside risks without reactivating a rate-cut narrative that it has spent months trying to retire.

A hawkish hold remains the path of least resistance because growth is steady, unemployment is low, spreads are calm, and credit conditions are already tightening through banks. If the ECB uses these facts to defend patience, the euro can stay supported, and volatility can remain contained. If the ECB instead centres on the strong euro and disinflation risks, markets will quickly rebuild easing expectations, and EUR/USD will likely slip back toward the middle of its recent range.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.