South Africa's rand (ZAR) and India's rupee (INR) don't usually make the tabloids, but for travellers, importers, miners, and remitters across the Indian Ocean, this pair matters. Below is a data-checked deep dive into where the rate is right now, how it's moved in the last week and months, and the macro forces pushing it around—followed by practical tips and a short outlook.

ZAR to INR Rate Today

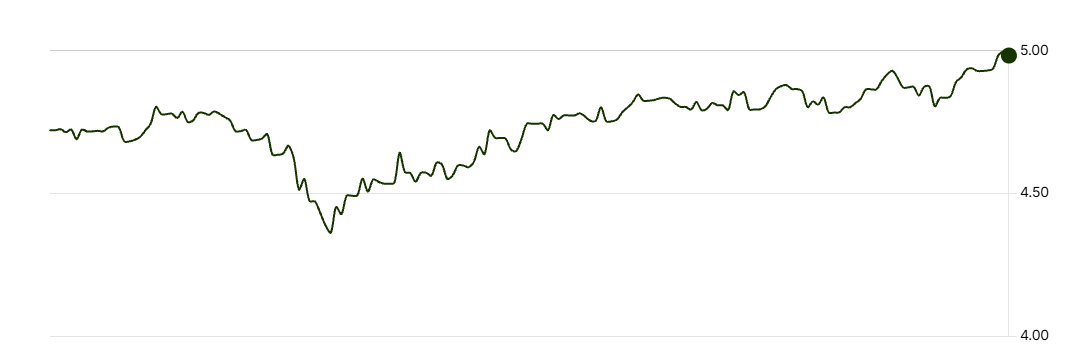

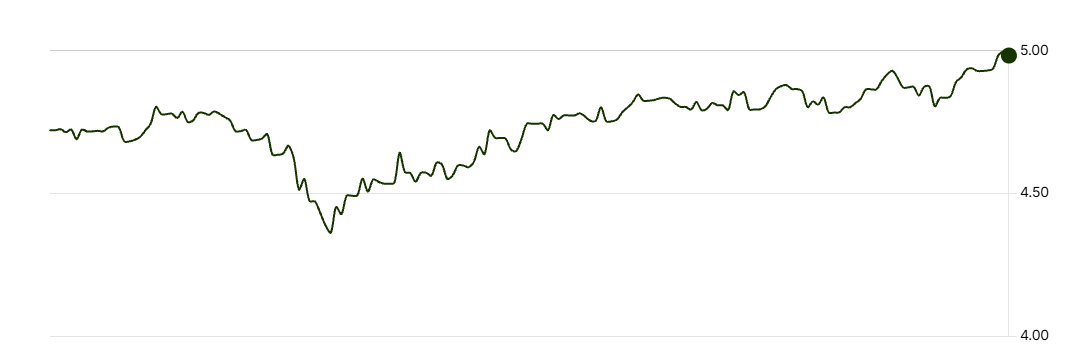

7-day context: Over the last week, the ZAR/INR rate peaked just under ₹5.00 and dipped to roughly ₹4.927. with the largest single-day move on 12 August. Net-net, the rand is up around 1% versus the rupee over the week.

Handy conversions at today's mid-market (≈₹4.982 per ZAR):

5 ZAR ≈ ₹24.91 • 10 ZAR ≈ ₹49.82 • 50 ZAR ≈ ₹249.09 • 100 ZAR ≈ ₹498.18 • 1.000 ZAR ≈ ₹4.981.84.

(The mid-market is a benchmark; retail providers may quote above/below it to include their margin.)

What's been moving ZAR/INR lately?

Think of ZAR/INR as a tug-of-war: global USD trends, South African dynamics, and Indian dynamics all matter.

1) The USD backdrop (indirect, but powerful)

Both ZAR and INR are highly sensitive to the dollar. Recent U.S. inflation prints that nudged markets toward Fed rate-cut hopes helped risk currencies, including the rand; subsequent hotter-than-expected data briefly dented that optimism and cooled the rand's bounce.

2) South Africa factors (the "ZAR leg")

Rates: The South African Reserve Bank (SARB) cut its repo rate by 25 bps to 7.25% on 29 May, and then by another 25 bps to 7.00% effective 1 August 2025. Lower domestic yields can trim rand carry appeal, although the effect depends on global conditions.

Local data flow: Investors keep an eye on mining output, unemployment, and retail data; lately, the rand's day-to-day has often been more about global drivers than domestic releases, with South African bonds broadly steady.

3) India factors (the "INR leg")

RBI stance and USD/INR line-watching: The rupee has traded near ₹87.5 per USD this week, with market chatter of RBI smoothing when levels approach record-weak territory (around ₹87.95 per USD). That policy backdrop influences all INR crosses, including ZAR/INR.

Flow and risk sentiment: Ahead of holidays or major geopolitical events, INR liquidity can thin, and global risk tone (e.g., U.S. policy or commodities) tends to do more of the steering.

Recent ZAR to INR Rate History and Volatility—What the Numbers Say

Weekly range: ~₹4.927 (10 Aug) to ~₹4.996 (14 Aug). That's a fairly tight band given the macro noise, showing mild positive drift for ZAR against INR.

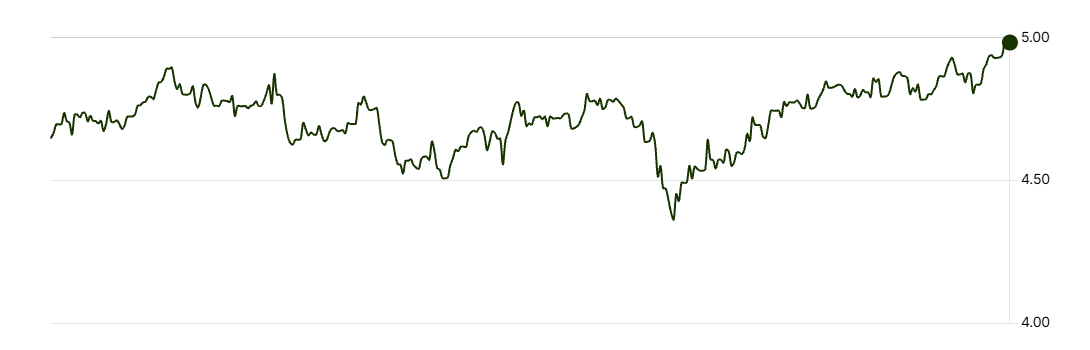

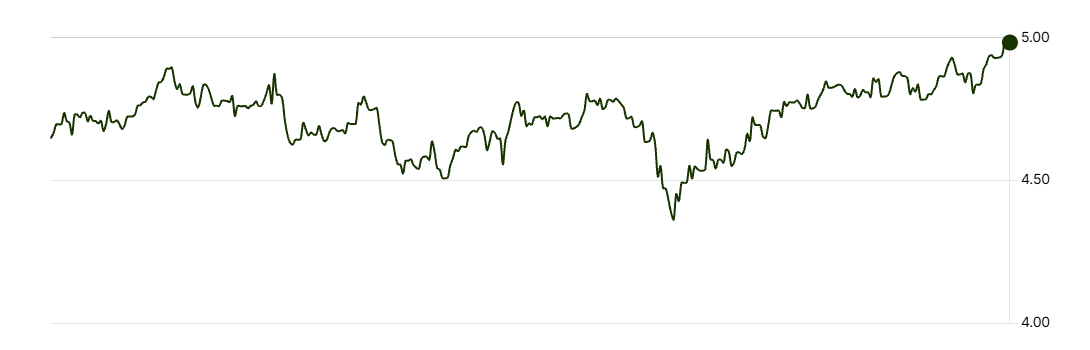

Six-month extremes: ~₹4.361 (9 Apr) to ~₹4.996 (14 Aug), a swing of roughly +15% from trough to peak—illustrating why timing matters if you're converting larger sums.

Year-to-date average: ~₹4.718 (2025 average so far), consistent with the six-month mean in the mid-₹4.7s.

Practical implications and conversion tips

1. Mind the provider spread: The live mid-market is a benchmark; banks and remittance firms often add a markup (and fees). Always compare the all-in INR you'll actually receive. Wise's converter explicitly warns about mark-ups embedded in retail quotes—use it as a neutral yardstick when shopping around.

2. Batching and timing: For sizeable transfers, consider staggering conversions or using rate alerts so you're not forced to deal at an intraday low. (Wise supports alerts; many brokerages and apps do as well.)

3. Watch the drivers that matter for this pair:

Fed expectations (dovish tilt tends to aid ZAR; hawkish surprises can hurt).

SARB tone and South African data (additional easing or weak data can weigh).

RBI's USD/INR management (defence near record-weak levels can stabilise INR across crosses).

Gold and base-metals prices (often positively correlated with ZAR performance).

Outlook: near-term scenarios (what seems most plausible)

No one can forecast FX with certainty, but conditional thinking helps:

Base case: If the Fed cut narrative survives and commodity prices hold, ZAR resilience can persist, leaving ZAR/INR hovering near ₹4.9–₹5.0 with typical day-to-day chop. INR stability efforts vs USD could dampen volatility in ZAR/INR.

Bullish ZAR/INR risk: Softer U.S. data and firmer gold could nudge the cross above ₹5.00 on spikes.

Bearish ZAR/INR risk: A hotter U.S. data run (or global risk-off) that revives the dollar, plus any SARB-leaning dovish messaging, could push the pair back towards the mid-₹4.8s.

Reality check: Automated "daily range" forecasts from some retail FX sites exist, but they're model-driven and not guarantees—use them as a sanity check, not a plan.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.