In forex trading, one of the most critical aspects of success is knowing how much profit or loss you stand to make before entering a trade. This is where a Forex Profit Calculator becomes an essential tool. By using it, traders can estimate potential returns, assess risks, and make informed decisions.

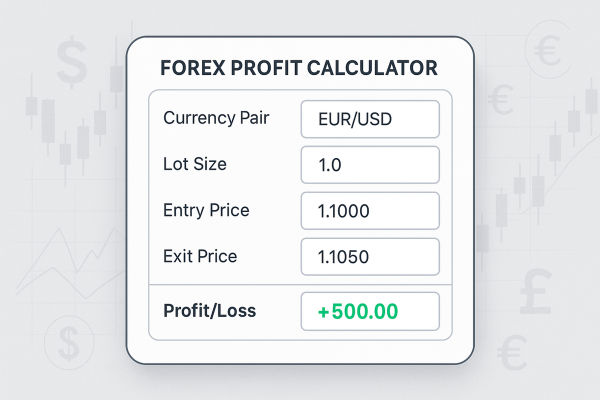

In short, a profit calculator helps you input key trade details such as currency pair, lot size, entry price, and exit price to see exactly what your potential outcome might be.

This guide will outline what a forex profit calculator is, its significance, how to utilise it in a step-by-step manner, and how it can be integrated into your trading strategy.

What Is a Forex Profit Calculator?

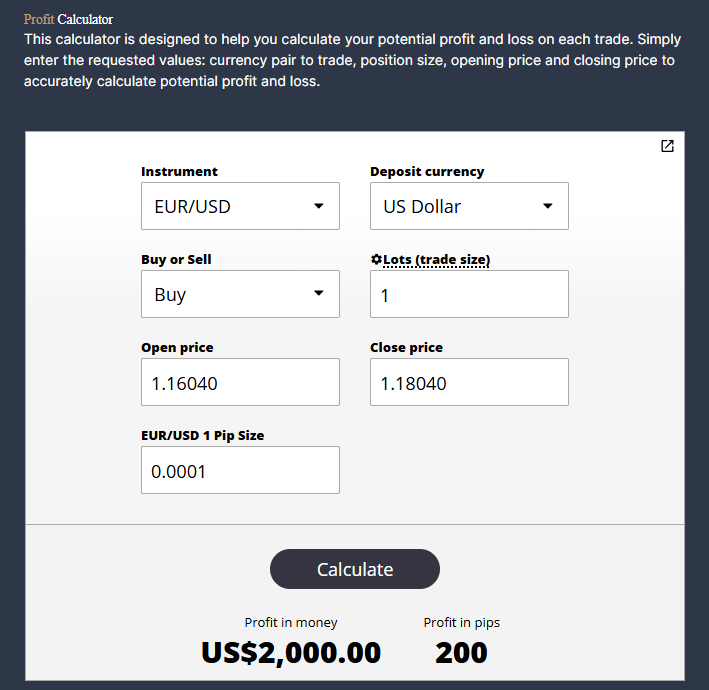

A Forex Profit Calculator is an online tool that helps traders estimate their profit or loss on a trade. It works by calculating the difference between the opening and closing prices of a currency pair, taking into account the trade size (lot), pip value, and account currency.

For example, if you plan to buy EUR/USD at 1.0800 and sell at 1.0900 with a standard lot, a profit calculator instantly shows your projected profit. This prevents manual errors and helps traders plan their trades with precision.

EBC Financial Group provides traders with an easy-to-use online Forex Profit Calculator. It allows you to quickly estimate profits or losses in different currency pairs, with accurate pip values, lot sizes, and conversions into your account currency.

Using EBC's calculator can help you:

Plan trades more effectively.

Improve your money management.

Save time compared to manual calculations.

This makes EBC's platform a powerful ally for traders at all levels.

How Does a Forex Profit Calculator Work?

A profit calculator takes the input values from a trade and produces the expected outcome. The formula is generally:

Profit or Loss = (Closing Price – Opening Price) × Lot Size × Pip Value

Lot Size: Standard (100,000 units), Mini (10,000 units), Micro (1,000 units).

Pip Value: The value of one pip movement in the chosen currency pair.

Entry & Exit Prices: Determine how many pips you win or lose.

Example:

If you buy 1 standard lot of EUR/USD at 1.1000 and sell at 1.1050, you make 50 pips. With each pip worth $10 on a standard lot, your profit is $500.

A forex profit calculator performs this calculation instantly, even for more complex trades, saving traders from manual effort.

Manual Calculation of Forex Profit

Although calculators make the process easier, knowing the manual method helps traders understand what's happening behind the scenes.

Calculate the pip difference between the entry and exit price.

Example: Buy EUR/USD at 1.1000 and sell at 1.1030 → difference = 30 pips.

Multiply by pip value based on lot size.

Standard lot = $10 per pip.

So, if you traded 2 mini lots and gained 30 pips, profit = 30 × $1 × 2 = $60.

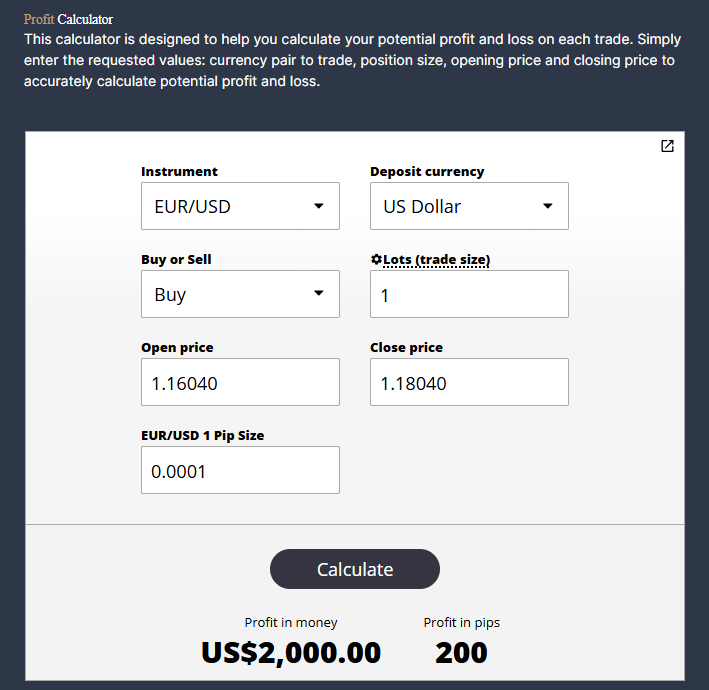

Step-by-Step Guide to Using a Forex Profit Calculator

Step 1: Choose Your Currency Pair

Select the pair you plan to trade, such as EUR/USD, GBP/JPY, or USD/ZAR.

Step 2: Input Trade Size

Enter your lot size (standard, mini, or micro). It determines the amount of money involved.

Step 3: Enter Entry and Exit Prices

Provide the opening price where you plan to enter and the closing price where you expect to exit.

Step 4: Select Account Currency

Set your account base currency (USD, EUR, INR) to convert the profit accordingly.

Step 5: View Results

The calculator instantly shows your potential profit or loss in your account currency. This simple process allows traders to plan trades with clarity before execution.

Why Use a Forex Profit Calculator Before Trading?

Many traders underestimate the importance of calculating their trade outcome before executing it. Here are the main reasons why a profit calculator is crucial:

Risk Management: You can determine how much you are risking per trade.

Planning Ahead: Helps you set realistic targets and stop-loss levels.

Accuracy: Eliminates human error when calculating pips and profit manually.

Time Efficiency: Saves time in fast-moving markets.

Confidence in Trading: Provides clarity before entering a position.

In simpler terms, using a forex profit calculator reduces uncertainty and ensures you trade with a well-informed plan.

Advantages and Risks of Using a Forex Profit Calculator

| Advantages |

Risks / Limitations |

| Saves time by instantly calculating potential profit or loss |

May give misleading results if the trader inputs incorrect trade details |

| Helps traders understand pip values, lot sizes, and risk exposure |

Does not always account for broker spreads, commissions, or slippage |

| Improves risk management by showing outcomes before entering a trade |

Overreliance may prevent traders from learning manual calculations |

| Useful for both beginners and experienced traders |

Can vary in accuracy depending on the platform or broker providing it |

| Available for free on most broker websites like EBC Financial Group

|

Some calculators may not support all exotic currency pairs or account types |

| Makes trade planning more efficient and less stressful |

Traders might ignore other important factors like news events or market volatility |

Forex Profit Calculator vs Other Trading Calculators

Besides a profit calculator, traders often use:

Pip Calculator: To find the value of each pip in a trade.

Margin Calculator: To know how much margin is needed to open a position.

Position Size Calculator: To balance risk and reward per trade.

Swap Calculator: To estimate overnight financing charges.

The forex profit calculator complements these tools, giving a complete overview of potential gains and losses.

Why Every Trader Should Use a Forex Profit Calculator

Trading without knowing your potential gain or loss is like sailing without a compass. A profit calculator ensures you always trade with awareness. It is helpful for:

Scalpers who make multiple quick trades daily.

Swing traders who hold positions for days.

Long-term investors who are analysing big moves.

Regardless of the approach, profit calculators enhance decision-making and guard against reckless risk-taking.

Frequently Asked Questions

Q1. What Is a Forex Profit Calculator?

A Forex Profit Calculator is an online tool that helps traders estimate potential profit or loss from a trade by calculating pip value, lot size, and price movement.

Q2. Can Beginners Use a Forex Profit Calculator?

Yes, beginners can use it easily since it requires only basic inputs, making it a great learning tool to understand pip values and lot sizes in forex trading.

Q3. Does a Forex Profit Calculator Include Spreads and Commissions?

Most calculators do not automatically include spreads or commissions, so traders must manually consider these expenses when assessing trade results.

Q4. Where Can I Find a Reliable Forex Profit Calculator?

Many brokers, including EBC Financial Group, offer free online Forex Profit Calculators that are accurate, fast, and beginner-friendly.

Conclusion

In conclusion, a Forex Profit Calculator is one of the most valuable tools in a trader's arsenal. It provides clarity, helps in planning trades, and improves risk management.

Whether you are a beginner just starting or an experienced trader managing multiple positions, incorporating a profit calculator into your routine is essential.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.