GBP/USD is experiencing a regime shift as the policy-rate gap has effectively closed, rendering 'carry' less influential than when the Federal Reserve maintained a significant lead over the Bank of England. With the spot rate near 1.37, future sustained movements are expected to be driven by relative growth surprises, inflation persistence, and risk sentiment, rather than a straightforward 'higher yield wins' dynamic. [1][2][9]

Immediate catalyst risks are concentrated, with the Bank of England’s next policy decision scheduled for February 5, 2026, and the subsequent U.S. jobs report on February 6, 2026. When the rate spread is narrow, event risk becomes more significant as it can influence the expected trajectory of rate cuts rather than the absolute level of rates. [1][8]

Tradeable Takeaways For GBP/USD

Policy rates are now closely aligned, with the Bank of England (BoE) Bank Rate at 3.75% and the Federal Reserve targeting a range of 3.50% to 3.75%. This alignment compresses forward points and increases GBP/USD sensitivity to data surprises and global risk appetite. [1][2]

UK inflation has increased, with the Consumer Price Index rising to 3.4% year-over-year in December 2025 from 3.2%. Services inflation and wage dynamics remain critical factors for the Bank of England’s assessment of progress toward a 'sustainable' 2% target. [3][1]

Labor market slack is increasing in the UK, with unemployment at 5.1% from September to November 2025. Although pay growth is moderating, it remains elevated relative to a 2% inflation environment. These conditions support a gradual approach to Bank of England easing rather than a rapid rate-cutting cycle. [4]

The United States is experiencing disinflation, though at a moderate pace. In December, the Consumer Price Index was 2.7% year-over-year and core CPI was 2.6%, while core Personal Consumption Expenditures inflation was 2.8% year-over-year in November. These figures prompt the Federal Reserve to maintain a cautious stance until greater confidence in sustained disinflation emerges. [6][7]

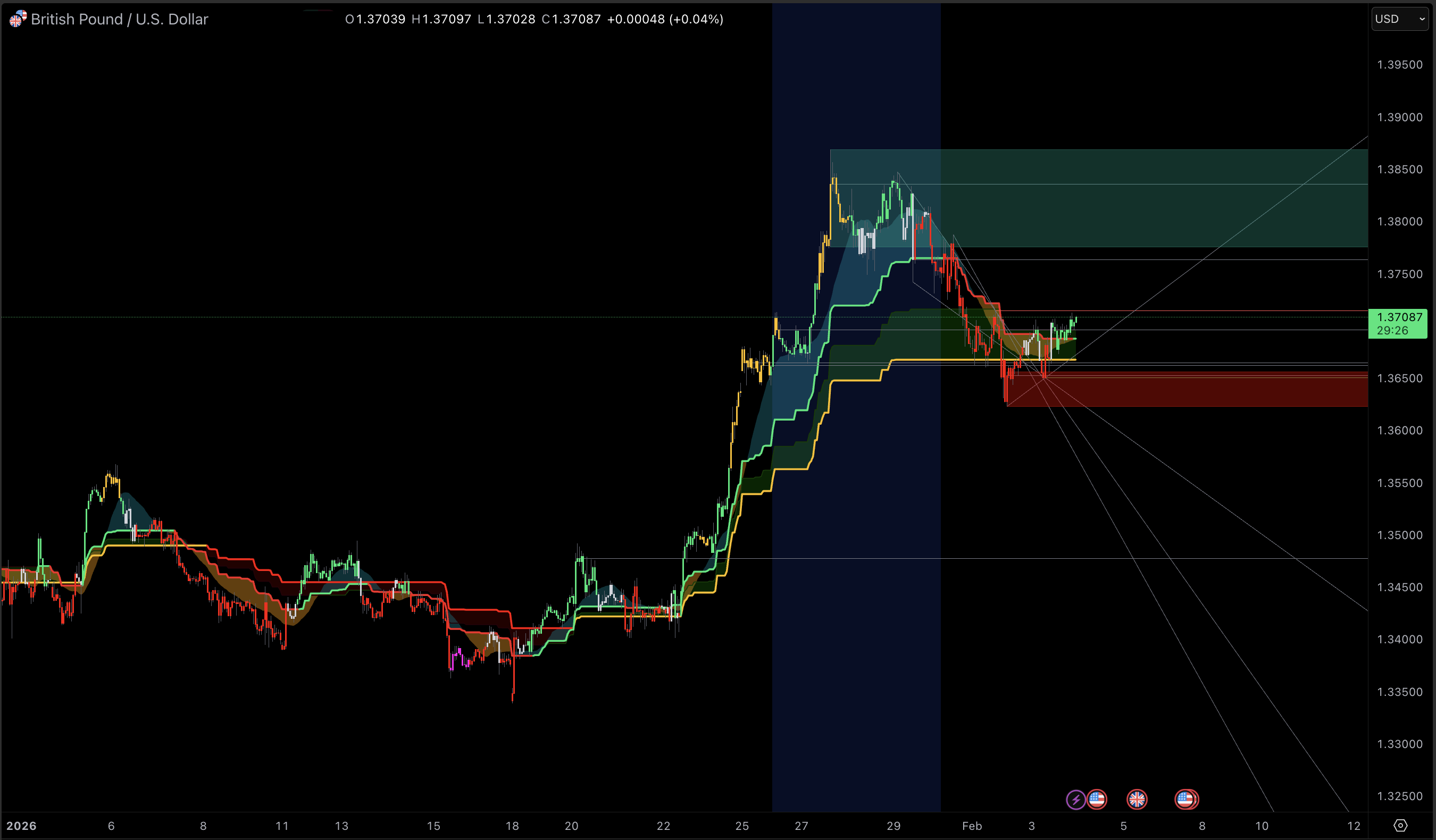

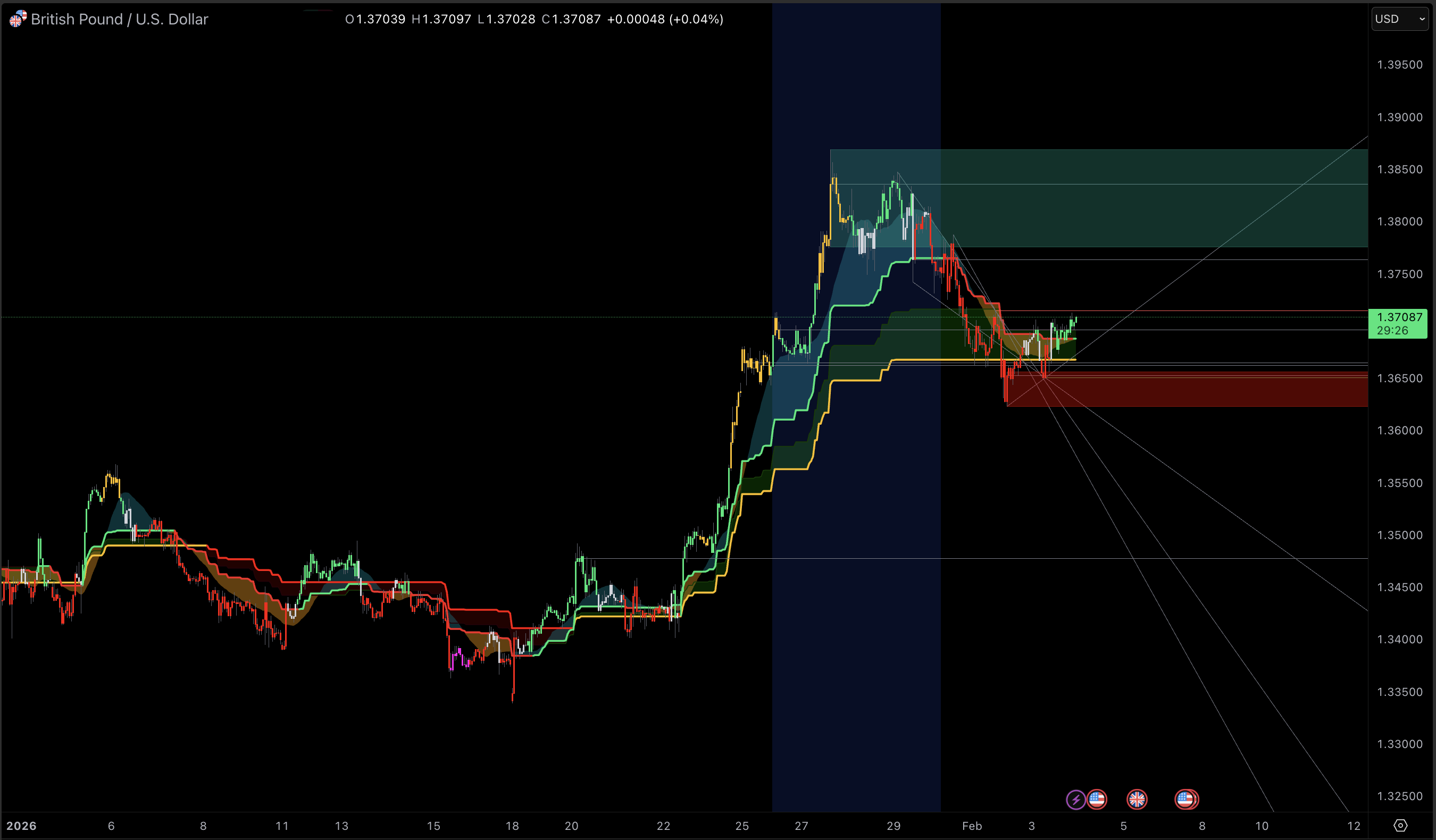

Technical indicators suggest a constructive outlook above the medium-term trend, although momentum is not excessive. The Relative Strength Index (RSI) is near 59, and the price remains above key exponential moving averages, with pivot resistance clustered between 1.37 and 1.38.

The base case anticipates a modest upside for GBP as long as the Federal Reserve maintains a neutral stance and UK data stabilize. However, sustained rallies require confirmation from improvements in UK real activity and favorable risk conditions. Conversely, breakdowns may accelerate if global risk sentiment deteriorates and the US dollar regains its funding premium.

Where Policy Really Stands: BoE Vs Fed

Bank Of England: Cutting, But Still Signaling Restraint

Bank Of England: Cutting, But Still Signaling Restraint

The BoE cut Bank Rate to 3.75% in December 2025 on a narrow 5 to 4 vote. The minutes explicitly frame future easing as gradual and contingent on inflation persistence risks continuing to fade. The BoE also notes policy has been reduced 150 bps since August 2024, but decisions are becoming “a closer call,” which is central-bank speak for higher meeting-to-meeting optionality. [1]

Implication for GBP/USD: the BoE is not pre-committing to a fast sequence of cuts. That reduces the odds of a structural sterling underperformance driven solely by rate expectations.

Federal Reserve: Range Held, Path Dependent

The Fed is directing policy to maintain the federal funds rate in a 3.50% to 3.75% target range effective January 29, 2026. With the top of the range matching the BoE’s Bank Rate, the differential that previously supported USD carry has narrowed materially. [2]

Implication for GBP/USD: the market will price relative timing of easing, not a wide level gap. That pushes attention to the next two inflation prints, labor market cooling speed, and financial conditions sensitivity.

The Data That Matters Most For The Next 1 To 3 Months

United Kingdom: Inflation Up-Tick, Labor Cooling, Growth Still Fragile

Inflation: UK CPI rose to 3.4% YoY in December 2025 (from 3.2%), and CPIH to 3.6% (from 3.5%). The direction matters because the BoE is trying to avoid cutting into a second-round services inflation problem. [3]

Labor market: unemployment is 5.1% (Sep to Nov 2025). Regular pay growth is 4.5%, total pay 4.7% (Sep to Nov 2025). That is cooler than prior peaks, but still high relative to consistent 2% inflation without extreme productivity. [4]

Activity: the ONS GDP monthly estimate shows real GDP up 0.1% in the three months to November 2025, with services up 0.2% and production slightly down. That is “not recessionary collapse,” but it also lacks the momentum to absorb shocks. [5]

United States: Sticky-Enough Inflation, Slower Jobs Growth, Solid Prior GDP

CPI: headline CPI is 2.7% YoY in December 2025, core CPI 2.6% YoY. This supports the case that inflation is not re-accelerating, but it also keeps the Fed from cutting aggressively without clearer labor weakening. [6]

PCE: core PCE inflation is 2.8% YoY in November 2025, matching headline PCE at 2.8% YoY. For the Fed, this is the cleaner signal than CPI. [7]

Jobs: December 2025 payrolls rose 50,000, unemployment held at 4.4%, and private average hourly earnings were up 3.8% over the year. That is a cooling labor market, but not an abrupt deterioration. [8]

Rates backdrop: U.S. 2-year yields around 3.57% and 10-year around 4.29% indicate the market still prices a meaningful term premium and a non-trivial neutral rate. This supports the dollar during risk-off episodes, even as policy rates converge. [10][11]

Overlooked Point: When Carry Shrinks, Flow Dynamics Change

When short-rate differentials compress, two things tend to matter more for GBP/USD than most traders model:

Hedging friction falls. With a smaller USD carry advantage, the “penalty” for hedging USD exposure back into GBP declines. That can reduce structural USD demand from hedged global portfolios at the margin, allowing sterling rallies to travel further when UK data are merely “less weak” than feared.

Relative growth surprises dominate. With less carry to anchor positioning, GBP/USD becomes more reactive to the surprise component of PMI, wage, and inflation prints. That raises the probability of sharp, data-driven moves that do not immediately mean-revert.

External financing sensitivity rises. The UK still runs a current account deficit, meaning it relies on net capital inflows over time. The ONS puts the underlying deficit (excluding precious metals) at 1.4% of GDP in Q3 2025. If global risk appetite fades, that financing channel can quickly become a sterling headwind. [12]

Macro Dashboard: What Matters Most for GBPUSD now

| Indicator |

United Kingdom |

United States |

Why it matters for GBPUSD |

| Policy rate |

3.75% |

3.50%–3.75% |

Nominal gap is minimal, so FX reacts more to expectations and risk premia. |

| CPI inflation |

3.4% |

2.7% |

Higher UK inflation reduces sterling’s real-rate support. |

| Core inflation |

3.2% |

2.6% |

UK core stickiness limits BoE flexibility. |

| Services inflation |

4.5% |

3.0% (services less energy services) |

Services pressure keeps UK policy cautious; US services are cooler. |

| Unemployment rate |

5.1% |

4.4% |

Softer UK labor supports easing; US labor remains tighter. |

| GDP growth |

+0.1% q/q (Q3 2025) |

+4.4% annualized (Q3 2025) |

Relative growth momentum still leans USD-positive. |

| External balance proxy |

Net borrowing vs RoW: 1.8% of GDP (Q3 2025) |

Structural safe-asset demand |

UK is more exposed to shifts in global risk appetite. |

GBPUSD Technical Analysis: Levels That Map to the Macro Narrative

Sterling is not in a stretched trend. It is in a constructive, but tactical, uptrend where breakouts require fresh macro confirmation.

Technical Signal Table (daily snapshot)

| Indicator |

Reading |

What it suggests |

| RSI (14) |

58.98 |

Positive momentum without overbought conditions. |

| MACD (12,26) |

0.003 (signal ~0.002) |

Mild bullish bias; momentum is positive but not explosive. |

| EMA 20 |

1.3650 |

Near-term trend support sits just below spot. |

| EMA 50 |

1.3507 |

Medium-term support that aligns with a “risk-off retrace” scenario. |

| EMA 200 |

1.3195 |

Long-term trend remains upward while price holds well above this level. |

| Support (classic pivots) |

S1 1.3658; S2 1.3594; S3 1.3550 |

Breaks below S1 shift the bias from “buy dips” to “sell rallies.” |

| Resistance (classic pivots) |

R1 1.3766; R2 1.3810; R3 1.3874 |

A sustained break above R2 is consistent with the bullish macro scenario. |

| Trend |

Up |

Structure supports sterling while price holds above the 20-day and 50-day averages. |

| Momentum |

Mildly bullish |

The market needs a catalyst to convert trend into acceleration. |

The technical picture reinforces the macro conclusion: the next move is likely catalyst-driven, not purely trend-following. If policy messaging pushes real-rate expectations toward the US, the pullback can be sharp even without a significant change in the nominal policy gap. If the Fed’s easing path becomes more credible while the BoE stays constrained by services inflation, the market has room to extend higher without being technically stretched.

Scenario Map: Three Paths For GBP/USD

Scenario 1: Grind Higher Toward 1.40

Setup: UK inflation continues easing in services, and wage momentum softens, allowing the BoE to cut gradually without sounding alarmed. The U.S. keeps disinflating but avoids a growth re-acceleration that would push Treasury yields higher.

Triggers to watch: UK pay prints and services-sensitive inflation components, plus U.S. core CPI and core PCE staying on a gentle downtrend. [3][4][6][7]

Market behavior: GBP/USD can work higher in steps, with dips bought as long as U.S. yields do not break higher and risk conditions stay constructive.

Scenario 2: Range Trade, Mean Reversion Around 1.35 To 1.40

Setup: both central banks look “careful,” inflation declines but slowly, and data are mixed enough to keep cuts spaced out.

Triggers: alternating surprises, plus choppy risk sentiment.

Market behavior: GBP/USD respects round-number pivots, volatility clusters around data days, and trend attempts fade without follow-through.

Scenario 3: Downshift Back Toward 1.33 And Below

Setup: U.S. growth or inflation surprises to the upside, pushing Treasury yields higher, while the UK data flow looks softer and the BoE leans more dovish. Alternatively, a global risk-off phase lifts the dollar’s funding premium.

Triggers: a rebound in U.S. inflation momentum or a repricing higher in the U.S. 2-year and 10-year complex, plus UK activity wobble. [10][11][5]

Market behavior: sterling tends to underperform in risk-off because of the UK’s external financing needs, and because GBP is a “high beta” G10 currency relative to USD.

Tactical Levels And Risk Management

GBP/USD last printed 1.3729 on the Fed’s H.10 noon buying rate series (via FRED). Treat 1.37 as the near-term pivot: it is close enough to current pricing that positioning can flip quickly on a single data surprise. [9]

Upside reference: sustained acceptance above 1.40 increases the odds that the market is repricing the easing path against the USD rather than simply oscillating.

Downside reference: a decisive move below 1.35 shifts the burden of proof back to sterling bulls and raises the likelihood of a push toward the low-1.30s.

Practical risk controls for an outlook article:

Anchor invalidation to the data regime, not one candle. For example, two consecutive UK wage prints cooling materially and U.S. core inflation surprisingly higher, are a regime change.

Use event clustering: the BoE decision (Feb 5) and U.S. payrolls (Feb 6) can produce gaps and stop runs. Position sizing matters more than precision. [1][8]

Frequently Asked Questions (FAQ)

1) What Drives GBP/USD The Most Right Now?

With BoE and Fed policy rates nearly aligned, GBP/USD is being driven more by relative growth surprises, inflation persistence signals, and risk sentiment than by simple carry. Watch UK wages and services inflation versus U.S. core CPI and core PCE for the cleanest policy signals. [4][6][7]

2) Is The BoE More Likely To Cut Faster Than The Fed?

The BoE is signaling gradual easing, but the UK’s inflation and wage backdrop still argues for caution. The Fed also remains data-dependent, with core inflation still below 2%. The “faster cutter” will likely be decided by the next few labor and inflation releases, not forward guidance. [1][2][4]

3) Why Can GBP/USD Fall Even If UK Rates Are Not Much Lower?

Sterling is more sensitive to global risk-off conditions and to the UK’s reliance on external capital inflows over time. Even with similar policy rates, USD can strengthen when U.S. yields rise or when investors demand liquidity and safety, pressuring higher-beta FX like GBP. [12][10]

4) Which Inflation Measure Matters Most For The Fed, And Why?

The Fed focuses heavily on PCE inflation, especially core PCE, because it has broader coverage and different weighting than CPI. Recent data show core PCE up 2.8% YoY (Nov), which is close to but still above a 2% target-consistent trend, keeping the Fed cautious. [7]

5) Is the Fed expected to cut aggressively through 2026?

The baseline implied by the December 2025 projections is gradual. The median projection places the policy rate midpoint at 3.4% at end-2026, only modestly below the current midpoint of 3.625%. That suggests limited cuts unless the data deteriorate. [13]

6) What Levels Matter Most For GBPUSD In The Near Term?

The market is hovering around a pivot zone near 1.37. Support sits near the mid-1.36s, while resistance clusters in the upper-1.37s to low-1.38s. A break above the low-1.38 area aligns with a Fed-easing-led upside scenario.

7) What Is The Cleanest Bullish Signal For GBP/USD From Here?

A bullish signal is a combination of easing UK wage pressure and stable activity, alongside continued U.S. disinflation that keeps Treasury yields from repricing higher. If that mix persists, the dollar’s advantage from yield and safety premium tends to fade, opening room for GBP/USD to press higher. [4][5][10]

Conclusion

GBP/USD’s next move is less about “BoE versus Fed” in the old carry sense and more about who delivers the next meaningful surprise in growth and inflation. With the BoE Bank Rate at 3.75% and the Fed targeting 3.50% to 3.75%, the macro-microstructure has changed: smaller forward points magnify the impact of data, risk sentiment, and cross-border flows. [1][2]

Base case: modest GBP upside bias as long as UK labor cooling continues without a growth break, and U.S. disinflation persists without a re-acceleration in yields. The near-term fork is event-driven, with the BoE decision and the U.S. jobs report back-to-back, which could quickly reprice the easing path. [1][8]

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Sources

[1] https://www.bankofengland.co.uk/monetary-policy-summary-and-minutes/2025/december-2025

[2] https://www.federalreserve.gov/newsevents/pressreleases/monetary20260128a1.htm

[3] https://www.ons.gov.uk/economy/inflationandpriceindices/bulletins/consumerpriceinflation/december2025

[4] https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/bulletins/uklabourmarket/january2026

[5] https://www.ons.gov.uk/economy/grossdomesticproductgdp

[6] https://www.bls.gov/cpi/news.htm

[7] https://www.bea.gov/news/2026/personal-income-and-outlays-october-and-november-2025

[8] https://www.dol.gov/newsroom/economicdata/empsit_01092026.pdf

[9] https://fred.stlouisfed.org/series/DEXUSUK/

[10] https://fred.stlouisfed.org/series/DGS2

[11] https://fred.stlouisfed.org/series/DGS10/

[12] https://www.ons.gov.uk/economy/nationalaccounts/balanceofpayments

[13] https://www.federalreserve.gov/monetarypolicy/fomcprojtabl20251210.htm