Dividend Kings are companies that have increased their dividends every year for at least 50 consecutive years. Maintaining that record requires consistent cash generation, disciplined balance-sheet management, and the ability to sustain payouts through economic downturns and inflationary periods.

The 50-year requirement places these companies in a category of their own. It is twice the standard used for Dividend Aristocrats and reflects businesses that have remained profitable and cash-generative across multiple recessions, market cycles, and leadership changes without interrupting dividend growth.

Top 25 Dividend Kings Ranked by Dividend Yield (As Of 2026)

| Rank |

Company |

Ticker |

Sector |

Dividend Yield |

Annual Dividend |

| 1 |

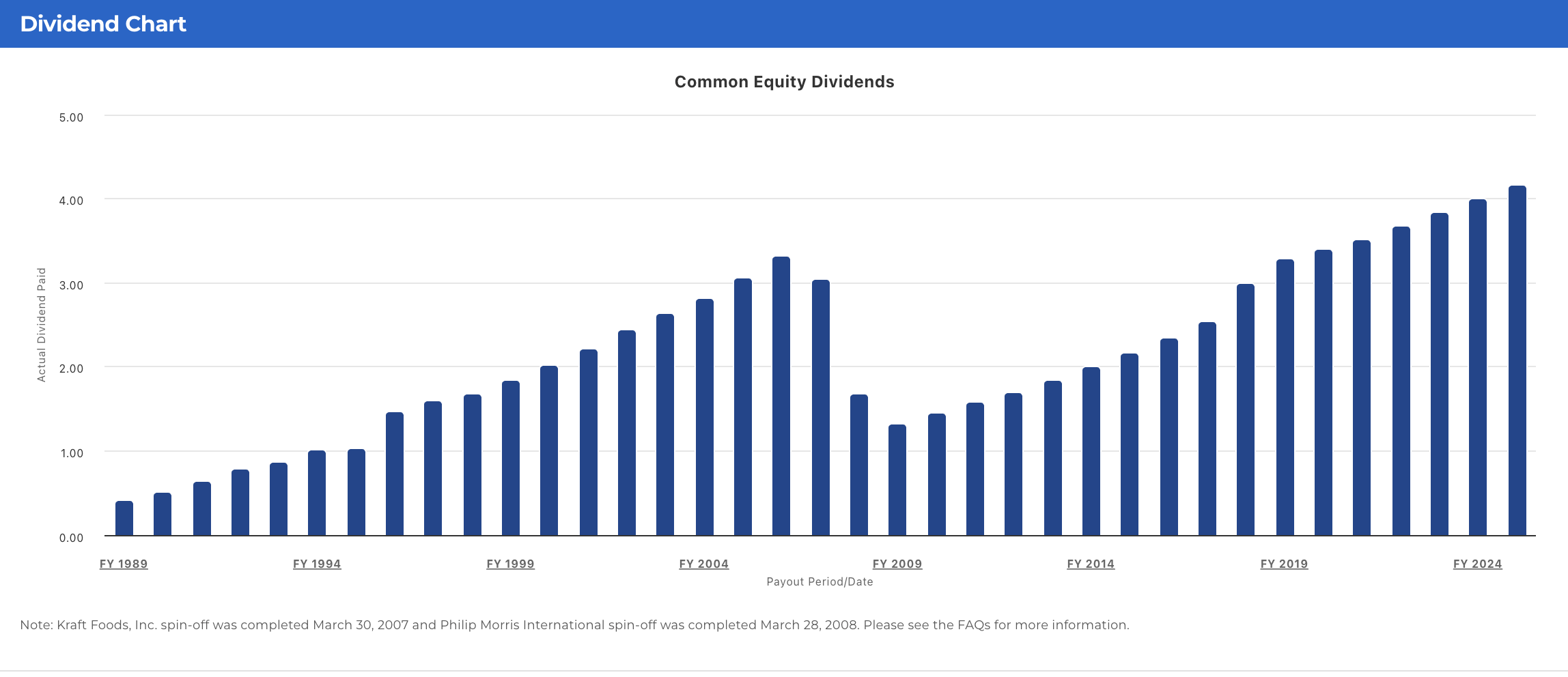

Altria Group |

MO |

Consumer Staples |

~7.3% |

~$4.24 |

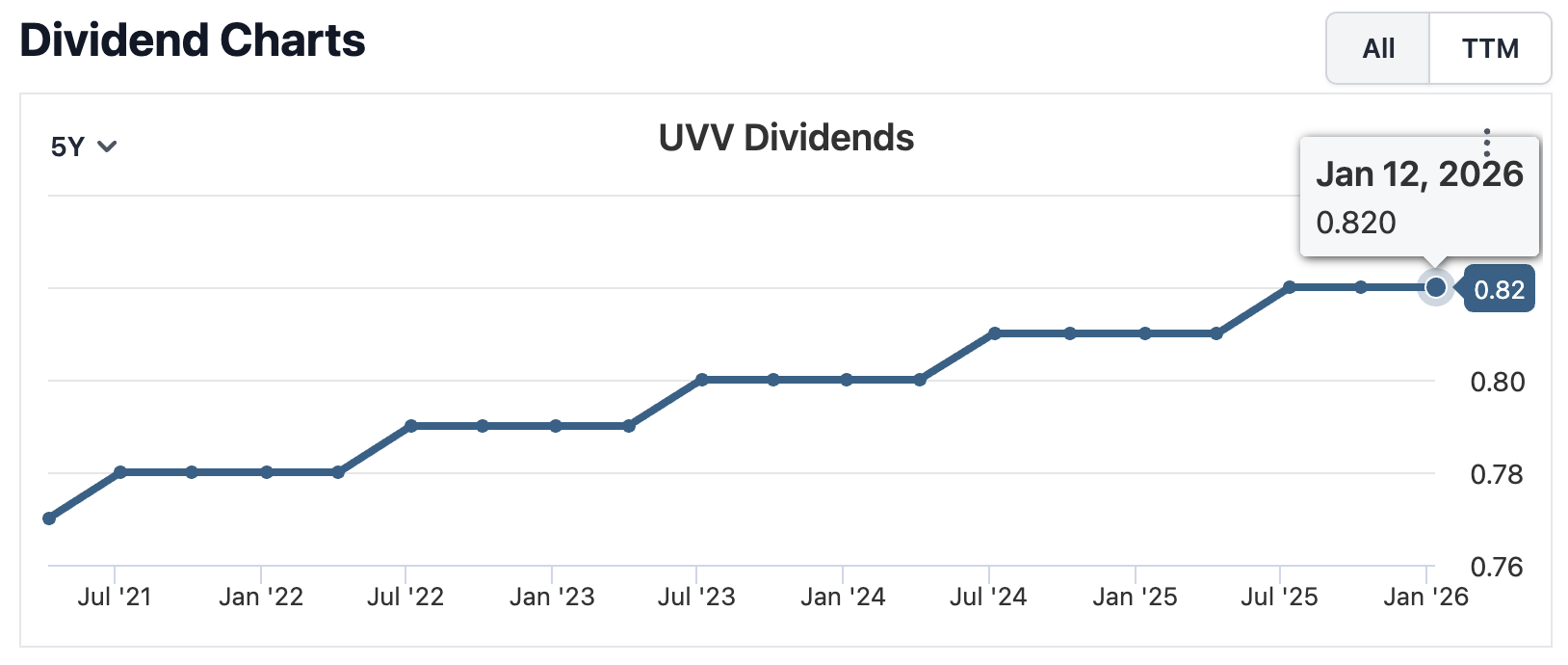

| 2 |

Universal Corporation |

UVV |

Consumer Staples |

~6.1% |

~$3.28 |

| 3 |

Kimberly-Clark |

KMB |

Consumer Staples |

~5.0% |

~$5.04 |

| 4 |

Hormel Foods |

HRL |

Consumer Staples |

~4.8% |

~$1.16 |

| 5 |

Federal Realty Investment Trust |

FRT |

Real Estate |

~4.4% |

~$4.52 |

| 6 |

Northwest Natural Holding |

NWN |

Utilities |

~4.4% |

~$1.97 |

| 7 |

Target |

TGT |

Consumer Discretionary |

~4.2% |

~$4.48 |

| 8 |

PepsiCo |

PEP |

Consumer Staples |

~3.9% |

~$5.69 |

| 9 |

Stanley Black & Decker |

SWK |

Industrials |

~3.8% |

~$3.28 |

| 10 |

Cincinnati Financial |

CINF |

Insurance |

~3.7% |

~$3.16 |

| 11 |

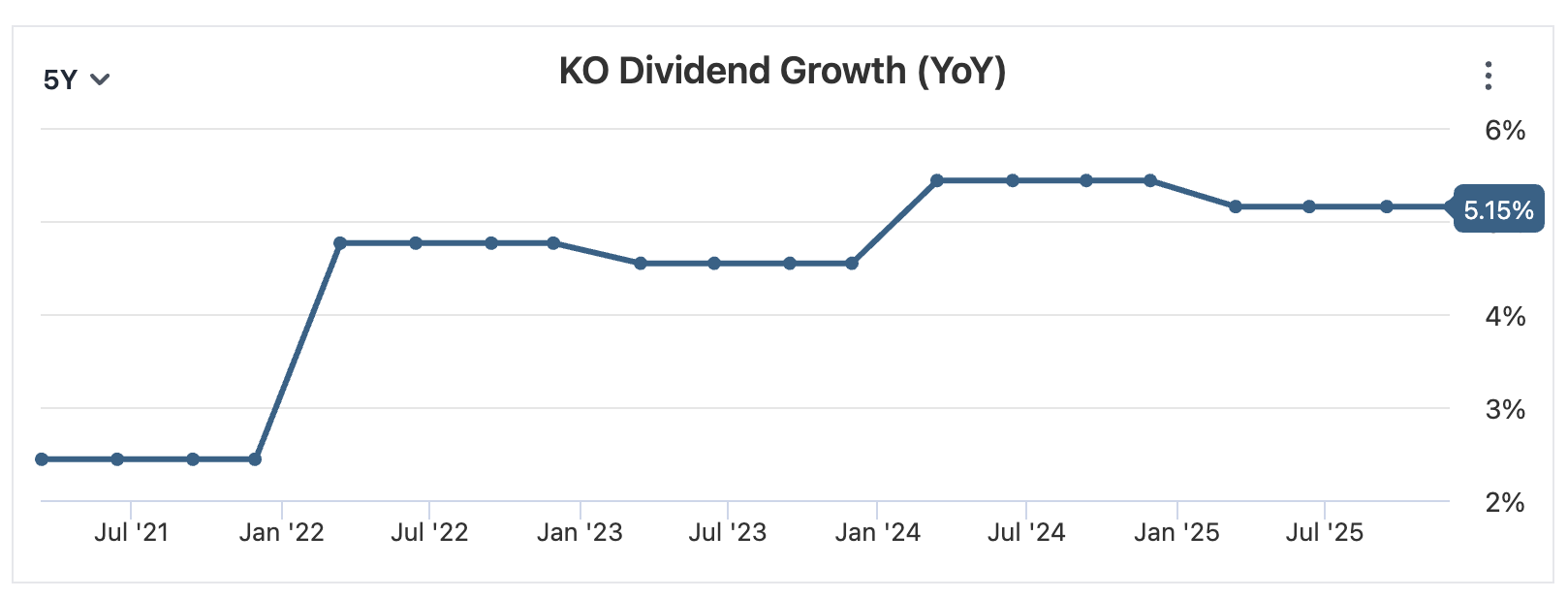

Coca-Cola |

KO |

Consumer Staples |

~3.0% |

~$2.04 |

| 12 |

Johnson & Johnson |

JNJ |

Healthcare |

~2.8% |

~$4.96 |

| 13 |

3M |

MMM |

Industrials |

~2.9% |

~$6.04 |

| 14 |

Genuine Parts Company |

GPC |

Consumer Discretionary |

~2.6% |

~$4.04 |

| 15 |

Procter & Gamble |

PG |

Consumer Staples |

~2.5% |

~$4.03 |

| 16 |

Colgate-Palmolive |

CL |

Consumer Staples |

~2.4% |

~$1.96 |

| 17 |

MGE Energy |

MGEE |

Utilities |

~2.4% |

~$1.76 |

| 18 |

Illinois Tool Works |

ITW |

Industrials |

~2.3% |

~$5.56 |

| 19 |

Emerson Electric |

EMR |

Industrials |

~2.2% |

~$2.10 |

| 20 |

Parker-Hannifin |

PH |

Industrials |

~2.1% |

~$6.52 |

| 21 |

Abbott Laboratories |

ABT |

Healthcare |

~2.0% |

~$2.04 |

| 22 |

PPG Industries |

PPG |

Materials |

~2.0% |

~$2.68 |

| 23 |

Dover |

DOV |

Industrials |

~2.0% |

~$2.02 |

| 24 |

Lowe’s |

LOW |

Consumer Discretionary |

~2.0% |

~$4.40 |

| 25 |

Nordson |

NDSN |

Industrials |

~2.0% |

~$2.80 |

Note: Dividend yield reflects forward annualized dividends relative to prevailing market prices in early January 2026.

The Top 10 Dividend Kings List

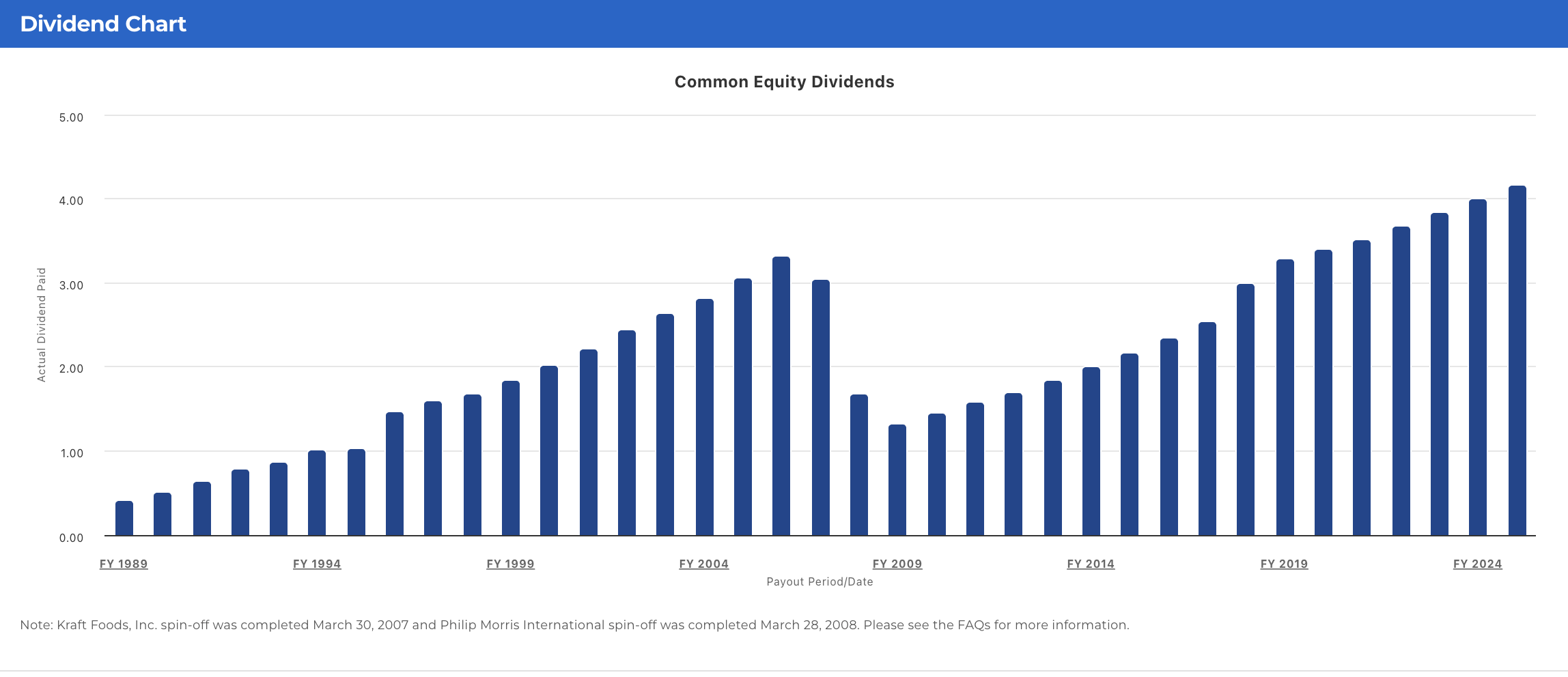

1. Altria Group (MO)

Why it’s a Dividend King:

Altria’s Dividend King reputation is driven by free cash flow durability rather than volume growth. While U.S. cigarette volumes continue their structural decline, the company’s best-in-class pricing power, disciplined cost efficiency, and capital-light operating model support strong free cash flow conversion and resilient margins.

The dividend remains underpinned by stable nicotine demand, a clear payout ratio framework, and minimal reinvestment requirements, enabling consistent shareholder returns, a compelling shareholder yield profile, and reliable income generation even amid long-term industry disruption and evolving smoke-free / reduced-risk nicotine categories.

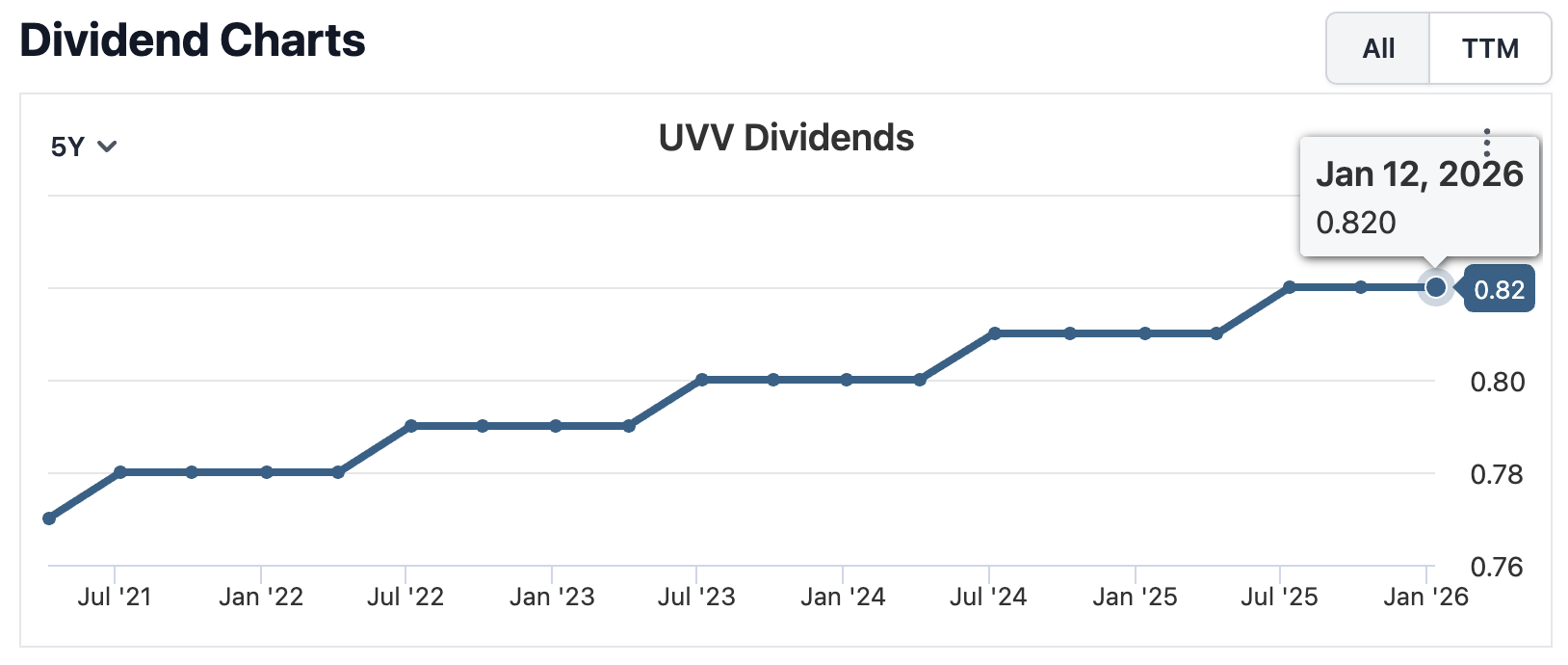

2. Universal Corporation (UVV)

Why it’s a Dividend King:

Universal’s upstream, asset-light role in the tobacco supply chain creates a durable supply-chain moat that insulates earnings from brand-level competition. Long-duration supply contracts, contracted cash flows, and capital-efficient operations drive predictable revenue and strong free-cash-flow conversion.

Coupled with conservative leverage and an ample liquidity buffer, this balance-sheet resilience supports steady dividend increases through commodity cycles. Its payout sustainability is powered by working-capital optimization, disciplined cash conversion, and a shareholder-first capital-allocation framework rather than reliance on top-line growth.

3. Kimberly-Clark (KMB)

Why it’s a Dividend King:

Kimberly-Clark’s portfolio of essential consumer staples (daily hygiene and household products) delivers defensive, repeat-purchase demand across both developed and emerging markets. While long-term volume growth is modest, the company has maintained free cash flow durability through pricing power, disciplined cost management, and ongoing productivity / efficiency initiatives that protect margins.

This cash-flow resilience underpins a consistent cash-return story, supporting steady dividend growth even during periods of input-cost inflation, margin pressure, and elevated macro uncertainty.

4. Hormel Foods (HRL)

Why it’s a Dividend King:

Hormel’s dividend record is built on a strong balance sheet and conservative capital management. A low payout ratio provides room to absorb protein price volatility, while recent yield expansion reflects share-price weakness rather than any pressure on the dividend itself.

5. Northwest Natural Holding (NWN)

Why it’s a Dividend King:

Northwest Natural’s regulated utility model produces exceptionally stable earnings. Dividend growth is intentionally slow, reflecting regulatory return caps rather than operational weakness. The company’s status as one of the longest-standing Dividend Kings underscores payout resilience across interest-rate regimes.

6. Federal Realty Investment Trust (FRT)

Why it’s a Dividend King:

Federal Realty is the only REIT to earn Dividend King status. Its portfolio is concentrated in A-quality, supply-constrained retail corridors in affluent coastal markets, creating strong tenant demand and supporting embedded rent growth even through real estate downturns.

Dividend increases are funded by recurring, AFFO-driven cash flows and internal growth (leasing spreads and rent escalators), not one-time asset sales or aggressive leverage, reinforcing a durable, balance-sheet disciplined income stream.

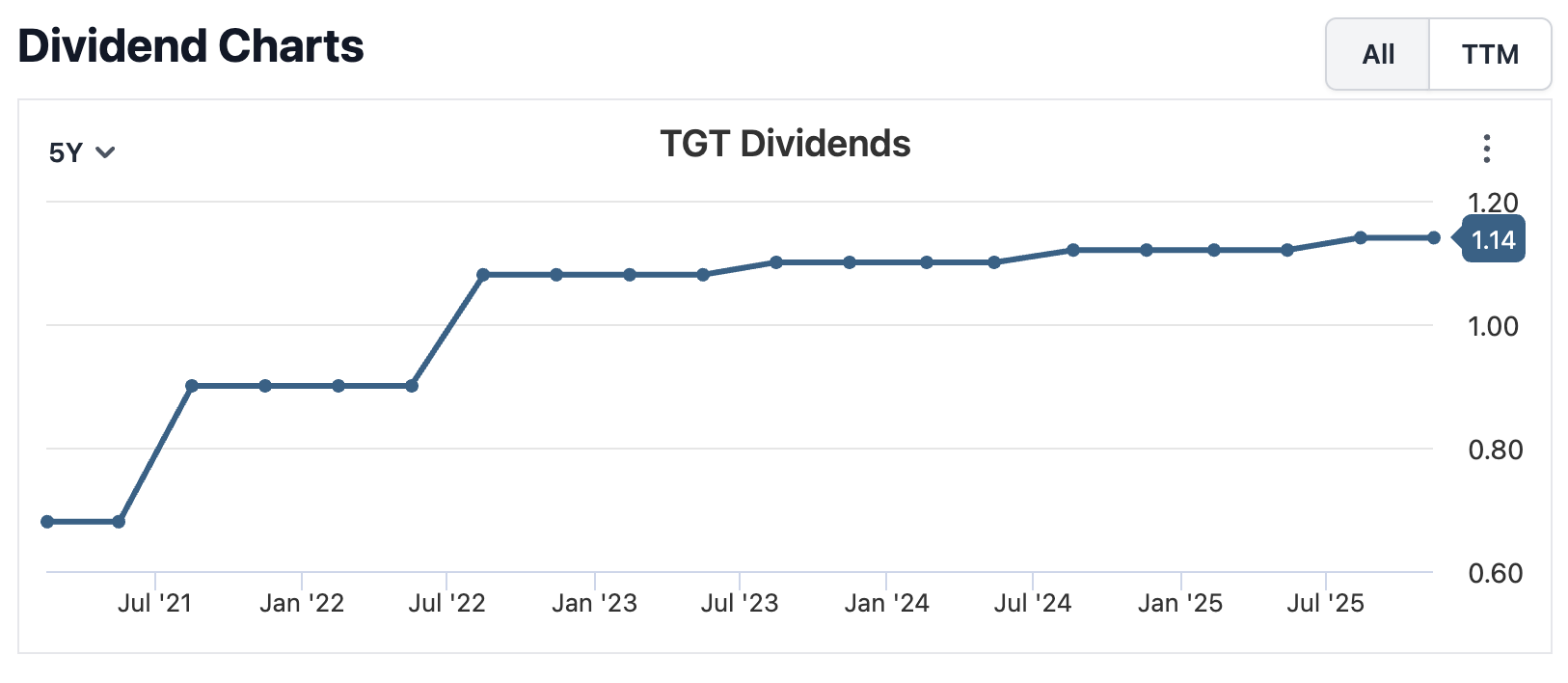

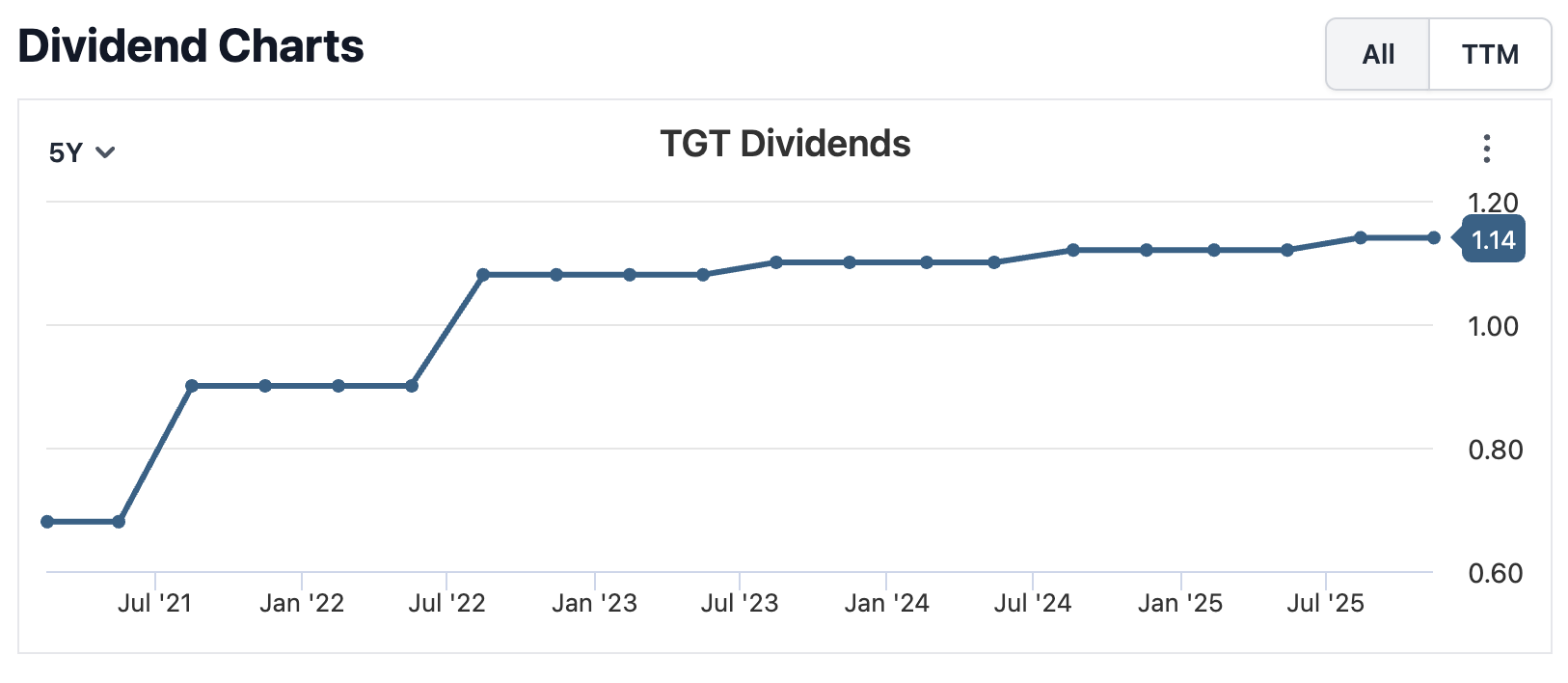

7. Target (TGT)

Why it’s a Dividend King:

Target’s long dividend growth record has been supported by strong free cash flow during favorable retail cycles and a disciplined approach to capital allocation.

While margins fluctuate with inventory cycles, pricing dynamics, and shifts in consumer demand, Target’s scale, operational flexibility, and disciplined balance-sheet management have supported uninterrupted dividend growth for more than five decades.

8. PepsiCo (PEP)

Why it’s a Dividend King:

PepsiCo’s status as a Dividend King is underpinned by its diversified snacks and beverages portfolio, which provides stronger pricing leverage than pure beverage competitors.

Stable organic growth, global reach, and efficient capital deployment have supported dividend growth that consistently exceeds inflation while keeping the payout ratio firmly in check.

9. Cincinnati Financial (CINF)

Why it’s a Dividend King:

Cincinnati Financial’s dividend is supported by underwriting discipline and long-term capital preservation. The insurer avoids aggressive yield chasing, instead funding dividend growth through retained earnings and conservative investment returns.

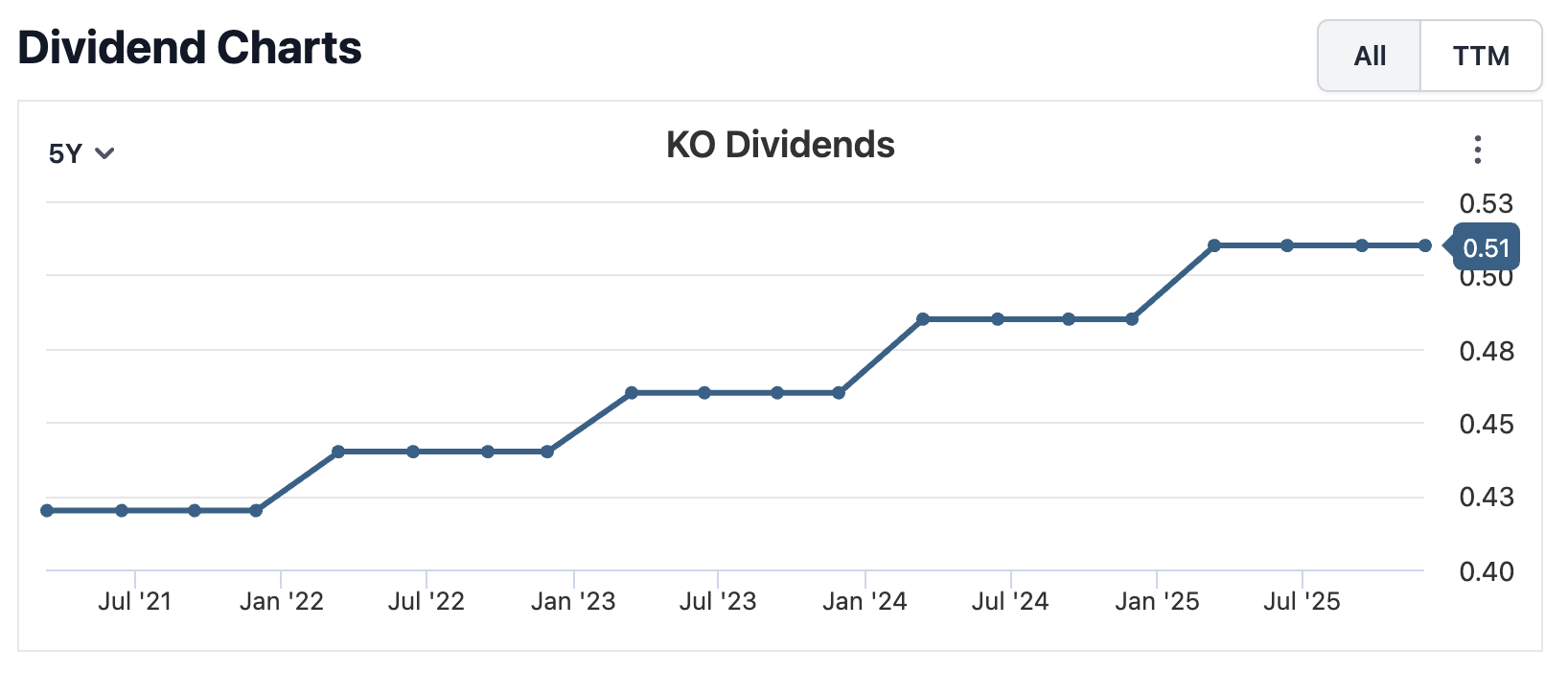

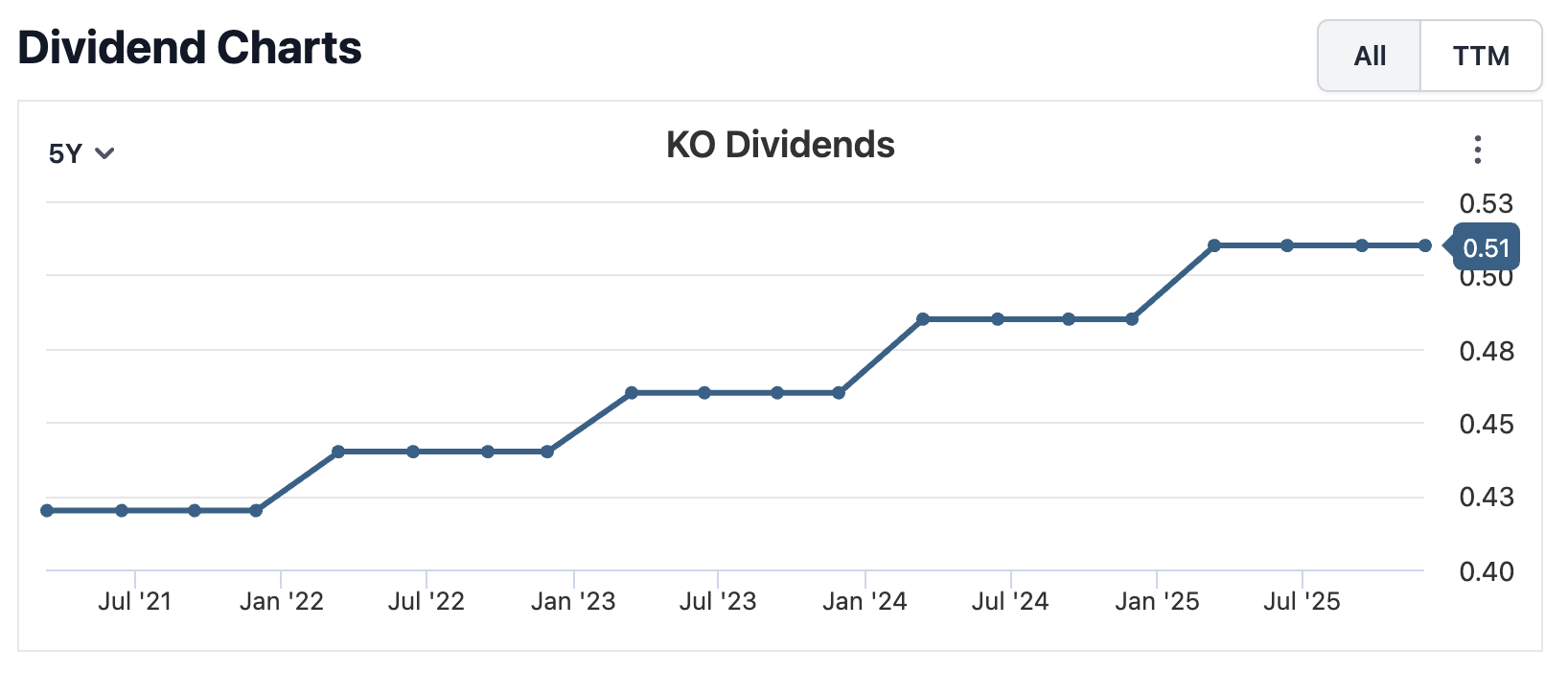

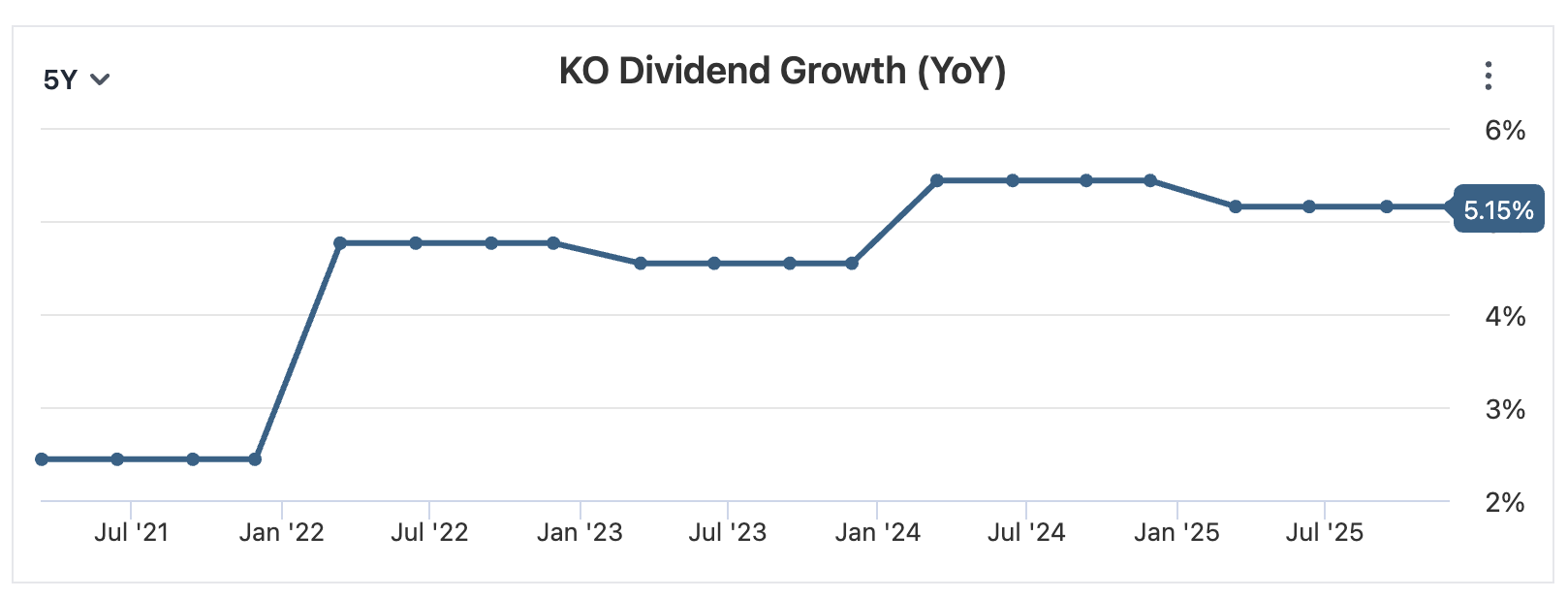

10. Coca-Cola (KO)

Why it’s a Dividend King:

Coca-Cola’s dividend resilience is anchored in its global brand moat, unmatched distribution scale, and a largely asset-light bottling structure that supports strong margins and free cash flow durability.

While its dividend yield is typically lower than that of higher-risk income peers, Coke’s pricing power, recurring demand, and disciplined capital allocation have consistently translated into reliable shareholder returns and steady long-term dividend growth.

What Qualifies as a Dividend King

1. 50+ consecutive years of dividend increases

A company must raise its regular dividend every year for at least five decades. A dividend freeze or cut immediately breaks the streak.

2. Regular cash dividends only

Special, one-time, or irregular payouts do not count. Only the recurring cash dividend paid to common shareholders qualifies.

3. No index requirement

Dividend Kings do not need to be included in the S&P 500 or any major index, which is why smaller and lesser-known companies can qualify.

4. Proven durability across cycles

Reaching 50+ years requires through-cycle resilience such as consistent dividend growth across recessions, inflationary periods, rising rate environments, and major market drawdowns.

In short, Dividend Kings are companies that have increased dividends without interruption for at least half a century, placing them among the most durable dividend-growth and shareholder-return businesses in the public markets.

Other High-Quality Dividend Kings Worth Watching

Lancaster Colony (LANC) | Dividend Yield: ~2.0% - A niche food producer with strong brand loyalty and conservative financial management, supporting steady dividend growth driven by dependable cash flows.

California Water Service Group (CWT) | Dividend Yield: ~1.7% - A regulated water utility company offering extremely stable earnings visibility and one of the longest dividend growth records in the market.

SJW Group (SJW) | Dividend Yield: ~2.3% - A low-volatility utility Dividend King with predictable returns tied to regulated rate structures and essential infrastructure demand.

Black Hills Corporation (BKH) | Dividend Yield: ~4.6% - A regional utility Dividend King benefiting from regulated electric and gas operations, offering a higher yield with steady, policy-driven dividend growth.

Commerce Bancshares (CBSH) | Dividend Yield: ~1.9% - A conservatively run regional bank whose dividend growth has been sustained through multiple credit cycles via disciplined underwriting and capital retention.

Farmers & Merchants Bancorp (FMCB) | Dividend Yield: ~1.5% - A lesser-known community bank, this is a Dividend King with an exceptionally long dividend record, supported by conservative lending and strong local deposit bases.

Frequently Asked Questions (FAQ)

1. What are Dividend Kings?

Dividend Kings are publicly traded companies that have increased their dividend payouts every year for at least 50 consecutive years. This standard reflects exceptional financial discipline, durable cash flows, and a long-term commitment to shareholder returns.

2. How are Dividend Kings different from Dividend Aristocrats?

The key difference is longevity. Dividend Aristocrats require 25 consecutive years of dividend increases, while Dividend Kings require 50 years. This higher threshold places Dividend Kings in a much smaller and more selective group.

3. Are Dividend Kings always high-yield stocks?

No. Many Dividend Kings offer moderate yields. Their appeal lies in consistency and long-term dividend growth rather than maximizing short-term income. Higher yields within the group often reflect valuation cycles rather than payout risk.

4. Can a company lose Dividend King status?

Yes. If a company fails to raise its dividend in any year, even if it maintains the same payout, it immediately loses its Dividend King status and must start a new streak from zero.

5. Are Dividend Kings safer during market downturns?

Historically, Dividend Kings tend to be more resilient during recessions due to stable business models and strong cash generation. However, they are still equities and remain subject to market risk.

6. Do Dividend Kings guarantee future dividend growth?

No dividend is guaranteed. While Dividend Kings have exceptional track records, future dividend growth depends on earnings, cash flow, and management decisions. Past consistency reduces risk but does not eliminate it.

Summary

Dividend Kings represent the highest standard in dividend growth investing. Their ability to raise dividends consistently for more than half a century reflects durable business models, disciplined capital allocation, and a deeply ingrained commitment to shareholder returns.

While yields vary across the group, what unites Dividend Kings is reliability rather than yield chasing. For investors seeking long-term income stability, inflation-resistant cash flow, and proven resilience across economic cycles, Dividend Kings remain one of the most credible foundations in equity markets.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.