If you know more about foreign exchange trading, you must have heard of

candle charts, also known as K-line charts. Candlestick charts are a widely used

technical analysis tool in the stock and foreign exchange markets and are

popular for their clear graphics and intuitive information delivery. Among the

many types of candle charts, some are considered particularly important by

investors because they can provide key market trend information and become a

powerful tool for investment decisions. This article will delve into these

important candle chart types, let investors know what types of candle chart

patterns are divided, and allow investors to better understand market

dynamics.

Candlestick charts refer to the price activity of an asset over a specific

period of time. They are an excellent way to understand the price movement of an

asset over a certain period of time, which can be hours, days, weeks, or even

months. They use four main components for their analysis, including open, close,

high, and low.

The history of candlestick charts dates back to the 18th century, when

Japanese rice farmers tried to understand fluctuations in rice prices. They

found that the market is affected by human emotions. In addition to following

the laws of supply and demand, candle charts can visually depict market emotions

and understand market patterns. Ultimately, traders use these patterns to

analyze and predict the short-term price trends of the market and then make

corresponding trading decisions based on this information.

While candlestick charts are similar to bar charts, candlestick charts are

more visual and more clearly highlight upward and downward price movements

between the open and close prices. Increasing price movement forms a green

candle, indicating strong positive price dynamics in the market. In contrast, a

bearish candle is red and indicates falling prices.

K-line candles are divided into two types: bullish candles and bearish

candles. The body of the candle represents the opening and closing prices of the

stock price, while the shadows of the candle represent the highest and lowest

prices the stock price has reached. A bullish candle is green and represents an

increase in stock price, opening at the bottom of the real body and closing at

the top of the real body. A bearish candle is red and represents a decline in

stock price, opening at the top of the real body and closing at the bottom of

the real body. On a given K line, any of the entity and upper and lower shadow

lines may not exist. By observing the color and shape of the candle, we can

understand the trend of the stock price.

There are many forms of candlestick charts, each representing different

market conditions and trends.

-

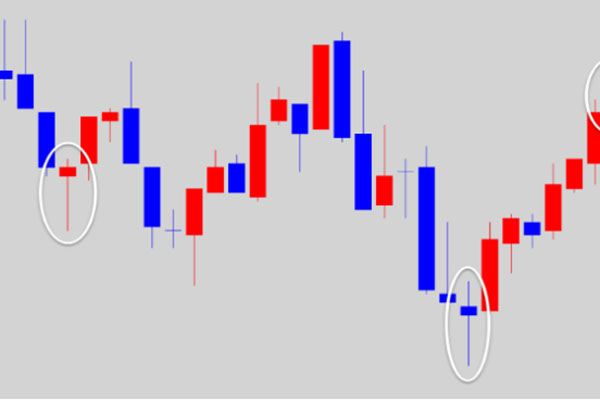

Bullish Engulfing Pattern

The highest price is the same (or slightly higher) as the closing price, and

the lowest price is the same (or slightly lower) as the opening price. There are

no upper and lower shadows or extremely short shadows. The big positive line is

a long positive line in the entity, and it is a bullish signal when it appears

in the early stage of the rising market. When a big positive line appears midway

and continues to rise, it indicates that the bulls are strong. In a market that

continues to accelerate its rise, the emergence of a big positive line indicates

that the rise has peaked. On the contrary, the big negative line is a long

negative line of entities. It is a bearish signal when it appears in the rising

market, and it continues to be bearish when it appears in the middle. In a

continuous falling market, the big negative line may be a signal of bottoming

out and rebounding.

Main features:

This pattern may appear in any stock price movement.

The longer the Yang line entity is, the stronger the power is; conversely,

the weaker the power is.

Under the daily limit system, the largest daily Yang line entity can reach

20% of the opening price of the day; that is, it opens with the lower limit and

closes with the higher limit.

-

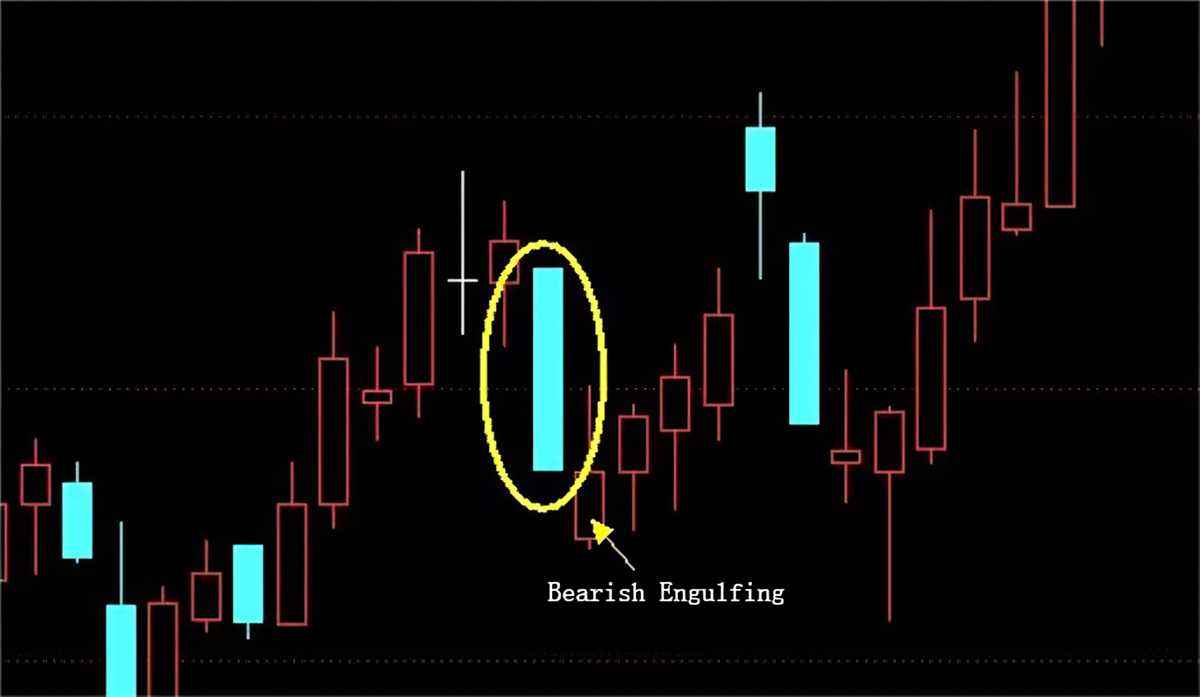

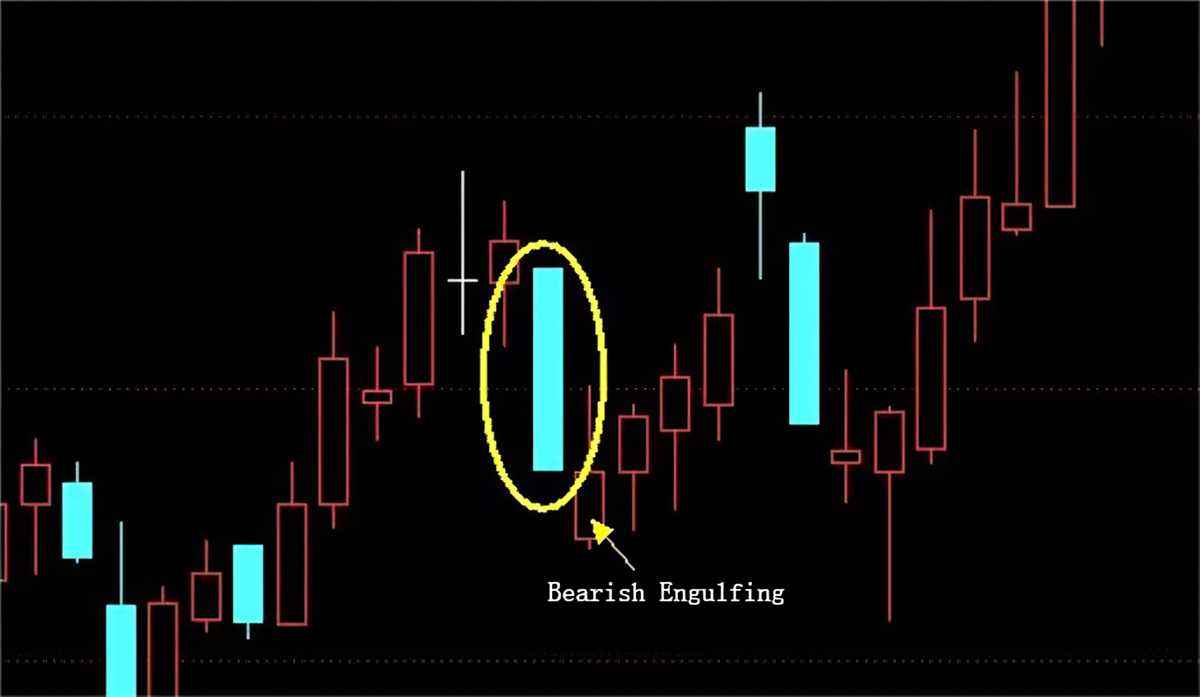

Bearish Engulfing Pattern

The big negative line is also called the long negative line. The "big

negative line" in the candle chart usually refers to a negative line with a long

real part, which means that the market sellers are stronger during a specific

period of time and the closing price is far away from the opening price. This

situation may reflect pessimistic investor sentiment and increased selling.

The candle chart consists of a real body (rectangular part) and a shadow line

(a line extending up and down), while the "big negative line" mainly focuses on

the length of the real body. A typical characteristic of a large negative line

is that the opening price is close to the highest price and the closing price is

close to the lowest price, forming a falling entity. This shows that during this

time period, the market started out strong but ended with increased seller

pressure, causing prices to fall significantly.

Application rules

The appearance of a large Yinxian in a rising market means that the market

will retreat sharply downward.

The appearance of a large Yinxian in a falling market means that the market

is accelerating its downward plunge.

-

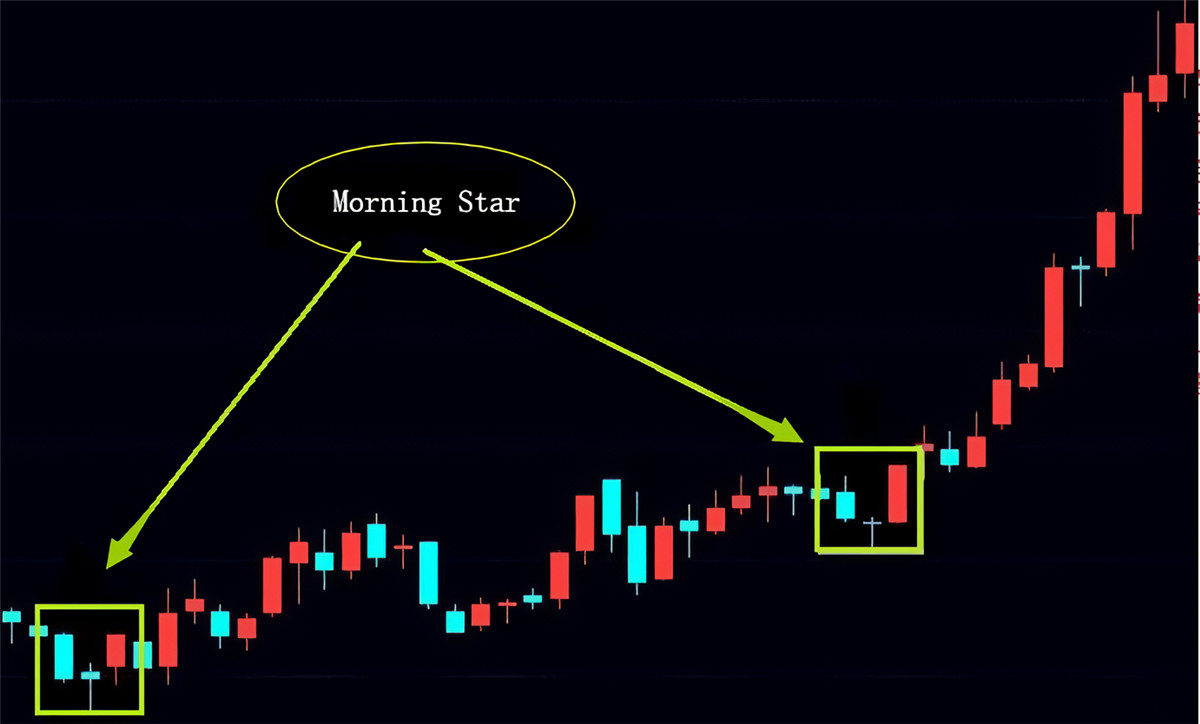

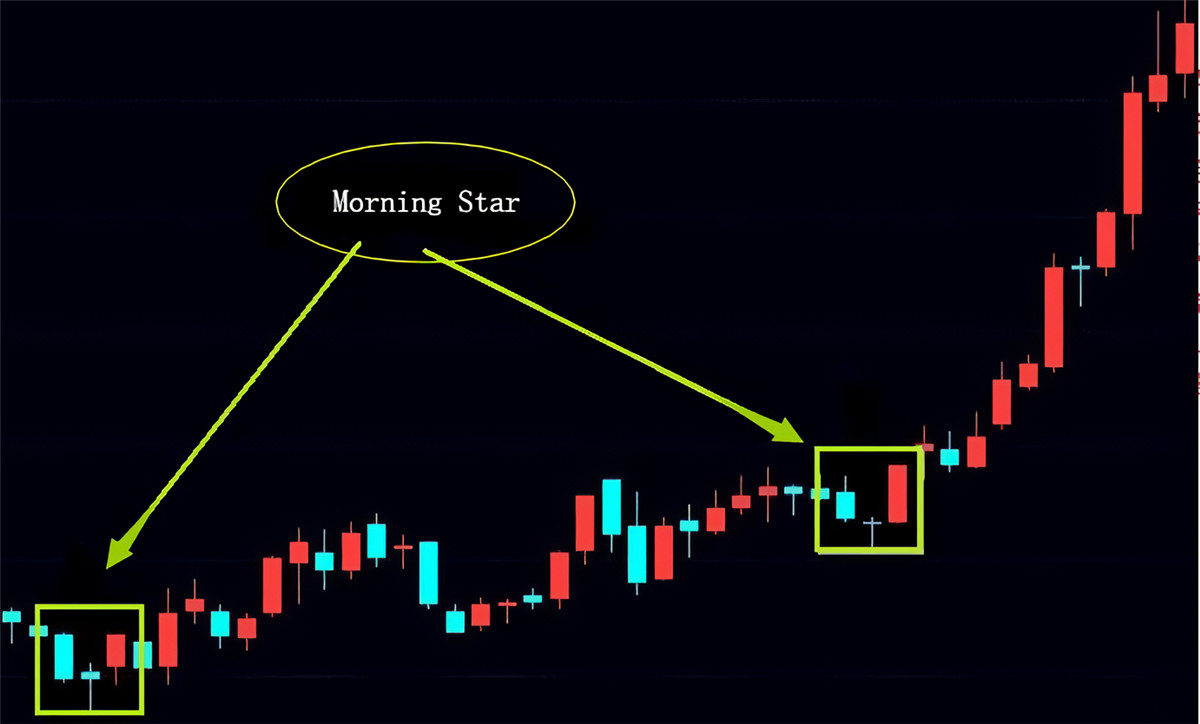

Morning Star Pattern

Morning Star is a pattern composed of three K lines, which marks the market

bottoming out and turning around. The occurrence of this pattern is worth

watching because it is a clear reversal signal, making it an ideal buying

opportunity.

First candle (negative line): This is a negative line in a downtrend,

indicating that the market is currently dominated by sellers.

The second candle line (a small, real body or a candle with a lower shadow):

This candle line is usually smaller than the first negative line and sometimes

has a lower shadow, indicating that there is some uncertainty in the market and

that buyers and sellers The forces between them begin to balance.

The third candle line (positive line): This is a positive line in an upward

trend, indicating that the buyer has taken control of the market and the price

may rise.

At the tail end of a downtrend, the Morning Star K-line Pattern usually

appears stronger and is an obvious trend reversal signal. The three K lines form

a complete psychological turning process: from pessimism to long-short balance,

and then to optimism. Therefore, this pattern is more effective in trend

reversal and stop-and-fall trading.

-

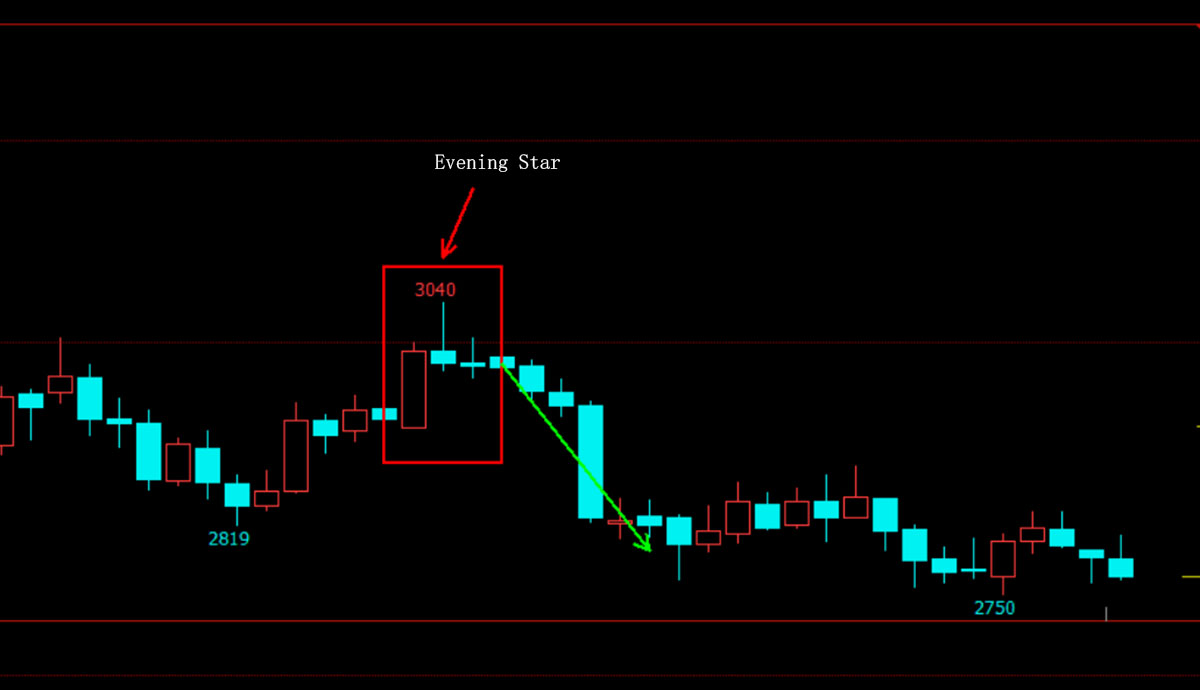

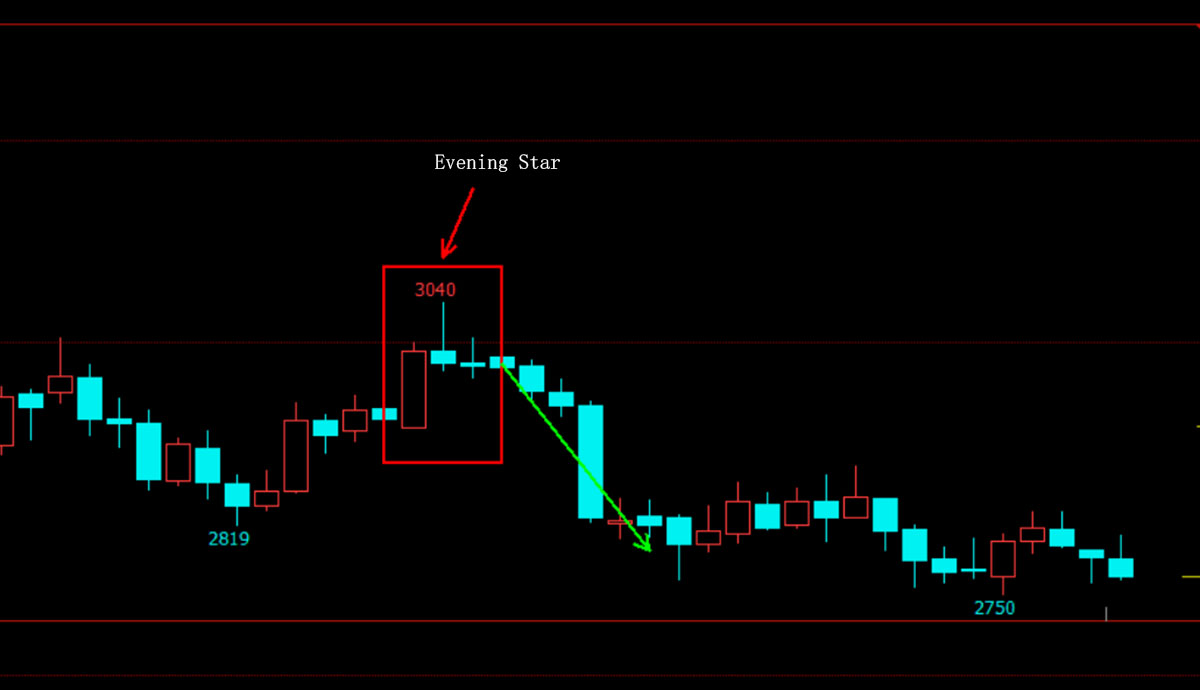

Evening Star

The evening star is similar to the morning star. It is a K-line combination

form and can be regarded as the reversal form of the morning star. Unlike the

morning star, the evening star usually appears at the end of an uptrend, often

marking a periodic top of the price.

First candle line (positive line): This is a positive line in an uptrend,

indicating that the market is currently dominated by buyers.

The second candle line (a small, real body or a candle with a shadow line):

This candle line is usually smaller than the real body of the first positive

line and sometimes has an upper shadow line, indicating that there is some

uncertainty in the market for sellers and buyers. The forces between them begin

to balance.

The third candle line (negative line): This is a negative line in a

downtrend, indicating that sellers have taken control of the market and prices

may fall.

When these three candles appear in sequence, forming an evening star pattern,

this may be a signal of a trend reversal.

-

Three Red Soldier

"Three Red Soldiers" is also called "three white soldiers," which is a bullish trend reversal pattern.

The three red soldiers usually consist of three adjacent positive lines. The

opening price of each positive line is higher than the opening price of the

previous one, and the closing price is also higher than the closing price of the

previous one.

This is considered a sign of strong buyer power, suggesting the market may

continue to rise.

-

Round Bottom Bullish

Also known as a saucer bottom, it is usually used to describe the stock price

trend forming a bottom arc shape, indicating that a trend reversal may occur.

This pattern may appear in a K-line candle chart as the stock price gradually

declines over several consecutive periods and then forms a curved bottom,

implying a change in market sentiment from pessimism to optimism. Because it is

shaped like a saucer, it is also called a saucer bottom.

In the K-line candle chart, the round bottom pattern may appear as the stock

price fluctuates at the bottom level for a long time and then gradually rises.

This pattern is sometimes called "bottom accumulation" because investors appear

to gradually accumulate shares at low prices, ultimately driving the stock price

higher.

Technical Characteristics:

It can appear at the end of a decline or in the middle of an increase.

The stock price or index initially fell and rebounded relatively quickly. As

the enthusiasm for traders' participation decreased, the strength of the decline

and rebound became weaker and weaker. Later, it could neither fall nor rise, and

it traded sideways. It is not until new funds enter the market that the stock

price or index begins to improve slightly and begins to rise slowly. Then more

funds enter the market, pushing the stock price or index to accelerate

upward.

The trading volume becomes smaller and smaller as the decline slows down,

shrinks to the minimum when going sideways, and then gradually increases as the

stock price or index rises. When Stock Prices accelerate their rise, trading

volume also increases significantly. On the K-line chart, the histogram of

trading volume is often arc-shaped.

-

Propeller Chart

Propellers refer to those stocks in the K-line combination that have small

K-line entities and long upper and lower shadows but show independent trends

within a certain period of time. Sometimes, these stocks may have continuous

negative lines, but the stock price does not fall. When these stocks with

propeller characteristics are not high in absolute price, have good

fundamentals, and have no history of capital expansion, we call them propeller

kings. Generally speaking, in a consolidating market, stocks with propeller-king

characteristics may provide greater investment opportunities.

The following conditions are required to determine whether a stock complies

with the propeller law:

It occurs when the overall market declines, and the cumulative decline is

relatively large, usually in the middle and late stages of the market.

It is in a shrinking state and does not meet the requirements of the 135-day

Moving Average.

The application of the propeller rule helps identify stocks that remain

relatively independent and have greater opportunities in market turbulence.

-

Friends Counterattack Chart

A friend counterattack is a graphic form in technical analysis that usually

appears in a downward trend and consists of two K lines, one yin and one

yang.

A friend's counterattack is seen as a signal to stop falling. When this

pattern appears, investors are reminded not to be blindly bearish because bulls

may launch a counterattack upward. The technical significance of Friend's

Counterattack is similar to that of Dawn, except that the signal is relatively

weak.

Features Include:

First, a big negative line appears, indicating that the market is

falling.

The next day, a short gap and a low opening followed, forming a big Yang line

or a Zhong Yang line. The closing price of this positive line is the same as or

very close to the closing price of the previous day's negative line.

-

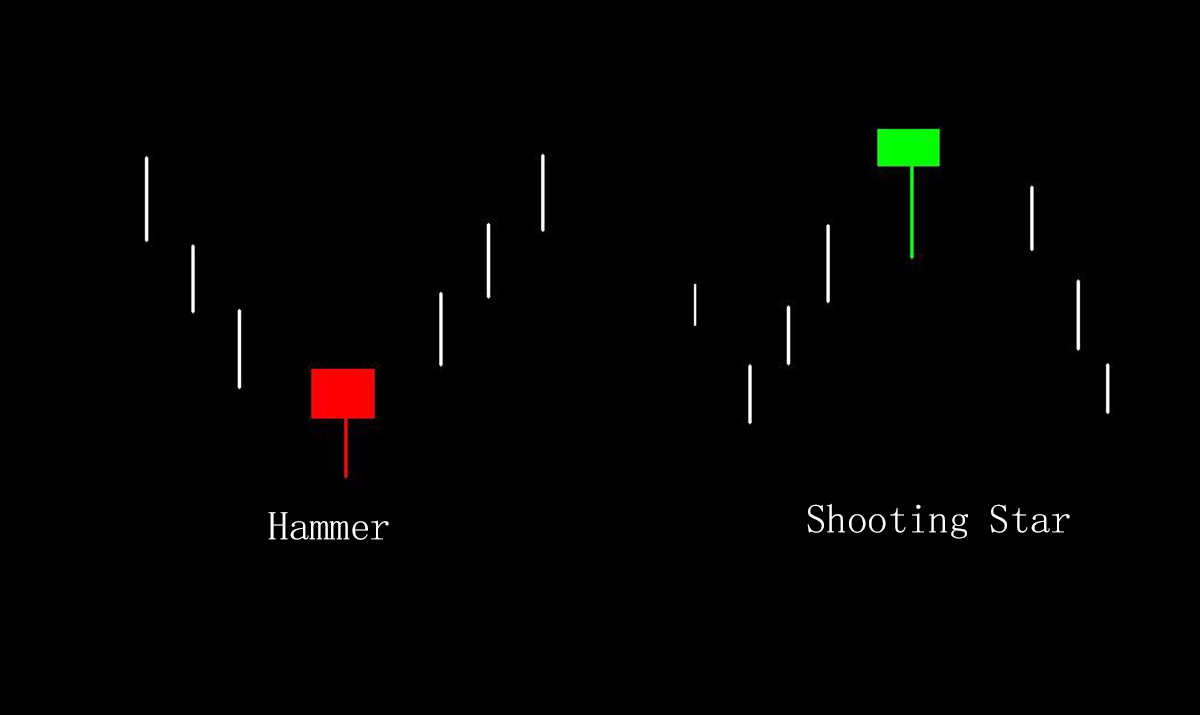

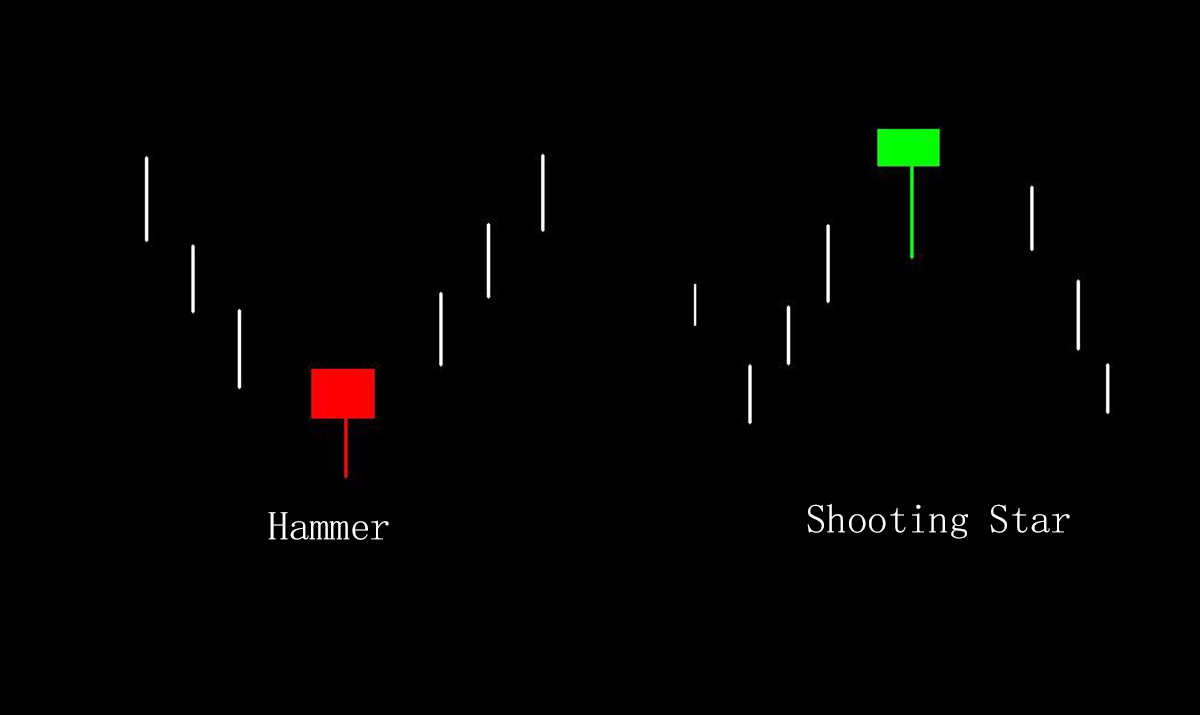

Hanging/Hammer Man Chart

Hammer Line

The lower shadow of the hammer line is very long, the upper shadow is very

short, the entity is small, and the shape is a bit like a hammer. If it occurs

during a downtrend, it may be a reversal signal, indicating that the market is

rebounding from the bottom.

Key points of the hammer line:

The hammer line needs to appear in a downtrend and have the characteristics

of a reversal.

The longer the lower shadow, the better, and the smaller the real body, the

better.

The hammer line is best able to appear at the support level.

The emergence of the hammer line indicates that the market has found support

at the bottom, and buying orders have gradually entered, pulling the market

up.

Hanging Man

Hanging man, also called hanging man, is a graph composed of two candle

lines. The first candle line is a long black real body, the second is a short

white real body, and the closing price of the second candle is higher than the

first real body. . The gap formed by the white real body between the two candle

lines is one of the characteristics of the hanging neck line.

The appearance of the hanging neck line indicates that the market is

experiencing seller pressure in an uptrend. Although the opening and closing

prices are close, the market has experienced large fluctuations throughout the

day. The lower shadow of the hanger indicates that buyers attempted to push the

price higher during the trading day but were ultimately unable to maintain it.

This could signal a shift in market power, with sellers potentially starting to

dominate.

Investors need to wait for more confirmation signals after confirming the

hanging neck pattern to avoid false signals.

-

Double Bottoms Patterns

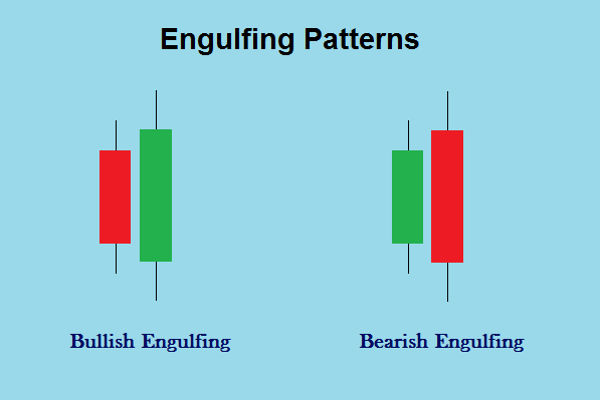

The engulfing pattern is an important reversal pattern consisting of two

candlestick real bodies of opposite colors.

Regarding the engulfing form, there are three criteria:

First, before an engulfing pattern occurs, the market must be in a clearly

identifiable up-or-down trend, even if the trend is only short-term.

Secondly, the engulfing pattern consists of two candle lines. The real body

of the second candle line must completely cover the real body of the first

candle line. If it is a bullish trend, the first candle is a bear line, and the

second candle is a bull line. Vice versa. Likewise.

Third, the color of the second entity of the engulfing form must be opposite

to the color of the first entity.

If engulfing patterns possess these characteristics, the likelihood that they

constitute an important reversal signal is greatly enhanced.

In an engulfing pattern, the real body on day one is very small, and the real

body on day two is very large. Engulfing patterns often appear after very

long-term or sharp market movements. If there is a very long-term uptrend, it

may mean that potential buyers have entered the market to take long positions,

resulting in a lack of sufficient new long supply in the market to continue to

push the market upward. And after a sharp market move, the market may have gone

too far and become susceptible to profit-taking positions.

In an engulfing pattern, the second real body is accompanied by excess

volume. Additionally, in an engulfing pattern, the next day's entity engulfs

more than one entity.

-

Dark Clouds Cover

The dark cloud cover pattern, also known as the dark cloud line pattern, is

one of the more common top transition patterns on the K-line chart. It usually

occurs during an upward trend in stocks or markets and is a potential turning

signal.

A dark cloud cover pattern indicates a possible reversal in the market's

uptrend. The Yang line on the first day represents a strong buyer's market, but

the Yin line on the second day indicates that sellers have entered the market,

pulling the price back, and the closing price of the Yin line is lower than half

of the previous day's Yang line, implying the strengthening of the seller's

power. This pattern suggests a potential bearish counterattack, and investors

should be aware that the market may enter a downtrend.

Traders usually adopt cautious strategies after confirmation of dark cloud

cover, such as waiting for further confirmation signals or adopting defensive

trading strategies to avoid potential downside risks.

Feature:

The first day is a Yang line. The specific pattern is based on a rising Yang

line, which represents an upward trend.

The second day is the Yin line. The opening price of the Yin line on the

second day is higher than the closing price of the previous day, but the final

closing price is lower than half of the previous day's Yang line, forming a

covered Yin line.

The above are not all K-line candle chart patterns. In fact, there are many

other complex candle chart patterns. Candlestick charts are a powerful technical

analysis tool that play a key role in interpreting market trends. By

understanding and skillfully using various important candle chart types,

investors can more accurately judge market behavior and improve the accuracy of

their trading decisions.

When using candlestick charts to make trading decisions, investors also need

to pay attention to some key techniques, such as using K-line patterns in

combination with support and resistance levels, for better results. For example,

if three or more K-line combinations appear at the same position, it is likely

to be a support or resistance level. If a K-line combination appears at the

support or resistance level, the signal is more reliable. It can also be

combined with other technical analysis tools, such as moving averages and

relative strength indicators, to comprehensively judge market trends. In

addition, pay attention to market news and events in a timely manner to avoid

blindly following the trend. Finally, set clear stop-loss and profit points,

reasonably control risks, and analyze the market rationally to ensure the

robustness and sustainability of investment decisions.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.