Traditionally, investment decisions mainly depend on traditional sources of information, trading journals, and media publications. However, 'social information arbitrage' investment is different. For many years, social media has become the mainstream medium for conveying information, and it is one of the fastest and most effective ways to collect information that affects investors' judgments.

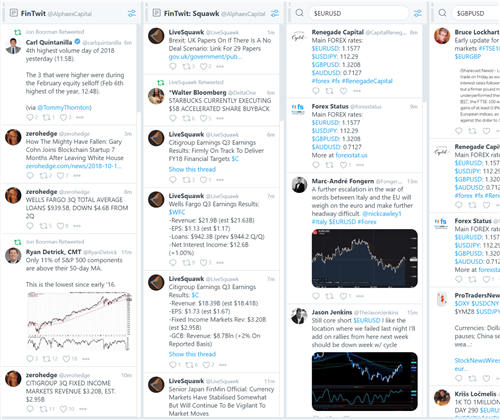

twitter

The importance of the FinTwit community in transactions is becoming increasingly prominent. Currently considered the fastest and most immediate news source in the world. Many events often begin to emerge hours before traditional media coverage. In other cases, a tweet from an influential person can also change the market process. Smart investors have begun to notice it and take advantage of this information gap.

According to EBC Finance, scholars Ekta Ashokkumar Mistri and Gurudutta P. Japee, Ph.DA research paper titled "Analyzing the Role of Social Media in Investment Decisions" was published in, and it was found that in the United States and Canada, over $100000 worth of 500 investments can be madeMillions of wealthy investors are now using social media for financial decision-making research.

Business professors Johan Bollen, Huina Mao, and Xiao JunZeng's research report "Twitter Emotions Predicting the stock market" shows that Twitter's prediction accuracy for the dow jones industrial average is as high as 87.6%.

Chris Camillo, the King of Social Information Arbitrage

Social information arbitrage has actually existed before. One of the most successful stock market investors of the 20th century, Andre é KostolaniAt that time, this trend was also noticed. He said, "Facts only account for 10% of the stock market reaction; everything else is psychology

However, it was not until Chris Camillo turned $20000 into $21 million within three years that social information arbitrage began to become the focus of attention.

After suffering huge losses through traditional trading methods, Chris Camillo read Peter Lynch's book - One up on WallStreet. Later, he was deeply inspired and completely changed his previous investment methods.

This book was published in 1989, and Peter claimed that the only way to defeat the market was to have an information advantage. ChrisCamillo regards this statement as the key to investment, and before Wall Street took action, he captured new social or cultural trends that have significant implications for stock price trends. Make him at 14In one year, it turned $20000 into an astonishing $21 million. Chris Camillo even appears in Jack Schwager's new book:

*Jack Schwager is a recognized expert in the futures and hedge fund industry, with many highly acclaimed financial books, including "Financial Geeks: Top Traders on Wall Street" and "Market Wizards"

This is not related to technical or fundamental analysis

From a historical perspective, stock trading methods can be divided into technical analysis, fundamental analysis, or a combination of both:

Technical analysis: Traders here attempt to predict price trends by examining historical data (mainly prices and trading volumes). Then, these data can help traders predict stock price trends based on the historical behavior of Stock Prices.

Fundamental analysis: This method involves determining the fair value of stocks by analyzing the company's financial statements, competitors, and market. Investors here will establish a discounted cash flow model or use peer analysis to determine the fair market value of the company.

Chris Camillo has created a completely new investment approach that is neither technical nor fundamental. He doesn't know the P/E ratio of the company he invests in, nor does he care if a particular stock has broken through resistance levels.

ChrisFollow a simple process to identify emerging trends, verify whether information exists in the public domain, and take action before it generates equivalence. Without computer processing power and social media, it is impossible for him to invest in new technologies.

Chris Camillo's Investment Journey

Chris Camillo is a living example where you don't need to read a lot of investment books, have a formal finance degree, or have years of trading experience to beat Wall Street.

Chris showed us how to earn huge profits in the stock market through social information arbitrage. He attributed his huge profits to analyzing FacebookPosts, research on consumer reactions when shopping in shopping malls, and time spent reading tabloids.

Laughing at Wall Street: How I Beat the Pros atIn the book 'Investing', one can gain a deeper understanding of his insights and strategies.

In 2006, he applied social information arbitrage strategy and invested $20000 in the stock market, earning a trading profit of $9.7 million over the next decade. Jack SchwagerIn his book 'Unknown Market Wizards', Chris achieved 68.4% between 2007 and 2020Average annual compound return.

Chris Camillo is also an entrepreneur who has owned several businesses. He is the founder of social data intelligence company TickerTags, which was founded in 2016Prior to the end of the annual voting, social media data was used to accurately predict the outcome of the UK's exit from Europe.

He also co founded the media company Dumb Money with friends Dave Hanson and Jordan MclainTV. They share video blogs and captivating podcasts behind the scenes, telling their investment stories. Dumb Money TV has a considerable number of fans, ChrisCamillo and his team have made "social arbitrage" a mainstream phenomenon, and their unique perspective has attracted many young investors who are unwilling to choose traditional paths.

Chris does not believe in fundamental or technical analysis, and he summarizes his strategy into three important stEPS:

When you discover an exciting piece of information or a unique trend, ask yourself if it may have a positive or negative impact on stock prices.

Next, ask yourself if the market already knows about this information. You can verify this by reading journals, blogs, articles, or any publicly available information. If your answer is yes, then trading is meaningless. However, if the answer is no, then you have an opportunity for social information arbitrage.

Have you foreseen a trading window that may have a greater impact on stock prices? This may be an event that could instantly eliminate the opportunities generated by the hidden information you foresee. Because if some negative information appears during this period, it may undermine your profit potential.

Let's have a detailed understanding of Chris's specific operations in investing in the stock market using social media.

Discovering Changes Before Others

When Chris was in his teensCamillo enjoys garage sales, buying cheap and unnecessary household items from families trying to empty the garage, and then identifying potential buyers willing to purchase these items from him at a high price. This is the core of the investment strategy he later invented.

Social information arbitrage refers to the discovery of new social trends and cultural shifts in daily life that may have a meaningful impact on stock prices, as noticed by Wall Street and the media.

Early understanding of these changes is crucial for making strategies work - once the media or Wall Street starts talking about these changes, the deal is over. When this situation occurs, it is usually time to close the position for trading.

As Chris said, "You don't have to predict the future in order to make money in the stock market, but you must be good at reading the present and identifying meaningful changes that are happening.

Online Investment Forum 2.0

Information arbitrage investment utilizes taking action on information that affects prices before the public becomes aware. Social information arbitrage mainly narrows the sources of such information to social media platforms, Weibo websites, Google Trends, discussion forums, etc.

Some social media portals and Weibo websites play a crucial role in connecting investors with each other. It also provides them with a platform to access market dynamics information and share their reactions in one place. Investors are very familiar withMotley Fool and Yahoo! Financial discussion board. However, recently, things like Stocktweets and RedditEmerging platforms like the sector have increased the space for social information arbitrage.

This kind of community is very active, regardless of size, every activity will cause a sensation. Investors who seriously participate in these communities can personally feel the pulse of the market. This is the best place to obtain original feedback from customers on new or existing products released by the company.

Smart investors can also use these social media communities to measure excitement or speculation about upcoming products or services or any other key business developments.

Social and Financial Chat Analysis

According to Chris Camillo, social chat analysis is increasingly being accepted by institutional investors and will become mainstream in the coming years.

He is also an investor and board member of HedgeCharter, HedgeCharterIt is a financial chat analysis startup aimed at transforming unstructured financial conversations into a deep financial insight tool for investors.

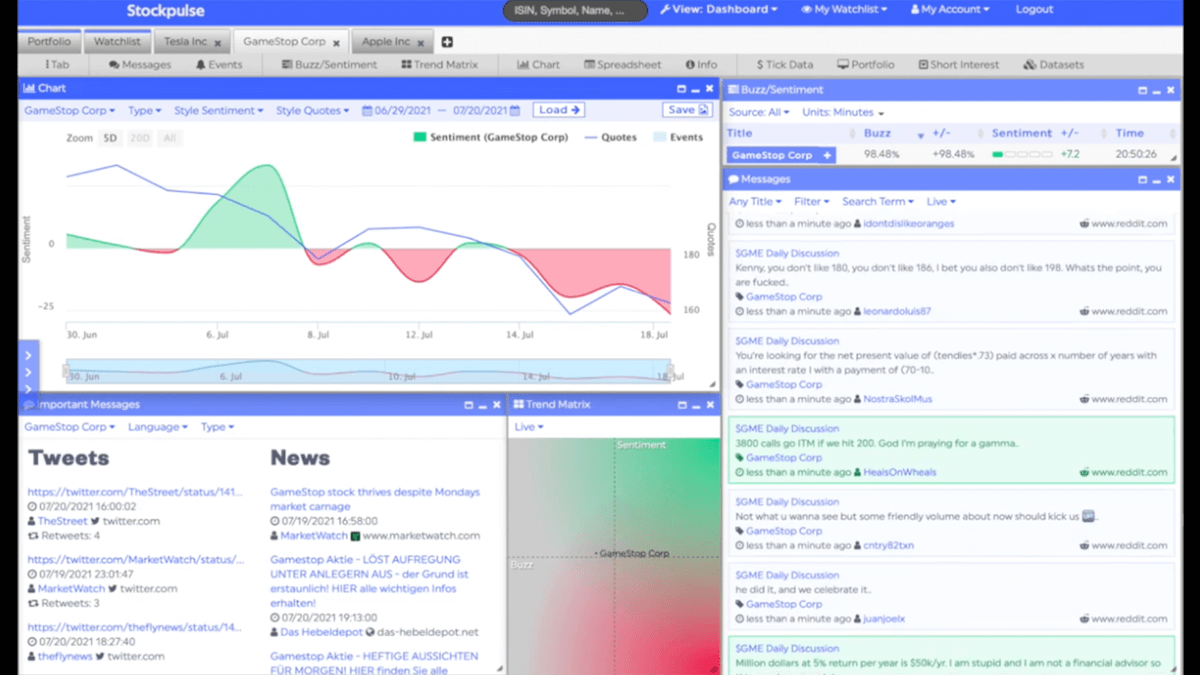

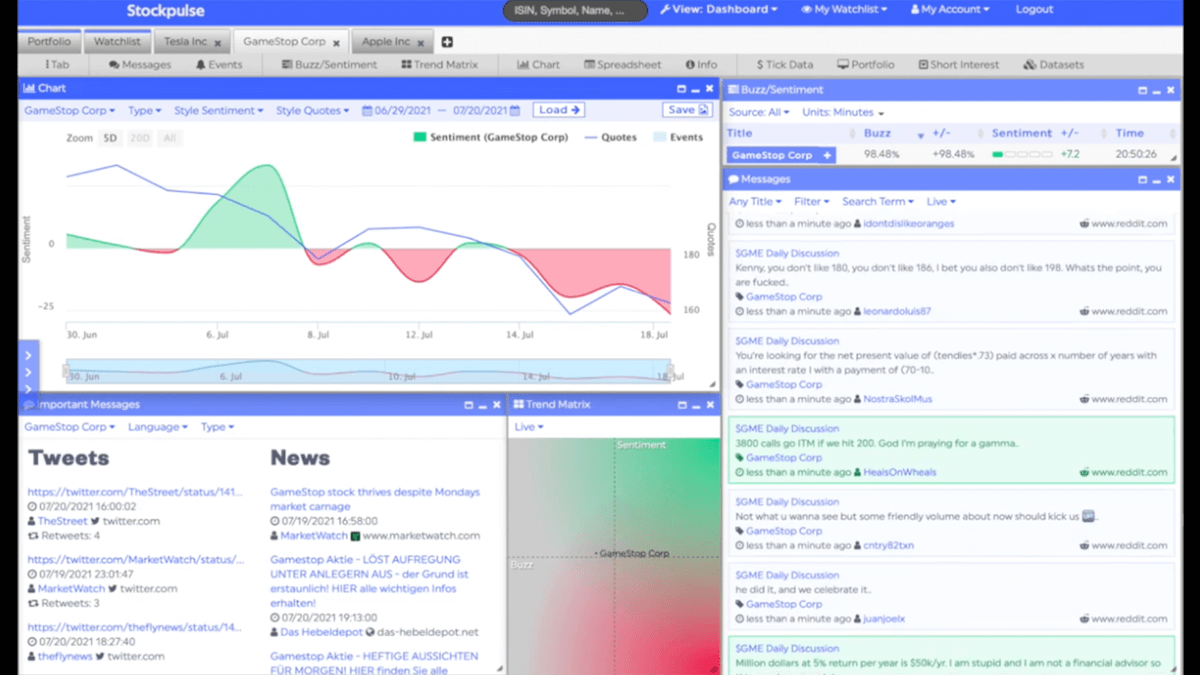

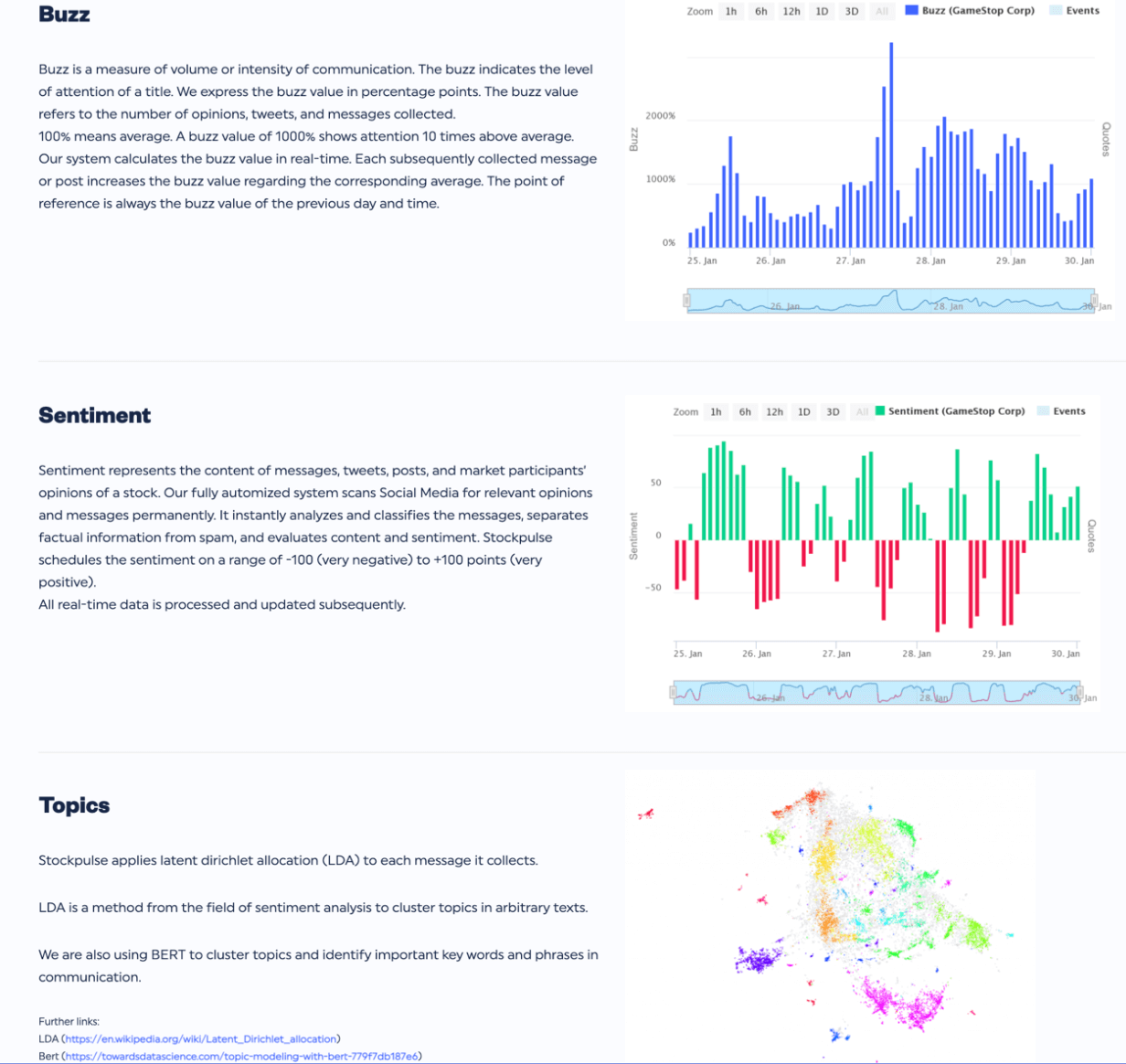

Aggregating and analyzing real-time financial conversations on many investment forums, blogs, or Weibo platforms is only possible with cutting-edge technology. This technology also helps generate buy/sell ratings for stocks based on 'emotions'. This sentiment more broadly reflects how investors view companies trading on the stock market.

Therefore, the entire process of analyzing the emotions, tone, and intentions behind comments, themes, and social media posts is called emotional analysis. It is also called emotional data intelligence, in which artificial intelligence, machine learning and natural language processing are applied to data to analyze potential emotions.

These techniques scan a large number of text strings for words with a positive or negative tone, and then assign emotional scores to the text. In the information arbitrage investment environment, sentiment analysis tools evaluate investors' optimism or pessimism towards specific stocks.

More advanced sentiment analysis tools can distinguish between positive and negative meanings in a single sentence. Except for HedgeChatterIn addition, several other emotional analysis tools also involve social media posts and conversations to extract in-depth insights.

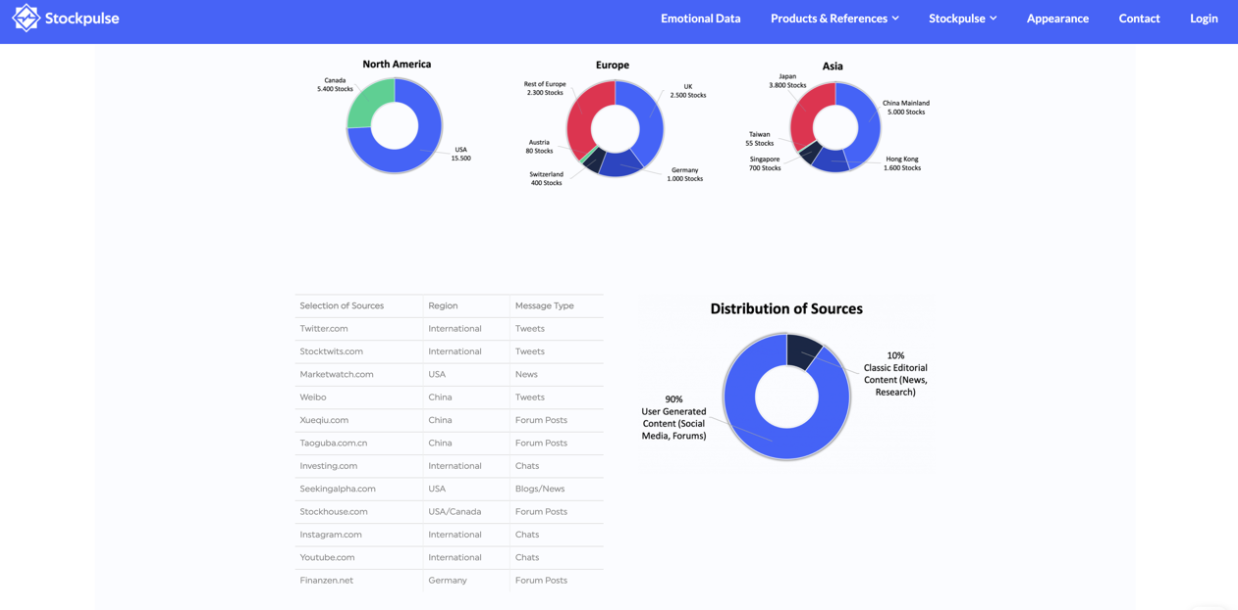

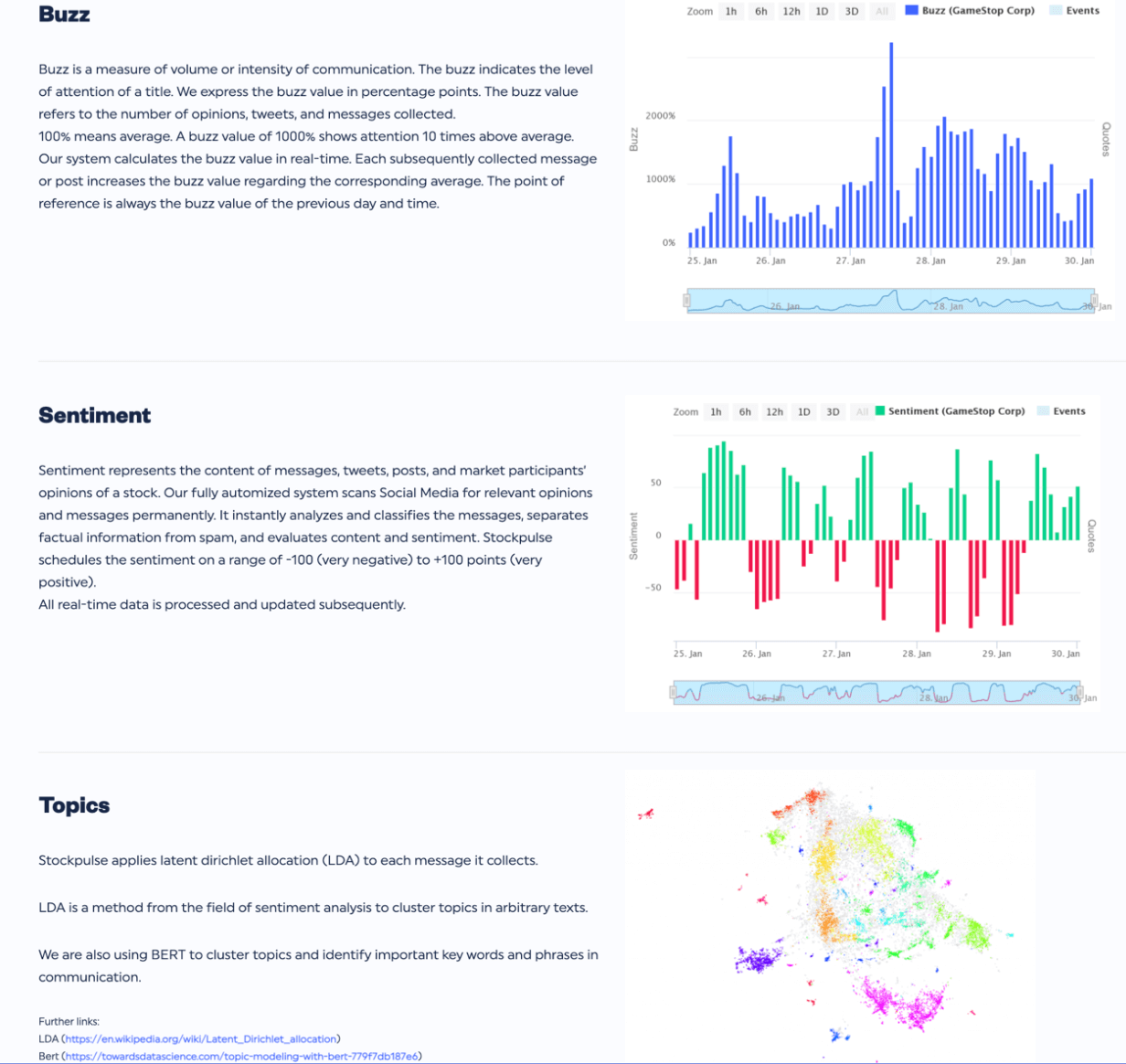

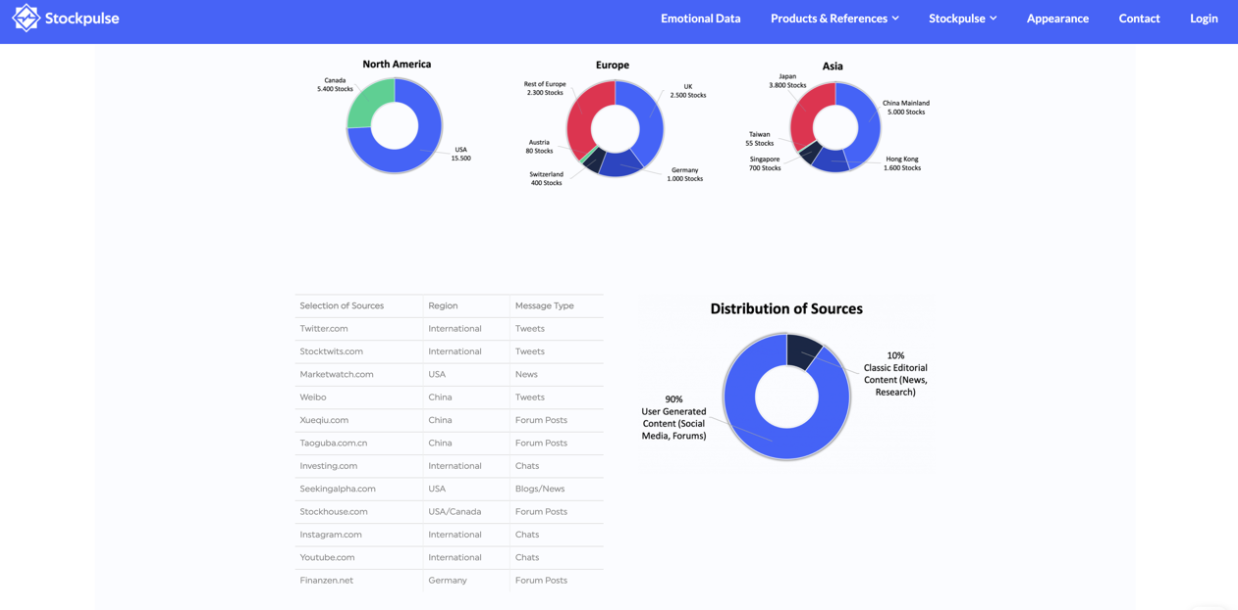

Stockpulse is such a social chat analysis tool, Stockpulse Natural language processing tracks English, German and Mandarin on social media. Collect data from thousands of different sources worldwide, such as news articles and journals, blogs, social media, and forums. Everyday from 6000+Collect+3 million messages from ten thousand verified accounts.

Web crawler and other data collection methods constantly scan countless different Internet resources to obtain relevant financial topics, influencers and other unstructured data. StockpulseAll these unstructured data sets are processed by artificial intelligence of and transformed into feasible and easy to understand information.

It also has historical data from unconventional sources since 2011. Covering stocks, stock indices, forex, commodities, and cryptocurrencies. Including major indices (S&P500, Dow Jones, Nasdaq, DAX, etc.) Commodity (gold, silver, oil, etc.) Currency (EUR/USD, GBP/USD, EUR/CHF, etc.)

Stockpulse also uses advanced emotion analysis tools and natural language processing methods to extract topics and explore the semantic structure of massive text subjects. Other widely used sensitivity analysis tools includeAwario, Mentionlytics, Lexalytics, Mediatoolkit, and Brandwatch.

Chris Camillo's Social Information Arbitrage Trading Example

Chris Camillo has conducted many successful social information transactions during his 14 year trading career.

2011- Investing in the Missoni collection of clothing sold by Target

Chris learned about the partnership between Target and Italian fashion company Missoni from his wife. On the day of launch, Chris stood at 150In the queue of famous shoppers, they saw that each item was sold out within two hours. He quickly discovered that a similar situation had occurred in every Target store across the country. According to Chris, this is a piece of information that Wall Street has not yet obtained. He quickly invested his funds inTarget stock has tripled within 48 hours.

2016- Nintendo Pokemon Go

In 2016, Chris Camillo analyzed Pokemon GoThe social craze of the game and its huge success was predicted a few months before its release. He also predicted that the value of Nintendo's stock would double.

2019- ELF Elf Beauty Makeup

In March 2019, Youtube Jeffreestar, a beauty company with over 16 million subscribers, evaluated ELF Beauty's makeup product Camo Concealer. The video received a total of 14 million views and inspired many millennials to purchase the product. This is an important turning point for ELF Beauty. From March to September 2019, during the month, the stock rose from $8 to $17.5, more than doubling. Chris Camillio purchased shares in this cosmetics company.

As shown in the figure below, the stock price of ELF Beauty rose from $8 to $17.5 between March and September 2019. In order to maximize his profits in the trade, Chris Camillo uses options. In this case, he bought the call option, and the bank's profit was 10 times higher than the stock appreciation of 120%.

Source: Yahoo

How to Utilize this Strategy to Its Full Advantage.

It is not easy to discover meaningful social trends before others. From a historical perspective, Chris Camillio only discovered a small number of social arbitrage trading opportunities on average every year.

Identifying information that affects prices through social trends requires sharp foresight. However, EBC Financial Group believes that if each investor retrains their thinking mode to examine and analyze the surrounding things, and then conducts extensive analysis to determine whether information advantages are meaningful for specific assets, it may also produce different results.