The euro’s uptrend stalled in 2024, hanging near a one-month low against the

US dollar, as the outlook for the eurozone remains bleak relative to that of the

US and risk sentiment has turned sour.

Economy looks set for another downturn in the last quarter, while a recent

pick-up in inflation is expected to persist in the coming months, according to

the central bank’s vice president.

"Positive energy base effects will kick in and energy-related compensatory

measures are set to expire, leading to a transitory pick-up in inflation," Luis

de Guindos said.

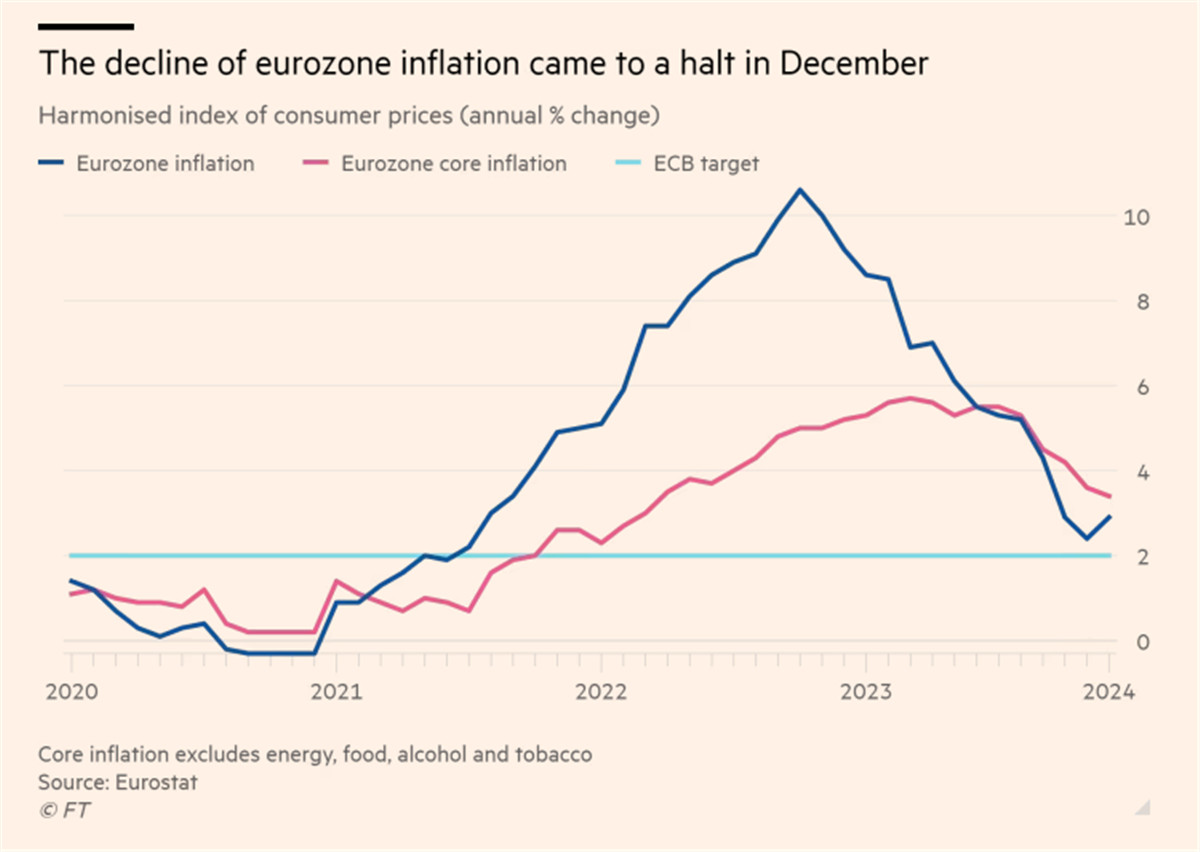

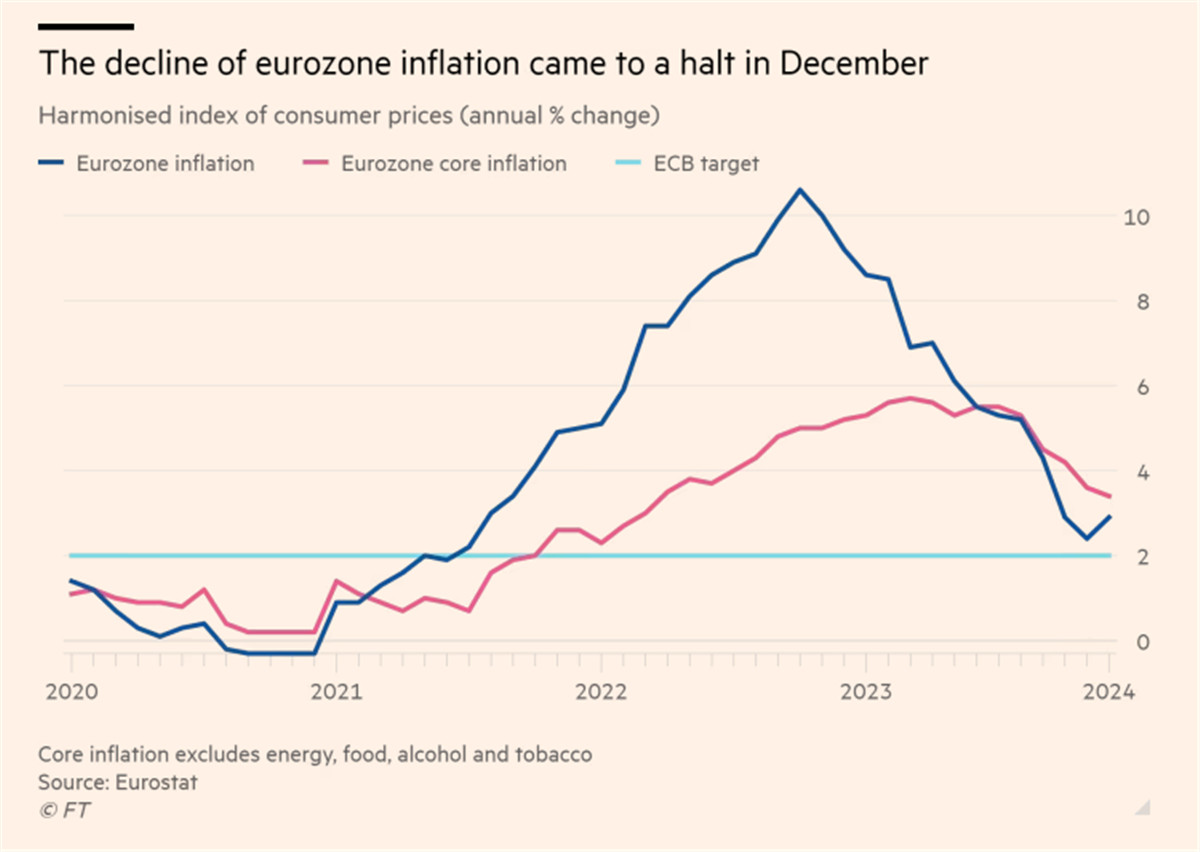

Annual inflation in Dec rose by 2.9% year-over-year, less than the 3%

expected, ending a seven-month decline streak. Meanwhile the contraction in euro

zone business activity continued at the end of 2023.

HCOB's Composite PMI remained below the 50 mark for a seventh month. Output

prices increased at their quickest pace since June, signalling it may be

premature to call end to inflation fight.

China, the EU’s largest trading partner, reported fourth-quarter GDP figures

slightly below expectations, bringing 2023 growth to 5.2%. Real estate risk is

lingering with the worst declines in new home prices in nearly nine years seen

last year.

Rate cut fantasy?

The ECB will lower interest rates four times this year as inflation retreats

more quickly than previously anticipated, according to a Bloomberg poll of

economists. The first one will most likely kick off in June.

Economists now expect price growth to cool to 2.3% this year and average 2.1%

in 2025. The central bank said last year’s dramatic slowdown could hardly

continue in 2024.

A recession in the second half 2023 will be followed by a gradual recovery

that may gather speed over the course of this year, the survey showed. The odds

are still against the gap narrowing between the US and the eurozone.

Investors have priced in 150-bp cuts by the end of the year, with a first

move in April fully priced in, but several policymakers have lately exhibited

hawkish tendencies when responding to that view.

Recent inflation data broadly confirmed assessment from the Dec’s meeting,

meaning interest rate cuts are not a near-term topic of debate, chief ECB

economist Philip Lane said on Friday.

Governing Council member Robert Holzmann said on Monday “everything we have

seen in recent weeks points in the opposite direction, so I may even foresee no

cut at all this year.”

He also flagged the “overlying problem” of geopolitical changes in the Middle

East, as the Israel-Hamas war has escalated to a regional war involving

Hezbollah and the Houthis.

Germany off track

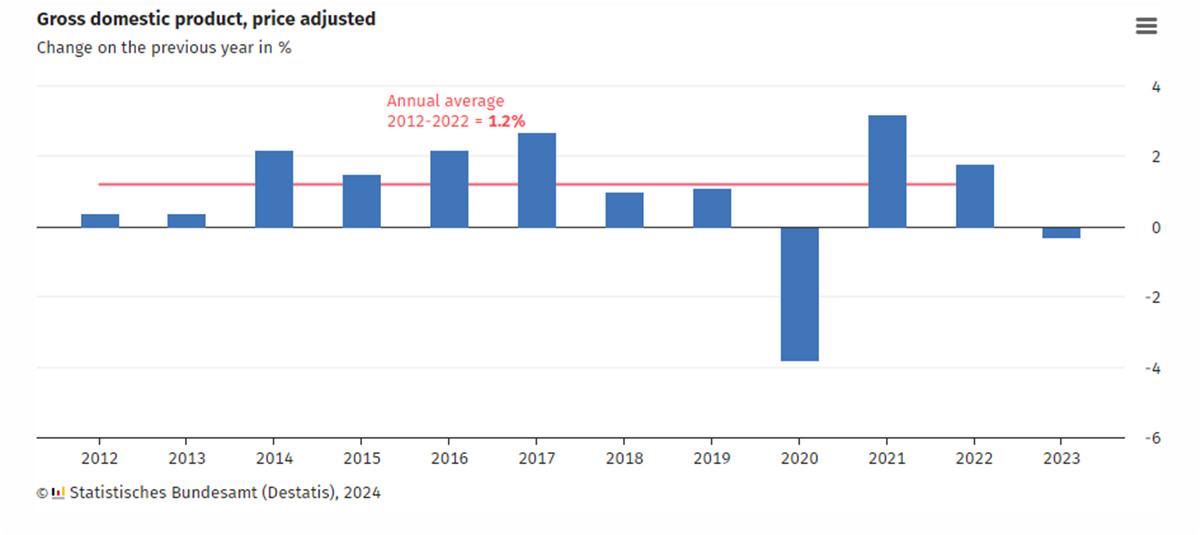

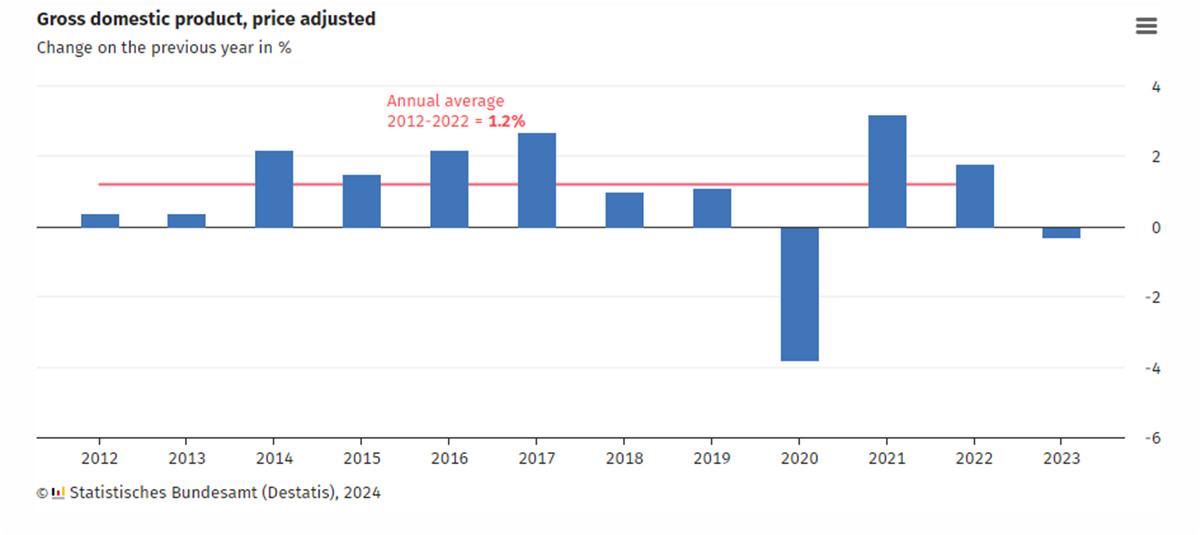

Once a locomotive, Germany now has been the laggard of Europe. It was the

worst performing major economy last year, burdened by rising interest rates and

energy costs.

Advanced economies grew 1.5% on average in 2023 while German output

contracted 0.3%, highlighting the vulnerability of its manufacturing to the loss

of Russia’s gas and China’s demand.

GDP was 0.7% higher in 2023 than in 2019. "It is worrying that the German

economy has hardly grown at all since the outbreak of coronavirus,"

Commerzbank's chief economist Joerg Kraemer said.

Growth in the country is expected to pick up to 0.6% this year – still one of

the world’s weakest large economies, according to the OECD. Some analysts say

the worst is yet to come.

Carsten Brzeski, the global head of macro research at the Dutch bank ING,

said: “There is no imminent rebound in sight and the economy looks set to go

through the first two-year recession since the early 2000s.

German insolvencies are expected to rise between 10% - 30% this year and

exceed pre-pandemic levels. Only 52% companies could be saved through insolvency

at the end of last year, according to data from Falkensteg.

The government reached a deal last month to have €17 billion cut from the

overall budget and leave the debt brake untouched, which could not have come at

a worse time.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.