Learning to trade from scratch is entirely feasible with a structured approach, dedication, and discipline.

At first glance, trading can appear overwhelming: charts full of indicators, unfamiliar jargon, and markets that move faster than you expect. Yet, when approached step by step, the process becomes far less daunting.

This guide will break down the essential steps, from understanding the basics to developing a trading strategy and managing risks.

1. Foundations of Trading for Beginners

What Is Trading — and Why Learn It Correctly?

Trading means buying and selling financial instruments (such as currencies, indices, commodities or CFDs) with the intention of making profits from price movement, often over shorter time horizons.

Unlike long-term investing (buy and hold), trading emphasises timing and tactical entry/exit.

Because of leverage, trading can magnify gains—but also losses—so a structured, disciplined approach is essential from day one.

Market Types You Should Understand

When starting, you should know the main markets you may trade:

Forex / currency pairs (e.g. EUR/USD, GBP/JPY)

Indices and commodities via CFDs (e.g. stock indices, oil, gold)

Stock (share) CFDs (depending on your jurisdiction)

EBC offers multi-asset class brokerage: forex, indices, shares, and commodities via CFD instruments.

ETFs (e.g. SPDR S&P 500 ETF Trust (SPY), Invesco QQQ Trust (QQQ), iShares Russell 2000 ETF (IWM))

Essential Terminology: Building Your Trading Vocabulary

You must become fluent in these basic terms:

Bid, Ask, Spread

Leverage, Margin, Margin Call — EBC allows leverage from 1:1 up to 500:1 for suitable instruments.

Order types: market orders, limit orders, stop or stop-loss, trailing stop, etc.

Liquidity, volatility, slippage

Pips, lots, contract size, notional value

Position sizing, risk per trade

Mastering these terms and their implications is your first step.

2. Setting the Right Trading Foundation

Why the Choice of Broker Matters for Beginners

Your broker is your gateway to markets. With EBC, you benefit from:

Top-tier regulation: EBC is authorised and regulated by the FCA (UK), CIMA (Cayman Islands), and ASIC (Australia).

Segregation of client funds: EBC holds client capital in separate accounts with Tier One banks.

Insurance and compensation protections: EBC maintains firm-level insurance and participates in compensation schemes.

Execution quality: EBC claims institutional-grade order execution, liquidity aggregation, and very low latency (~20 ms average).

Transparent pricing and educational tools

These advantages help ensure that your learning is not undermined by poor execution, hidden fees, or unreliable service.

How to Get Started on a Platform from Scratch

Here's how to begin:

1)Open an account

EBC offers a streamlined registration process (submit personal info, verify identity, deposit funds).

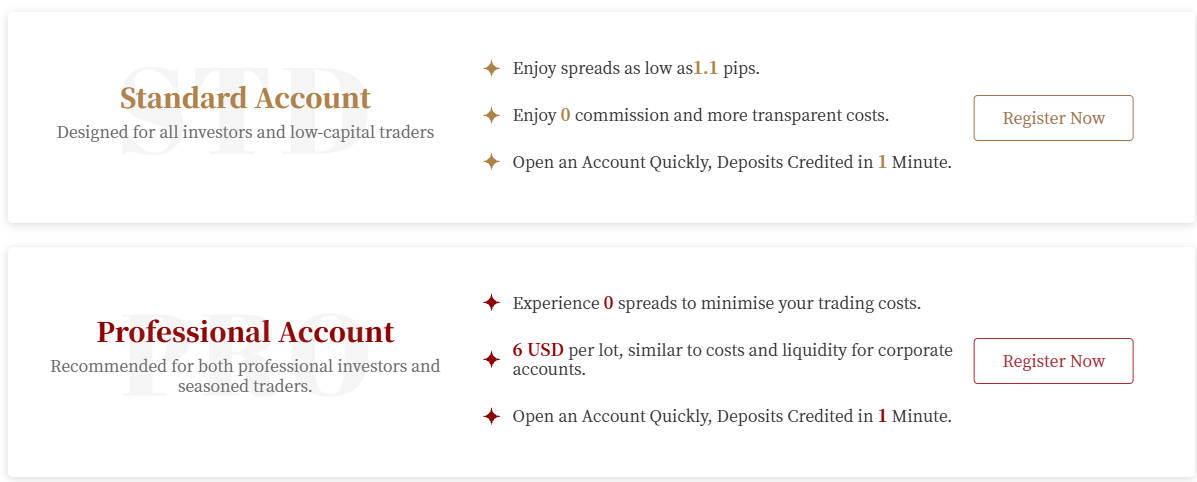

2) Choose account type

You can select between Standard and Professional accounts. The Standard account is suitable for most beginners (with floating spreads, no commission) while the Professional account may offer tighter spreads but with commission per lot.

3) Install / access trading terminals

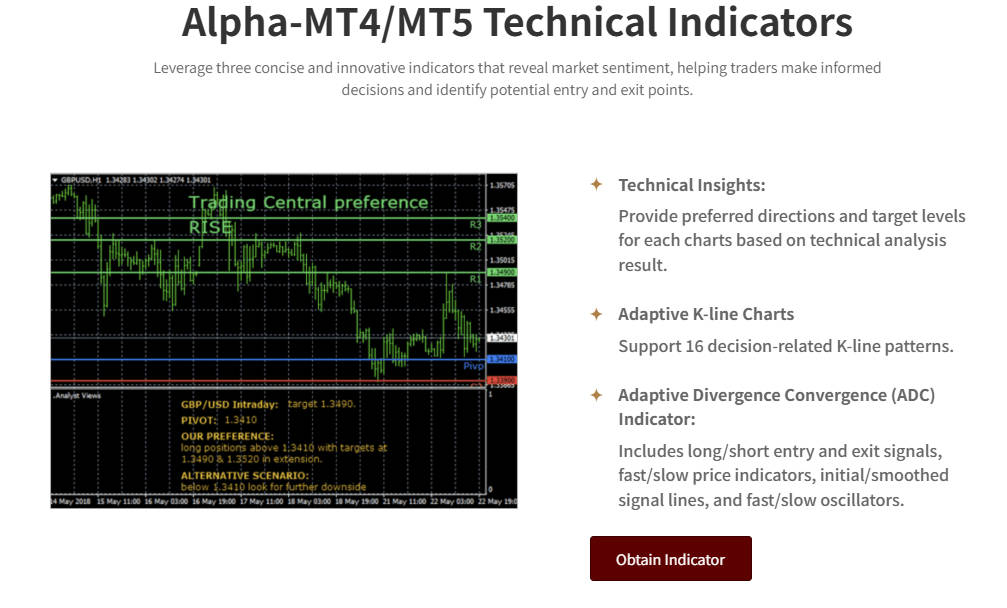

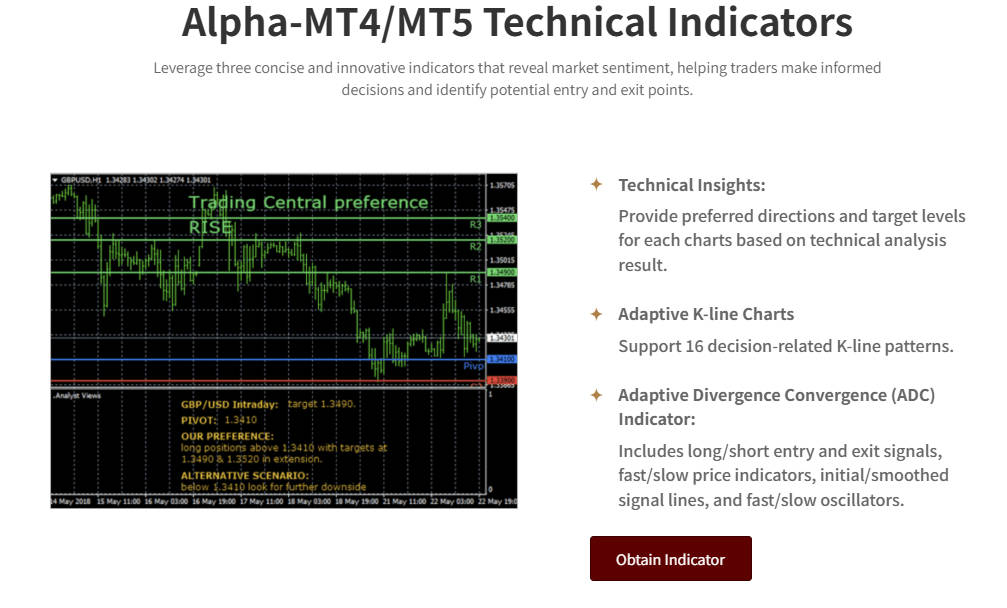

EBC supports MT4 and MT5 platforms (desktop, web, mobile) for charting, analysis, and order execution.

4) Fund your account and begin

Once your deposit is processed, you can begin trading via the live account or continue practising in a demo account until you are confident.

5) Familiarise yourself with the interface

Explore charts, order windows, trade panels, historical data views, account statements and risk tools.

Learning Roadmap & Integration with EBC's Resources

To progress efficiently, you should:

Alternate theory reading with hands-on demo practice

Keep a trading journal (recording every trade: entry, exit, rationale, result)

Use EBC's educational materials, webinars, market insights, and platform guides

Review and refine your approach regularly

EBC promotes its own state-of-the-art trading solutions, risk tools, APIs, and analytics support to help traders manage multiple strategies.

3. Mastering Market Analysis: Fundamentals + Technicals

To learn to trade from scratch, you must learn both fundamental analysis (why markets move) and technical analysis (when to trade).

Fundamental Analysis: Understanding the "Why" Behind Market Moves

Macroeconomic data: GDP growth, inflation, interest rates, employment figures

Central bank policies: rate decisions, quantitative easing, forward guidance

Fiscal decisions: government spending, taxation, regulation

Corporate fundamentals (for stock/CFD trading): revenue, profits, balance sheet, earnings per share, valuation multiples

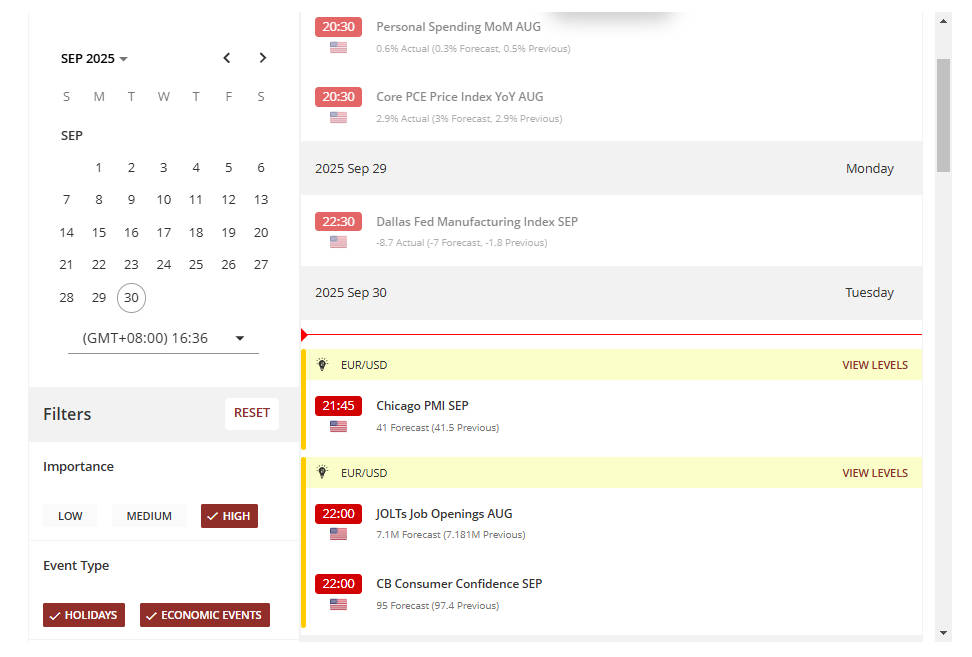

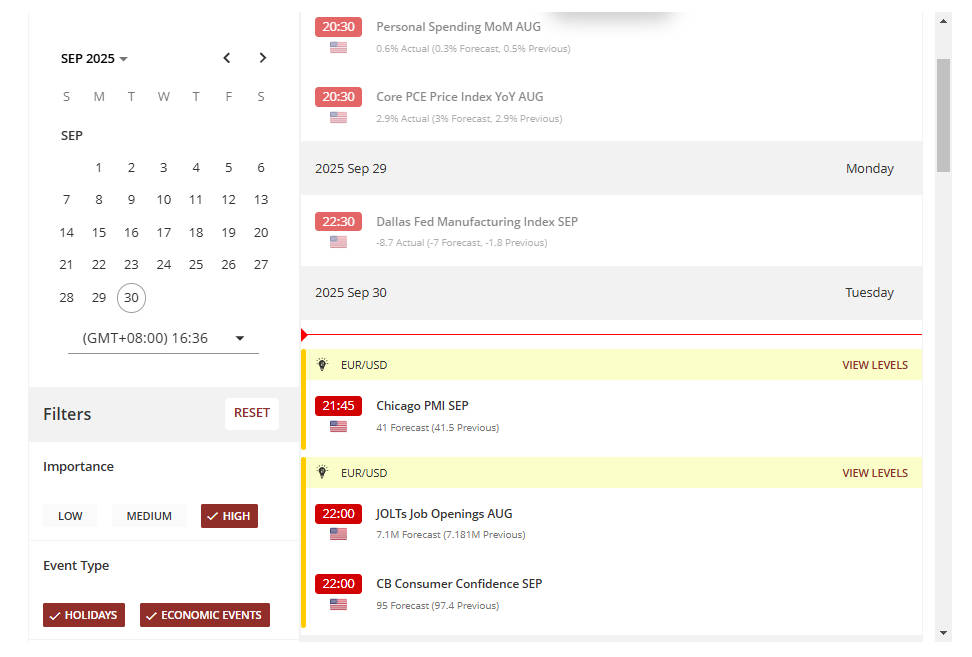

News & events: earnings releases, economic calendar events, geopolitical developments

You should learn to interpret calendars and event impact, and use them to filter trades.

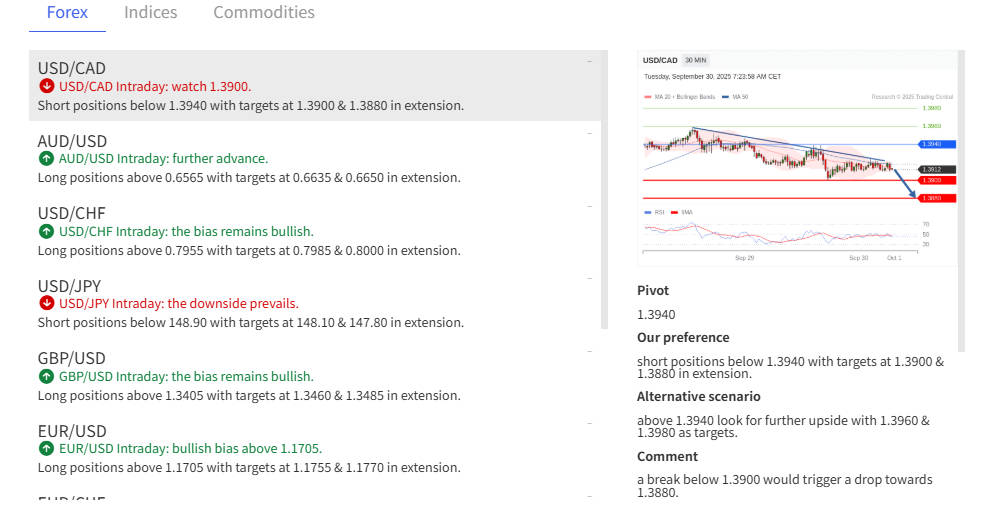

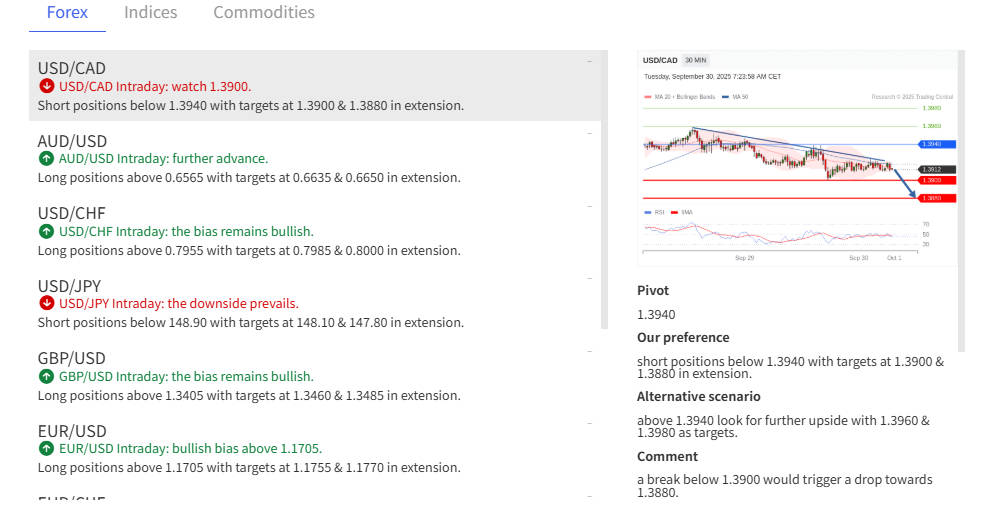

Technical Analysis: Understanding the "When & How"

Price charts & patterns: candlestick charts, bar charts, chart patterns (double tops, triangles, head & shoulders)

Support, resistance, trendlines, channels

Indicators & oscillators: moving averages (SMA, EMA), MACD, RSI, Bollinger Bands, stochastic, volume indicators

Divergences & confirmation techniques

Multiple time frame alignment: aligning signals from higher timeframes (daily, 4H) with lower ones (1H, 15min)

Importantly, you should not rely on a single indicator alone—use combinations and filters for greater robustness.

Using EBC's Tools for Market Analysis

EBC provides real-time market data feeds (for forex, CFDs) via its trading platforms.

Charting and technical analysis tools are embedded in MT4/MT5. accessible through EBC's system.

EBC offers liquidity aggregation and smart order routing to improve trade execution quality.

For advanced users, EBC supports API / FIX connectivity for algorithmic strategies.

Use these tools to cross-check your hypotheses before placing trades.

4. Developing Your First Trading Strategy Step by Step

Choose a Trading Style That Matches Your Personality

Each style has its own demands:

Common Trading Styles for Beginners to Learn Trading from Scratch

| Style |

Time horizon |

Typical trade duration |

Advantages / Pitfalls |

| Scalping |

seconds to minutes |

many trades per day |

high intensity, needs low latency, high discipline |

| Day Trading |

intraday |

within same session |

manageable pace, no overnight risk |

| Swing Trading |

days to weeks |

fewer trades |

more breathing time, lower stress |

| Position Trading |

weeks to months |

very few trades |

less time pressure, subject to macro regimes |

As a beginner, many find swing or day trading easiest to manage without constant stress:

Less stress: Unlike scalping, you don't need constant screen time; unlike position trading, you don't wait months to see results.

Faster learning: Trades play out within hours or days, giving quicker feedback on strategy.

Manageable pace: Enough opportunities to practise without being overwhelming.

In short, they offer beginners the right mix of control, learning speed, and reduced stress.

Building a Simple, Clear Trading Plan

Your plan must define:

Entry rules (e.g. price breaks resistance + indicator confirmation)

Exit rules: take profit points, stop-loss levels

Risk/reward ratio (for example, aim to risk 1 to make 2 or 3)

Position sizing method (e.g. fixed-fraction, volatility-based)

Filters and confirmations (time of day, news avoidance, higher timeframe trend alignment)

Write your plan down. This is your trading playbook.

Backtesting & Forward Testing

Use historical data (via MT4/MT5) to simulate trades according to your plan

Record results: win rate, average profit/loss, drawdowns

Avoid overfitting (don't tailor your plan to past data so tightly that it fails out of sample)

Move to forward test (demo account) under live-market conditions

Observe how it performs under different market regimes

Executing Trades on EBC's Platform

Use limit orders or market orders depending on your strategy

Be mindful of slippage and execution latency

Use partial exits, scaling in/out, or trailing stops as appropriate

Monitor trade performance, and always abide by your stop-loss rules

5. Risk Management & Trading Psychology

Protecting Your Capital

Limit your risk per trade (often 1–2 % of total capital)

Set a maximum daily or monthly loss limit

Diversify across instruments to avoid correlation risk

Plan for worst-case drawdowns and know how you will respond

Money Management Techniques

Position sizing models: fixed fractional, volatility-based sizing, Kelly criterion (with caution)

Use trailing stops to lock in profits

Hedge or scale exposure when needed

Resist "putting all eggs in one trade"

Psychology: The Inner Game of Trading

Expect to feel fear, greed, doubt—learn to manage them

Avoid overtrading, revenge trades, and impulsive decisions

Cultivate discipline, patience, consistency

Keep a journal of your mental state during trades

Accept drawdowns as part of the process, not a personal failure

EBC's support tools like risk calculators, alerts, and education resources can help reinforce discipline.

6. Transitioning from Beginner to Competent Trader

1) Start Small, Scale Slowly

Begin with micro or small-sized trades

Only increase exposure when you are consistently profitable

Slowly compound gains rather than taking large leaps

2) Continuous Review and Iteration

Weekly / monthly review of all trades (winners and losers)

Update your journal and metrics

Refine or discard parts of your plan that consistently underperform

Study new methods, adapt to changing market conditions

3) Evolving Your Goals & Exploring Advanced Topics

Once you are stable, consider:

Algorithmic trading / automated strategies

Options, futures, derivatives

Portfolio-level strategies, hedging, intermarket analysis

Incorporating alternative assets or strategies

Always retain the fundamentals: risk control, clarity in entry/exit rules, and psychological strength.

Frequently Asked Questions (FAQ)

Q1. How much money do I need to start?

A modest starting amount is sufficient, especially when practising on a demo account. Focus on learning, not capital.

Q2. Should I use a demo account first?

Definitely. Demo accounts allow risk-free practice and help you understand the platform.

Q3. Why choose a regulated platform?

Regulation ensures secure handling of funds, fair execution, and professional oversight.

Q4. What are common mistakes new traders make?

Overleveraging and risking too much

Trading without a plan or clear rules

Ignoring stop-losses

Letting emotions drive decisions

Switching strategies too often

Q5. How long will it take to become a competent trader?

It depends on your discipline, consistency, and time invested. Many see meaningful progress in 6–12 months of structured practice.

Conclusion

Learning trading from scratch is a step-by-step process. Focus on mastering fundamentals, practising strategies safely, managing risk, and developing discipline.

Platforms like EBC Financial Group can provide the tools and secure environment for practice, but the core of success lies in structured learning, consistent practice, and thoughtful reflection.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.