Financial markets move quickly, and traders are always looking for new ways to profit from price changes across various assets. CFD trading has grown in popularity as a flexible way to participate in these markets.

But what exactly is CFD trading, and why do both professional and retail traders rely on it? Understanding how it works is essential before engaging in this type of trading.

Highlights

CFDs let traders profit from price changes without owning the asset, by buying (long) or selling (short) contracts.

Leverage offers amplified opportunities and risks, making risk management essential.

Flexibility to go long or short allows traders to benefit from rising and falling markets.

Benefits include global access, cost efficiency, and hedging, but risks stem from volatility, leverage, and fees.

This article explores the meaning, mechanics, risks, and benefits of Contracts for Difference (CFDs), offering a clear and practical guide to this versatile trading tool.

What Is CFD Trading?

A Contract for Difference (CFD) is a type of financial derivative that allows traders to speculate on the price movements of assets—such as stocks, indices, commodities, and currencies—without actually owning the underlying asset.

CFDs provide a unique opportunity for traders to participate in the financial markets while avoiding some of the complexities and costs associated with direct ownership.

At its core, CFD trading revolves around agreements between a trader and a broker.

The contract stipulates that the trader will pay (or receive) the difference in the price of the asset from the time the contract is opened to when it is closed. This means that profit or loss is determined entirely by changes in the asset's price rather than its physical ownership.

Key Features of CFDs:

1)Speculation on Price Movements:

Traders can profit not only from rising markets (going long) but also from falling markets (going short). This flexibility makes CFDs particularly attractive in volatile conditions.

2)Leverage:

CFDs are often traded on margin, meaning traders can open positions with a fraction of the total value. Leverage amplifies both potential profits and potential losses.

3)No Ownership of the Underlying Asset:

CFD traders do not own the assets they are trading. This eliminates the need for storage, management, or physical delivery of commodities or shares.

How Does CFD Trading Work?

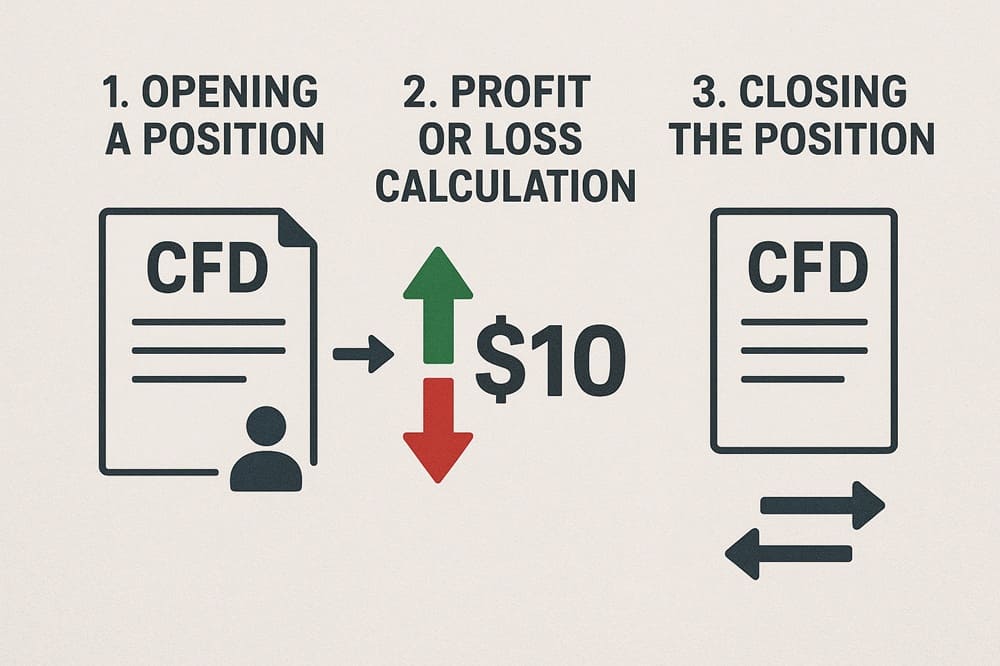

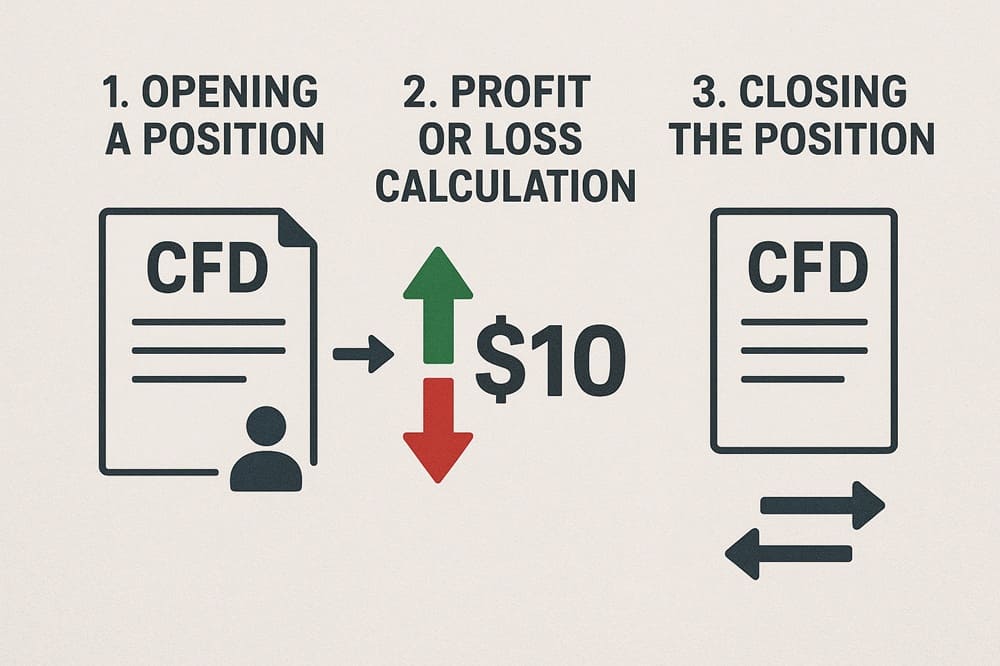

Understanding the mechanics of CFD trading is essential for anyone considering entering this market. Here’s a step-by-step look at how CFD trading operates:

1. Opening a Position

To begin trading CFDs, a trader opens a contract with a broker. This involves choosing an asset and determining whether to go long (buy) or short (sell) based on the expected direction of the market.

2. Profit or Loss Calculation

The profit or loss from a CFD position is calculated as the difference between the opening price and the closing price of the contract, multiplied by the number of units traded.

For example, if a trader buys a CFD on a stock at £100 per share and closes it at £110. the profit would be £10 per share. Conversely, if the price falls to £90. the loss would be £10 per share.

3. Closing the Position

To realise gains or losses, the trader must close the position by executing an opposing trade. This action settles the contract, and the broker either credits the profit or debits the loss to the trader's account.

Example of Positions:

Long Position: Buying a CFD in anticipation of a price increase.

Short Position: Selling a CFD expecting the asset's price to fall.

This flexibility allows traders to exploit both upward and downward market trends, which is particularly useful in volatile markets where prices fluctuate rapidly.

Risks and Considerations in CFD Trading

While CFDs offer unique opportunities, they also carry substantial risks. Prospective traders should be aware of the following:

1)Leverage Risks:

Leveraged trading can magnify profits but equally amplifies losses. A small adverse price movement can result in substantial financial loss.

2)Market Volatility:

Rapid price changes in highly liquid or volatile markets can lead to unexpected losses.

3)Overnight Financing Fees:

Holding CFD positions overnight may incur additional costs, which can accumulate over time.

4)Regulatory Restrictions:

CFD trading is heavily regulated in many jurisdictions. For example, it is prohibited for retail traders in the United States, and leverage limits are imposed in Europe to protect investors.

Due to these risks, CFD trading is generally more suitable for experienced traders who have a solid understanding of market dynamics and risk management strategies.

Benefits of CFD Trading

Despite the risks, CFDs have several distinct advantages that make them appealing:

Access to Global Markets: CFDs allow traders to access a wide array of international assets without the need to open separate accounts or purchase physical assets.

Flexibility: The ability to take both long and short positions provides a strategic advantage in diverse market conditions.

Cost Efficiency: Since traders do not own the underlying assets, CFD trading often incurs lower transaction costs, such as stamp duty in certain jurisdictions.

Hedging Opportunities: CFDs can also be used to hedge existing positions in a trader’s portfolio, mitigating potential losses from adverse market movements.

FAQ: Common Questions About CFD Trading

1. What is the difference between CFD trading and traditional stock trading?

CFD trading allows traders to speculate on price movements without owning the underlying asset, while traditional stock trading involves purchasing and holding actual shares.

2. Can I trade CFDs on all assets?

Most brokers offer CFDs on a wide range of assets, including stocks, indices, commodities, and currencies, though availability varies by broker and region.

3. Is CFD trading suitable for beginners?

CFD trading carries significant risks, particularly due to leverage and market volatility. It is recommended that beginners gain experience and understanding before engaging extensively.

4. How are profits and losses calculated in CFD trading?

Profits and losses are determined by the difference between the opening and closing prices of the CFD, multiplied by the number of units traded.

Conclusion

CFD trading represents a flexible and potentially profitable way to engage with financial markets, offering the ability to trade multiple asset classes, benefit from leverage, and profit from both rising and falling markets.

However, it is not without risks. Understanding the mechanics, leveraging strategies carefully, and practising rigorous risk management are essential for success. For those willing to educate themselves and approach trading strategically, CFDs can be a powerful tool in the trader's arsenal.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.