Visa reports fiscal first-quarter 2026 results after the market close on Thursday, January 29, 2026, followed by a management webcast at 2:00 p.m. Pacific (5:00 p.m. Eastern).

The quarter covers the December holiday period, typically resulting in elevated transaction volumes. Investors are expected to focus on transaction mix, cross-border momentum, and management's guidance for the remainder of fiscal 2026.

Visa’s fiscal Q1 2026 earnings arrive after a sharp January pullback, so the market is likely to weigh guidance and KPI quality as much as the headline beat. Investors typically focus on cross-border momentum, revenue mix (including value-added services), and the outlook for incentives and expenses, because these factors can change margins even when volumes look healthy.

Key Takeaways

The consensus is $3.14 EPS on about $10.68 billion revenue, implying double-digit year-on-year growth despite a more mature base.

Cross-border remains the swing factor, as Visa’s last reported quarter showed 12% total cross-border growth and 11% ex intra-Europe, reinforcing that travel and international e-commerce still drive upside in take-rate-rich revenue lines.

-

Client incentives and operating expense discipline matter as much as volume: Q4 FY2025 showed incentives rising and a litigation-related provision inflated GAAP noise, so the market will look through headline EPS to underlying margins and “clean” growth.

Q1 FY2026 Visa Earnings Forecast (Consensus)

| Metric |

Q1 FY2026 Forecast |

YoY |

Q1 FY2025 Actual |

What tends to move Visa Stock |

| EPS (consensus) |

$3.14 |

+14.2% |

$2.75 |

Beat/raise dynamic matters more than a small beat alone |

| Revenue (consensus) |

$10.68B–$10.686B |

+12.3% |

$9.51B |

Mix (cross-border + services) often matters as much as headline growth |

For fiscal Q1 2026, the Zacks consensus cited by Nasdaq is $3.14 EPS on about $10.68 billion revenue (estimates vary by provider and can change before the release). Against fiscal Q1 2025 results (EPS $2.75, revenue $9.51B), this implies another year of double-digit growth even as the payments cycle normalises.

The Operating Baseline: What Visa Delivered

To gauge what matters in the Q1 2026 report, start with Visa’s most recent confirmed baseline. In fiscal Q4 2025, Visa reported net revenue of $10.7 billion (up 12% year on year) and non-GAAP earnings per share (EPS) of $2.98 (up 10%).

For the full fiscal year 2025, Visa reported net revenue of $40.0 billion (up 11%) and non-GAAP EPS of $11.47 (up 14%). GAAP refers to Generally Accepted Accounting Principles; non-GAAP refers to adjusted figures that Visa presents alongside GAAP.

Visa also reported steady underlying throughput:

Payments volume: +9% in Q4, +8% for FY2025

Cross-border volume (total): +12% in Q4, +13% for FY2025

Processed transactions: +10% in Q4 and FY2025

Visa financial and volume snapshot (latest reported)

| Metric |

Q4 FY2025 |

YoY |

FY2025 |

YoY |

| Net revenue |

$10.7B |

+12% |

$40.0B |

+11% |

| Non-GAAP EPS |

$2.98 |

+10% |

$11.47 |

+14% |

| Payments volume (constant dollar) |

N/A |

+9% |

N/A |

+8% |

| Cross-border volume total (constant dollar) |

N/A |

+12% |

N/A |

+13% |

| Processed transactions |

67.7B |

+10% |

257.5B |

+10% |

Two implications matter for Visa Stock in this quarter:

Growth is broad-based, but not immune to noise. Q4 GAAP earnings carried a large litigation provision, reminding investors that Visa’s economics are strong while legal and regulatory overhangs can distort optics.

The market’s “beat” calculus is tighter. With strong FY2025 delivery already priced in, Q1 needs to reinforce the 2026 runway, not merely clear a modest consensus hurdle.

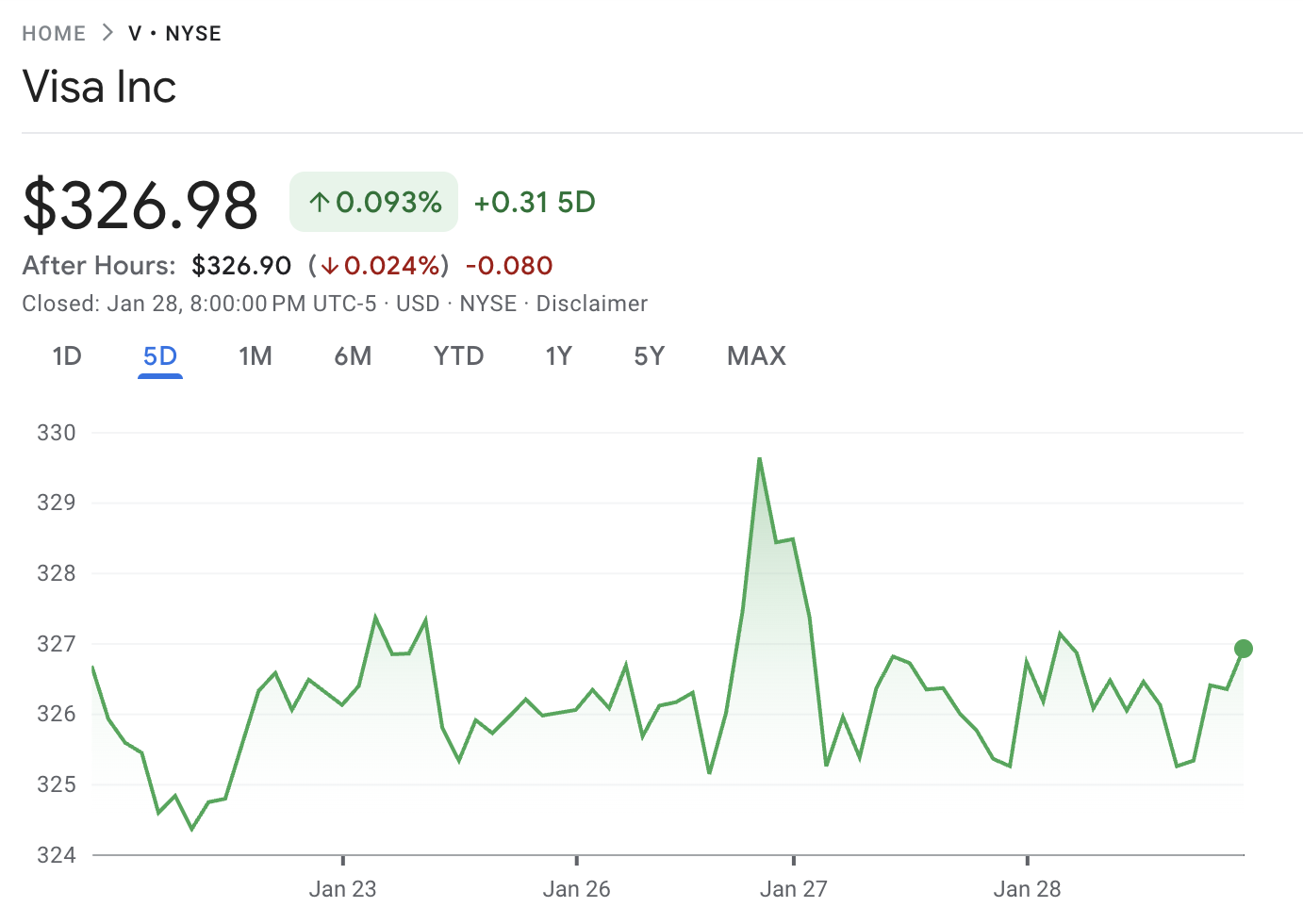

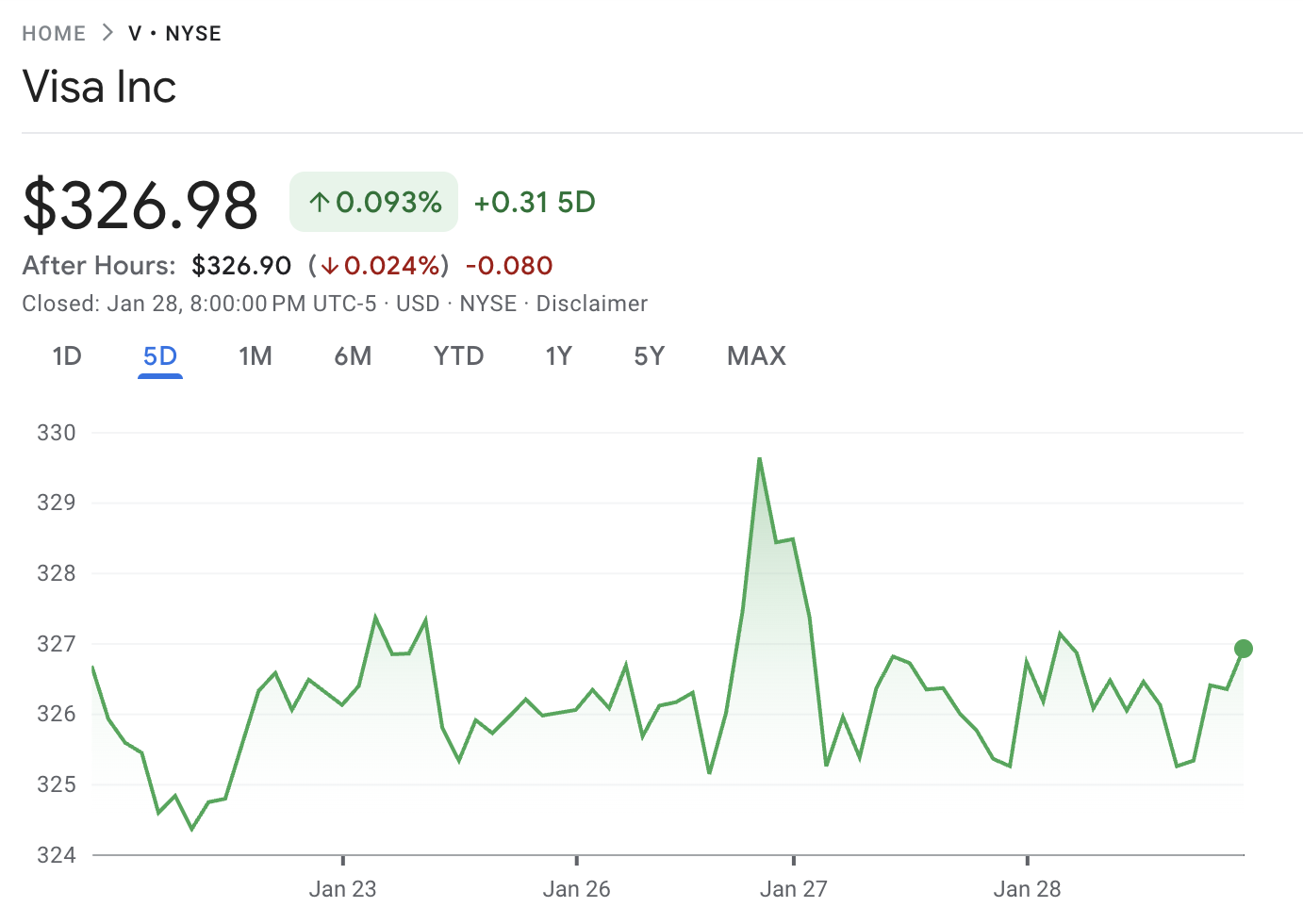

Visa's Stock Recent Performance

As of the Jan 28, 2026, close, Visa stock (V) traded at $326.98. Over the prior week, it was up about 0.5%, while over the prior month it was down about 7.9% (based on historical prices). Results show a six-month return of about -8.01% and a 12-month change of about -2.24%.

| Time frame |

Price change |

Performance |

Period start used |

| 1 Week (5 trading days) |

+$1.70 |

+0.52% |

Since 01/21/26 |

| 1 Month |

-$28.02 |

-7.89% |

Since 12/26/25 |

| 6 Months |

-$28.49 |

-8.01% |

Since 07/28/25 |

| 12 Months (52-week) |

-$7.50 |

-2.24% |

Since 01/28/25 |

Key overview: The short-term gain over the past week still sits inside a broader reset over the past month. That can reduce the penalty for a strictly in-line quarter, but it keeps guidance and cross-border commentary as the likely swing factors for repricing.

What Will Move The Visa Stock

1) Cross-border volume quality, not just the rate.

Investors are expected to assess whether growth is primarily driven by travel, which typically yields higher returns and signals confidence, rather than solely by e-commerce. Previous disclosures indicated that both travel and e-commerce contributed to cross-border strength; therefore, any slowdown in travel-related flows may have a significant impact on market perception.

2) Revenue mix and “take-rate durability.”

Visa’s revenue is not a single lever. Data processing, international transaction revenue, and value-added services tend to expand margins when volumes are healthy. In Q4 FY2025, Visa’s data processing revenue grew faster than service revenue, reinforcing operating leverage. If Q1 shows a similar mix, the market often rewards quality of earnings rather than quantity.

3) Client incentives trajectory.

Client incentives are the quiet margin governor. In Q4 FY2025, incentives rose sharply year-on-year, a reminder that competition for issuer and merchant relationships can pressure net yields even when gross volumes are strong. A “stable-to-easing” incentives narrative would be read as structurally positive for Visa Stock.

4) FY2026 guidance tone and confidence.

Management previously framed fiscal 2026 as a low-double-digit growth year for net revenue and non-GAAP EPS. In this setup, guidance confirmation can be as market-moving as an EPS beat.

How Visa Earnings Can Move Visa Stock

Because Visa is widely owned, the stock often reacts to guidance and cross-border rather than the headline print alone. The scenarios below frame typical market interpretations rather than predictions.

| Scenario |

What the print looks like vs consensus |

Likely Visa Stock reaction |

Market logic |

| Bull case |

EPS and revenue beat; cross-border remains firm; FY2026 confidence improves |

+3% to +6% |

Re-prices growth durability and supports multiple |

| Base case |

Modest beat or in-line; steady volumes; guidance reiterated |

-1% to +2% |

Confirms thesis but lacks catalyst to expand valuation |

| Bear case |

In-line EPS but weaker cross-border/mix; incentives or expenses surprise |

-4% to -8% |

Investors de-rate on quality of growth and margin outlook |

| Risk-off shock |

Solid Visa numbers but macro tone cautious |

-2% to -6% |

Multiple compression dominates fundamentals |

A key nuance: Visa can “beat” and still trade down if the market reads the beat as incentives-driven, FX-flattered, or accompanied by cautious forward commentary. Conversely, a narrow miss can be tolerated if cross-border services remain intact and guidance stays steady.

Technical Setup

Visa’s stock pullback can magnify post-earnings volatility because many traders anchor on moving averages and momentum stabilisation after a sharp decline. If you use indicators like the relative strength index (RSI) and moving average convergence divergence (MACD), confirm the current readings on your own platform because values can vary by data source and settings.

From a levels perspective, the market is likely to anchor around:

Support zone: low-$320s (prior recent lows)

Resistance zone: high-$320s to low-$330s (near-term pivots), then the mid-$330s to mid-$340s (moving-average gravity)

For earnings, the practical takeaway is simple: a strong guide can trigger a fast mean reversion toward those overhead levels, while a weaker print risks a break of recent support that invites systematic selling.

Risks Considerations

Regulatory and litigation overhangs. Visa’s fiscal Q4 2025 materials included a litigation-related provision, which reinforces that legal outcomes can create periodic headline risk even when operating trends are steady.

Competitive intensity in incentives. A sustained step-up in incentives can compress net revenue growth relative to gross volumes. That dynamic matters most when markets are already sceptical about “peak margins.”

Macro sensitivity through travel and discretionary spend. Visa is not a lender, but it is a high-frequency read on consumption. If management signals moderation in travel-linked cross-border flows, the market tends to extrapolate.

Valuation risk. With forward valuation still elevated relative to slower-growth financials, Visa Stock typically needs clean execution to hold its multiple.

Frequently Asked Questions (FAQ)

1) When is the Visa Earnings for Q1 2026?

Visa reports fiscal first-quarter 2026 results after the market close on January 29, 2026, with a webcast at 2:00 p.m. Pacific (5:00 p.m. Eastern). That timing matters because most of the initial Visa Stock reaction will occur after hours.

2) What are the consensus estimates for Visa Earnings this quarter?

Consensus expectations cluster around $3.14 EPS and about $10.68 billion revenue for fiscal Q1 2026. Traders tend to treat the revenue figure as a better read-through on volume and mix, while EPS is more sensitive to incentives and expenses.

3) Which Visa metrics are most important beyond EPS?

Investors focus on payment volume, cross-border volume (especially ex intra-Europe), processed transactions, client incentives, and the growth of data processing and international transaction revenues. These reveal whether Visa is winning on network economics, not just riding consumer spend.

4) Why does cross-border volume matter so much for Visa Stock?

Cross-border activity tends to carry richer economic signals and indicates the health of travel and international e-commerce. When cross-border growth is strong, Visa’s margin structure is usually more durable, which can justify a higher multiple in the next guide.

5) How should investors think about Visa's stock performance heading into earnings?

Over the past month, Visa's stock is down roughly 7.9%, even as it is modestly positive over the last week. That suggests some de-risking has already occurred, but it also means guidance and cross-border commentary could still drive a sharp repricing.

6) Is Visa Stock a “buy before earnings”?

The setup is a classic quality-growth trade-off: Visa’s business has demonstrated durable double-digit operating momentum, but valuation is not cheap, and technicals are softer. For many investors, sizing and time horizon matter more than the binary print, because the longer-term story is driven by sustained volume and services growth.

Conclusion

Visa Earnings for Q1 2026 are less about proving that payments are healthy and more about validating that Visa can keep converting volume into high-quality, defensible profit growth in 2026.

The consensus bar is clear: $3.14 EPS on about $10.68 billion revenue. The market’s real test will be cross-border resilience, revenue mix, incentives discipline, and the confidence embedded in guidance. If those elements align, Visa Stock can rebound from a technically weakened setup. If they do not, the downside reaction can be sharper than the headline EPS suggests.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Sources

1. Visa Investor Relations