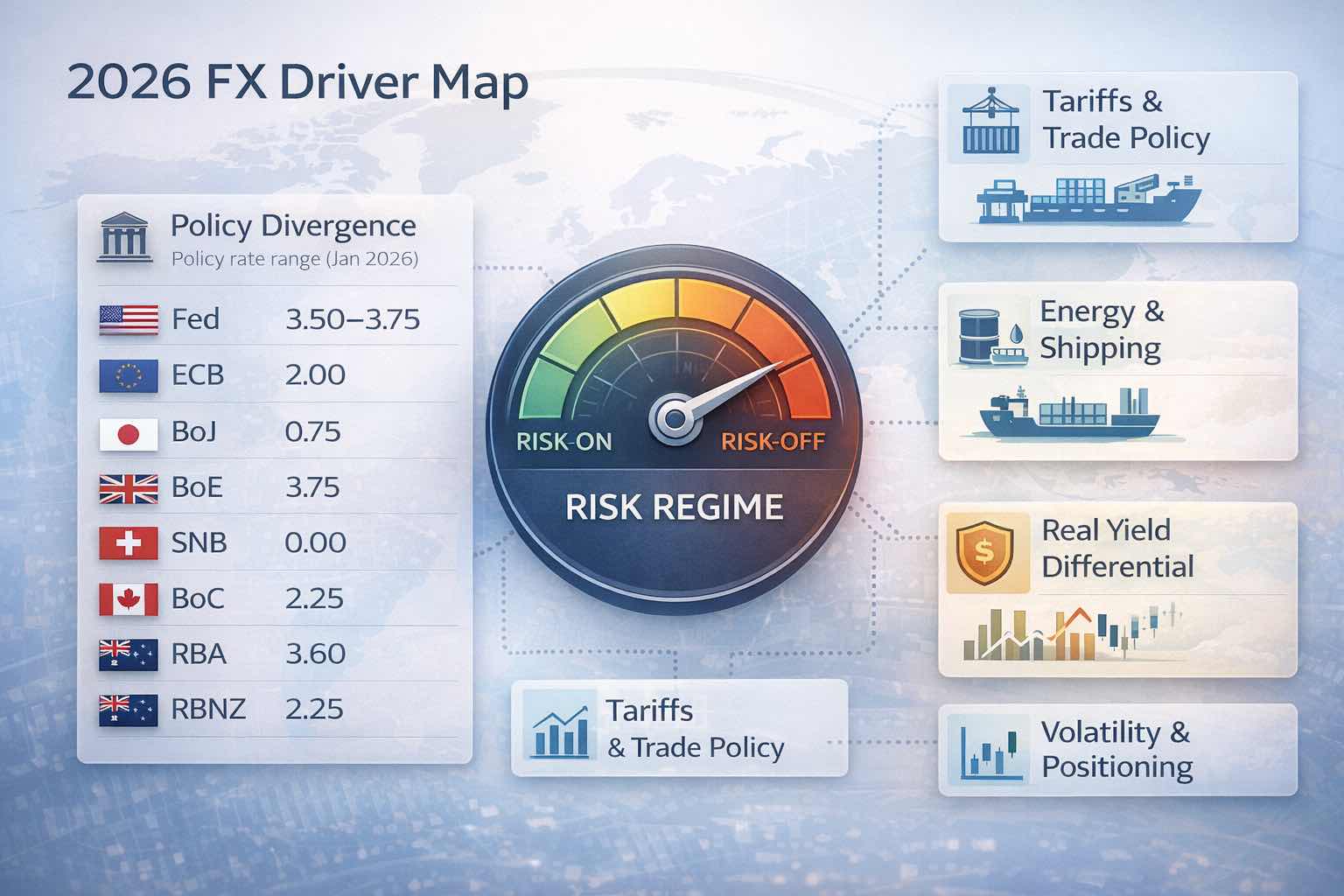

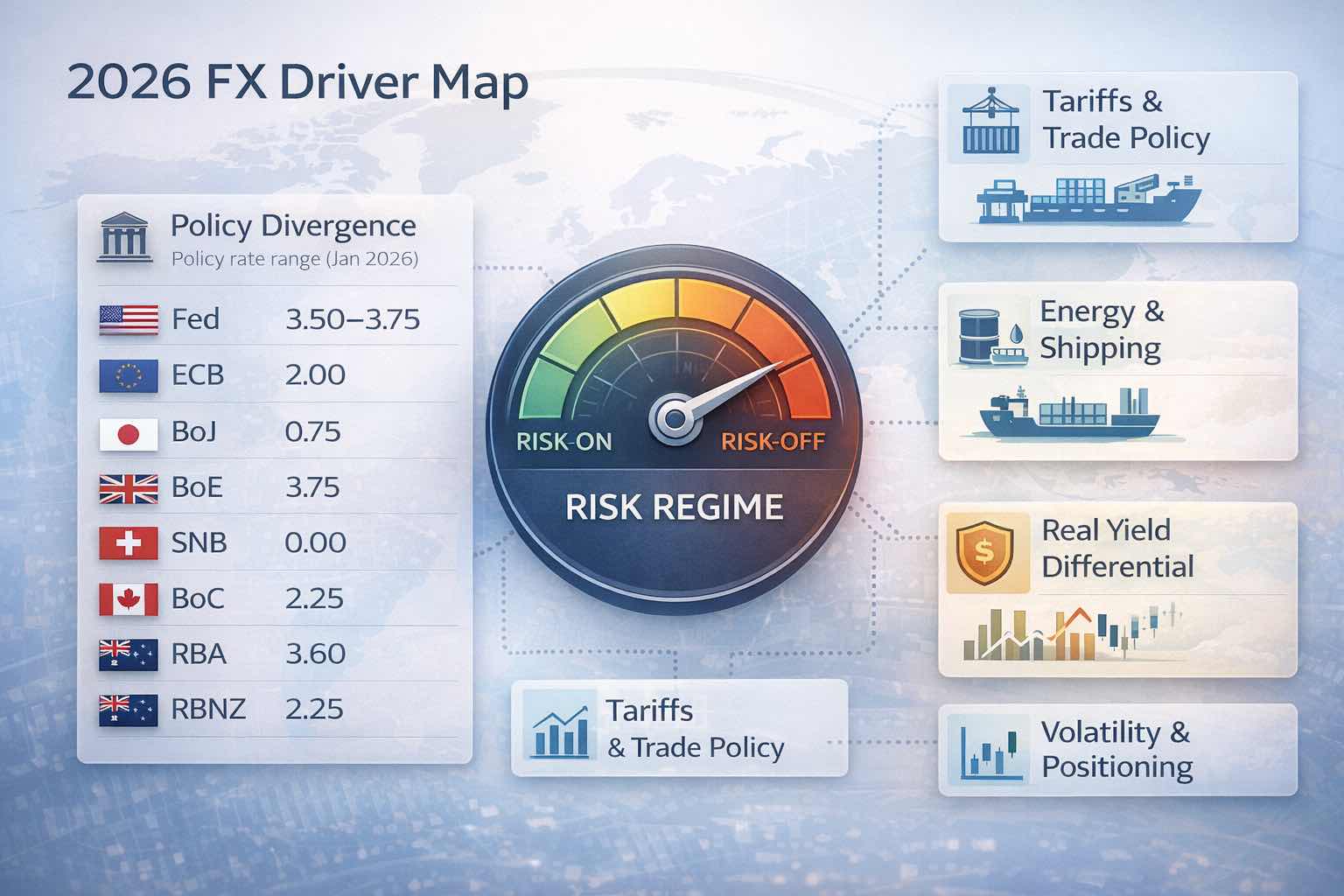

Major forex pairs are entering 2026 amid a highly volatile environment. The Federal Reserve has paused rate cuts, maintaining a policy rate of 3.50% -3.75%. Japan's 0.75% policy rate no longer suppresses yen volatility, and tariff policy has evolved from negotiation to a persistent macroeconomic shock. When rate differentials become unstable and political factors drive prices, foreign exchange markets shift rapidly rather than drift.

These developments are unfolding as the global economic cycle remains intact but fragile. The International Monetary Fund projects global growth of 3.3% in 2026 and 3.2% in 2027. This growth rate may coincide with significant foreign exchange volatility, primarily driven by frequent regime shifts between risk-on carry trades and risk-off deleveraging.

Furthermore, commodity markets are shaped by continued production increases projected by the U.S. Energy Information Administration, while geopolitical risks can trigger abrupt price spikes. This environment creates conditions favorable for trend bursts, stop runs, and pronounced mean reversion.

Key Takeaways For Major Forex Pairs In 2026

Policy divergence remains wide and unstable: rate spreads still matter, but political shocks can quickly dominate price action.

The yen has regained two-way risk: crowded funding trades can unwind fast when Japan rates or risk appetite shifts.

Tariffs are a major volatility source: headline-driven USD liquidity bids can trigger sudden

risk-off moves.

Commodity FX is not only about China: bearish fundamentals can be interrupted by geopolitics and supply-route risks.

-

Cross-currency pairs matter more: relative-value crosses (e.g., EUR/GBP) can offer cleaner signals when USD absorbs most headline volatility.

2026 Policy-Rate Snapshot Traders Keep Mispricing

| Central bank |

Policy setting (latest) |

What it means for FX in 2026 |

| Federal Reserve |

3.50%–3.75% |

USD carry remains relevant, but the pause increases sensitivity to data surprises |

| ECB (deposit) |

2.00% |

EUR reacts more to growth and trade shocks than to incremental rate tweaks |

| Bank of Japan |

~0.75% |

JPY volatility is back, and carry trades are less “free” |

| Bank of England |

3.75% |

GBP becomes a rates-repricing and fiscal-confidence trade again |

| Swiss National Bank |

0% |

CHF retains haven convexity, with intervention tail risk |

| Bank of Canada |

2.25% |

CAD trades as oil + North America policy risk, not just rates |

| RBA |

3.60% |

AUD is a risk-regime proxy with enough carry to attract positioning |

| RBNZ |

2.25% |

NZD remains high beta to global growth and risk sentiment |

Major Forex Pairs To Add To Your Watchlist In 2026

| Pair |

2026 move potential |

Reason |

| EUR/USD |

High |

Clean expression of US growth, tariff shocks, and shifting Fed path expectations |

| USD/JPY |

Very High |

BoJ policy reintroduces convexity; small yield repricing can drive outsized moves |

| GBP/USD |

Medium-High |

GBP becomes highly sensitive to rates repricing and confidence shocks |

| USD/CHF |

Very High |

Haven flows plus intervention risk can produce fast moves and abrupt reversals |

| USD/CAD |

High |

CAD is a conduit for oil volatility and North American trade/tariff risk |

| AUD/USD |

Medium-High |

Carry attracts positioning, but AUD de-rates sharply in risk-off regimes |

| NZD/USD |

Medium |

Higher beta and thinner liquidity can create overshoots and mean reversion |

| EUR/JPY |

Very High |

Europe growth sensitivity combined with revived JPY volatility |

| AUD/JPY |

Very High |

Pure risk-on carry versus risk-off unwind cross |

| EUR/GBP |

Medium-High |

Cleaner relative-value cross when USD is dominated by headline volatility |

Pair-By-Pair: What Moves Each One In 2026

1) EUR/USD

What moves it

Rate-path repricing and shifts in risk regimes can dominate. During risk-off episodes, demand for USD liquidity can pressure EUR/USD quickly; in risk-on conditions it may appreciate more gradually.

Catalyst checklist

US inflation and labor surprises that alter Fed expectations

Euro area growth surprises that shift ECB easing assumptions

Trade and tariff headlines that compress global risk appetite

Tell-tale behavior

Sharp downside in stress; slower, steadier upside when carry and valuation reassert.

2) USD/JPY

What moves it

More volatility-sensitive than a slow carry trade. Repricing of Japan rates and global risk swings can trigger rapid reversals.

Catalyst checklist

BoJ communication and policy-normalization signals

US yield swings on growth or inflation surprises

-

Equity drawdowns that unwind carry

Tell-tale behavior

Trends in calm markets; sharp reversals when volatility rises. Disproportionate yield moves can precede FX acceleration.

3) GBP/USD

What moves it

Rate differentials and confidence. Sterling can swing around inflation persistence, growth weakness, and fiscal credibility headlines.

Catalyst checklist

UK services inflation, wages, and retail activity

BoE guidance on the pace of easing

-

Broad USD risk swings that overwhelm UK idiosyncrasies

Tell-tale behavior

Rallies can be fragile during broad USD strength; when USD weakens, GBP can rise quickly if rates expectations reprice.

4) USD/CHF

What moves it

Risk premia and policy response. CHF often appreciates during stress; intervention risk can shape speed and persistence.

Catalyst checklist

Geopolitical escalation or risk sentiment deterioration

Credit events or banking stress narratives

-

Signals that reprice intervention probability

Tell-tale behavior

Sharp, directional moves in stress, followed by abrupt reversals when conditions stabilize.

5) USD/CAD

What moves it

Oil prices and North American macro risk, with trade uncertainty amplifying otherwise oil-driven moves.

Catalyst checklist

Oil shocks from geopolitics and supply routes

US trade policy headlines repricing cross-border growth

-

Canadian growth prints shifting the domestic rate path

Tell-tale behavior

Strongest trends when oil and risk sentiment align; volatility rises when oil signals diverge from rate spreads.

6) AUD/USD

What moves it

Barometer for global growth and risk regimes, with enough yield sensitivity to attract positioning when volatility is low.

Catalyst checklist

Global PMI momentum and risk appetite

Trade-policy developments affecting Asia-linked demand expectations

-

Shifts in the US rate path changing USD carry attractiveness

Tell-tale behavior

Fast drawdowns during volatility spikes; slower recoveries. Failure to rally on risk-on days can signal fragility.

7) NZD/USD

What moves it

Higher-beta cousin to AUD with thinner liquidity, making overshoots and frequent breaks more common.

Catalyst checklist

Broad risk sentiment shifts

Global rate volatility, especially the US curve

-

Commodity and Asia-growth narrative changes

Tell-tale behavior

Breaks technical levels more often and then mean-reverts; cleaner trends reflect sustained risk regimes.

8) EUR/JPY

What moves it

Blends carry conditions with Japanese volatility. Calm periods behave like carry; stress periods turn it into a deleveraging instrument.

Catalyst checklist

BoJ-driven yield volatility

European growth surprises and political risk premia

-

Equity drawdowns and volatility spikes

Tell-tale behavior

Declines often occur faster than rallies; failure to recover quickly after a volatility spike can signal a longer unwind.

9) AUD/JPY

What moves it

A clean risk-on carry versus risk-off unwind gauge, often capturing regime changes early when trade and geopolitics are unstable.

Catalyst checklist

Volatility spikes and equity drawdowns

BoJ surprises that reprice JPY funding costs

-

Asia-linked growth narrative shifts

Tell-tale behavior

Crowded carry positioning can produce steep unwinds; lighter positioning tends to stabilize faster after shocks.

10) EUR/GBP

What moves it

Relative-value cross for policy divergence within Europe without USD headline interference; reacts to which economy weakens faster and which central bank is expected to ease more.

Catalyst checklist

UK inflation and wages versus euro area growth momentum

Fiscal credibility headlines

-

Surprises that reprice the relative easing path

Tell-tale behavior

Often ranges quietly, then moves sharply when expectations shift; rewards patience and clear thesis positioning.

Frequently Asked Questions (FAQ)

1) What are “major forex pairs”?

Major forex pairs are the most actively traded currency pairs, typically involving the U.S. dollar, euro, yen, pound, Swiss franc, Canadian dollar, Australian dollar, and New Zealand dollar. These pairs tend to have tighter spreads and deeper liquidity.

2) Which forex pairs are likely to be most volatile in 2026?

Pairs linked to Japanese normalization and haven flows are expected to show significant volatility, including USD/JPY, EUR/JPY, AUD/JPY, and USD/CHF.

3) Why do tariffs matter so much for FX traders?

Tariffs can shift growth expectations, inflation pass-through, and risk sentiment, increasing the frequency of abrupt risk-off moves where USD and CHF can strengthen quickly.

4) How should traders build a watchlist for 2026?

A balanced watchlist can include a global risk barometer (EUR/USD), a Japan volatility anchor (USD/JPY), a haven pair (USD/CHF), an oil-and-trade conduit (USD/CAD), and a relative-value cross (EUR/GBP).

5) Is 2026 more about trend trading or range trading?

Both can work: baseline growth can sustain ranges, but regime shifts can decisively break them. Traders often benefit from focusing on catalysts, invalidation levels, and volatility conditions rather than static patterns.

Conclusion

2026 is likely to feature persistent policy divergence, renewed yen volatility, and recurring tariff risks. The FX environment may alternate between carry-friendly conditions and shock-driven repricing. Building a watchlist around the ten pairs above concentrates attention on the currencies most likely to reflect these dominant forces.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Sources