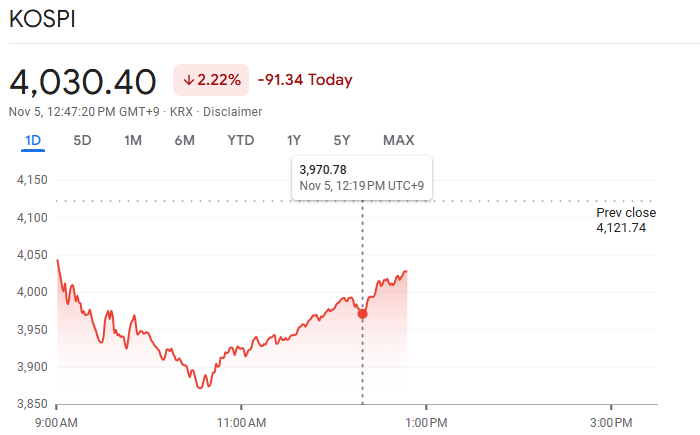

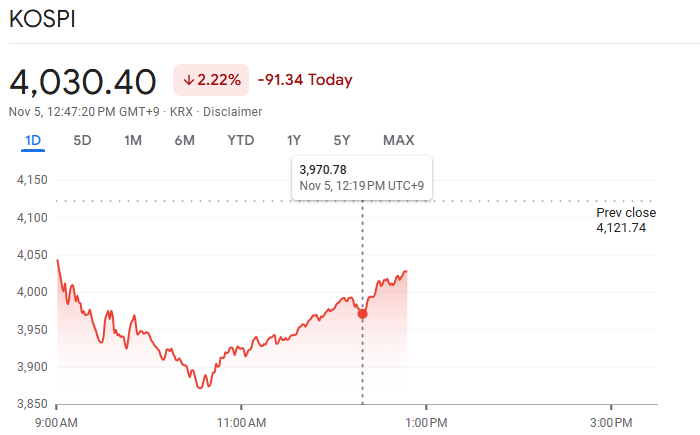

After a historic rally that saw it surpass 4,200 to reach new all-time highs, South Korea's KOSPI index has abruptly reversed course this week.

On November 5, 2025, South Korea's benchmark KOSPI briefly dipped below the symbolic 4,000 level, reaching approximately 3,985.6 in early trade, as KOSPI-200 futures plunged roughly 5.2%. This triggered an automatic trading curb, known as a "sidecar," at about 9:46 a.m., which halted program trades for five minutes.

The sudden move rekindled questions investors have been asking all year: was this a routine pullback after an outsized rally, or the start of a deeper correction that will hurt tech-heavy portfolios and foreign investor flows?

This article walks through what happened, why it happened, what the market mechanisms did, and the scenarios you should be watching next.

KOSPI's Steep 5.2% Drop

On November 5, 2025, during the morning session, the KOSPI dipped below the 4,000 level following a significant decline in KOSPI-200 futures, with intraday softness primarily caused by a selloff in major tech and semiconductor stocks. [1]

KOSPI-200 futures also fell more than 5% within minutes, triggering an automatic "sidecar" (a five-minute halt on program trading) under Korea Exchange rules; trading resumed after the temporary curb. This was the KRX's sidecar activation after the futures index deviated by 5.2% for a minute.

Stocks sensitive to global tech sentiment, particularly chipmakers and related suppliers, were among the hardest hit, and the won weakened as bond yields ticked up amid the risk-off move.

Foreign investors led the selloff, with massive net selling. The local press reported net foreign sales of about ₩2.2 trillion on November 4, and offshore flows remained heavy into the volatile session that followed.

Why Is KOSPI Down Today? 5 Key Factors Explained

1. AI Sector Selloff and Overvaluation Concerns

The primary catalyst was a sharp decline in U.S. technology and AI stocks overnight, including big names such as Nvidia, Advanced Micro Devices, and Palantir Technologies, which impacted their Korean suppliers and tech-related equities.

Given that technology significantly influences South Korea's market, with Samsung Electronics and SK Hynix together representing a large portion of the market capitalisation, the effect of sector weakness intensified.

AI bubble fears, driven by valuation concerns and questions about sustainable earnings growth, created panic selling.

2. Aggressive Foreign Investor Selling

As mentioned earlier, foreign institutions aggressively sold shares during this period, reversing the earlier buying momentum and exerting downward pressure on the KOSPI. [2]

Local reports indicate net foreign outflows of approximately ₩2.2 trillion on November 4, driven by a strengthening U.S. dollar and shifting global macro trends that prompted funds to rotate out of riskier Asian equities.

3. Profit-Taking After a Steep Rally

KOSPI had enjoyed a strong run into late October, hitting record territory at 4,000+ after a months-long rally.

When markets experience extended gains, short-term traders and momentum funds often step aside to lock in profits, which can amplify a pullback into a cascade.

Multiple local sources cited profit-taking in major index components as the immediate reason.

4. Macro Signals: Rate-Cut Expectations and Data

Markets are sensitive to changing expectations for Federal Reserve policy and U.S. data.

Comments from Fed officials earlier in the season, which trimmed the odds of an imminent rate cut, have periodically dented risk appetite; coupled with mixed global macro prints, that can flip investor posture from "risk-on" to "risk-off."

Analysts noted these macro signals as part of the backdrop for the selloff.

5. Inflation Data and Bank of Korea Policy Uncertainty

New data showed South Korea's inflation rose to 2.4% YoY in October, exceeding forecasts and boosting fears the Bank of Korea may delay rate cuts, tightening financial conditions and pressuring equities.

Higher-than-expected inflation reduces appetite for risky assets and raises the cost of capital.

Futures Halt Explained: What Is a "Sidecar" Trigger?

Korea's exchange has several contingency rules to dampen sharp moves:

1. Sidecar:

The sidecar mechanism automatically halts futures trading temporarily when the KOSPI 200 futures index moves sharply, typically by 5% or more, sustained for at least one minute, to curb volatility caused by automated program trading, allowing investors time to digest market information and reduce panic-driven price swings.

The Korea Exchange activated its five-minute 'sidecar' on the KOSPI-200 futures after the futures index plunged roughly 5.2% and the curbs took effect at about 9:46 a.m.; volatility also prompted additional sidecar activity across KOSPI/KOSDAQ futures as trading proceeded. [3]

The sidecar is not a full market halt as cash trading continues. However, it prevents automated index-based selling and gives market participants a brief respite.

2. Circuit Breakers / Trading Curbs:

There are also larger circuit breakers designed for extreme stress if the index exceeds larger thresholds.

The immediate effect of the sidecar activation on November 5 was the temporary halt of programmatic selling, which heavily relies on futures signals, helping to stabilise the market after the initial sharp decline.

However, human-driven panic selling or fundamental reassessment can continue once program trades resume.

What Stocks Were Most Affected?

| Sector |

Leading Stocks |

Approximate Drop |

Key Notes |

| Technology |

Samsung Electronics, SK Hynix |

−5% to −6.5% |

AI and chipmaker selloff |

| Automobiles |

Hyundai Motor |

−3.5% |

Supply chain and global demand worries |

| Industrials |

Hanwha Aerospace, Doosan Enerbility |

−4% to −7% |

Defense/government contract concerns |

| Biopharma |

Samsung Biologics |

−2% |

Regulatory uncertainties |

By contrast, defensive sectors (utilities, some consumer staples) typically outperform in these episodes. However, today, the sheer size of the hit to tech and chips overwhelmed any defensive cushioning.

Short-Term Implications for the Kospi Index (Next Several Days to Weeks)

1. Increased Volatility:

Expect greater intraday volatility as program trading resumes and investors reassess positions. The sidecar gives a short pause but does not eliminate uncertainty.

2. Rotation & Leadership Change:

If the selloff is primarily profit-taking, we may see rotation into defensive sectors (utilities, staples, large financials) while small-cap and momentum names lag. If macro worries deepen, defensive leadership could last longer.

3. Foreign Investor Behaviour:

Watch net foreign flows as continued selling by foreigners could pressure the won and push yields higher, which would feed back into valuations. Short-term currency weakness is a risk during large equity outflows.

4. Policy Response & Communication:

Korean authorities (Finance Ministry, KRX) often communicate quickly during extreme stress to reassure markets.

Any explicit policy, contingency statements or liquidity measures will be market-moving.

Market participants will pay attention to official guidance. Historically, policymakers have signalled readiness to act if volatility threatens financial stability.

Longer-Term Scenarios: Three Paths the Market Could Take

1. Bullish Mean-Reversion (Best-Case)

If the move was a classic short-term profit-taking episode driven by momentum unwinding, healthy macro data or renewed U.S./global risk appetite could re-ignite buying.

In that case, KOSPI could stabilise and regain 4,000 within a few sessions or weeks, especially if large exporters report solid fundamentals or earnings surprises.

Expect a V-shaped stabilisation characterised by heavy buying in large-cap tech once valuations realign.

2. Prolonged Consolidation (Base-Building)

Markets may enter an extended consolidation phase, where the KOSPI trades within a range below recent peaks, as investors digest earnings, policy signals, and global growth cues.

It is the most common outcome after huge rallies, as the index may test support zones, rebalance its leadership, and resume a new uptrend only after a clearer macro direction is established.

3. Deeper Correction (Risk-Off)

If global tech weakness accelerates, Fed rhetoric remains restrictive, or foreign outflows gather steam, the KOSPI could enter a broader correction.

That would pressure domestic risk assets, widen credit spreads, weaken the won, and force heavier selling by leveraged strategies. Policymakers may intervene more explicitly in this scenario.

What's Next for KOSPI Investors?

Watching U.S. Federal Reserve communications, global tech earnings, and South Korean inflation data will be critical for investors gauging the next direction.

Market participants view this as a technical correction rather than a fundamental bear market, so medium to long-term outlooks remain cautiously bullish, assuming global and domestic macro factors stabilise.

Conditions in other Asian equity markets, such as Japan's Nikkei and China's Hang Seng, will also influence Korea's market trajectory.

Frequently Asked Questions (FAQ)

1. Is the KOSPI "Breaking" and Is This a Crash?

Not necessarily. The move triggered mechanical curbs and reflected profit-taking and global tech weakness.

2. What Is a Sidecar Futures Halt?

The sidecar is an emergency mechanism that temporarily halts trading to prevent disorderly market conditions triggered by rapid price declines, providing a cooling-off period for investors.

3. Is This the Start of a Prolonged Bear Market?

Analysts consider this a correction following an extended rally, rather than a bear market, although volatility is anticipated.

Conclusion

In conclusion, the KOSPI's fall below 4,000 in early November 2025 marks a sharp but orderly correction fueled by global tech stock weakness, foreign investor outflows, and rising domestic inflation concerns.

The activation of the KRX sidecar underscores how quickly programmatic trades can amplify volatility. However, fundamental strengths, including South Korea's leading technology exporters and the authorities' readiness to manage market stability, continue to provide a strong buffer.

Investors should brace for continued volatility but can expect recovery and renewed momentum if global AI demand and South Korean economic policies align favourably in 2026.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.bloomberg.com/news/articles/2025-11-05/korea-s-kospi-tumbles-as-valuation-concerns-hit-tech-stocks

[2] https://www.mk.co.kr/en/stock/11460073

[3] https://biz.chosun.com/en/en-finance/2025/11/05/XLV65SRNIZFXNEGLXPR7S66644/