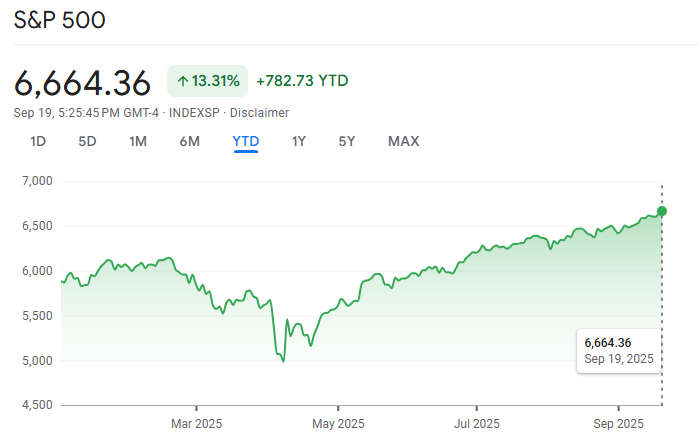

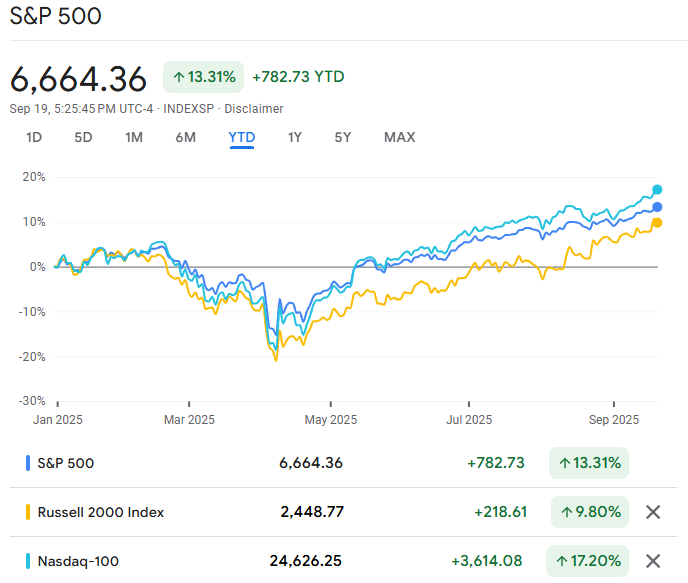

The S&P 500 has been on a rollercoaster in 2025, starting the year with weakness before regaining momentum through the summer.

As valuations remain high and Federal Reserve policy takes centre stage, investors are posing a crucial question: Will the bull market persist into late-2025?

Current S&P 500 Overview (As of September 2025)

S&P 500 Forward P/E Ratio: 23.66

S&P 500 Operating Forward P/E Ratio: 21.84

Goldman Sachs Year-End Target: 6,800 (raised in Sept 2025)

YTD Performance: modest gains after a weak Q1, recovery in Q2 and Q3

Fed Policy: The market expects two rate cuts in 2026, but much of this is already priced in

What's Driving the Market Now?

1. Earnings and Valuations

As of September 2025, the S&P 500 forward P/E stands near 23.66, while the operating forward P/E is about 21.84.

This indicates that valuations remain high relative to historical averages (15–17), albeit lower than the peaks observed in late 2021.

Earnings growth for corporations in the second and third quarters has surpassed expectations, especially in the technology, energy, and financial sectors.

2. Federal Reserve and Inflation

The Fed has signalled a cautious but dovish stance. Traders anticipate as many as two rate reductions from late 2025 to 2026, yet analysts caution that a significant portion of this positivity is already reflected in prices.

Inflation has cooled from its 2022 peaks but remains sticky in housing and services, leaving risks of policy surprises if inflation ticks up again.

3. Geopolitics and Macro Risks

Fluctuations in global energy prices, supply chain disruptions, and tensions among trade blocs persist in obscuring the outlook.

Geopolitical risks in Europe, Asia, and the Middle East continue to pose significant potential catalysts for instability.

S&P 500 Forecast Late-2025: Expert Forecast and Analysis

| Scenario |

Assumptions |

Potential Outcome |

| Bull Case |

Inflation falls toward 2.5–3%, Fed cuts twice, AI-driven earnings boom continues |

S&P 500 rises 5–10% into year-end |

| Base Case |

Growth steady but not strong, inflation sticky at ~3–3.5%, Fed cautious |

S&P 500 trades in range, modest gains 0–5% |

| Bear Case |

Inflation re-accelerates, Fed delays cuts, or geopolitical/economic shock hits |

S&P 500 falls 5–15% |

Latest Analyst Forecasts

Goldman Sachs (Sept 2025): Target raised to 6,800, citing dovish Fed and stronger earnings. [1]

Morgan Stanley (Q3 2025): More cautious, citing stretched valuations and recommending defensive positioning.

Bank of America (Aug 2025): Warns that over-optimism on Fed cuts could lead to a correction if inflation surprises.

What Are Some Risks to Monitor?

1. Inflation Upside Surprises

Particularly in energy and services.

2. Fed Policy Missteps:

If the Fed delays cuts or signals hawkishness.

3. Credit Market Stress

Rising defaults in corporate or consumer lending.

4. Geopolitics

Escalating trade conflicts, wars, or sanctions.

5. China & EU Growth

Global demand slowdown could weigh on S&P exporters.

Other Opportunities for Traders

While the long-term outlook remains mixed, the current environment of volatility offers multiple trading opportunities. Keeping a close eye on divergences across indices, FX pairs, and commodities can help active traders capitalise on short- to medium-term moves.

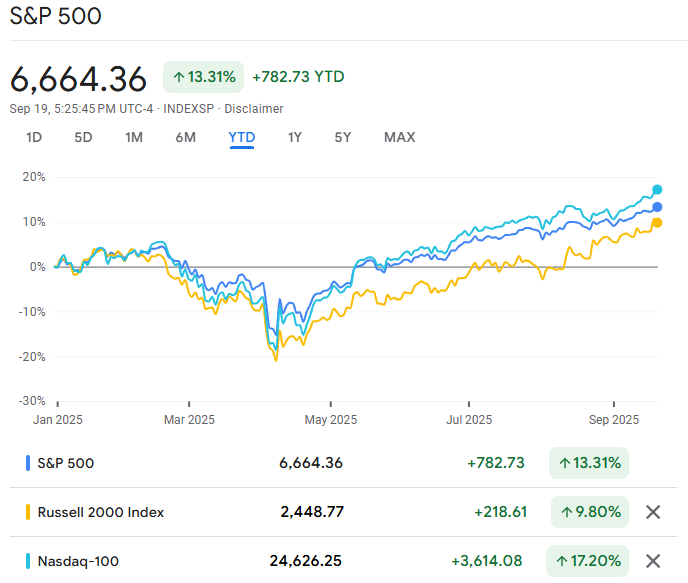

Key Indices & Sector Splits

1) Russell 2000 (Small Caps):

The Russell 2000 recently hit a fresh record closing high of 2,467.70 on September 18, 2025, its first since November 2021. [2]

It has outperformed many large-cap indices in recent weeks, up ~13.5% since August, compared to about ~7% for the S&P 500.

2) S&P 500 vs Nasdaq-100:

Large-cap and growth-oriented names continue to benefit from AI, semis, and cloud infrastructure, but valuations are more vulnerable in the event of rising yields or inflation surprises.

Monitor for divergence: when small and mid-cap stocks surge notably before the S&P or when growth stocks underperform.

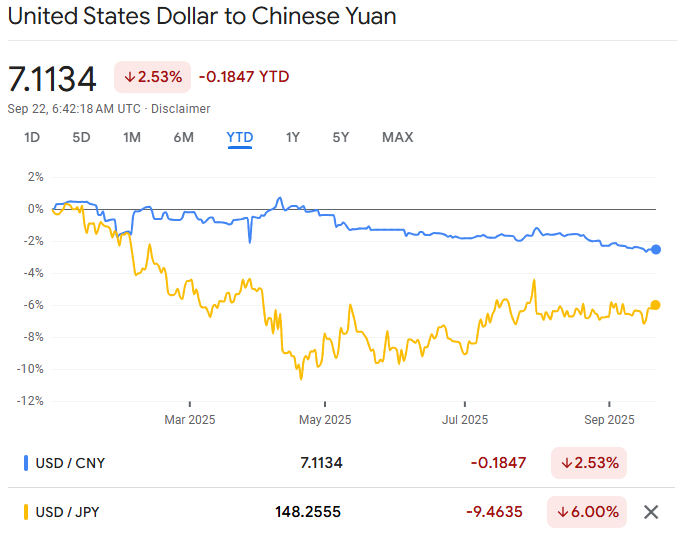

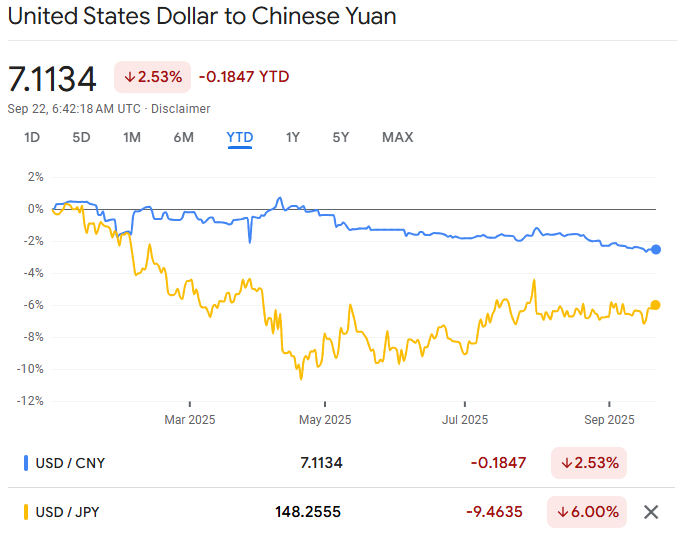

FX & Currencies

1) USD/CNY:

The Chinese yuan has recently shown policy-driven strength vs the dollar. [3]

Goldman Sachs has revised predictions based on this, suggesting that recent yuan appreciation is not just market noise. However, his forecast is supported by China's export strength and policy calibration.

2) Other pairs:

USD/JPY remains a central pair due to fluctuations in U.S. interest rates compared to Japan's policy; traders may take advantage of the rate differential or engage in carry trades, particularly during Fed announcements.

Also, commodity-linked currencies (AUD, CAD) have benefited recently from stronger commodities and regional trade ties.

Commodities

1) Gold:

Gold continues to attract investments as a hedge, with declining real rates and geopolitical concerns persisting as supportive factors.

For traders, gold CFDs or options offer an unequal risk/reward ratio during macroeconomic or inflation surprises.

Frequently Asked Questions

1. What Kind of Earnings Growth Are Analysts Expecting for the Rest of 2025?

For Q3 2025, earnings growth predictions compared to the previous year are approximately 7.7%, while revenue growth estimates are about 6-6.5%. Analysts estimate full-year 2025 EPS growth in the S&P at about 10-11%.

2. What Are the Major Analyst Price Targets for the S&P 500 Year-End?

Recent forecasts (e.g. Goldman Sachs) suggest a year-end target in the 6,700-6,800 range. Capital Economics also raised its 2025 forecast to about 6,750.

3. What Signals or Data Should Investors Monitor to Assess Whether the Bull Run Can Continue?

Fed meeting minutes and inflation prints (CPI / PCE)

Corporate earnings reports, especially if guidance is lowered

Yield curve behaviour (inversion or steepening)

Global growth indicators (China, Europe)

Market breadth and fund flows (are small caps and lesser-followed stocks participating?)

Conclusion

In conclusion, the S&P 500 remains in a bull market, although conditionally. The outlook for late 2025 hinges on whether inflation continues to decline and if earnings can sustain their performance.

If they do, the market may grind higher toward the 6,800 level. If not, investors should prepare for corrections in a market that has already priced in a lot of good news.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.reuters.com/business/goldman-sachs-lifts-sp-500-indexs-annual-target-2025-09-22/

[2] https://www.marketwatch.com/story/russell-2000-scores-fresh-record-for-the-first-time-in-4-years-why-the-small-cap-rally-still-has-room-to-run-b076bf30

[3] https://www.bloomberg.com/news/articles/2025-07-10/dollar-losing-allure-for-chinese-traders-creates-runway-for-yuan