A single symbol can define a nation’s monetary identity in an instant, not just in 2026. Across forex trading platforms, banknotes, contracts, and digital payment systems, currency symbols condense sovereignty, credibility, and pricing authority into one character. Exchange rates fluctuate continuously, but money symbols remain fixed, providing structural consistency to the global currency market.

In foreign exchange, money symbols function as core market infrastructure. They distinguish base and quote currencies, standardise valuation, and remove ambiguity in cross-border pricing. From reserve currencies to regional and emerging units, each symbol reflects a specific monetary system.

What follows is a complete, structured list of money symbols used around the world, covering major economies and lesser-known currencies with equal precision.

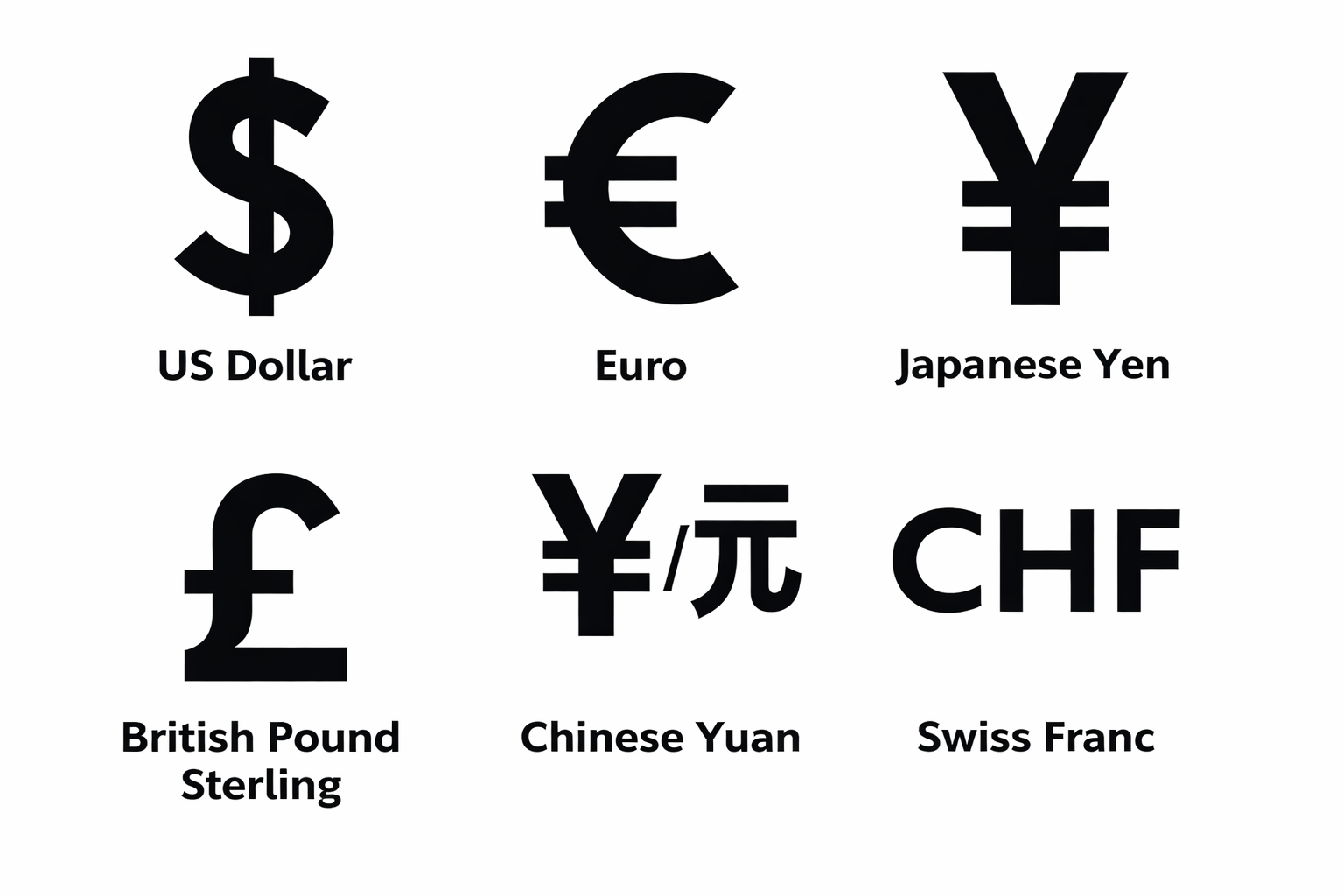

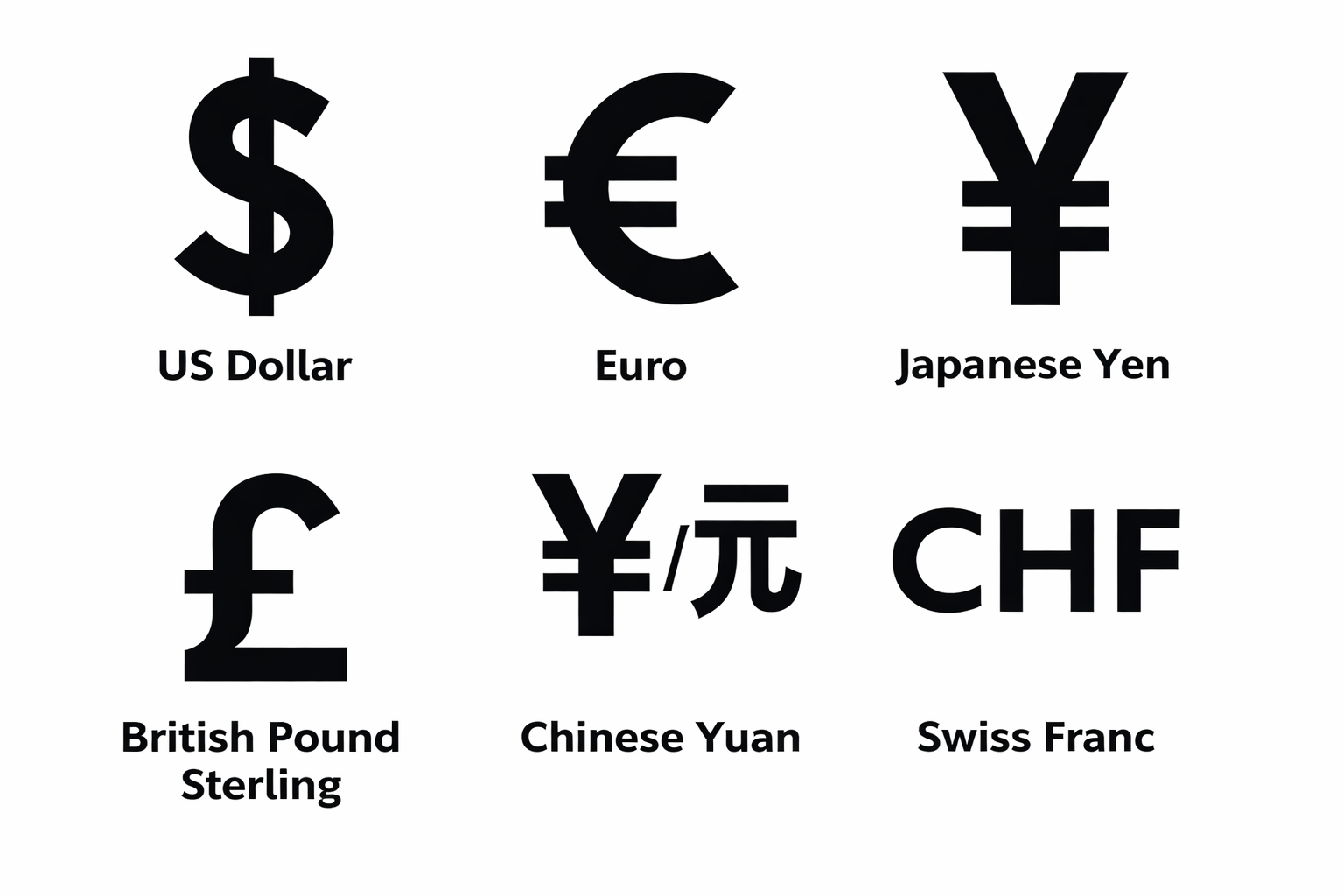

Major Global Currency Symbols

The dollar sign is the most widely recognised monetary symbol globally. Its reuse across multiple countries reflects historical trade ties rather than monetary dominance. Context, not the symbol alone, determines which currency is implied.

| Currency |

Symbol |

Country |

| US Dollar |

$ |

United States |

| Euro |

€ |

Eurozone |

| British Pound Sterling |

£ |

United Kingdom |

| Japanese Yen |

¥ |

Japan |

| Chinese Yuan |

¥ / 元 |

China |

| Swiss Franc |

CHF |

Switzerland |

| Canadian Dollar |

$ |

Canada |

| Australian Dollar |

$ |

Australia |

| New Zealand Dollar |

$ |

New Zealand |

| South Korean Won |

₩ |

South Korea |

| Indian Rupee |

₹ |

India |

Dollar-Based Currency Symbols

Dollar-based currencies typically rely on prefixes such as C$, A$, or HK$ in international markets to prevent confusion.

| Currency |

Symbol |

Country |

| US Dollar |

$ |

United States |

| Canadian Dollar |

$ |

Canada |

| Australian Dollar |

$ |

Australia |

| New Zealand Dollar |

$ |

New Zealand |

| Singapore Dollar |

$ |

Singapore |

| Hong Kong Dollar |

$ |

Hong Kong |

| Jamaican Dollar |

$ |

Jamaica |

| Bahamian Dollar |

$ |

Bahamas |

| Eastern Caribbean Dollar |

$ |

Caribbean states |

| Mexican Peso |

$ |

Mexico |

| Argentine Peso |

$ |

Argentina |

| Chilean Peso |

$ |

Chile |

| Colombian Peso |

$ |

Colombia |

European Currency Symbols (Non-Euro)

Northern European currencies frequently use abbreviated letter symbols rather than unique glyphs, reflecting linguistic structure and historical accounting traditions.

| Currency |

Symbol |

Country |

| British Pound |

£ |

United Kingdom |

| Swiss Franc |

CHF |

Switzerland |

| Norwegian Krone |

kr |

Norway |

| Swedish Krona |

kr |

Sweden |

| Danish Krone |

kr |

Denmark |

| Czech Koruna |

Kč |

Czech Republic |

| Polish Zloty |

zł |

Poland |

| Hungarian Forint |

Ft |

Hungary |

| Romanian Leu |

lei |

Romania |

| Bulgarian Lev |

лв |

Bulgaria |

| Icelandic Krona |

kr |

Iceland |

| Ukrainian Hryvnia |

₴ |

Ukraine |

| Serbian Dinar |

дин |

Serbia |

Asian Currency Symbols

Asia displays the widest variation in currency symbolism, blending ancient scripts with modern typographic standards.

| Currency |

Symbol |

Country |

| Japanese Yen |

¥ |

Japan |

| Chinese Yuan |

¥ / 元 |

China |

| South Korean Won |

₩ |

South Korea |

| Indian Rupee |

₹ |

India |

| Pakistani Rupee |

₨ |

Pakistan |

| Sri Lankan Rupee |

Rs |

Sri Lanka |

| Bangladeshi Taka |

৳ |

Bangladesh |

| Nepalese Rupee |

₨ |

Nepal |

| Thai Baht |

฿ |

Thailand |

| Indonesian Rupiah |

Rp |

Indonesia |

| Malaysian Ringgit |

RM |

Malaysia |

| Philippine Peso |

₱ |

Philippines |

| Vietnamese Dong |

₫ |

Vietnam |

| Cambodian Riel |

៛ |

Cambodia |

| Myanmar Kyat |

Ks |

Myanmar |

| Mongolian Tugrik |

₮ |

Mongolia |

Middle Eastern Currency Symbols

Arabic-script currencies often use diacritic-based symbols derived from linguistic abbreviations rather than standalone glyphs.

| Currency |

Symbol |

Country |

| UAE Dirham |

د.إ |

United Arab Emirates |

| Saudi Riyal |

﷼ |

Saudi Arabia |

| Qatari Riyal |

﷼ |

Qatar |

| Kuwaiti Dinar |

د.ك |

Kuwait |

| Bahraini Dinar |

.د.ب |

Bahrain |

| Omani Rial |

﷼ |

Oman |

| Jordanian Dinar |

JD |

Jordan |

| Israeli Shekel |

₪ |

Israel |

| Iranian Rial |

﷼ |

Iran |

| Lebanese Pound |

L£ |

Lebanon |

African Currency Symbols

African currencies frequently combine Latin letters with symbolic notation, reflecting post-colonial monetary systems.

| Currency |

Symbol |

Country |

| South African Rand |

R |

South Africa |

| Nigerian Naira |

₦ |

Nigeria |

| Kenyan Shilling |

KSh |

Kenya |

| Tanzanian Shilling |

TSh |

Tanzania |

| Ugandan Shilling |

USh |

Uganda |

| Ghanaian Cedi |

₵ |

Ghana |

| Ethiopian Birr |

Br |

Ethiopia |

| Zambian Kwacha |

ZK |

Zambia |

| Botswana Pula |

P |

Botswana |

| Egyptian Pound |

E£ |

Egypt |

| Moroccan Dirham |

د.م. |

Morocco |

| West African CFA Franc |

CFA |

West Africa |

| Central African CFA Franc |

CFA |

Central Africa |

Latin American Currency Symbols

The peso symbol mirrors the US dollar sign in appearance, but market context and country identifiers distinguish usage.

| Currency |

Symbol |

Country |

| Mexican Peso |

$ |

Mexico |

| Brazilian Real |

R$ |

Brazil |

| Argentine Peso |

$ |

Argentina |

| Chilean Peso |

$ |

Chile |

| Colombian Peso |

$ |

Colombia |

| Peruvian Sol |

S/ |

Peru |

| Bolivian Boliviano |

Bs |

Bolivia |

| Venezuelan Bolívar |

Bs |

Venezuela |

| Paraguayan Guarani |

₲ |

Paraguay |

| Uruguayan Peso |

$U |

Uruguay |

| Costa Rican Colón |

₡ |

Costa Rica |

| Dominican Peso |

RD$ |

Dominican Republic |

Cryptocurrency Symbols (Widely Used)

Cryptocurrencies rely on ticker-style symbols for clarity across decentralised platforms rather than country-based notation.

| Currency |

Symbol |

| Bitcoin |

₿ |

| Ethereum |

Ξ |

| Tether |

₮ |

| Litecoin |

Ł |

| Ripple (XRP) |

XRP |

| Solana |

◎ |

What Are Money Symbols Used For?

Money symbols serve as functional tools within global finance, ensuring clarity, speed, and consistency wherever monetary value is expressed. Their uses extend well beyond visual shorthand.

Price representation and quotation

Money symbols define the currency attached to a price, preventing ambiguity in domestic and international pricing.

Forex market identification

In foreign exchange, currency symbols help distinguish base and quote currencies, supporting accurate valuation and execution.

Cross-border financial communication

Symbols standardise how currencies are referenced across contracts, invoices, trade documents, and settlement systems.

Accounting and financial reporting

Balance sheets, income statements, and cash flow reports rely on currency symbols to identify the denominations clearly and consistently.

Digital payments and e-commerce

Online transactions, payment gateways, and digital wallets use money symbols to signal currency type instantly.

Monetary jurisdiction signaling

Currency symbols communicate the issuing authority and underlying monetary system without requiring a written explanation.

Market data and trading interfaces

Charts, order books, and pricing feeds depend on symbols to display currency values efficiently in high-frequency environments.

Why Some Currencies Lack Unique Symbols

Some money symbols around the world are expressed through letter-based abbreviations rather than standalone graphical signs. This is not an oversight, but a deliberate outcome shaped by monetary history, operational efficiency, and global usage patterns.

Key reasons include:

Limited global circulation

Currencies primarily used within domestic markets face little demand for a unique symbol. Abbreviations are sufficient for pricing, accounting, and local transactions where contextual ambiguity is minimal.

Linguistic and structural constraints

In several languages, currency names do not compress naturally into a single typographic mark.

Letter-based formats preserve clarity and align with native writing systems.

Digital and system compatibility

Abbreviations integrate seamlessly across banking software, spreadsheets, payment systems, and legacy financial infrastructure. Unique glyphs require standardised encoding and font support, which can introduce friction.

Historical accounting conventions

Many currencies were formalised long before modern typography and Unicode standards. Once embedded in legal texts, contracts, and bookkeeping systems, abbreviated currency notation became institutionalised.

Cost-benefit considerations

Designing, standardising, and globally adopting a new currency symbol offers little practical advantage for currencies with low international visibility.

Common examples of currencies without unique symbols include:

Icelandic Krona

Cambodian Riel

Lao Kip

Malagasy Ariary

Mozambican Metical

Uzbek Som

These currencies demonstrate that the absence of a graphical currency symbol reflects pragmatic monetary design, not diminished economic relevance. In global finance, clarity, consistency, and system compatibility often outweigh the visual distinction.

Frequently Asked Questions (FAQ)

1. Why do so many currencies use the dollar sign?

The dollar sign spread through historical trade networks and colonial monetary systems. Its widespread use reflects legacy adoption and familiarity, not parity in value or economic strength.

2. Is the yuan symbol the same as the yen symbol?

Yes. Both currencies use ¥. The distinction is determined by context, language, and market convention rather than the symbol itself.

3. Why does the euro have a unique symbol?

The euro required a single, standardised identity across multiple countries, leading to a purpose-built symbol that represents monetary unity and legal consistency.

4. Do currency symbols always appear before numbers?

No. Placement varies by region. Some monetary systems position the symbol after the number based on linguistic and formatting conventions.

5. Are cryptocurrency symbols officially regulated?

Most cryptocurrency symbols are community-defined rather than government-regulated, though consistent usage has emerged through exchanges and trading platforms.

6. What are money or currency symbols used for?

Money symbols are used to identify the currency attached to a price, standardise valuation across markets, distinguish currencies in forex trading, and ensure clarity in contracts, accounting, payments, and cross-border financial communication.

Conclusion

Money symbols operate as structural markers within the global financial system, not mere typographic shorthand. They bring order and consistency to forex markets, payment infrastructure, and pricing mechanisms, ensuring that value is communicated instantly and unambiguously across borders.

Whether appearing on trading interfaces, financial statements, or legal contracts, each symbol signals jurisdiction, monetary authority, and economic structure at a glance. As capital flows become faster and more interconnected, standardised currency symbols grow even more critical.

Together, they form a shared visual language that supports valuation, exchange, and trust across modern finance, making their understanding indispensable in a global market environment.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.