Imagine you're holding a small seed, your hard-earned money. If you keep it in your pocket, it remains the same. But if you plant it wisely, in the right soil, at the right time, it can grow into a tree that bears fruit for years.

That's exactly what investing is about. It's not just for Wall Street experts or millionaires. In 2025, with online trading apps and global access to financial markets, anyone, anywhere in the world, can start investing smartly.

Below, we'll explain the ten main types of investments to help you choose those that align with your goals, timeline, and risk tolerance.

What Are the Types of Investments You Should Know?

| Investment Type |

Risk Level |

Approx. Annual Return* |

Liquidity |

Ideal For |

| Stocks |

High |

~8–12% |

High |

Long-term growth seekers |

| Bonds |

Low–Moderate |

~4–6% |

Moderate |

Conservative investors |

| Mutual Funds |

Moderate |

~6–10% |

High |

Beginners, passive investors |

| ETFs |

Moderate |

~6–10% |

High |

Global, tech-savvy traders |

| Real Estate |

Moderate |

~5–8% (varies by region) |

Low |

Long-term wealth builders |

| Gold |

Moderate |

~3–5% |

High |

Inflation hedge |

| Cryptocurrencies |

Very High |

20%+ (very high risk) |

Very High |

Risk-tolerant investors |

| Index Funds |

Moderate |

~7–9% |

High |

Long-term passive investors |

| Fixed Deposits |

Very Low |

Highly variable (e.g. 4–7%) |

Moderate |

Risk-averse, retirees |

| Alternatives |

High |

~10–15%+ (very variable) |

Low |

Diversifiers, wealthy investors |

*Estimates only; actual results vary significantly by region, time-horizon and market conditions.

1. Stocks: Owning a Piece of a Company

When you buy a stock, you own a small part (or share) of a company. Should the company expand and generate profits, the value of your stock may increase.

Think of it like becoming a mini-partner in your favourite brand, whether it's Apple, Tesla, or Netflix.

As of this year, the global stock market capitalisation had climbed to $140–$145 trillion by mid-/Q3 2025.

Why People Invest in Stocks

Potential for high returns over time

Dividend income (some companies share profits with shareholders)

However, stock prices can be volatile. Successful investors learn to remain patient and focus on the long term, rather than panic over short-term declines.

2. Bonds: The Safe Borrower's Deal

If stocks are about ownership, bonds are about lending.

When you buy a bond, you're lending money to a government or corporation, and they pay you back with interest over time.

It's like giving a friend a loan, but one that's written, regulated, and usually safe.

In 2025, the global bond markets are valued at around $140 trillion, led by U.S. Treasuries, with emerging market bonds gaining popularity among Asian investors.

Why Bonds Matter

Still, inflation and rising interest rates can reduce bond values. That's why investors often include bonds with stocks to balance growth with stability.

3. Mutual Funds: Teamwork Investing

Not sure how to pick individual stocks or bonds? Mutual funds do it for you.

A mutual fund pools money from many investors, and a professional fund manager decides how to invest it across stocks, bonds, or both.

As of 2025, global mutual fund assets exceed $70-$75 trillion, reflecting their sustained appeal among passive investors.

Why Mutual Funds Are Popular

You'll pay small fees (called expense ratios), but in return, you get access to expert management and diversified exposure.

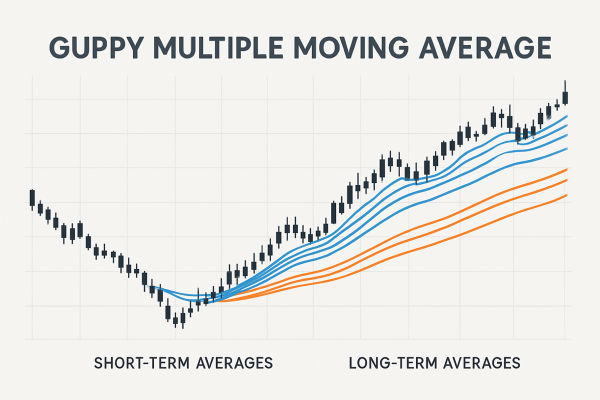

4. Exchange-Traded Funds (ETFs): Flexible, Affordable Investing

ETFs are like mutual funds, but they trade on exchanges just like stocks.

If mutual funds are buses that run on a fixed route, ETFs are taxis: flexible, easy to get in and out during the trading day.

In late 2025, global ETF assets reached approximately $16–17 trillion, driven by record inflows from retail investors who were seeking simplicity and low costs.

ETF Advantages

You can invest in ETFs for specific sectors, such as renewable energy or technology, or even in entire indexes like the S&P 500 or Nifty 50.

5. Real Estate: Tangible Wealth You Can See

Real estate investing means buying property, residential, commercial, or land, to earn rent or capital gains.

In 2025, despite higher global interest rates, the real estate market remains valued at $390–$395 trillion, making it the largest asset class.

Purchasing real estate is akin to sowing a tree that develops gradually yet yields fruits (rental income) and shade (increased value).

Why Investors Love Real Estate

The downside? High upfront cost, maintenance, and illiquidity. You can't sell property as easily as you can sell stocks.

6. Gold and Precious Metals: The "Safe Haven"

For centuries, gold has been a universal symbol of wealth and safety.

In times of market uncertainty, investors often turn to gold as a shield to protect portfolio value.

In 2025, gold trades near $4,300 per ounce, as inflation fears and geopolitical tensions boost demand.

Why Gold Still Shines

Acts as a hedge against inflation and currency declines

Globally recognised and liquid

Can diversify your investment mix

Today, you can invest in gold easily through Gold ETFs, sovereign gold bonds, or even CFDs (contracts for difference), without holding physical metal.

7. Cryptocurrencies: The Digital Frontier

Investing in cryptocurrencies like Bitcoin and Ethereum has evolved from just speculation to a crucial component of mainstream finance.

As of October 2025, Bitcoin is trading in the $110k–$125k range, and the total cryptocurrency market cap was approximately $3.8–4.0 trillion (Q3–Oct 2025).

While the ride is volatile, many see crypto as the "digital gold" of the modern era.

Why Crypto Attracts Investors

However, it remains risky as prices can swing 10–20% in a day. Always research, diversify, and refrain from investing more than you can afford to lose.

8. Index Funds: The Lazy Investor's Best Friend

If you don't want to pick winners, then invest in the entire race.

Index funds track a market index such as the S&P 500 or Nifty 50 automatically. When the index rises, so does your investment.

As of 2025, index funds manage over $13 trillion globally, largely due to iconic investors such as Warren Buffett, who stated that the majority of individuals are better suited for long-term investments in index funds.

Why Index Funds Work

They might not make you rich overnight, but they compound steadily over time, like the quiet tortoise that beats the impatient hare.

9. Fixed Deposits (FDs) and Savings Schemes: Security First

For ultra-conservative investors, fixed deposits (FDs) and savings schemes offer guaranteed returns.

In 2025, interest rates have risen globally.

In India, 1-year FDs typically ranged from ~4.5%.

In the U.S., top 1-year CD offers were roughly 4.0–4.4% APY.

These instruments don't make you rich but help preserve wealth while earning predictable interest.

Why People Choose FDs

Zero risk of loss (if within insured limits)

Stable, guaranteed returns

Perfect for emergency funds or retirees

However, FDs barely beat inflation, so they work best as part of a balanced portfolio, not your only investment.

10. Alternative Investments: Thinking Outside the Box

This category includes assets like:

Private equity

Hedge funds

Commodities (oil, agriculture)

Collectables (art, watches, NFTs)

In 2025, alternative investments attract record inflows from high-net-worth investors seeking diversification outside traditional markets.

According to Preqin, the global alternatives market is projected to exceed $24 trillion by the end of 2025.

Why Consider Alternatives

Low correlation with stocks or bonds

Potentially higher returns

Portfolio diversification

However, they often require larger capital and longer lock-in periods and are not ideal for small investors unless accessed through managed funds or ETFs.

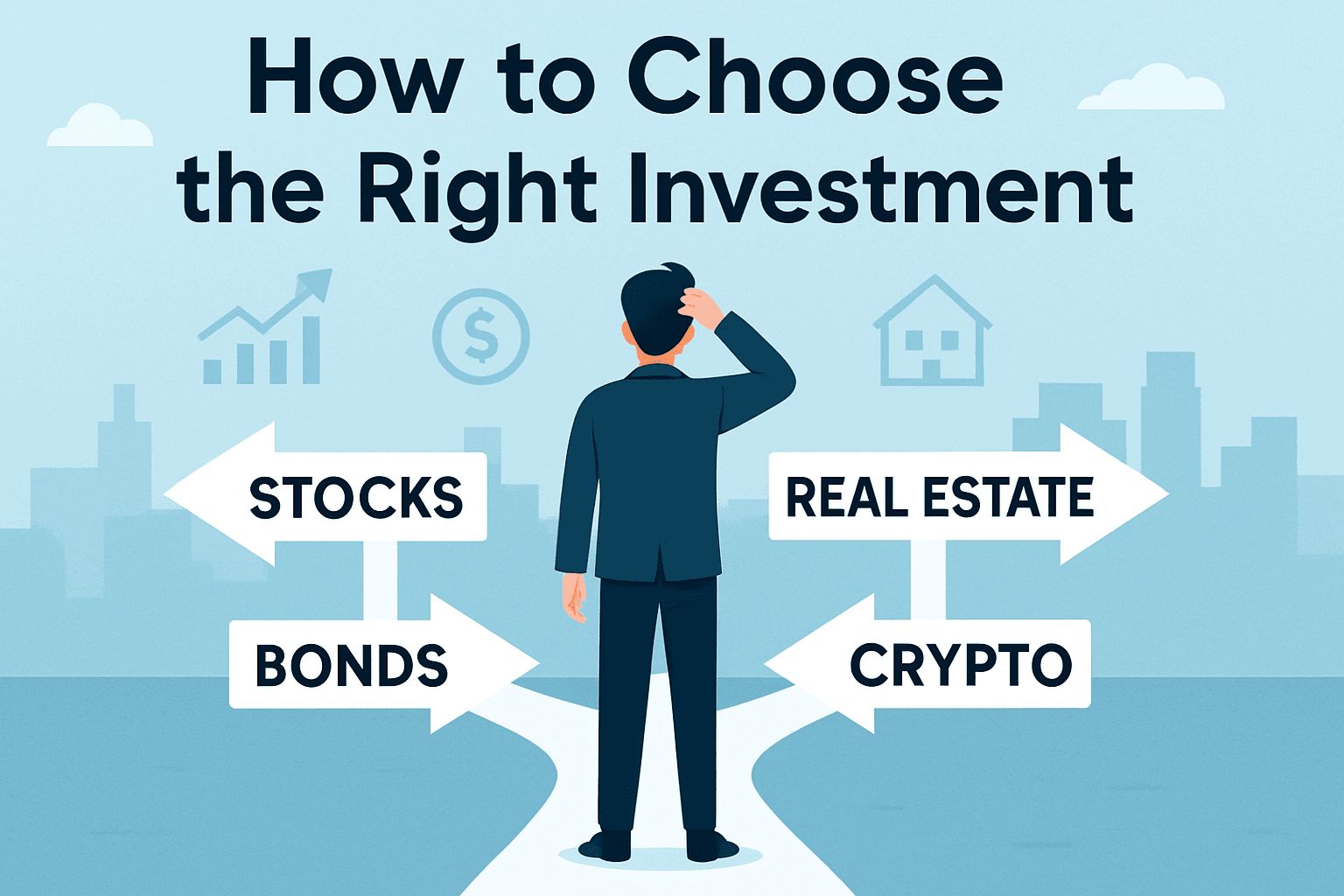

How to Choose the Right Investment Type

Choosing where to invest depends on three key questions:

What are your goals? (Wealth building, income, or safety)

What's your time horizon? (Short-term or long-term)

What's your risk comfort level?

A simple framework:

Low risk: FDs, bonds, index funds

Moderate risk: Mutual funds, ETFs, real estate

High risk: Stocks, crypto, alternative assets

The key is diversification. Don't put all your eggs in one basket.

Common Mistakes to Avoid as a Beginner

Chasing quick profits: Patience grows wealth; greed destroys it.

Ignoring diversification: One bad bet can ruin years of effort.

Skipping research: Always know what you're investing in.

Letting emotions rule: Fear and greed are an investor's worst enemies.

Remember: even small, consistent investments of $50 a week can grow significantly through the power of compounding.

Frequently Asked Questions

1. Which Type of Investment Gives the Highest Return in 2025?

As of October 2025, the S&P 500 has delivered an average annual return of around 10%, while Bitcoin has gained over 150% year-to-date.

2. What Is the Safest Type of Investment Right Now?

Government bonds and fixed deposits (FDs) remain among the safest choices in 2025.

3. Which Investment Type Is Best for Long-Term Wealth Building?

For most investors, stocks and index funds are ideal for long-term growth.

4. How Can I Diversify My Investments Effectively?

A balanced 2025 portfolio might include 60% equities, 25% bonds, 10% alternatives, and 5% cash or crypto to manage risk and smooth returns.

Conclusion

In conclusion, the world of investing is more accessible than ever in 2025. From global ETFs and crypto wallets to digital FDs and fractional real estate, the barriers are gone; only your willingness to start remains.

You don't need to predict the next big thing. You need to start, stay consistent, and let time work its magic.

Start by choosing one investment type today, and your future self will thank you. As Warren Buffett says, "The best investment you can make is in yourself, and the second-best is to start early."

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.