Raytheon (RTX) began 2026 with strong operating momentum, a substantial backlog, and a dividend well supported by projected free cash flow. However, a sudden policy change introduced potential restrictions on how profits may be distributed to shareholders.

On January 7, 2026, President Donald Trump signed an executive order aimed at stopping defense contractors from prioritizing stock buybacks and “corporate distributions” over production capacity and on-time delivery. The order directs the Defense Department to identify underperforming contractors, push remediation plans, and write future contracts so dividends and buybacks can be prohibited during periods of underperformance.

The Policy Shock Affecting RTX Stock

This executive order is significant because it targets the primary reason many long-term investors hold Raytheon stock: consistent cash returns.

Intended changes to the executive order

The order’s core principle is that contractors failing to meet delivery or performance requirements should not issue significant cash payouts to shareholders. It calls for:

Identification of contractors viewed as underperforming

A remediation process and contract remedies if performance does not improve

Future contract terms that can prohibit stock buybacks and corporate distributions during defined periods of underperformance

Executive compensation and incentives will be more closely linked to delivery and production outcomes.

Why RTX is under increased scrutiny

Public statements specifically named Raytheon and warned of reduced government business unless buybacks cease and responsiveness improves. This increases headline risk for RTX’s defense segment, even before any contract changes are implemented.

Immediate market reaction

RTX stock closed at $185.73 after a sharp decline, trading between $193.93 and $177.09 on high volume. This activity typically indicates rapid risk repricing rather than gradual changes in business fundamentals.

RTX Fundamentals That Continue To Support The Business

RTX is a combined aerospace and defense company with three major segments: Collins Aerospace, Pratt and Whitney, and Raytheon. In Q3 2025, RTX reported:

Sales: $22.5 billion

Adjusted EPS: $1.70

Operating cash flow: $4.6 billion

Free cash flow: $4.0 billion

Backlog: $251 billion total, including $148 billion commercial and $103 billion defense

RTX also raised its 2025 outlook:

Adjusted sales: $86.5 to $87.0 billion

Adjusted EPS: $6.10 to $6.20

Free cash flow: $7.0 to $7.5 billion (confirmed)

Table: Key Baseline Numbers Investors Use For RTX Stock

| Item |

Latest disclosed |

Why it matters |

| Backlog |

$251B |

Provides multi-year demand visibility |

| 2025 adjusted EPS guide |

$6.10–$6.20 |

Establishes an earnings baseline for valuation |

| 2025 free cash flow guide |

$7.0B–$7.5B |

Supports dividends, debt reduction, and investment funding |

Dividend risk: Is RTX’s payout at risk?

RTX declared a $0.68 per share quarterly dividend, paid December 11, 2025. That implies $2.72 per share per year if the rate continues.

What RTX is already paying out (real cash, not opinion)

What RTX is already paying out (real cash, not opinion)

RTX disclosed in its Q3 2025 Form 10-Q:

Dividends paid (first nine months of 2025): $2.66B

Repurchase of common stock (first nine months of 2025): $50M

Shares outstanding (Sep 30, 2025): 1,340,771,942

Dividend coverage analysis (why this is not a current cash crisis)

Using the disclosed share count:

This indicates that free cash flow covers the dividend by approximately 1.9 to 2.1 times under current guidance.

Conclusion on the dividend: The primary risk is not affordability, but rather that policy pressure and contract terms may restrict or discourage large payouts during periods the government defines as underperformance.

Buyback RIsk: Greater Headline Impact Than Financial Impact

RTX buybacks were already small in 2025. The 10-Q shows:

Only $50M of buybacks settled in cash in the first nine months of 2025

Remaining authority to repurchase stock was about $0.6B as of Sep 30, 2025

RTX’s 2023 repurchase program size was up to $11B

Implications for RTX stock: A buyback restriction may negatively affect sentiment and valuation, even with a low current buyback pace, as buybacks contribute to the overall shareholder return narrative.

Key Operating Risk In The Fundamentals: Pratt and Whitney GTF

RTX’s Pratt & Whitney segment faces a known disruption from the “Powder Metal Matter,” affecting PW1100G-JM geared turbofan engines (used on the A320neo family of aircraft). RTX disclosed:

This affects dividends and buybacks by redirecting cash toward customer compensation and maintenance, reducing financial flexibility.

Earnings Outlook: The Next Major Catalyst For RTX Stock

RTX will release Q4 and full-year 2025 results on January 27, 2026, and will discuss its 2026 outlook on the conference call that morning.

What investors should listen to on January 27?

The following factors are most likely to influence RTX stock:

2026 free cash flow guidance (dividend safety starts here)

Update on the Powder Metal Matter cash timing and shop capacity

Any change in language about capital returns (dividends and buybacks)

Evidence of delivery improvement and production ramp progress (now linked to policy risk)

Debt reduction and capital spending priorities

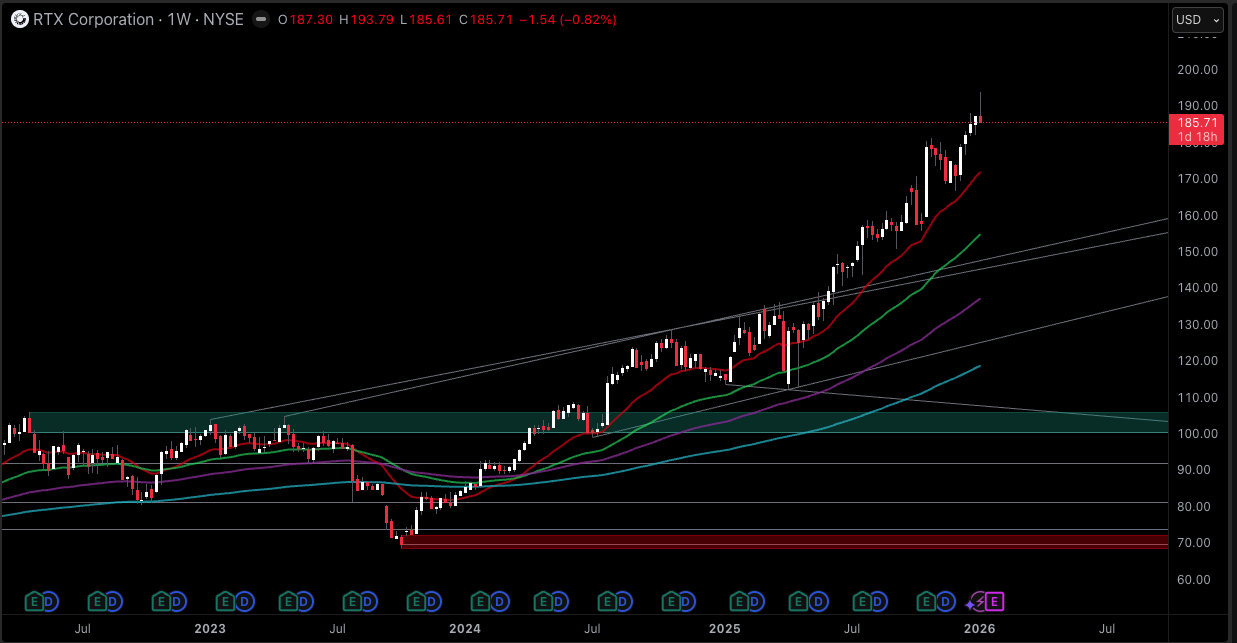

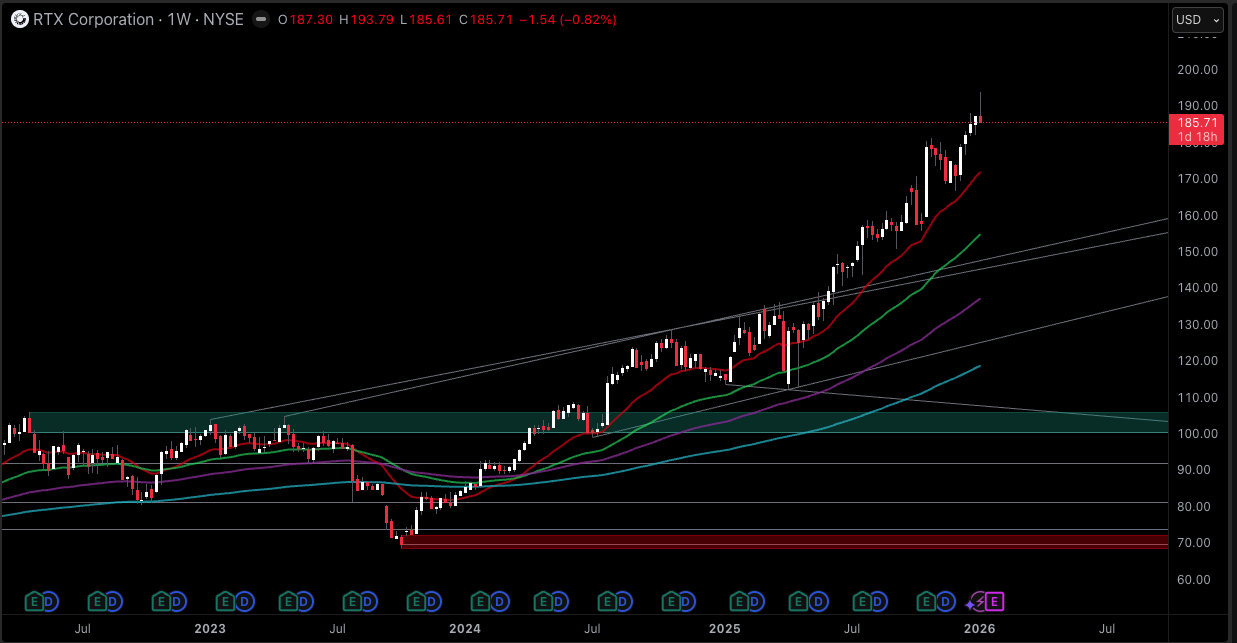

Technical Analysis: Key Levels Following The Policy Shock

Technical analysis identifies price levels where buyers and sellers have recently demonstrated willingness to act.

Key observable levels from the latest session

Near-term support: $177 to $180 (the day’s low zone)

Near-term resistance: $194 area (the day’s high zone)

Psychological resistance: $200 (a common decision level for traders)

Implications of candlestick patterns and trading volume

A wide trading range with high volume often signals forced selling and rapid risk reduction by large investors.

If the price remains above the recent low zone ($177 to $180), selling pressure may subside.

If the price falls below that zone and remains there, the market may be signaling that the policy shock is evolving into a longer-term valuation concern.

RTX Stock Forecast Scenarios For 2026

These scenarios incorporate policy, cash flow, and execution factors. They are not guarantees, but structured frameworks for considering possible outcomes.

| Scenario |

Policy outcome |

Cash flow outcome |

Likely RTX stock behavior |

| Base case |

Contract language tightens gradually, enforcement remains selective |

Dividend continues; buybacks remain limited |

Wide trading range until 2026 guidance becomes clearer |

| Downside case |

RTX is treated as underperforming on key programs |

More cash retained for investment and remediation |

Lower valuation multiple due to payout uncertainty |

| Upside case |

Enforcement is narrow and policy clarity arrives quickly |

Cash flow remains near guidance; dividend stays steady |

Recovery toward prior highs as risk premium fades |

Frequently Asked Questions (FAQ)

1. Can policy really affect dividends and buybacks?

Yes. The January 7, 2026, executive order is designed to use contract terms and enforcement tools to limit buybacks and corporate distributions during periods of underperformance.

2. Is RTX’s dividend unaffordable?

Based on RTX’s 2025 free cash flow guidance and disclosed share count, the dividend appears affordable on cash flow. The bigger risk is policy and contract restrictions, not immediate insolvency risk.

3. Are buybacks a big part of shareholder returns right now?

Not recently. RTX reported $50M of common stock repurchases in the first nine months of 2025, compared with $2.66B of dividends paid in the same period.

What is the biggest business cash risk investors should track?

The Pratt and Whitney GTF Powder Metal Matter, including elevated aircraft-on-ground levels through 2026 and the estimated 2025 cash impact of $1.1B to $1.3B.

Conclusion

RTX stock is currently valued based on two factors. The first is business performance, including backlog, earnings, and free cash flow. The second is policy risk, specifically whether the government will restrict dividends and buybacks through contract terms if it determines contractors are not meeting delivery expectations.

The most significant near-term event is January 27, 2026, when RTX will report results and outline its 2026 outlook. If RTX demonstrates strong free cash flow, credible production progress, and a stable dividend policy, investor confidence may recover.

However, if capital returns depend on government assessments of performance, RTX stock may trade at a lower valuation even if earnings remain strong.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.